In 2019, with the approval of our new energy lending policy, we set a final deadline of 2021 to end our financing of energy projects reliant on unabated fossil fuels. Now, armed with our new Climate Bank Roadmap, which is the result of months of intense work and in-depth dialogue with our external stakeholders, we will put into operation the European Green Deal. This will have far-reaching effects on the way we lend money, issue financial guarantees and invest in equity funds.

As part of our enhanced efforts to tackle climate change, the EIB Group became a supporter of the Task force on Climate-related Financial Disclosures (TCFD) in 2020. For the first time, we prepared a TCFD report to describe how we integrate climate-related risks and opportunities in our governance structure, strategy, risk management and metrics and targets.

Another major achievement of 2020 was the EIF’s signature of the Principles for Responsible Investment and its continued cooperation with the United Nations Development Programme (UNDP), which will help the EIF to develop joint initiatives for sustainable finance and to implement the Sustainable Development Goals (SDGs).

As you will read in this report, the entire EIB Group is contributing to a more sustainable and resilient future, in Europe and globally.

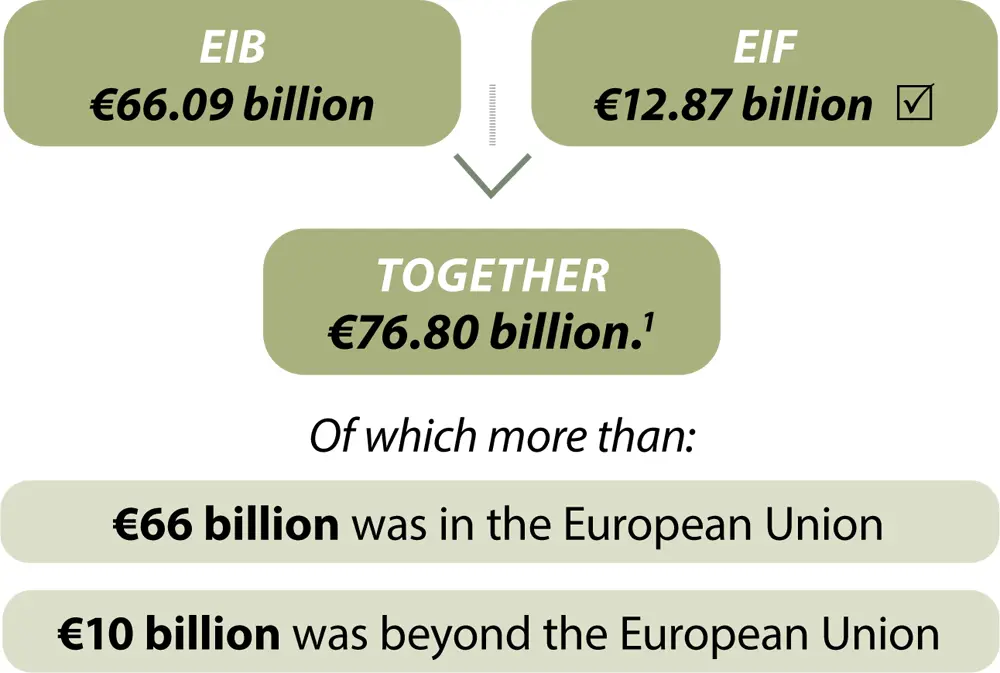

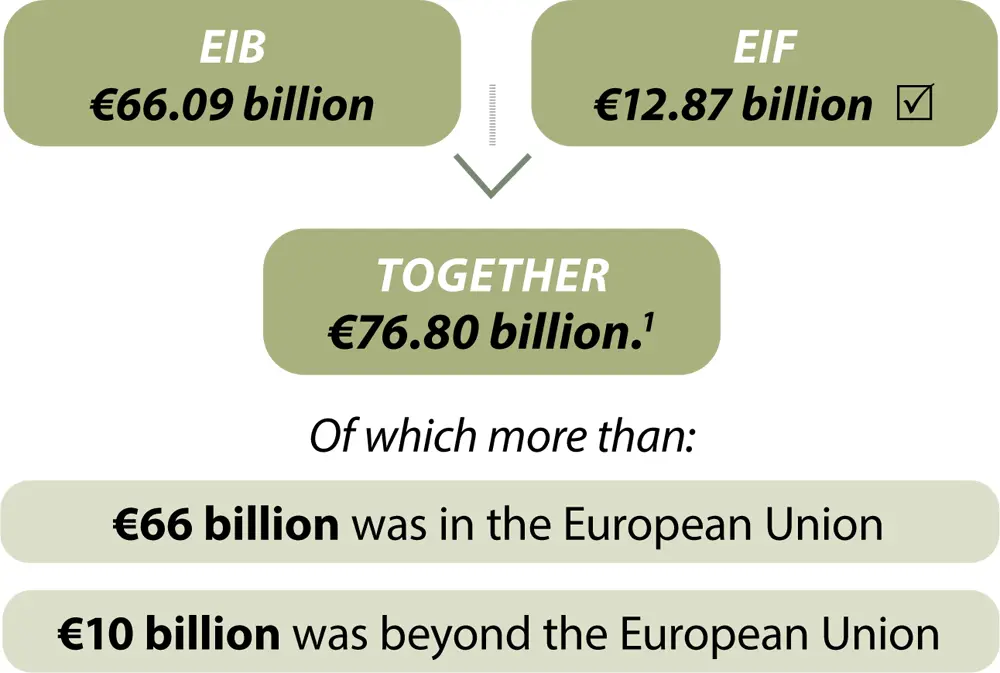

