IMPROVE THE INTERNAL CAPITAL MARKETDiversified firms can suffer from failures in the internal capital market to allocate resources effectively—the most prominent kind of failure is the subsidization of inefficient units by efficient units. By shedding the inefficient operations, a restructuring program can eliminate the cross-subsidies.

OPTIMIZE FINANCIAL LEVERAGE AND REDUCE TAX EXPENSEMany restructurings that entail a change in capital structure for the firm seek to create value for shareholders by reducing the risk of default to acceptable levels or exploiting the tax deductibility of interest expense. The valuation of debt tax shields is discussed in more detail in Chapter 13, and Chapter 34gives a detailed discussion of leveraged restructuring.

STRENGTHEN MANAGERIAL INCENTIVES/ALIGN THEM WITH THE INTERESTS OF SHAREHOLDERSFinancial restructurings and leveraged buyouts often result in management holding a meaningful investment in the equity of the firm. This tends to focus management attention on the efficiency of the business and align their interests more tightly with those of the other equity investors.

RESPOND TO CAPITAL MARKET DISCIPLINEFinancial underperformance by firms can trigger a range of reactions from capital markets, from adverse comments by journalists and securities analysts to depressed share prices, higher interest rates, shareholder proxy contests to replace the board of directors, and hostile takeover attempts. A defensive restructuring is a prominent response to capital market discipline. Chapter 36describes the case of American Standard’s defensive restructuring.

GAIN FINANCING WHEN EXTERNAL FUNDS ARE LIMITEDFirms with poor access to debt or equity markets may turn to the sale of assets to raise funds. Thus, divestiture may relax capital constraints. Consistent with this financing motive, Schlingemann et al. (2002) found that the liquidity of the market for the particular corporate assets is a significant determinant of which assets are likely to be divested. Kruse (2002) found that there is a greater probability of asset sales if the firm is performing poorly and suffers from low debt capacity.

Transactions to Restructure, Redeploy, or Sell

A strategic decision to focus or restructure the firm poses the choice about degree (partial deployment or outright exit) and method. Here, the possible transactions also span a wide range of alternatives.

SALE OF MINORITY INTERESTThe sale of a block of shares to another firm gains the selling firm fresh capital and attracts a committed partner who might be induced to contribute know-how or other resources. This alternative should be compared to a public offering of shares (i.e., for pricing and costs). The investor may seek advantageous (i.e., low) pricing, arguing that it amounts to a private transaction. The trade-off for the issuer is whether the other resources the investor might contribute will compensate for any private transaction discount. An added consideration is political: How will the minority stake affect the balance of voting power in the firm, and how will other equity investors respond? Sometimes a minority stake is prelude to a takeover.

SALE OF JOINT VENTURE INTERESTThe sale of a partial interest in a joint venture to a partner attracts fresh capital for the venture and the participation of a partner with know-how and other resources. Compared to the minority stake, this has the virtue of less political impact and affords more transparency about the contributions of the respective sides.

