What are the key industry sectors that exhibit the greatest ESG risks or opportunities?

Which ESG execution strategy approach should you employ to benefit from this data?

What are the material ESG components that affect a company’s financial performance?

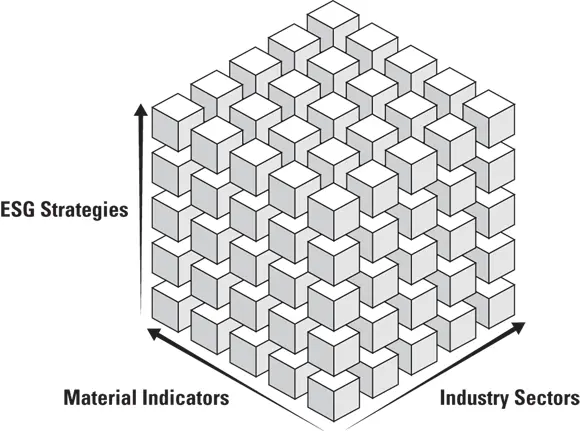

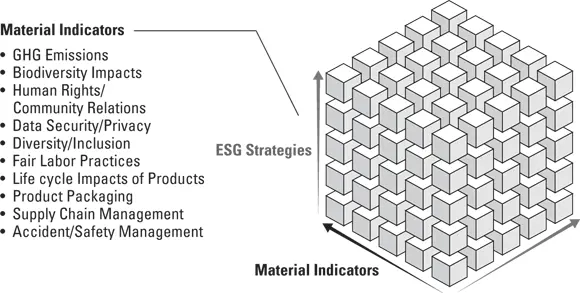

Welcome to the concept of the ESG Cube, which represents the intersections between these factors. Figure 1-2 illustrates the cube, using three axes: Industry Sectors on the X-axis, ESG Strategies on the Y-axis, and Material Indicators on the Z-axis.

© John Wiley & Sons, Inc.

FIGURE 1-2:ESG Cube with intersections between factors.

Each of these dimensions can be further categorized, as you find out in the following sections.

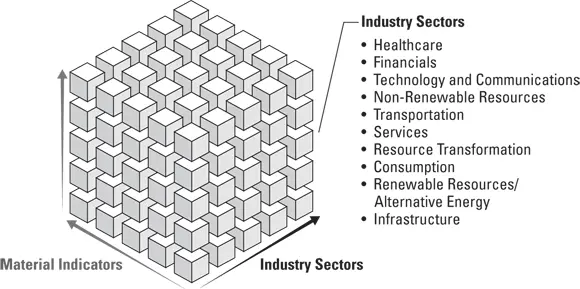

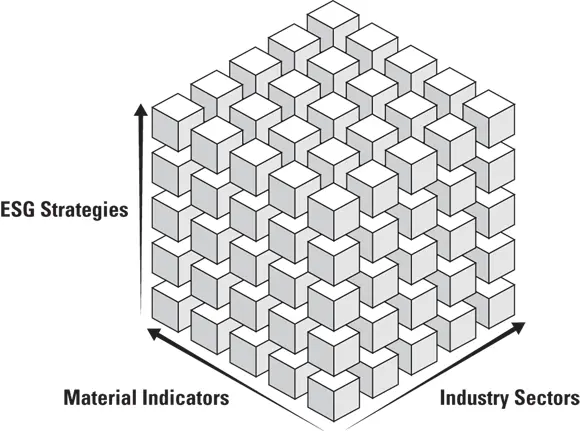

Figure 1-3 expands on the concept by adding the industry sectors utilized in the Sustainability Accounting Standards Board (SASB) Materiality Map:

Healthcare

Financials

Technology and communications

Non-renewable resources

Transportation

Services

Resource transformation

Consumption

Renewable resources and alternative energy

Infrastructure

© John Wiley & Sons, Inc.

FIGURE 1-3:Industry sectors per the SASB’s Materiality Map.

