Transactions for Inorganic Growth

Executives enjoy a wide range of tactical alternatives for inorganic growth. Mergers and acquisitions are often the focus of financial advisers seeking to generate fee income by assisting firms on M&A. But the executive should consider at least four other avenues before embarking on an M&A effort. These include contractual relationships , strategic alliances , joint ventures , and minority investments .

CONTRACTUAL RELATIONSHIPSThis is the simplest of all inorganic expansions; it may assume strategic significance if the relationship extends over the long term, if there is a two-way exchange of information; if the two firms are linked into each other’s business processes (e.g., inventory management systems), and/or if it entails an exchange of managers. These relationships can take many forms. Several classic arrangements are these:

Licensing agreements. Your firm simply “rents” the technology, brand name, or other assets that are the focus of your interest.

Co-marketing agreements. Your firm and the partner each agree to sell the products of the other party. The owner of the product permits another firm to make and market the product under a different brand name in return for a fee and profits on ingredients sold to the partner.

Co-development agreements. Your firm and the partner each agree to share the costs of R&D or creative work necessary to develop a new product or process.

Joint purchasing agreements. Your firm and the partner each agree to combine purchase orders for raw materials or other resources, to exploit economies of scale in purchasing.

Franchising. Your firm grants an exclusive market territory to the partner in return for a one-time payment or annual fee.

Long-term supply or toll agreement. Your firm commits to a predictable volume of unit purchases over the long term, in return for advantageous pricing.

These kinds of agreements are widespread in business. For instance, Glaxo Holdings, a pharmaceutical company established a co-marketing agreement with Hoffmann–La Roche to market its best-selling product, Zantac, an antiulcer drug. Bruner et al. (1992) detail the economics of these agreements: The trade-off for Glaxo was between lost direct sales versus fee income, profits on ingredients, and faster time to market within a limited period of patent protection.

STRATEGIC ALLIANCEIn comparison with a contractual relationship, an alliance is typically more complicated and expresses a more serious commitment between the parties. A contract may formalize the alliance. But it is the exchange of managerial talent, resources, capabilities, and possibly even equity investment that elevates the alliance beyond a mere contractual agreement. An equity investment under the alliance may be structured across a range of possible deals, including a joint venture or minority investment.

JOINT VENTUREA joint venture (JV) creates a separate entity in which your firm and the counterparty will invest. The JV agreement between the venture partners specifies investment rights, operational responsibilities, voting control, exit alternatives, and generally the allocation of risks and rewards. The entity could be a division carved out of one of the venture partners, or an entirely new business established for the venture. The agreement for large JVs may be as complicated as for an acquisition.

MINORITY INVESTMENTHere, your firm invests directly in the counterparty firm, rather than in an intermediate firm (like the joint venture). Sometimes firms take mutual minority interests in each other; this is called a cross-shareholding arrangement and is common among large Japanese and Continental European firms. Taking a direct equity interest in another firm is a strong signal of commitment and participation in the fortunes of that firm.

Research Findings about Joint Ventures, Alliances, and Minority Equity Investments