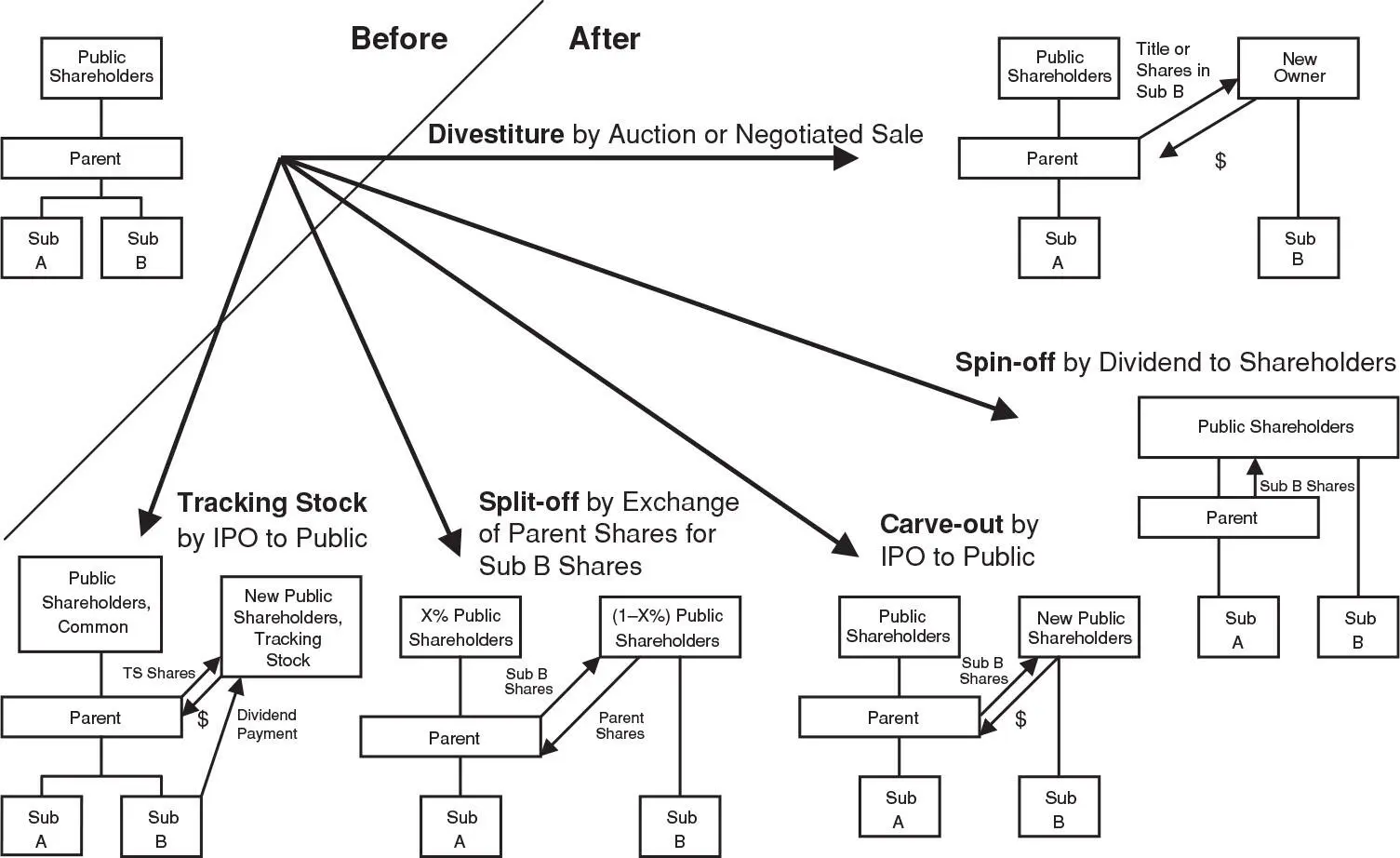

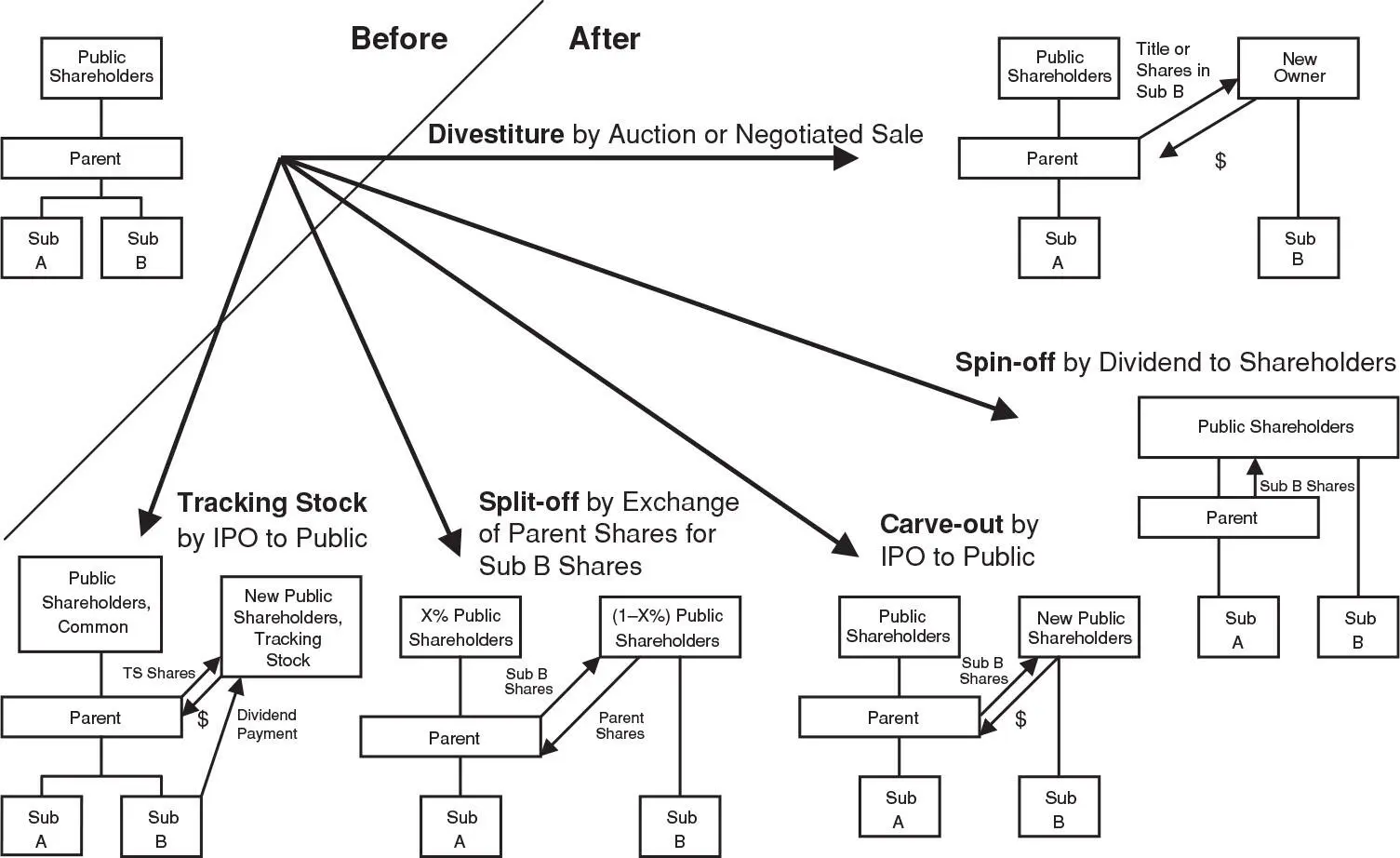

DIVESTITURE OR ASSET SALEThe business unit, or certain assets in the unit (such as a factory), could be sold outright to an unrelated party. This raises funds for your firm and possibly frees it from a money-losing proposition. While divestitures account for a large proportion of M&A activity (26 to 35 percent of all deals are divestitures), two types of sales deserve special mention. In the leveraged buyout/going private transaction , the management of the unit will organize an investor group and debt financing with which to pay for the unit. Usually the ability to sell a unit into an LBO depends on its capacity to succeed as a stand-alone entity and on its capacity to bear debt used to finance the transaction. Chapter 13discusses LBOs and other highly leveraged transactions in more detail. The liquidation is the extreme divestiture strategy: the firm sells all of its assets, pays any outstanding liabilities, dividends the net proceeds to shareholders, and then dissolves. Bruner et al. (1979) explored the liquidation of UV Industries, a Fortune 500–ranked firm, in 1979. Triggered by a hostile raid, the firm commenced a voluntary liquidation that yielded a return of 163 percent over its preraid value. Exhibit 6.14illustrates the divestiture alternative.

CARVE-OUTThis tactic organizes the business unit as a separate entity and sells to the public an interest in the equity of the unit through an initial public offering (IPO). This generates cash for the parent, monetizes the parent’s interest in the subsidiary, and creates more transparency for investors to assess its value. Exhibit 6.14presents the carve-out alternative.

