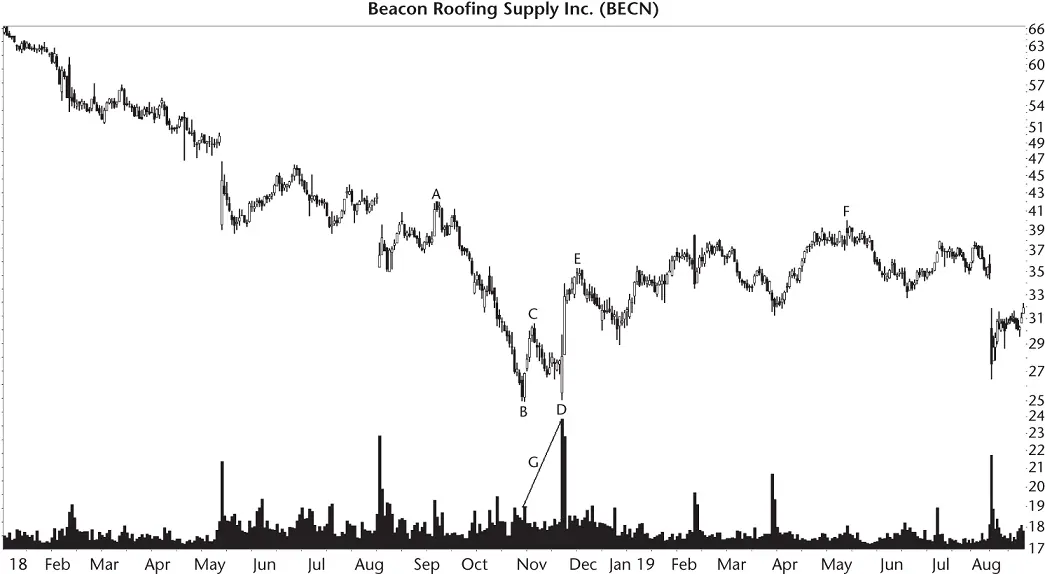

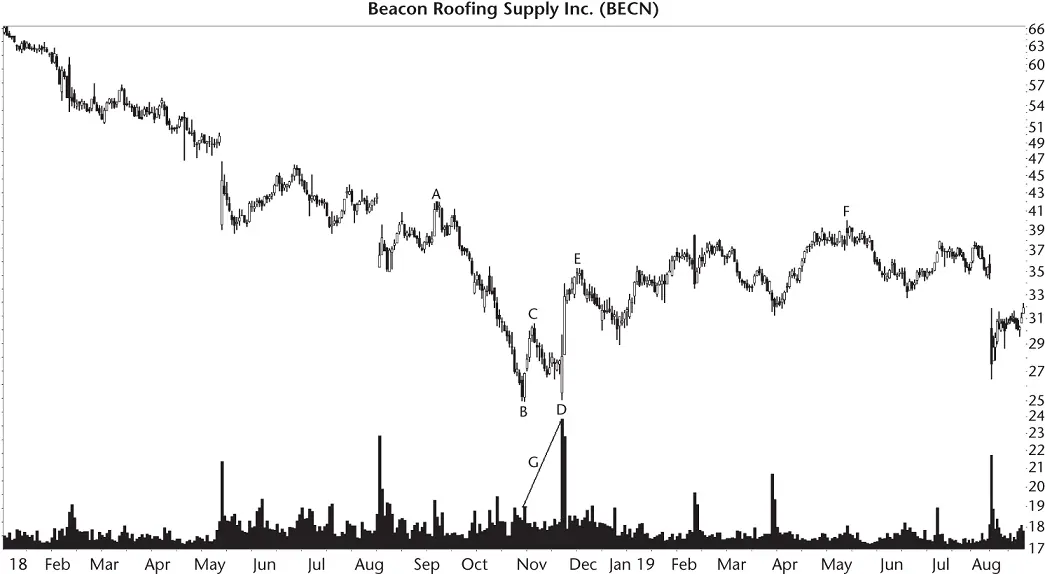

He checked a wider view of the chart to see where support and resistance were located. The daily chart showed a ceiling of overhead resistance blocking an advance higher (line A). Price at the top of the big M, peaks C and E, smacked against that resistance and ducked.

“I checked the weekly chart going back to 2015, but didn't see much support between D and H. But look at H. It's tight with lots of overlap as price moves sideways. Very nice.” A loose‐looking congestion region has price meandering all over the place, but H looked different. “H is my target. I think the stock will drop that far.”

“What about the knot at I?” I asked and circled it on the chart. “It'll support price. It's an energy barrier. When Chakotay and Seven hit one, they crashed. You don't want that to happen.”

He made a funny face.

“It's from Star Trek: Voyager .”

“I like football, baseball, and soccer: any sport with a ball.”

I wondered how he felt about polo, but decided not to ask. I pointed to I again.

“It's too close to the breakout. The stock will blow right through that without pausing and head down to H. Trust me. I do this for a living. I know what I'm talking about.”

My face didn't move a muscle, but inside I grinned and thought that his money was about to become someone else's.

He used the measure rule to determine how likely it would be for price to reach H. The top of the pattern is at C, 24, and the bottom is at D, 20.60, for a height of 3.40. The top of the region at H is at 14.50, or 1.75 times the height of the big M below the bottom of it.

