Shadow banks are entities such as structured investment vehicles that (like traditional banks) perform credit intermediation services, but (unlike traditional banks) lack central bank liquidity of public sector credit guarantees (Pozsar, Tobias, Ashcraft & Boesky, 2013). Shadow banking is, in essence, any form of non-depository credit intermediation.

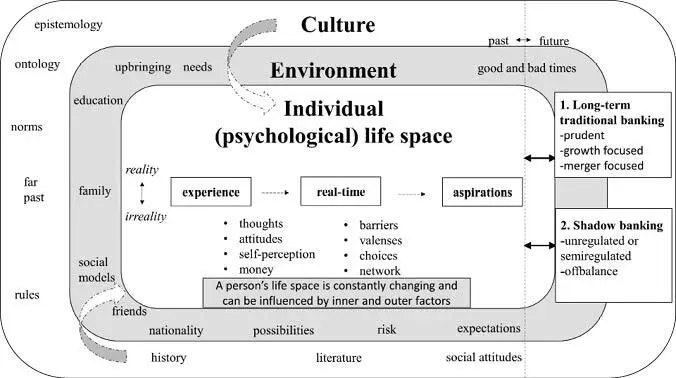

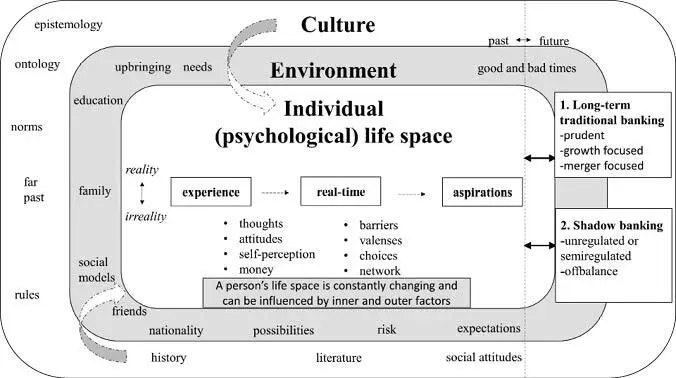

Figure 2.1. The bank manager’s decision-making is affected by society, i.e., culture and environment as well as what the bank manager has done before, his current life situation (life space) and his dreams about the future.

Figure 2.1. above represents both the normal banking situation during good times and that of a crisis-pressured banker during harder times, which we saw all over the world after the Lehman Brothers crisis and the shadow banking crisis in the USA. The shadow banking crisis in the USA pushed most of the world into the Global Financial Crisis of 2008, which has been ongoing in many counties in Europe in 2016–21, with speculations about the potential failure of Deutsche Bank in Germany and Societe General in France, just to mention a couple of banks that are considered too-big-to-fall. Thus, there has been an unusually long and unexpectedly deep recession, that has affected the banking industry in Europe and the rest of the world.

The organisation that stipulates the rules for the international banks is the Basel Committee on Banking Supervision (BCBS). It is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking supervisory matters. Many bankers entering into the 2020s are concerned with increasing solvency demands stated in the Basel III agreements, which raised solvency for the banking industry by about 50 percent. As a rule of thumb, one can argue that the new Basel III requirements, currently expected to enter into force in 2022 (it was initially expected to enter into force in 2015), raise a ‘normal’ international bank’s minimum solvency requirement from 2 percent to 3 percent Equity-to-Total Assets.

The official solvency requirements reported by banks, for example Basel II or the Basel II Accord (sometimes also called BIS) place solvency levels at 8 percent. However, that number has little to do with Equity-to-Total Assets, because it depends on the risk level of the banks’ balance sheet. Basel III standards are the minimum requirements which apply to internationally active banks. Furthermore, in some countries Basel III solvency applies to both national and international banks. Many bankers feel that this required Equity-to-Total Assets level is still too low; and we belong to that group. Thus, the new Basel III regulation will, according to our judgement, only have a marginal effect when it comes to preventing a new crisis and potential bank runs!

How should you act as a banker if you want the bank, and the banks’ customers to grow and prosper? That is the main point with this endeavour that has taken us eight years to complete! And yes, we are still puzzled concerning many parts of good and bad banking. However, we have found some of the keys behind good bank management in the Age of Nuclear Finance; a period in banking when things happen both slowly and rapidly. In brief, our findings behind good banking are like a simple Hedgehog strategy: know one thing well! and that thing is to serve your customers in a trust-creating way that is best for the customers!

On the content of a bank manager’s work

“Do not ever grant loans without suitable and certain collaterals. Do not advance and encourage speculation on any habits. Finance only legal and considered transactions”.

(From the memo of the Bank Superintendent of the USA, Hugh McCullochin 1863, which was duplicated in 1988 by Vice Managing Director of KOP Simo Kärävä for the Board of Directors of a bank that did not listen and seven years later ended up in the history books.)

A bank manager’s fundamental content in the banking business is to have or borrow money, in order to lend money to customers profitably. As an industry, the banking business is simple. However, in reality, working with money and people is difficult and complex. We try to find the answer to a question: how does a banker get the information needed to decide on lending and to analyse credits and investments? We used to think that a banker had more information on the economy than a manufacturing firm. However, we do not think that is true anymore.