The EIB Group is the European Union’s long-term financing institution. It provides finance and technical assistance to achieve sustainable, inclusive growth through two complementary entities, the European Investment Bank (EIB or Bank) and the European Investment Fund (EIF).

The European Investment Bank– the EU bank – is owned by the EU Member States. We are the world’s largest multilateral borrower and lender. The finance and assistance we provide contributes to the achievement of EU policy goals. We also operate globally as a multilateral development bank.

The European Investment Fundprovides risk finance to benefit micro, small and medium-sized enterprises (SMEs) and stimulates growth and innovation across Europe. It provides financing and expertise for sound, sustainable investment and guarantee operations. EIF shareholders include the EIB, the European Commission, and a wide range of public and private banks and financial institutions. By developing and offering targeted products to its financial intermediaries, such as banks, guarantee and leasing institutions, microcredit providers and private equity funds, the EIF enhances access to finance for small and medium enterprises.

TOTAL FINANCING

PUBLIC POLICY GOALS:

Environment: €16.82 billion

Infrastructure: €14.99 billion

Innovation and skills: €14.43 billion

Small and medium-sized businesses (SMEs) and mid-caps:[2] €30.56 billion

TRANSVERSAL OBJECTIVES:[3]

Climate action financing:[4] 37% of total EIB financing

Economic and social cohesion and convergence: >35% of total EIB financing[5]

