On the other hand, the greater fall of the labour income share in the continental European economies reflects a more hidden path of rising income inequality related to the weakening of labour power. During the post-war era labour unions were particularly strong in the Eurozone countries and in the Scandinavian countries, but their bargaining power has declined significantly since the end of the 1970s due to a number of developments that will be discussed in the following chapters. One of these developments is economic globalization, which put more pressure on labour unions to contain their wage demands in order to preserve the competitiveness of internationally oriented manufacturing firms, and gave these firms more ‘exit options’ to shift their production to countries with lower labour costs. Another important development is the rise in unemployment in the wake of the neoliberal shift in macroeconomic policy targets away from ‘full employment’ towards the lowering of inflation and public debt levels. As we will see in chapter 3, the Northern European countries have adopted more restrictive monetary and fiscal policies since the 1980s than the Anglo-Saxon countries, as a way to contain the wage demands of their more powerful labour unions and to strengthen the competitiveness of manufacturing sectors, which play a central role in the export-led growth models of the Northern European countries.

Wealth inequality refers to the unequal distribution of a country’s net national wealth – that is, all the financial and non-financial assets (mostly land and real estate) owned by the residents of a country minus all the liabilities owed by them. For a typical rich country, it consists of about 50 per cent real estate wealth and 50 per cent financial wealth like savings on banking accounts, stocks and bonds. 6Traditionally, wealth inequality is significantly higher than income inequality. There are several reasons for this. By definition, an individual’s wealth is income that has been saved and accumulated during his or her lifetime. Because individuals with high incomes tend to save and invest more than individuals with low incomes (who have insufficient income to save and invest), inequality of income translates almost automatically into inequality of wealth. Moreover, wealthy individuals tend to enjoy larger investment returns because they are in a more financially comfortable position to invest in riskier assets and have higher levels of financial expertise and access to professional investment assistance. Finally, and most importantly, wealth can be inherited across generations. In short, as the OECD notes in a recent report, ‘A key aspect of wealth accumulation is that it operates in a self-reinforcing way; wealth begets wealth.’ 7

Table 1.2shows the household net wealth shares held by the 10 per cent, 5 per cent and 1 per cent of households at the top of the wealth distribution in each country, along with the shares of those held by the bottom 40 per cent and 60 per cent. Based on top wealth shares, household net wealth is most unequally distributed in the United States, where the top 10 per cent of households owned 79 per cent of total wealth and the top 1 per cent held a staggering 42 per cent in 2015. By comparison, the bottom 60 per cent of the wealth distribution in the United States owned a meagre 2.4 per cent of net national wealth. Looking at the concentration of wealth at the other end of the distribution, the share held by the bottom 60 per cent of households was negative in some countries, meaning that, on average, these households had liabilities exceeding the value of their assets (because, for instance, the value of their house was lower than the value of their mortgages and other real estate debt).

Table 1.2Distribution of net wealth in the OECD world, 2015 or latest available year

