Again, this is just as applicable to Type I providers. It is a good practice to periodically review the competitive position of every service in the corresponding market space. This is particularly important in relation to shifts in business trends or major changes in the business environment that may alter the economics behind the customer’s decision to source a service

5 Service economics

‘Economy does not lie in sparing money, but in spending it wisely.’

Thomas Henry Huxley

5.1 Financial Management

Operational visibility, insight and superior decision making are the core capabilities brought to the enterprise through the rigorous application of Financial Management. Just as business unit s accrue benefits through the analysis of product mix and margin data, or customer profiles and product behaviour, a similar utility of financial data continues to increase the importance of Financial Management for IT and the business as well.

Financial Management as a strategic tool is equally applicable to all three service provider types. Internal service provider s are increasingly asked to operate with the same levels of financial visibility and accountability as their business unit and external counterparts. Moreover, technology and innovation have become the core revenue-generating capabilities of many companies.

Financial Management provides the business and IT with the quantification, in financial terms, of the value of IT Service s, the value of the asset s underlying the provisioning of those services, and the qualification of operational forecasting. Talking about IT in terms of services is the crux of changing the perception of IT and its value to the business. Therefore, a significant portion of Financial Management is working in tandem with IT and the business to help identify, document and agree on the value of the services being received, and the enablement of service demand modelling and management.

5.1.1 Enterprise value and benefits of Financial Management

The landscape of IT is changing as strategic business and delivery model s evolve rapidly, product development cycles shrink, and disposable designer products become ubiquitous. These dynamics create what often appears to IT professionals as a dichotomy of priorities: increasing demands on performance and strategic business alignment, combined with greater demand for superior operational visibility and control . Much like their business counterparts, IT organizations are increasingly incorporating Financial Management in the pursuit of:

Enhanced decision making

Speed of change

Service portfolio management

Financial compliance and control

Operational control

Value capture and creation.

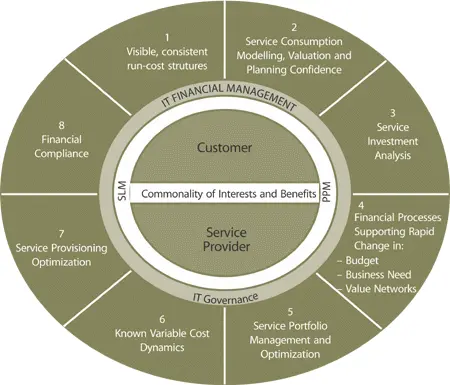

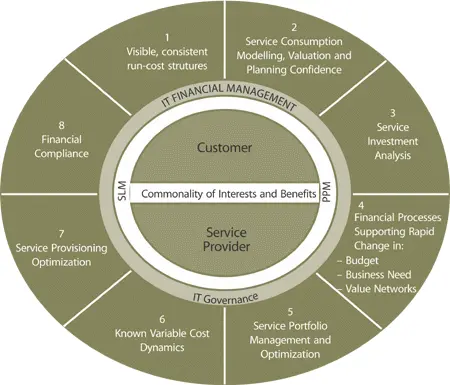

IT organizations are conceding they are quite similar to market-facing companies. They share the need to analyse, package, market and deliver services just as any other business. They also share a common and increasing need to understand and control factors of demand and supply, and to provision services as cost-effectively as possible while maximizing visibility into related cost structures. This commonality is of great value to the business as IT seeks to drive down cost while improving its service offerings. The framework below illustrates the commonality of interests and benefits between the business and IT (Figure 5.1).

Figure 5.1 Shared imperatives framework: business and IT

Service and strategy design both benefit greatly from the operational decision-making data that Financial Management aggregates, refines and distributes as part of the Financial Management process . Rigorously applied, Financial Management generates meaningful critical performance data used to answer important questions for an organization :

Is our differentiation strategy resulting in higher profits or revenues, lower costs, or greater service adoption?

Which services cost us the most, and why?

What are our volumes and types of consumed services, and what is the correlating budget requirement ?

How efficient are our service provisioning model s in relation to alternatives?

Does our strategic approach to service design result in services that can be offered at a competitive ‘market price’, substantially reduce risk or offer superior value?

Where are our greatest service inefficiencies?

Which functional areas represent the highest priority opportunities for us to focus on as we generate a Continual Service Improvement strategy?

Without meaningful operational financial information, it is not possible to answer these questions correctly, and strategic decisions become little more than instinctive responses to flawed or limited observations and information, often from a single organizational unit. Such methods can often incorrectly steer strategy, service design, and tactical operational decisions.

Whereas Financial Management provides a common language in which to converse with the business, Service Valuation provides the storyline from which the business can comprehend what is actually delivered to them from IT. Combined with Service level management , Service Valuation is the means to a mutual agreement with the business regarding what a service is, what its component s are, and its actual cost or worth.

Additionally, the application of Service Valuation discussed in this chapter transforms the discussion and interaction between IT and the business customer , and the way customers plan for and consume IT Service s. The use of Financial Management to provide services with cost transparency (such as via a Service catalogue ) that can then be clearly understood by the business and rolled into planning processes for demand modelling and funding, is a powerful benefit. Such maturity in an IT operation can generate enormous cost savings and Demand Management capabilities.

5.1.2 Concepts, inputs and outputs

Like its business equivalent, IT Financial Management responsibilities and activities do not exist solely within the IT finance and accounting domain. Rather, many parts of the enterprise interact to generate and consume IT financial information, including operations and support units, project management organizations, application development, infrastructure, Change Management , business unit s, end user s etc. These entities aggregate, share and maintain the financial data they need. The Financial Management data used by an IT organization may reside in, and be owned by the accounting and finance domain, but responsibility for generating and utilizing it extends to other areas. Financial Management aggregates data inputs from across the enterprise and assists in generating and disseminating information as an output to feed critical decisions and activities such as those discussed below.

5.1.2.1 Service Valuation

Service Valuation quantifies, in financial terms, the funding sought by the business and IT for services delivered, based on the agreed value of those services. FM calculates and assigns a monetary value to a service or service component so that they may be disseminated across the enterprise once the business customer and IT identify what services are actually desired.

Читать дальше