European Investment Bank Group Sustainability Report 2020

Здесь есть возможность читать онлайн «European Investment Bank Group Sustainability Report 2020» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:European Investment Bank Group Sustainability Report 2020

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 80

- 1

- 2

- 3

- 4

- 5

European Investment Bank Group Sustainability Report 2020: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «European Investment Bank Group Sustainability Report 2020»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

European Investment Bank Group Sustainability Report 2020 — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «European Investment Bank Group Sustainability Report 2020», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

The EIB Group, through a wide spectrum of financial products and advisory services, is helping the European Union to deliver on these ambitions.

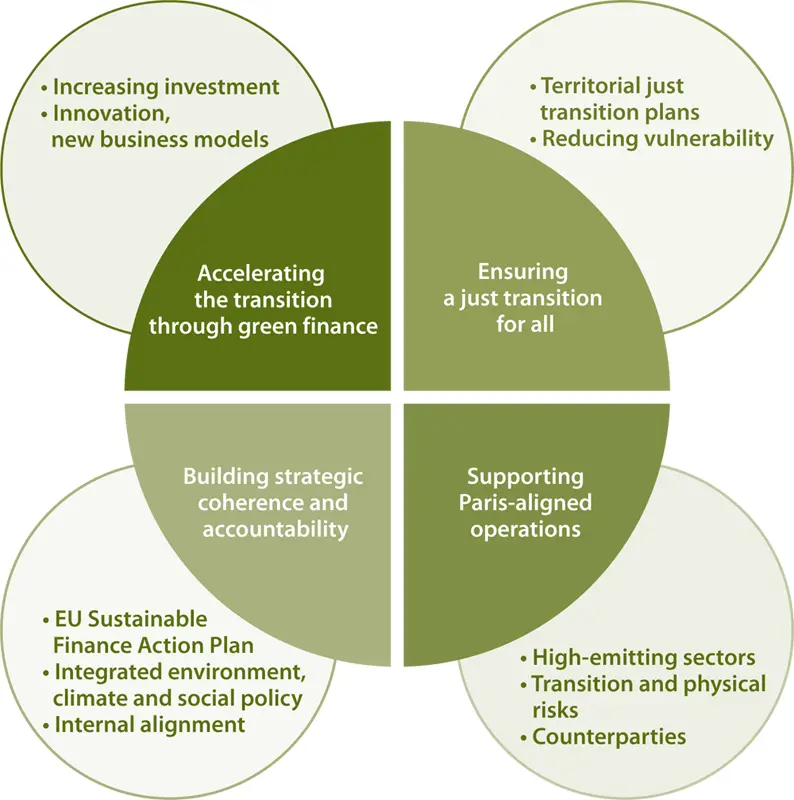

FOUR KEY AREAS

The EIB Group Climate Bank Roadmap adopts these commitments by focusing on four key areas.

1. Accelerating the transition

The roadmap details our new level of commitment to accelerating the transition to a low-carbon and climate-resilient economy. By 2025, the EIB will increase its support for climate action and environmental sustainability to exceed 50% of its overall lending.

This means that we will continue to support areas that have already made considerable progress in the transition (such as low-carbon electricity, electric vehicles and battery storage) and tackle other areas that are lagging behind. For investments in natural capital – carbon sinks, biodiversity and ecosystem preservation, for example – the transition has barely begun.

To accelerate the transition, the Climate Bank Roadmap stresses four key messages about the value that the EIB Group can provide. A major one is substantially increasing adaptation efforts, supporting the new EU Adaptation Strategy. A second message is to focus on investment in innovative green technologies, alongside new business models. A third is to help drive down the long-term cost of capital in capital-intensive green infrastructure. Finally, the EIB can help drive aggregation, scalability and replicability to boost investment.

In close cooperation with EU Member States, the EIB Group will use this support to help deliver national energy and climate plans, national adaptation strategies, as well as recovery and resilience plans. This approach extends beyond the European Union, where the EIB works with individual countries to support ambitious nationally determined contributions ( NDC Spotlight | UNFCCC). This includes projects in some of the most vulnerable regions on our planet.

2. Ensuring a just transition for all

Supporting cohesion was one of the founding principles of the EIB when it was established in 1958, and it continues to be a core priority. The green and resilient transition should leave no person or region behind. A just transition is of particular concern for countries that currently rely on carbon-intensive sectors or where local economies may become less viable due to climate change. In both cases, strategic action is needed to develop new skills in the workforce along with new, green and resilient economies for the cities and regions affected.

The Just Transition Mechanismis the cornerstone of the European Union’s response to this challenge. The EIB Group will play a central role in the mechanism, supporting, to varying degrees, each of its three main pillars: (1) the Just Transition Fund, (2) the InvestEU programme, and (3) a public-sector loan facility. Our Advisory Services team will complement and support all three pillars, providing guidance on everything from strategies to market development and project implementation. The EIB will present a detailed Just Transition plan in 2021, once the Just Transition Mechanism is agreed by EU members.

InvestEU

InvestEUbuilds on the success of the Juncker Plan, the European Fund for Strategic Investments (EFSI) and other existing financial instruments such as the Connecting Europe Facility (CEF), InnovFin and the Competitiveness of Enterprises and Small and Medium-sized Enterprises (COSME) programme, which are managed and implemented by the EIB Group. It will be based on a €26.2 billion guarantee from the EU budget and aims to mobilise around €370 billion of investment to keep the European Union socially aware, green and competitive. In addition to implementing 75% of the programme and the responsibilities the EIB will have for managing the banking aspects of the programme in partnership with the European Commission, the EIB will also provide technical support to project promoters under the InvestEU Advisory Hub, continuing the advisory work developed under the Juncker Plan.

