1 ...7 8 9 11 12 13 ...16 Most individuals do not own stocks or bonds on their own account. In most cases, individuals invest their money in stocks and bonds (or other types of financial assets) through institutional investors like private pension funds and mutual funds. These institutional investors pool money from both small savers and wealthy individuals to purchase a variety of financial assets in order to diversify risk. Although many middle-income households have invested some of their savings in financial assets through these institutional investors, the ownership of financial wealth remains highly unevenly distributed in every society. In the United States, for instance, the top 10 per cent of US households owns more than 80 per cent of all the stocks that have been issued by publicly listed US corporations.

Functional income distribution

Why does this matter? The relative importance of capital income for the top 1 per cent – and especially for the top 0.1 per cent and top 0.01 per cent – suggests that these groups are the main beneficiaries of the declining labour share and parallel rising capital share in national income. The statistics on income inequality that we have discussed so far are measures of the personal income distribution – that is, the distribution of income between the various individuals or households in a country. Another important indicator for our purposes is the functional income distribution, which measures the distribution of income between the two factors of production – that is, the inputs that are needed by firms to produce goods and services: capital (which also includes land) and labour. In capitalist economies, firms make profits by adding value to the raw material and intermediate goods consumed in the production process, using both labour (workers and managers) and capital (factory and administrative buildings, machines and equipment). The gross domestic product (GDP) is the market value of all final goods and services produced within a country in a given period of time, where ‘final’ means that the value of intermediate goods – that is, parts and components that are used to produce final goods – is not included (to avoid double accounting). GDP is, perhaps, the single most important concept in economics, because it represents the economic size of a country as well as the national income that is generated in a country every year. Hence, GDP is a reflection of a country’s material well-being: GDP per capita gives an approximate idea of how much money an average citizen earns in a particular year.

A key problem with the concept of GDP and national income is that it tells us nothing about the distribution of that income. While the average annual income of a US citizen was about US$59,000 in 2017, a top manager of a large US firm received a multiple of that amount while a retail worker earned much less. Measures of personal income distribution like the Gini index or the income share of the top percentile give us information about the degree of income inequality, and should always be considered together with data on GDP and GDP per capita in order to get a full picture of a country’s economic well-being. Measures of functional income distribution represent a different type of income distribution: the labour share and capital share of GDP or national income indicate how the national income of a country is distributed between the two factors of production in that country; they measure how much of the added value that has been generated in a country is seized either by the sellers of labour (in the forms of wages, salaries and other employment-related income) or the owners of capital (in the form of profits, rents and other investment-related income). The best way to understand a country’s labour and capital share is that they offer an idea of how the value added and profits of firms in that country are, on average, divided between its workers and managers (who supply labour) and its shareholders (who own the firms and supply capital). Since labour and capital are both needed to produce goods and services, the labour and capital share indicate how much of the profits from selling these goods and services goes to either labour or capital.