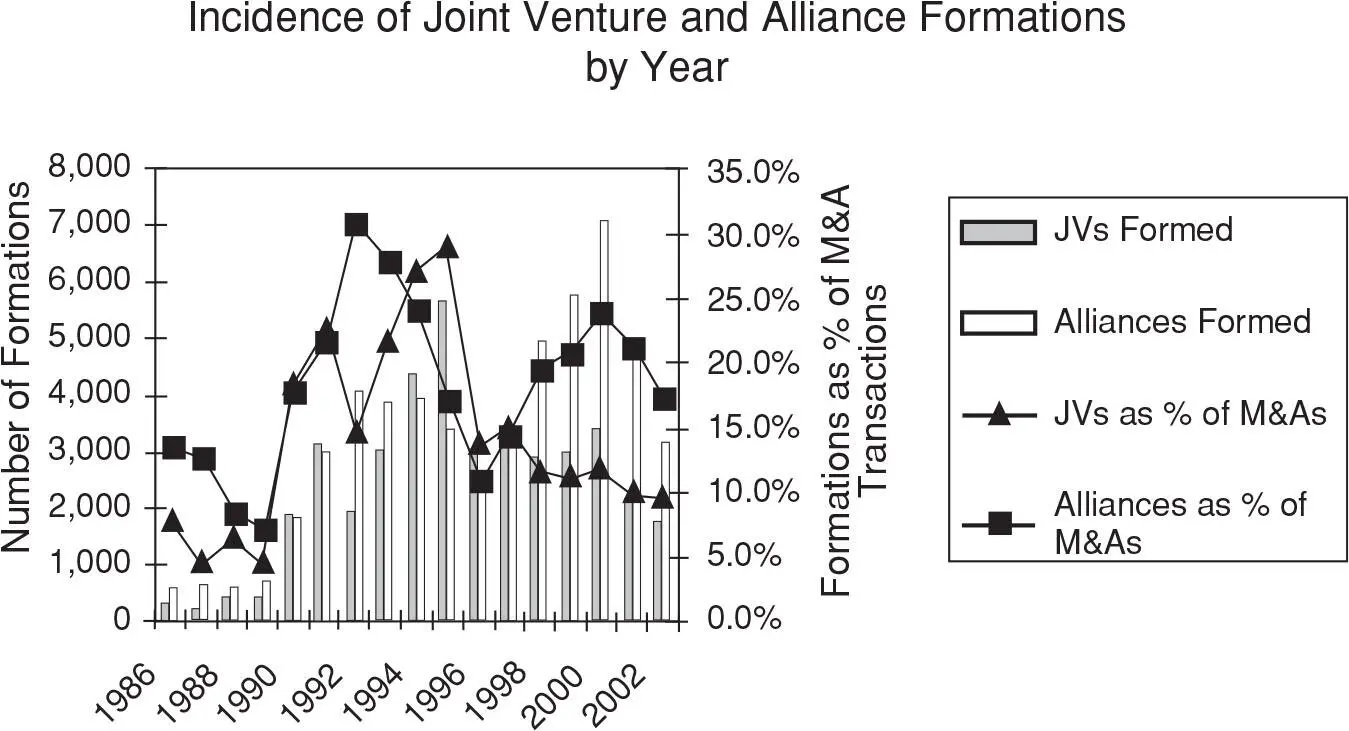

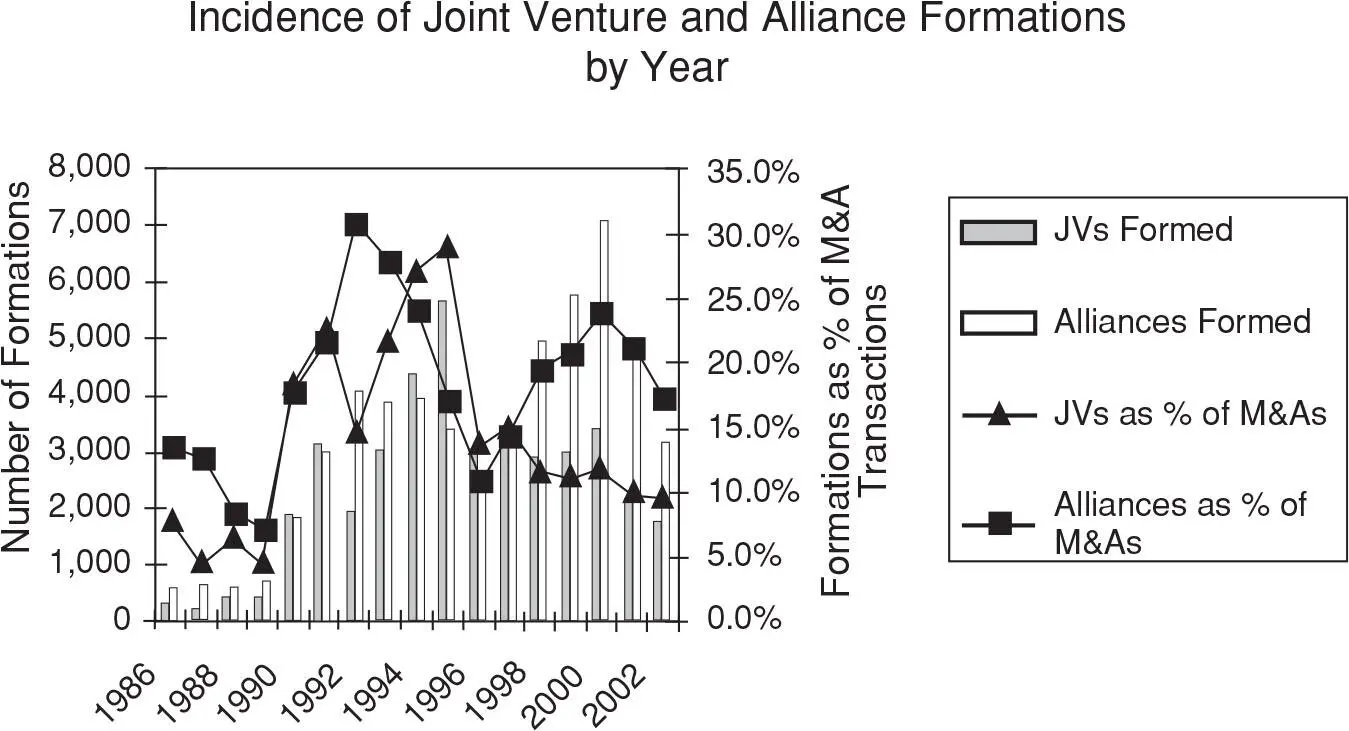

Continuing a trend of several decades, the formation of joint ventures and alliances grew dramatically during the 1990s, as shown in Exhibit 6.12. Robinson (2001) argued that the growth of JVs and alliances was due to their success as commitment devices between organizations—alliances bind the partners not to divert resources in inefficient ways. Also, he found that alliances are more likely than acquisitions where the risk of the venture is greater than the risk of the partner’s core business.

EXHIBIT 6.12 Formation of Joint Ventures and Alliances by Year and as a Percentage of Total M&A Activity

Source of data: Thomson Financial SDC, Platinum Joint Ventures Database.

Desai, Foley, and Hines (2002) studied the formation of international joint ventures and found a trend away from minority ownership and toward whole ownership. They speculated that this change might reflect relaxation of restrictions on whole ownership or changes in the geographic mix of investments. They found that “whole ownership is most common when firms coordinate integrated production activities across different locations, transfer technology, and benefit from world-wide tax planning” ( page 1) and that this propensity toward global organization explained a declining tendency to organize foreign operations as joint ventures.

Lerner, Shane, and Tsai (2003) studied R&D ventures formed by small biotechnology firms. They found that when external equity financing is unavailable or limited in supply, these firms are more likely to fund their R&D by organizing research JVs with large corporations. And the agreements structured under these circumstances tend to assign the bulk of control to the large corporate partner. Such agreements are likely to be renegotiated and to be significantly less successful than others. Robinson and Stuart (2002) found that the staging of investment is ubiquitous between small biotechnology R&D firms and their partners. Staging releases investment funds as the R&D firm passes preset milestones—this is discussed in more detail in Chapter 14.

