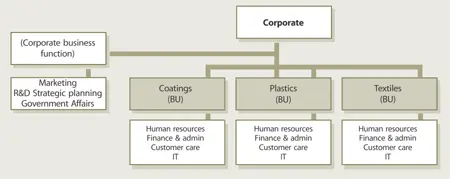

Figure 3.12 Type I providers

Competition for Type I providers is from providers outside the business unit , such as corporate business functions, who wield advantages such as scale, scope , and autonomy. In general, service providers serving more than one customer face much lower risk of market failure. With multiple sources of demand, peak demand from one source can be offset by low demand from another. There is duplication and waste when Type I providers are replicated within the enterprise.

To leverage economies of scale and scope, Type I providers are often consolidated into a corporate business function when there is a high degree of similarity in their capabilities and resources. At this level of aggregation Type I providers balance enterprise needs with those at the business unit level. The trade-offs can be complex and require a significant amount of attention and control by senior executives. As such, consolidated Type I providers are more appropriate where classes of assets such as IT, R&D, marketing or manufacturing are at the core of the organization ’s competitive advantage and therefore need careful control.

3.3.2 Type II (shared services unit)

Function s such as finance, IT, human resource s, and logistics are not always at the core of an organization’s competitive advantage. Hence, they need not be maintained at the corporate level where they demand the attention of the chief executive’s team.11 Instead, the services of such shared functions are consolidated into an autonomous special unit called a shared services unit (SSU) (Figure 3.13). This model allows a more devolved governing structure under which SSU can focus on serving business units as direct customers. SSU can create, grow, and sustain an internal market for their services and model themselves along the lines of service provider s in the open market. Like corporate business functions, they can leverage opportunities across the enterprise and spread their costs and risk s across a wider base. Unlike corporate business functions, they have fewer protections under the banner of strategic value and core competence. They are subject to comparisons with external service provider s whose business practices, operating models and strategies they must emulate and whose performance they should approximate if not exceed. Performance gaps are justified through benefits received through services within their domain of control.

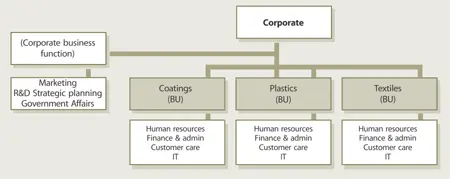

Figure 3.13 Common Type II providers

Customer s of Type II are business units under a corporate parent, common stakeholders, and an enterprise-level strategy . What may be sub-optimal for a particular business unit may be justified by advantages reaped at the corporate level for which the business unit may be compensated. Type II can offer lower prices compared to external service providers by leveraging corporate advantage, internal agreement s and accounting policies. With the autonomy to function like a business unit, Type II providers can make decisions outside the constraints of business unit level policies. They can standardize their service offerings across business units and use market-based pricing to influence demand patterns.

Market-based pricing

With market-based pricing there is minimal need for complex discussions and negotiations over specific requirement s, technologies, resource allocations, architecture s, and designs (that would be necessary with Type I arrangements) because the prices would drive adjustments, self-corrections and optimization on both sides of the value equation.

While Type II providers benefit from a relatively captive internal market for their services, their customers may still evaluate them in comparison with external service providers. This balance is crucial to the effectiveness of the shared services model. It also means that poorly performing Type II providers face the threat of substitution. This puts pressure on the leadership to adopt industry best practices, cultivate market space s, formulate business strategies, strive for operational effectiveness , and develop distinctive capabilities. Industry-leading shared services units have successfully been spun off by their parents as independent business es competing in the external market. They become a source of revenues from the initial charter of simply providing a cost advantage.

3.3.3 Type III (external service provider)

The business strategies of customers sometimes require capabilities readily available from a Type III provider. The additional risk s that Type III providers assume over Type I and Type II are justified by increased flexibility and freedom to pursue opportunities. Type III providers can offer competitive prices and drive down unit cost s by consolidating demand. Certain business strategies are not adequately served by internal service provider s such as Type I and Type II. Customer s may pursue sourcing strategies requiring services from external providers. The motivation may be access to knowledge, experience, scale, scope , capabilities, and resources that are either beyond the reach of the organization or outside the scope of a carefully considered investment portfolio. Business strategies often require reductions in the asset base, fixed cost s, operational risks, or the redeployment of financial assets. Competitive business environment s often require customers to have flexible and lean structures. In such cases it is better to buy services rather than own and operate the assets necessary to execute certain business function s and processes. For such customers, Type III is the best choice for a given set of services (Figure 3.14). The experience of such providers is not limited to any one enterprise or market. The breadth and depth of such experience is often the single most distinctive source of value for customers. The breadth comes from serving multiple types of customers or markets. The depth comes from serving multiples of the same type.

From a certain perspective, Type III providers are operating under an extended large-scale shared services model . They assume a greater level of risk from their customers compared to Type I and Type II. But their capabilities and resource s are shared by their customers – some of whom may be rivals. This means that rival customers have access to the same bundle of assets, thereby diminishing any competitive advantage those assets bestowed.

Security is always an issue in shared services environments. But when the environment is shared with competitors, security becomes a larger concern. This is a driver of additional costs for Type III providers. As a counter-balance, Type III providers mitigate a type of risk inherent to Types I and II: business functions and shared service units are subject to the same system of risks as their business unit or enterprise parent. This sets up a vicious cycle, whereby risks faced by the business units or the enterprise are transferred to the service units and then fed back with amplification through the services utilized. Customers may reduce systemic risks by transferring them to external service provider s who spread those risks across a larger value network .

Читать дальше