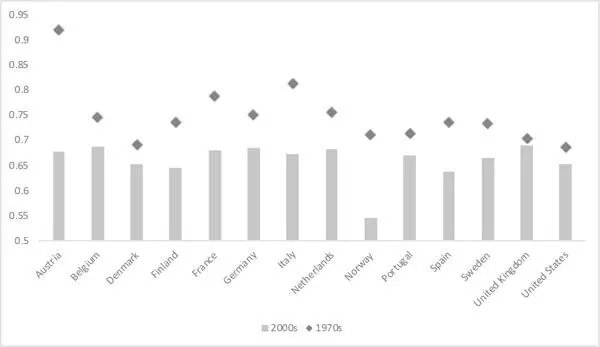

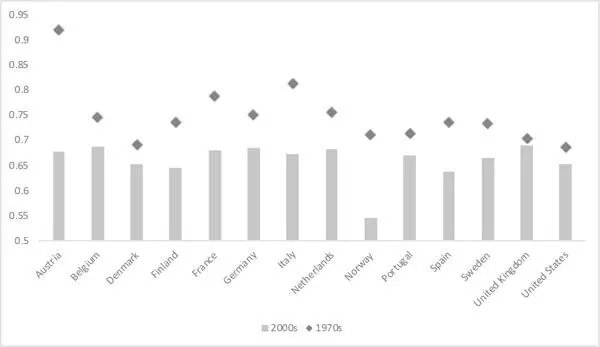

The labour share of national income seems to capture the Marxist notion that capitalism features intrinsically competing interests between the working class and the owners of capital (see below) – that is, that there is a ‘zero-sum’ conflict between capital and labour over the division of the national income pie: the gain of one production factor is the other one’s loss. 3While the Eurozone’s labour share was, for instance, 68 per cent in 2010 – meaning that 68 per cent of Eurozone GDP went to wages and other types of labour income and the rest to profits and other types of capital income – the ratio has not been stable over time: figure 1.5shows that the labour income share has been falling in the advanced capitalist world since the 1970s. A falling labour share implies that workers have been getting a shrinking piece of the pie and the owners of capital a growing piece.

Figure 1.5 Average labour income share, 1970s and 2000s

Source: OECD

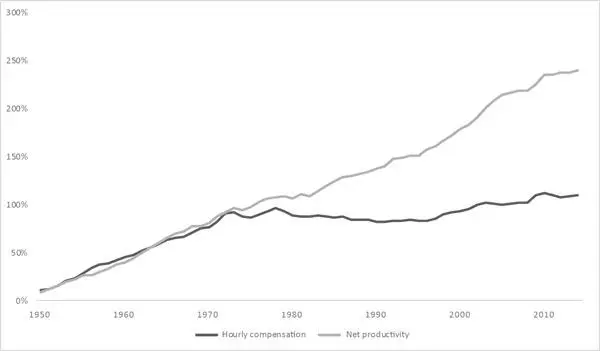

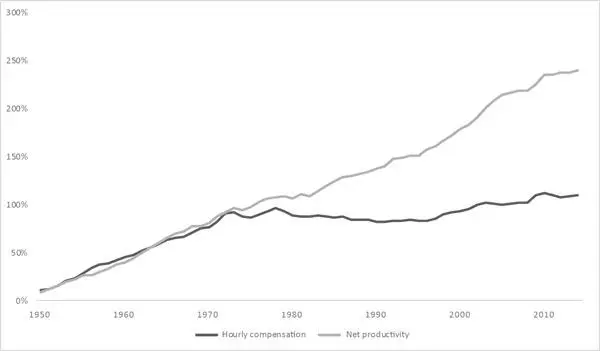

It is interesting and important to note that the fall in the labour income share has been more pronounced in the continental European countries than in the United States and the United Kingdom. There are two complementary explanations for this observation. On the one hand, the labour income share is a broad measure that integrates the incomes of employees working on very different pay scales and in different economic sectors: it includes the low wages of workers located in traditionally low-pay sectors such as food and retail as well as the exorbitantly high salaries of chief executives and senior managers. So given the fact that management pay rose more sharply in the Anglo-Saxon countries than in the continental European countries (as we will see in chapter 5on corporate governance), it is not really surprising that the labour share fell less prominently in the former group of countries than in the latter. Yet the sharper rise in wage inequality makes the fall in the labour share in the Anglo-Saxon economies look more modest than it is in reality for the majority of wage earners. 4For this reason, it is more appropriate to compare the evolution of median wages with the evolution of average labour productivity – that is, the amount of real output (GDP) produced by an hour of labour. Since the 1980s a growing productivity–wage gap has emerged in the US economy: from 1973 to 2015, net productivity rose by 73.4 per cent, while the hourly pay of the typical median wage earners essentially stagnated – increasing only 11.1 per cent over forty-two years (after adjusting for inflation). So while US workers are more productive than ever, the fruits of their labour have primarily accrued to corporate profits (which were distributed to US corporations’ shareholders and their managers) ( figure 1.6). 5

Figure 1.6 The productivity–pay gap in the US economy, 1948–2014

Source: Economic Policy Institute analysis using data from the Bureau of Economic Analysis and Bureau of Labor Statistics

Data are for average hourly compensation of production/nonsupervisory workers in the private sector and net productivity of the total economy. Net productivity is the growth of output of goods and services minus depreciation per hour worked.

Читать дальше