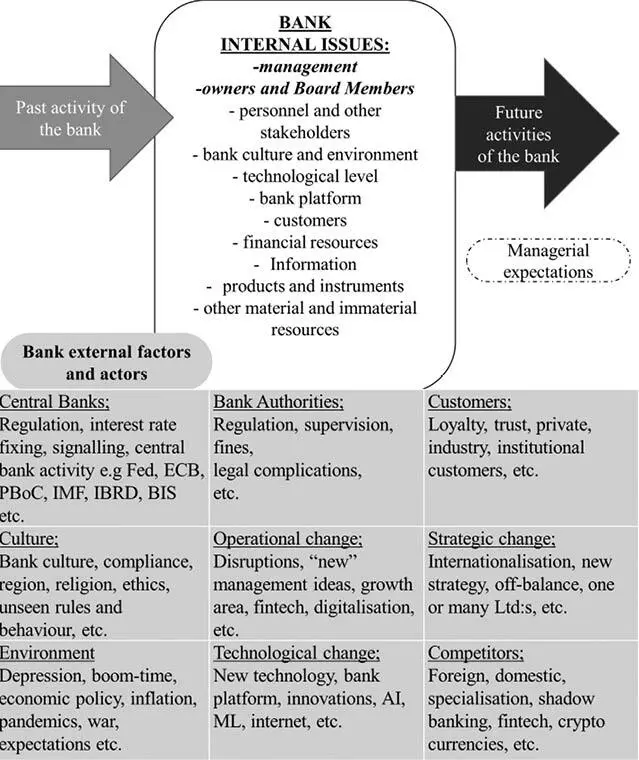

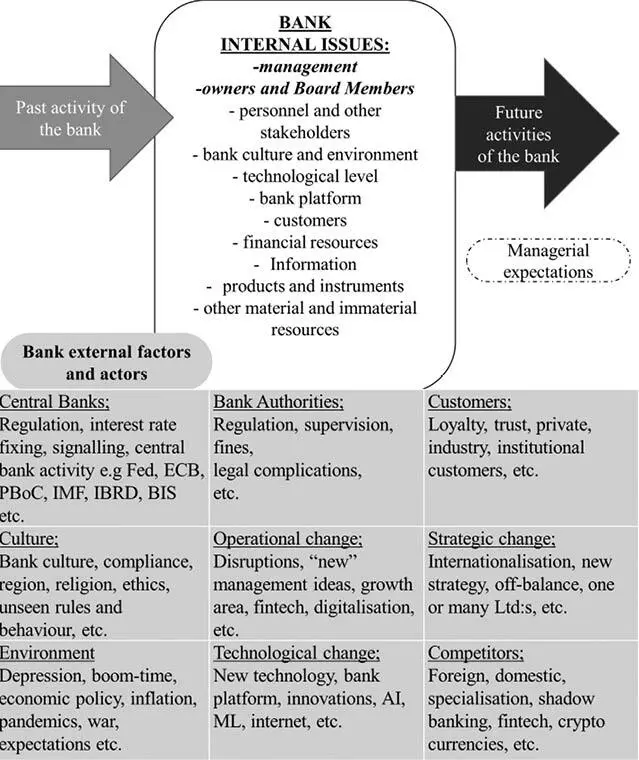

In the operational environment, where a bank manager works daily, there are internal and external actors and factors, which affect the bank’s performance. We assume that the performance of all these actors and factors will be affected by their past, current and future activities. The banks are being pushed and pulled by the past activities of the bank, the current activities and the expected future aspirations of the bank and its Board of Directors, management, customers and owners.

Figure 2.2. The operational environment of a bank manager is affected by interlinked internal and external factors.

In Figure 2.2. above we can see important internal and external factors affecting the space of movement, i.e., the range of freedom in a bank manager’s work. Though these factors are important in the strategy of a bank, the actors and factors are also part of a bank manager’s daily operational work, which is a more relevant part of a bank manager’s activity than strategic work.

We note that far too little has been studied in banking concerning operational risk. The risk Management Group of the Basle Committee on Banking Supervision (2001, 2003) defines operational risk as ‘the risk of loss resulting from an inadequate or failed internal process, people and systems or from external events’. In general terms, this is the risk associated with the possible failure of a bank’s systems, controls or other management failure (including human error). We note that the definition of operational risk given above includes technology risk. There are different operational risk event types. We are interested in management risk, which is the risk that management lacks the ability to make commercially profitable and other decisions consistently. It can also include the risk of dishonesty by employees and the risk that the bank will not have an effective organisation (see Casu, Girardone & Molyneux, 2006: 272–275) (Table 10.3). In Chapter 3, we explain how a bank manager’s moving space can disappear in a decline.

The significant changes that have occurred in the financial sector industry have increased the importance of performance analysis in modern banks. Performance analysis is an important tool used by various agents operating either internally (for example managers) or who form part of the bank’s external operating environment (for example regulators). Casu et al. (2006, 212–213) believed that bank performance is calculated using ratio analysis and made their assessments with the aim of: 1) looking at past and current trends; and 2) determining future estimates of bank performance. Financial ratio analysis investigates different areas of bank performance, such as profitability, liquidity, asset quality and solvency. We think that management is an important part of bank performance. However, many bank researchers say that it is difficult to see how banks are performing and what they are doing in practice.

On Halo Effects and complexity in banking

Читать дальше