From Table 6.10, he calculated a 48% chance of reaching point H by interpolating the numbers of 55% (.55) of patterns reaching the target using the full height, and 26% (.26) of them using the 2× height. That is, .26 + (.55 – .26) × .75 = 48% chance of the stock dropping to H. The .75 number is 75% of the distance from 1 to 2, which is where H (1.75 times the height) sits.

How did he feel about a 48% chance of success? He looked at me and cocked an eyebrow. “Yuck,” he said.

For grins, he computed the height of the big M (3.40) and divided it by the breakout price (20.60) to get a value of 16.5%. According to Table 6.5, the pattern was tall, making him feel better. He considered B to be the launch price, and Table 6.10said there was a 52% chance of reaching it (the last line in the table).

The two values were different: a 48% chance of reaching H and a 52% chance of reaching B, which was further away. Hmm . Maybe a subspace anomaly would be involved. I didn't say anything to Justin because a ball wasn't involved.

He had an order to short the stock if it dropped a penny below the low at D, or 20.59. He placed an order to cover the short at 17.03 (his target), above the top of the region at H, and above round number support at 17. Once the short triggered to open the trade, he placed a stop to exit the trade should price rise a penny above C, or 24.01.

Then he sat back and watched disaster unfold. The stock broke out downward at F, placing him in the trade, and it hit the energy barrier at the price of I. As I left his house, I started whistling the Voyager theme song.

The stop covered his position at G for a loss of 3.42 a share, not including commissions.

What did Justin do wrong? I think he should have anticipated a pullback at the energy barrier (the knot at the price of I). After that, though, I would have expected the stock to resume the downward move to H. Table 6.4says that 60% of the time, price does resume the downward move. Fortunately he had a stop in place to protect his backside while he waited for the Voyager crew to rescue him.

Appearance: Price forms twin bottoms at or near the same price with an unusually tall left side, often looking like a big W.

|

Bull Market |

Bear Market |

| Reversal or continuation |

Long‐term bullish reversal |

Short‐term bullish reversal |

| Performance rank |

11 out of 39 |

8 out of 20 |

| Breakeven failure rate |

9% |

9% |

| Average rise |

46% |

30% |

| Volume trend |

Downward |

Downward |

| Throwbacks |

64% |

66% |

| Percentage meeting price target |

74% |

55% |

| See also |

Bearish bat, double bottoms (all varieties) |

A big W is nothing more than a double bottom with a tall left side. It might have a tall right side, too, but that depends on how well the stock performs after an upward breakout. If price doesn't break out upward, then it's not a big W. I'll discuss identification guidelines later.

The above Results Snapshot shows important performance numbers for the big W. For example, the breakeven failure rate, at 9%, is quite good (meaning relatively small compared to other chart pattern types). The average rise for perfect trades is 46% (bull market), which is also good, hence the rank of 11 where 1 is best. Bear markets see price climb by 30%, which ranks 8 out of 20, where 1 is best.

If you use the full height of the pattern in the measure rule computation, price will reach the target 55% to 74% of the time (bear, bull markets, respectively).

Let's look at examples of big Ws.

Figure 7.1shows what a big W looks like. The pattern has the first bottom at B, the second one at D, with a hill in between, C. The pattern confirms as valid when price closes above the top of the hill.

The left side of the pattern begins at A, which is what I call the launch price. The stock drops in a straight‐line run down to the first bottom of the big W.

After the big W forms the second bottom, price recovers. In this example, the stock rises to E in a quick sprint higher from the low at D. That's still well short of the launch price, A. After point E, the stock is like a speedboat pulling a water skier. You get a lot a thrust to get the skier on top of the water (to E) and then the boat planes out (on the way to F). It's possible that the stock will recover and post a new ultimate high, so F is tentative until more data arrives.

Volume (G) has a U‐shape (in this example) until the spike at D. Linear regression says volume trends upward from bottom to bottom, so that's why I drew the line sloping higher at G. Volume for the big W trends downward most often, though.

Figure 7.1 This big W sees price rise, but not very far.

Identification Guidelines

Table 7.1shows identification guidelines for the big W and refer to Figure 7.2for guidance.

Appearance.The big W is a form of double bottom, one with a tall left side, and if the pattern works as it's supposed to, a tall right side as well. The two valleys should bottom near the same price (use your best judgment as to how close the bottoms need to be to each other). Often the bottom‐to‐bottom variation is small (the median is 14 cents).

Table 7.1 Identification Guidelines

| Characteristic |

Discussion |

| Appearance |

Price forms twin bottoms at or near the same price with an unusually tall left side. A well‐formed pattern should remind you of a big W (that is, if price on the right side rises to match the left). |

| Price trend |

Downward, leading to the first bottom. Look for a long, steep drop often at least the height of the pattern (from the lower of the two valleys to the peak between the valleys) above the top of the pattern. See text. |

| Volume |

Downward the majority of the time, but don't exclude a big W with a rising volume trend. |

| Breakout direction, confirmation |

To break out, price has to close above the peak between the two bottoms, confirming the pattern as valid. Without an upward breakout, you don't have a big W. |

| Duration |

No minimum duration and the longest pattern I studied is about 9 months wide. |

Figure 7.2 Price at F almost returns to the launch price, A.

Читать дальше