A just and inclusive transition is directly linked to the wider issue of social development. Climate change continues to disproportionately affect least developed countries, and disadvantaged and vulnerable populations, specifically undermining people’s health, incomes, livelihoods, food security and human rights. Carefully targeted investments can contribute to the green transition and social development. At the EIB, we are supporting both objectives and stepping up our efforts for two key themes: (i) gender equality and (ii) conflict, fragility and migration. We believe that gender-responsive investments can strengthen climate, environmental and social outcomes and increase the overall positive impact of projects. At the same time, reducing fragility can also contribute to the success of a just transition. Our activities here will further support climate adaptation and resilience projects in fragile contexts, urban infrastructure that is resilient to future shocks (such as the influx of refugees and migrants), disaster preparedness and post-disaster recovery.

3. Supporting Paris-aligned operations

The European Union has committed to reducing greenhouse gases by at least 55% by 2030 and to achieving net zero greenhouse gas emissions by 2050. In line with these objectives, the EIB Group committed to aligning all our financing activities with the goals and principles of the Paris Agreement by the end of 2020. The roadmap lays out our framework for putting this commitment into practice. It covers the low-carbon and climate-resilient dimensions.

To align with low-carbon pathways, we adopted sector-specific criteria for carbon-intensive sectors of the economy, such as energy (already addressed through the 2019 EIB energy lending policy), aviation, road infrastructure, road vehicles, energy-intensive industries, as well as agriculture and forestry. These criteria are set out in a series of simple tables, facilitating engagement with potential clients. Sector-based criteria are also applied across the wide range of EIB Group products. The alignment framework is adapted for intermediated SME and mid-cap finance. For these products, the framework focuses on three sectors: energy, mobile assets for transport services and energy-intensive industries, ensuring that certain high-emitting industries do not receive support from standard products.

The alignment framework helps define the Group’s priorities for a given sector. For instance, we will focus on improving existing airport capacity, including safety, security and decarbonisation, but will no longer support airport capacity expansion and conventionally fuelled aircraft. In industry, we will look at innovation in low-carbon technologies – and therefore withdraw from any new capacity based on traditional high-carbon processes. In the farming sector, we will concentrate on meat and dairy industries with improved greenhouse gas emissions profiles thanks to the sustainable animal-rearing methods they adopt.

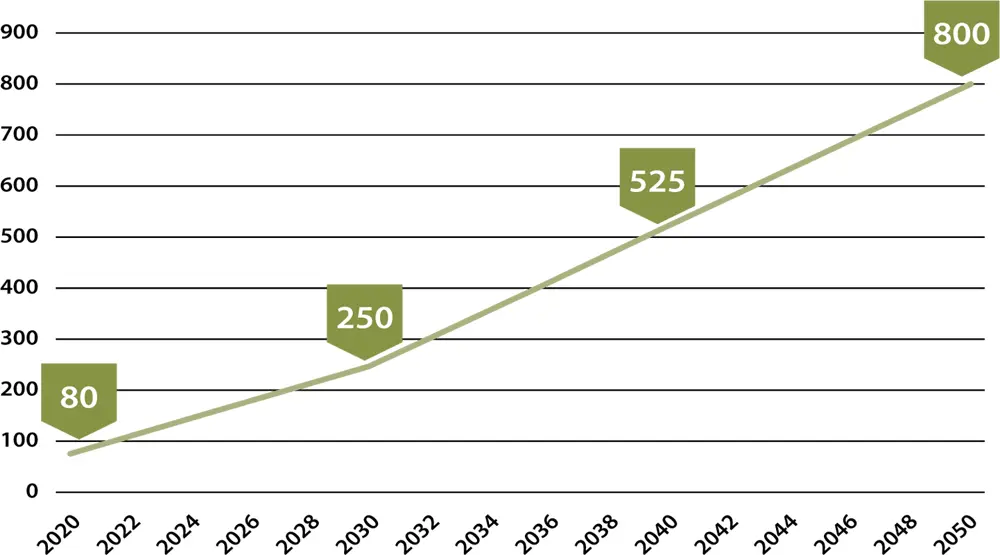

As part of the roadmap, we revised the shadow cost of carbon, a key technical parameter used to estimate the full value for society when a tonne of carbon is saved. The Bank has been using the shadow cost of carbon for projects that go through an economic assessment since the 1990s. To align with the Paris Agreement, we reviewed the latest modelling evidence and agreed to increase these values. As shown in the graph below, the shadow cost of emitting one tonne of carbon equivalent rises to €250 by 2030 and to €800 by 2050.

EIB SHADOW COST OF CARBON (IN € PER tCO 2e)

The graph shows the EIB shadow cost of carbon (a key technical parameter used to estimate the full value for society when a tonne of carbon is saved), as included in the roadmap. It is based on the estimated full cost to society of limiting the rise in global average temperature to 1.5˚C above pre-industrial levels and helps to assess whether EIB financing is on track with this goal. This will be reviewed on an annual basis and the cost will be adjusted accordingly.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «European Investment Bank Group Sustainability Report 2020»

Представляем Вашему вниманию похожие книги на «European Investment Bank Group Sustainability Report 2020» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «European Investment Bank Group Sustainability Report 2020» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.