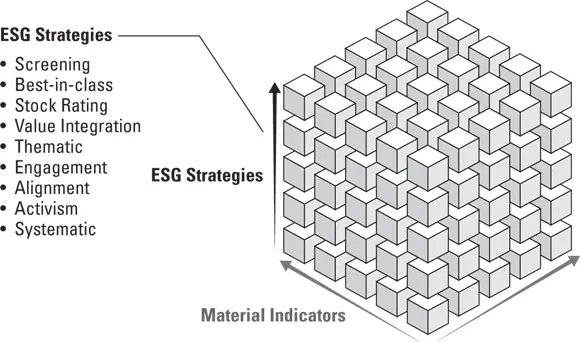

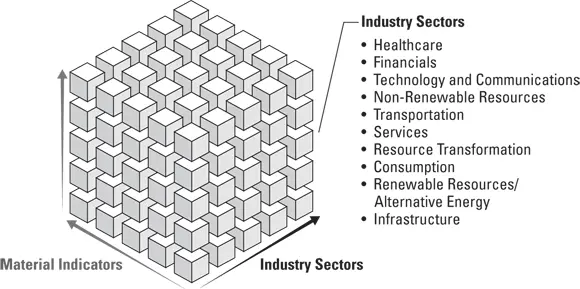

The most common ESG integration strategies that asset managers tend to employ on behalf of their clients are outlined in Figure 1-4:

Screening: Excluding or including stocks based on exposure to certain factors

Best-in-class: Selecting stocks based on high ESG scores

Stock rating: Using an ESG performance rating system

Value integration: Integrating ESG issues into stock valuations

Thematic: Focusing portfolios on certain themes

Engagement: Maintaining an ongoing dialogue on ESG issues

Alignment: Affiliating with social or environmental goals

Activism: Using voting capacity to engage companies

Systematic: Employing quantitative or data-driven factors

© John Wiley & Sons, Inc.

FIGURE 1-4:Popular ESG investment strategies.

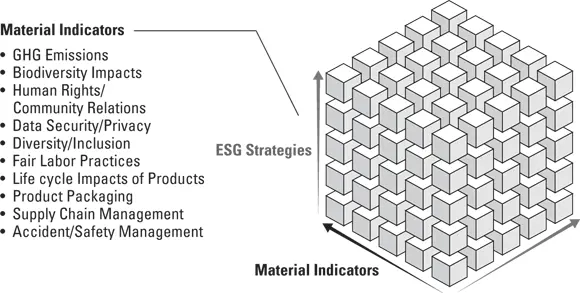

Figure 1-5 shows the details of the cube’s third dimension, where the SASB has identified, per industry sector, the likely financially material ESG issues. These are just indicators, and investors can choose their own material issues that are relevant to their values. They are as follows:

Environment: Greenhouse gas emissions and biodiversity impacts

Social capital: Human rights/community relations and data security and privacy

Human capital: Diversity/inclusion and fair labor practices

Business model and innovation: Life cycle impacts of products and product packaging

Leadership and governance: Supply chain management and accident/safety management

© John Wiley & Sons, Inc.

FIGURE 1-5:Material indicators per the SASB’s Materiality Map.

ESG strategies, applicable by type of client or sustainability preference, can be visualized relative to given industry sectors. For example, you might have a client seeking an alignment strategy (ESG Strategies on the Y-axis), focused on a social or environmental goals solution (Material Indicators on the Z-axis) within the transportation sector (Industry Sectors on the X-axis). If specific companies from the transportation sector are overlaid on top of this approach, a Best-in-Class filter could also be applied to identify the right addition to a portfolio.

ESG strategies, applicable by type of client or sustainability preference, can be visualized relative to given industry sectors. For example, you might have a client seeking an alignment strategy (ESG Strategies on the Y-axis), focused on a social or environmental goals solution (Material Indicators on the Z-axis) within the transportation sector (Industry Sectors on the X-axis). If specific companies from the transportation sector are overlaid on top of this approach, a Best-in-Class filter could also be applied to identify the right addition to a portfolio.

