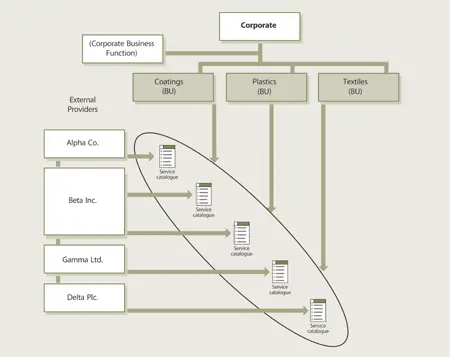

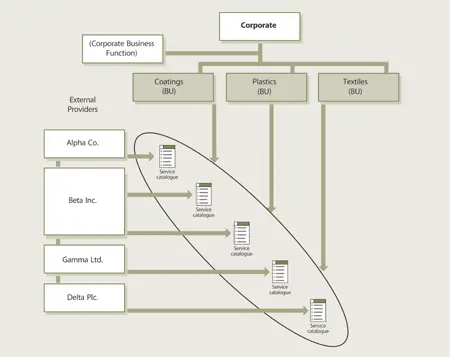

Figure 3.14 Type III providers

3.3.4 How do customers choose between types?

From a customer’s perspective there are merits and demerits with each type of provider. Service s may be sourced from each type of service provider with decisions based on transaction costs, strategic industry factors, core competence, and the risk management capabilities of the customer . The principles of specialization and coordination costs apply.

The principle of transaction costs is useful for explaining why customers may prefer one type of provider to another. Transaction costs are overall costs of conducting a business with a service provider. Over and above the purchasing cost of services sold, they include but are not limited to the cost of finding and selecting qualified providers, defining requirement s, negotiating agreement s, measuring performance , managing the relationship with supplier s, cost of resolving disputes, and making changes or amends to agreements.

Additionally, whether customers keep a business activity in-house (aggregate) or decide to source it from outside (disaggregate) depends on answers to the following questions.15

Does the activity require asset s that are highly specialized? Will those assets be idle or obsolete if that activity is no longer performed? (If yes, then disaggregate.)

How frequently is the activity performed within a period or business cycle? Is it infrequent or sporadic? (If yes then disaggregate.)

How complex is the activity? Is it simple and routine? Is it stable over time with few changes? (If yes, then disaggregate.)

Is it hard to define good performance ? (If yes, then aggregate.)

Is it hard to measure good performance? (If yes, then aggregate.)

Is it tightly coupled with other activities or assets in the business? Would separating it increase complexity and cause problems of coordination? (If yes, then aggregate.)

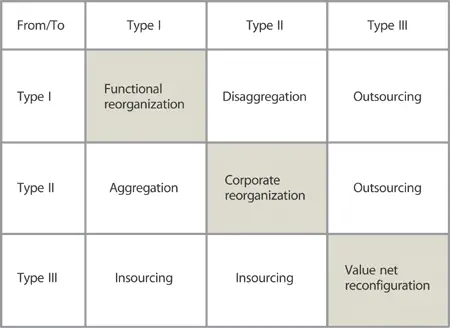

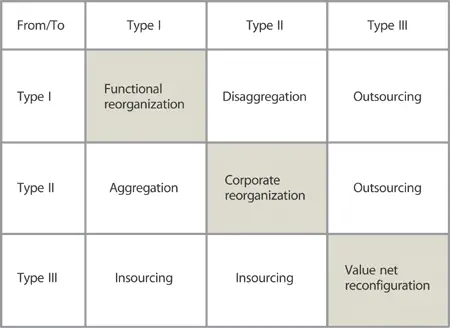

Based on the answers to those questions, customers may decide to switch between types of service providers (Figure 3.15). Answers to the questions themselves may change over time depending on new economic conditions, regulations, and technological innovation. Transaction costs are discussed further under the topics of Strategy , tactics and operations (Chapter 7), Service structures (Section 3.4) and Challenges and opportunities (Chapter 9).

