Much of the value of service management , however, is intangible and complex. It includes knowledge and benefits such as technical expertise, strategic information, process knowledge and collaborative design . Often the value lies in how these intangibles are combined, packaged, and exchanged. Linear models have shown themselves to be inadequate for describing and understanding the complexities of value for service management, often treating information as a supporting element rather than as a source of value. Information is used to monitor and control rather than to create new value.

Case example 5 (solution): Commerce services

Most services focus on making a profit or performing social benefits. A value net analysis revealed the online auctioneer did both.

The value net revealed a hidden participant and their intangible exchanges: hobbyists. Hobbyists discovered they could take part in the auctioneer’s micro-economy. They became professional participants with their own value capture. They created a sense of community, loyalty, feedback mechanisms and referrals.

By indirectly creating prosperity for the hobbyists, the auctioneer created prosperity for itself. The auctioneer used this insight to create a new class of services directed at hobbyists.

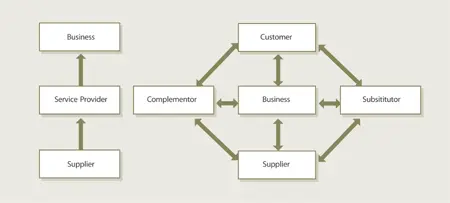

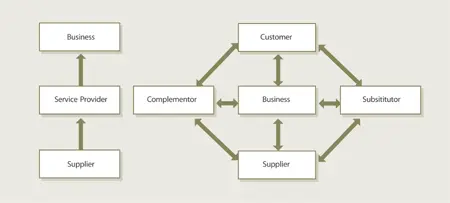

Value chains remain an important tool. They provide a strategy for vertically integrating and coordinating the dedicated asset s required for product development . The framework focuses on a linear model but as discussed throughout this publication, linear models are seldom ideal for the complexities of service management. In this case, it is the assembly line metaphor. Upstream supplier s add value and then pass it down to the next actor downstream. This approach assumes that definitions and needs are stable and well understood. If there was a problem or delay, it was because of a weak or missing link in the chain. In this traditional service model , there are three role s: the business , the service provider and the supplier . The service provider acquires goods and services from its suppliers and assembles them to produce new services to meet the needs of the business. The business, or customer, is the last link in the chain.

The economics for linear models is based on the law of averages. If the aggregate cost of a service is competitive, then seeking a cost advantage at every link in the chain is not required or even feasible. In the day-to-day practice of manufacturing, for example, it is not practical to break down processes into independently negotiated transactions. Tight coupling is the nature of the chain.

Global sourcing and modern distribution technologies, however, have undermined this logic. A service provider no longer has the luxury of compensating for weak performance in one area with the strength of another. Further, there are often many actors performing intermediary and complementary function s who are not reflected. Also, most important in a service strategy , the focus must be on the value creating system itself, rather than the fixed set of activities along a chain.

It is important to understand the most powerful force to disrupt conventional value chain s: the low cost of information. Information was the glue that held the vertical integration. Getting the necessary information to suppliers and service providers has historically been expensive, requiring dedicated asset s and proprietary systems. These barriers to entry gave value chains their competitive advantage. Through the exchange of open and inexpensive information, however, businesses can now make use of resource s and capabilities without owning them.

Lower transaction costs allow organizations to control and track information that would have been too costly to capture and process just years ago. Transaction costs still exist, but are increasingly more burdensome within the organization than without. This in turn has created new opportunities for collaboration between service providers and suppliers. The end result is a flexible mix of mechanisms that undermine the rigid vertical integration. New strategies are now available to service providers:

Marshal external talent – no single organization can organically produce all the resources and capabilities required within an industry. Most innovation occurs outside the organization.

Reduce costs – produce more robust services in less time and for less expense than possible through conventional value-chain approaches. If it is less expensive to perform a transaction within the organization, keep it there. If it is cheaper to source externally, take a second look. An organization should contract until the cost of an internal transaction no longer exceeds the cost of performing the transaction externally. This is a corollary to ‘Coase’s Law’: a firm tends to expand until the costs of organizing an extra transaction within the firm become equal to the costs of carrying out the same transaction on the open market. The concept of Coase’s law was first developed by Tapscott.16

Change the focal point of distinctiveness – by harnessing external talent, an organization can redeploy its own resources and capabilities to enhance services better suited to its customer or market space . Take the case of a popular North American sports league and its Type I service provider . By harnessing the capabilities of Type III infrastructure service providers, the Type I is free to redeploy its capabilities to enhance its new media services, namely, web-based services with state-of-the-art streaming video, ticket sales, statistics, fantasy leagues and promotions.

Increase demand for complementary services – an organization , particularly a Type I, may lack the breadth of services offered by Type II and Type III service provider s. By acting as a service integrator, such organizations not only remedy the gap but boost demand through complementary offerings.

Collaborate – as transaction costs drop, collaboration is less optional. There are always more smart people outside an organization than inside.

Value network

A value network is a web of relationships that generates tangible and intangible value through complex dynamic exchanges through two or more organizations.

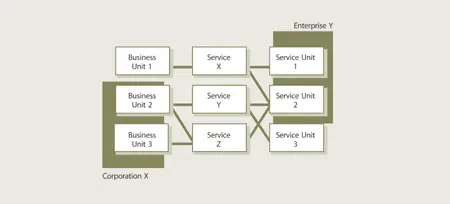

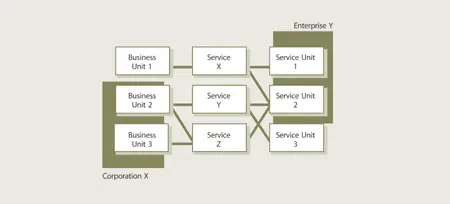

Once we view service management as patterns of collaborative exchanges, rather than an assembly line, it is apparent that our idea of value creation is due for revision. From a system s thinking perspective it is more useful to think of service management as a value network or net. Any group of organizations engaged in both tangible and intangible exchanges is viewed as a value network (Figures 3.17 and 3.18), whether or not they are in the same self-contained enterprise, whether private industry or public sector.

Figure 3.17 Generic value network

Figure 3.18 Basic value chain and value network

Take, for example, the financial services industry. Brokerage services leveraged IT to provide customers with market access, real-time market data and the ability to execute trades. The costs of computing, network and data were high, creating significant barriers to entry for competitors. The value proposition was based on the ability to perform these services reliably and securely.

Читать дальше