Comparing SRI, ethical, and impact investing to ESG

Having identified that strictly speaking, ESG isn’t actually an investing style, but a consideration of relevant ESG issues to manage risk, it’s worth considering how ESG ratings can be used in various sectors of the social investment arena. This starts with social investing as an umbrella term that assumes the provision of finance to achieve a combination of economic, social, and environmental goals. Some of the more specialized approaches are described here, with each one increasingly representing a more tangible approach to investment (see Chapter 7for more details):

Sustainable and Responsible Investing (SRI) uses relevant ESG criteria to choose companies for investment, typically based on a negative screening approach to exclude companies that produce or sell harmful substances, like tobacco, and those that engage in harmful activities, such as polluting or violating human rights. SRI doesn’t necessarily include positive screening to include companies that engage in beneficial activities, such as using sustainable practices, or producing clean technologies. There are attempts to establish standards and indexes in areas like climate change and human rights to further facilitate such investments.

In ethical investing, investments are selected or excluded according to the individual investors’ personal beliefs and values. Similar to SRI, ethical investing may exclude investments in certain industries (such as firearms) and is connected with the movement to divest from fossil fuel companies. The key difference with SRI is that ethical investing tends to be more issue-based and produces a more personalized result, whereas SRI normally uses one all-encompassing set of parameters to select investments.

Impact investing goes a step further by intentionally looking to produce both financial return and positive social or environmental impacts that are actively measured, so it’s much harder to apply ESG factors. Impact investors attempt to generate specific, positive impacts using financial instruments, and then require the companies to report evidence that the impacts have really been produced. It’s distinct from SRI in that it seeks positive impacts associated with areas such as renewable energy, sustainable agriculture, water management, and clean technology. Many of the independent companies or funds in such areas may not have specific ESG ratings. Moreover, measuring the actual social and environmental impact is difficult, and a standardized measurement system (the Impact Reporting and Investment Standards, or IRIS) has been developed to facilitate measurement and produce comparable impact performance data, rather than using ESG criteria. IRIS ( https://iris.thegiin.org/about/ ) is a free, publicly available resource that is managed by the Global Impact Investing Network (GIIN) for measuring, managing, and optimizing impact.

Socially responsible investments can be used to represent the political and social environment of the day. Therefore, it’s important for investors to recognize that if a given social value falls out of favor, their investment may also suffer. Considering such investments through an ESG lens may guard against some of these issues. Similarly, investors should carefully read any fund prospectuses to ensure that the philosophies being employed are in line with their values.

Socially responsible investments can be used to represent the political and social environment of the day. Therefore, it’s important for investors to recognize that if a given social value falls out of favor, their investment may also suffer. Considering such investments through an ESG lens may guard against some of these issues. Similarly, investors should carefully read any fund prospectuses to ensure that the philosophies being employed are in line with their values.

Читать дальше

ESG strategies, applicable by type of client or sustainability preference, can be visualized relative to given industry sectors. For example, you might have a client seeking an alignment strategy (ESG Strategies on the Y-axis), focused on a social or environmental goals solution (Material Indicators on the Z-axis) within the transportation sector (Industry Sectors on the X-axis). If specific companies from the transportation sector are overlaid on top of this approach, a Best-in-Class filter could also be applied to identify the right addition to a portfolio.

ESG strategies, applicable by type of client or sustainability preference, can be visualized relative to given industry sectors. For example, you might have a client seeking an alignment strategy (ESG Strategies on the Y-axis), focused on a social or environmental goals solution (Material Indicators on the Z-axis) within the transportation sector (Industry Sectors on the X-axis). If specific companies from the transportation sector are overlaid on top of this approach, a Best-in-Class filter could also be applied to identify the right addition to a portfolio.