creeping inflationsmall increases in the general level of prices in an economy. See INFLATION, HYPERINFLATION.

Crestsee SHARE PURCHASE/SALE.

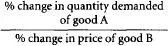

cross-elasticity of demanda measure of the degree of responsiveness of the DEMAND for one good to a given change in the PRICE of some other good.

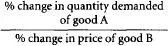

(i) cross-elasticity of demand =

Products may be regarded by consumers as substitutes for one another, in which case a rise in the price of good B (tea, for example) will tend to increase the quantity demanded of good A (coffee, for example). Here the cross-elasticity of demand will be positive since as the price of B goes up the quantity demanded of A rises as consumers now buy more A in preference to the more expensive B.

(ii) cross-elasticity of demand =

Alternatively, products may be regarded by consumers as complements that are jointly demanded, in which case a rise in the price of good B (tea, for example) will tend to decrease not only the quantity demanded of good B but also another good, C (sugar, for example). Here the cross-elasticity of demand will be negative since a rise in the price of B serves to reduce the quantity demanded of C.

The degree of substitutability between products is reflected in the magnitude of the cross-elasticity measure. If a small increase in the price of good B results in a large rise in the quantity demanded of good A (highly cross-elastic), then goods B and A are close substitutes. Likewise, the degree of complementarity of products is reflected in the magnitude of the cross-elasticity measure. If a small increase in the price of good B results in a large fall in the quantity demanded of good C (highly cross-elastic), then goods C and B are close complements.

Cross-elasticities provide a useful indication of the substitutability of products, so helping to indicate the boundaries between markets. A group of products with high cross-elasticities of demand constitutes a distinct market, whether or not they share common technical characteristics; for example, mechanical and electronic watches are regarded by consumers as close substitutes. See MARKET.

cross-sectional datainformation gathered for the same period of time that is split into certain groupings based upon characteristics such as age, income, etc. Compare TIME SERIES DATA.

cross-subsidizationthe practice by firms of offering internal subsidies to certain products or departments within the firm financed from the profits generated by other products or departments. Cross-subsidization is often used by diversified and vertically integrated firms as a means of financing new product development; DIVERSIFICATION into new areas; or to facilitate price cuts to match intense competition in certain of its markets. See VERTICAL INTEGRATION, PRICE-SQUEEZE.

Fig. 34 Crowding-out effect.(a) An increase in government expenditure raises real NATIONAL INCOME and output (see EQUILIBRIUM LEVEL OF NATIONAL INCOME), which in turn increases the demand for money from D mto D m 1, with which to purchase the greater volume of goods and services being produced. (b) This causes the equilibrium INTEREST RATE to rise (from r to r 1), which then reduces – ‘crowds out’ – an amount of private INVESTMENT (ΔT). (c) An increase in government expenditure by itself would increase AGGREGATE DEMAND from AD to AD 1, but, allowing for the fall in private investment, the net result is to increase aggregate demand to only AD 2.

crowding-out effectan increase in GOVERNMENT EXPENDITURE that has the effect of reducing the level of private sector spending. Financial crowding-out of the type described in the captions to Fig. 34 would occur only to the extent that the MONEY SUPPLY is fixed, so that additional loanable funds are not forthcoming to finance the government’s additional expenditure. If money supply is fixed, then increases in the PUBLIC SECTOR BORROWING REQUIREMENT associated with additional government expenditure will tend to increase interest rates as the government borrows more, these higher interest rates serving to discourage private sector investment. On the other hand, if additional loanable funds were obtainable from, say, abroad, then additional government borrowing could be financed with little increase in interest rates or effect on private investment.

The term ‘crowding-out’ is also used in a broader sense to denote the effect of larger government expenditure in pre-empting national resources, leaving less for private consumption spending, private sector investment and for exports. Such real crowding-out would occur only to the extent that total national resources are fixed and fully employed so that expansion in public sector claims on resources contract the amount left for the private sector. Where unemployed resources can be brought into use, additional claims by both the public and private sectors can be met. See MONEY-SUPPLY/SPENDING LINKAGES, MARGINAL EFFICIENCY OF CAPITAL/INVESTMENT.

cum dividend adj. (of a particular SHARE) including the right to receive the DIVIDEND that attaches to the share. If shares are purchased on the STOCK EXCHANGE cum. div., the purchaser would be entitled to the dividend accruing to that share when the dividend is next paid. Compare EX DIVIDEND.

currencythe BANK NOTES and coins issued by the monetary authorities that form part of an economy’s MONEY SUPPLY. The term ‘currency’ is often used interchangeably with the term cash in economic analysis and monetary policy.

currency appreciationsee APPRECIATION 1.

currency depreciationsee DEPRECIATION 1.

currency matchingsee EXCHANGE RATE EXPOSURE.

currency swapsee SWAP.

current account1 a statement of a country’s trade in goods (visibles) and services (invisibles) with the rest of the world over a particular period of time. See BALANCE OF PAYMENTS.

2 an individual’s or company’s account at a COMMERCIAL BANK or BUILDING SOCIETY into which the customer can deposit cash or cheques and make withdrawals on demand on a day-to-day basis. Current accounts (or sight deposits as they are often called) offer customers immediate liquidity with which to finance their transactions. Most banks and building societies pay INTEREST on current account balances that are in credit. See BANK DEPOSIT, DEPOSIT ACCOUNT.

current assetsASSETS, such as STOCKS, money owed by DEBTORS, and cash, that are held for short-term conversion within a firm as raw materials are bought, made up, sold as finished goods and eventually paid for. See FIXED ASSETS, WORKING CAPITAL.

current liabilitiesall obligations to pay out cash at some date in the near future, including amounts that a firm owes to trade CREDITORS and BANK LOANS/OVERDRAFTS. See WORKING CAPITAL.

Читать дальше