|

Bottom 40% share |

Bottom 60% share |

Top 10% share |

Top 5% share |

Top 1% share |

| Australia |

4.9 |

16.5 |

46.5 |

33.5 |

15.0 |

| Austria |

1.0 |

8.0 |

55.6 |

43.5 |

25.5 |

| Belgium |

5.7 |

19.0 |

42.5 |

29.7 |

12.1 |

| Canada |

3.4 |

12.4 |

51.1 |

37.0 |

16.7 |

| Denmark |

-8.6 |

-3.9 |

64.0 |

47.3 |

23.6 |

| Finland |

2.2 |

13.6 |

45.2 |

31.4 |

13.3 |

| France |

2.7 |

12.1 |

50.6 |

37.3 |

18.6 |

| Germany |

0.5 |

6.5 |

59.8 |

46.3 |

23.7 |

| Greece |

5.3 |

17.9 |

42.4 |

28.8 |

9.2 |

| Ireland |

-2.1 |

7.2 |

53.8 |

37.7 |

14.2 |

| Italy |

4.5 |

17.3 |

42.8 |

29.7 |

11.7 |

| Japan |

5.3 |

17.7 |

41.0 |

27.7 |

10.8 |

| Luxembourg |

3.9 |

15.3 |

48.7 |

36.3 |

18.8 |

| Netherlands |

-6.9 |

-4.0 |

68.3 |

52.5 |

27.8 |

| New Zealand |

3.1 |

12.3 |

52.9 |

39.7 |

… |

| Norway |

-3.0 |

7.3 |

51.5 |

37.8 |

20.1 |

| Portugal |

3.2 |

12.4 |

52.1 |

36.5 |

14.4 |

| Spain |

6.9 |

18.7 |

45.6 |

33.3 |

16.3 |

| United Kingdom |

3.4 |

12.1 |

52.5 |

38.8 |

20.5 |

| United States |

-0.1 |

2.4 |

79.5 |

68.0 |

42.5 |

| Source: OECD |

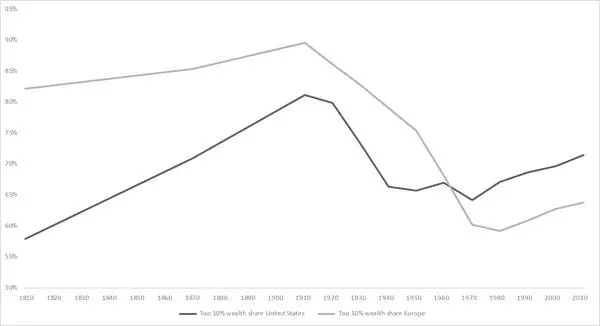

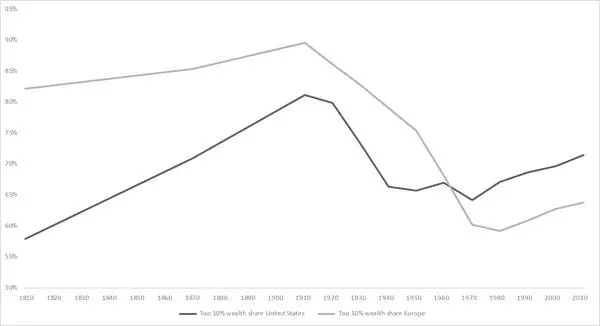

The level of wealth inequality has also been rising since the 1980s. Figure 1.7, drawn from Piketty’s Capital in the 21st Century , reveals that wealth inequality was extremely high in the beginning of the twentieth century – even higher in Europe than in the United States. For reasons we will explore in this book, the level of wealth inequality was brought down in the United States during the interwar years and continued to decline in Europe until the 1970s. In other words, the post-war Golden Age of capitalism was the most egalitarian period in human history in terms of both income and wealth distribution. The period from the 1930s to the 1970s saw the emergence of what Piketty calls the ‘patrimonial middle class’ – ‘the principal structural transformation of the distribution of wealth in the developed countries in the twentieth century’: the wealth share of the middle 40 per cent reached 35 per cent in the 1970s in the United States and as much as 40 per cent in several European countries. Since the end of the 1970s, the share of the middle classes has been declining, while the share of the top 10 per cent – and especially of the top 1 per cent – has been rising in the United States and, to a lesser extent, in other advanced capitalist countries. One of the central objectives of this book is to explain what happened during this unique period of democratic capitalism, why this egalitarian period came to a halt in the course of the 1970s, and why a less egalitarian period has followed ever since.

Figure 1.7 Wealth shares of top 10 per cent in Europe and the United States, 1810–2010

Source: Piketty 2014

The central thesis in Piketty’s book is that wealth inequality in the United States and Europe is set to rise because, historically, the net rate of return to capital (r) exceeds the growth rate of output (g): if we assume that the annual increase in medium wages reflects the growth rate of output (GDP), the relationship r > g basically means that the annual growth of the capital income of the medium capital owner will be higher than the annual growth of the wage income of the medium worker. However, the relationship r > g is not a natural or deterministic feature of the capitalist economy but is deeply influenced by public policies, institutions and regulations. As we will see in the next section, a political economy perspective deviates fundamentally from a neoclassical interpretation by making the analysis of these policies, institutions and regulations central to the explanation of past and future patterns of income and wealth inequality.

Читать дальше