The overarching conclusion about the profitability of joint ventures, alliances, and minority equity investments is that, like M&A, it is profitable for targets, a break-even proposition for purchasers, and for both target and purchaser combined, an economically positive activity. Exhibit 6.13summarizes findings across 12 studies and shows significantly positive abnormal returns of 0.5 to 1.0 percent to firms announcing investments in JVs. JVs seem to pay. The findings suggest that JV partners do better when:

Buyers have good investment opportunities. Chen et al. (2000) find that where the buyer has a good record of investment returns, the announcement of a JV is associated with gains to shareholders. But where the buyer’s record is weak, the JV announcement could be taken as a signal of pessimism about the buyer’s internal opportunities.

JV increases focus for the buyer. Ferris et al. (2002) find materially better returns for buyers where the JV increases the business focus of the firm.

JV reduces agency costs. Allen and Phillips (2000) concluded that intercorporate equity investments in the form of JVs, alliances, and minority stakes reduced “the costs of creating, expanding, or monitoring the alliances or ventures between firms and their corporate block holders.” (Page 2813) Robinson (2001) argued that JVs help to shelter “underdog” projects from the adverse behavior sometimes found in internal capital markets (e.g., winner-picking). Allen and Phillips (2000) found that the returns from JVs and alliances were greatest in the instance of R&D intensive industries. These gains may stem from alleviating the problems of information asymmetries arising from the development of new technology.

Читать дальше