SPIN-OFFLike the carve-out, the spin-off creates a separate entity for the business and results in public trading of its shares with majority ownership retained by the parent. But in the case of a spin-off, the shares are given to the parent’s shareholders in the form of a dividend. No money is exchanged. Where one firm existed before, two firms exist after. At the point of spin-off, the same shareholder group owns both companies (though ownership will probably change once trading commences in the new firm’s shares). Exhibit 6.14diagrams the spin-off alternative.

EXHIBIT 6.14 Comparison of Divestiture, Spin-off, Carve-out, Split-off, and Tracking Stock Where the Parent Considers Redeploying Subsidiary B

SPLIT-OFF, OR EXCHANGEIn this instance, shares of the subsidiary business are swapped by shareholders of the parent for shares in the subsidiary. This results in a freestanding firm, no longer a subsidiary of the parent, owned initially by a subgroup of the former parent’s shareholders. Exhibit 6.14illustrates the split-off alternative.

TRACKING STOCKHere, there is no transfer of ownership of a business or its assets. But a special equity claim on the subsidiary business is created, the dividend of which is tied to the net earnings of the subsidiary. This results in monetization of the subsidiary and in greater transparency. Exhibit 6.14illustrates the tracking stock alternative.

FINANCIAL RECAPITALIZATIONThis focuses on changes in the firm’s capital structure. 5 The intent is usually to optimize the mix of debt or equity, or to adjust the equity interests in the business. Regarding the debt/equity mix, firms might undertake a leveraged restructuring in which the firm borrows debt to repurchase shares or pay an extraordinary dividend. Chapters 13, 20, and 34explore the implications of capital structure altering transactions. Regarding changes in the equity base, firms could contemplate an ESOP restructuring in which the firm purchases its own shares (or issues them from its treasury) for sale to an employee stock ownership plan. Alteration of both the capital mix and equity ownership is seen in reorganization in bankruptcy in which the firm exchanges debt obligations for equity interests to reduce its debt burden under the protection of the court.

Читать дальше