Figure 3.15 Customer decisions on service provider types

Customer s may adopt a sourcing strategy that combines the advantages and mitigates the risks of all three types. In such cases, the value network supporting a customer cuts across the boundaries of more than one organization . As part of a carefully considered sourcing strategy, customers may allocate their needs across the different types of service provider s based on whichever type best provides the business outcomes they desire. Core service s are sought from Type I or Type II providers, while supplementary services enhancing core services are sought from Type II or Type III providers.

In a multi-sourced environment , the centre of gravity of a value network rests with the type of service provider dominating the sourcing portfolio. Figure 3.15 shows the range of sourcing options available to customers based on the types of service providers between which controls are transferred. Outsourcing or disaggregating decisions move the centre of gravity away from corporate core. Aggregation or in-sourcing decisions move the centre of gravity closer to the corporate core and are driven by the need to maintain firm-specific advantages unavailable to competitors. Certain decisions do not shift the centre of gravity but rather reallocate services between service units of the same type.

The sourcing structure may be altered due to changes in the business fundamentals of the customer, making one type of service provider more desirable than the other. For example, a customer merger or acquisition may dramatically alter the economics that underpin a hitherto sound sourcing strategy; see Case Example 4. The customer decides to in-source an entire portfolio of services now to be offered by a newly acquired Type I or Type II.

3.3.5 The relative advantage of incumbency

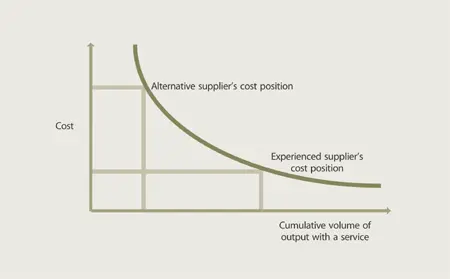

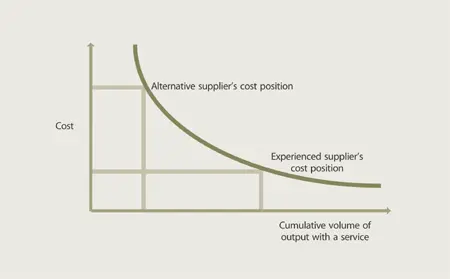

Lasting relationships with customers allow organizations to learn and improve. Fewer error s are made, investments are recovered, and the resulting cost advantage can be leveraged to increase the gap with competition (Figure 3.16).

Figure 3.16 Advantage of being a well-performing incumbent

Customer s find it less attractive to turn away from well-performing incumbents because of switching costs. Experience can be used to improve asset s such as processes, knowledge, and the competencies that are strategic in nature.

Service provider s must therefore focus on providing the basis for a lasting relationship with customers. It requires them to exercise strategic planning and control to ensure that common objective s drive everything, knowledge is shared effectively between units, and experience is fed back into future plan s and actions for a steeper learning curve.

Case example 4 (solution): Newly acquired service provider types

The Type II provider for the conglomerate had achieved its cost reductions through a relationship with a Type III. As a result of mergers and acquisitions activity , however, the company grew to include additional Type I providers.

When the company re-examined its service strategy , it realized it could in-source and consolidate all service providers into a single Type II – at a lower cost and with an enhanced technological distinctiveness unavailable from any Type III.

3.4 Service structures

‘All models are wrong, but some of them are useful.’

George Box, statistician

Case example 5: Commerce services

A web-commerce company thrives despite a severe economic slowdown. The business model , based on online auctions, is profitable. However, the business model does not explain why its services succeed in creating sustainable value as other sites fail.

Process flows fail to provide insight. A value net analysis, however, reveals the distinctiveness between the auctioneer and its competitors.

What did the value net reveal about the services that a process flow could not?

(Answer in Section 3.4.1)

3.4.1 From value chains to value networks

Business executives have long described the process of creating value as links in a value chain . This model is based on the industrial age production line: a series of value-adding activities connecting an organization ’s supply side with its demand side. Each service provides value through a sequence of event s leading to the delivery, consumption and maintenance of that particular service. By analysing each stage in the chain, senior executives presumably find opportunities for improvements.

Читать дальше