COVID-19 related financing: €25.46 billion

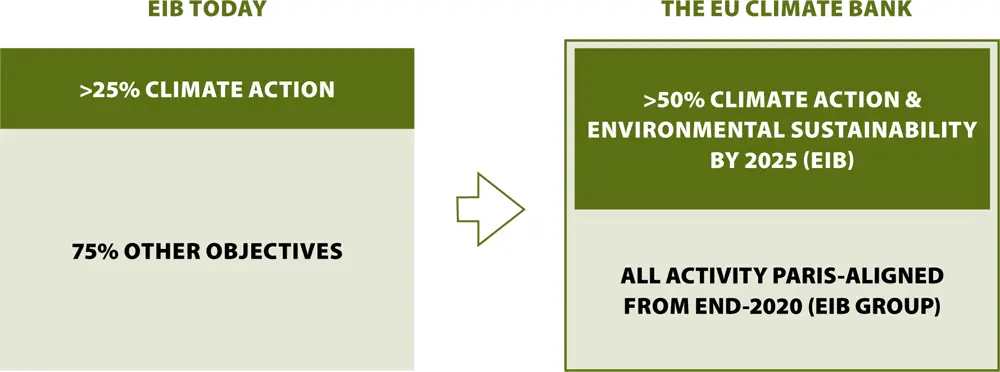

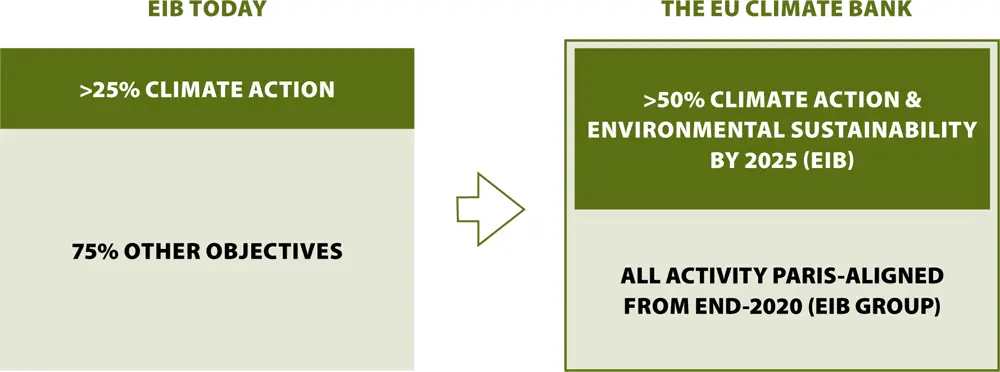

CLIMATE BANK ROADMAP: PUTTING THE PARIS AGREEMENT INTO PRACTICE

With a bold vision and substantial financing, the EIB Group is turning its climate ambitions into reality. The Climate Bank Roadmap, approved in November 2020, sets out our commitment to support the European Green Deal. It puts into action the decisions taken by the EIB Board of Directors in November 2019. The roadmap draws on constructive, strategic discussions with a broad range of stakeholders, and transforms the EIB Group into the European Union’s climate bank.

“Following the recent reports by the Intergovernmental Panel on Climate Change (IPCC) and accelerating evidence of both the climate and environmental emergencies, the need for the EIB Group as the EU climate bank to decisively support efforts to achieve the 1.5 degree temperature goal was evident. But we have done more than that. With the updated EIB Climate Strategy and the clear plans laid out for the next five years in our Climate Bank Roadmap, we have put in place a robust framework with ambitious climate action targeting 1.5 degrees, a renewed effort for increased adaptation, strong environmental action and a real focus on people.

Nancy SaichEIB chief climate change expert

It is people that are being already, and will be further, affected by climate change and environmental degradation. These impacts will be felt everywhere, but always fall hardest on the most vulnerable. The planet will ultimately be fine – but can humans continue to live here healthily and successfully? And can we make the urgent changes we need to make while leaving no one behind? This is why our Climate Bank Roadmap not only lays out how the EIB Group will address Paris alignment in all its activities – but also how we will support a just transition for all.”

In November 2020, the EIB Board of Directors, comprised of representatives from the EU Member States, approved the updated EIB Climate Strategyand the EIB Group Climate Bank Roadmap 2021-2025. The roadmap was also approved by the EIF Board of Directors separately. It is the operational framework setting out how the EIB Group will support the objectives of the European Green Deal, the European Union’s strategy for battling climate change, which the European Commission presented in December 2019.

One of the biggest issues of our time, climate change is physically threatening our coastlines, soil, health and biodiversity, and posing severe challenges for people and their livelihoods. Combating the physical and transition risks of climate change, while also adapting to its consequences, requires huge amounts of investment in renewable energy generation, low-carbon transport and climate-smart agriculture, along with new ways of thinking about how to move to low-carbon, resilient and circular economies.

CLIMATE BANK ROADMAP: AMBITIOUS TARGETS

STEPPING UP CLIMATE FINANCE

The EIB Group is well prepared for what the future holds – a carbon-neutral economy. At the UN Climate Conference in Paris in 2015, we committed to financing $100 billion in climate investments from 2016 to 2020. With $122 billion in climate action investment signed in this period, we considerably exceeded this target.

The Climate Bank Roadmap details the EIB Group’s role in supporting the European Green Deal. The Green Deal is the European Commission’s framework for making the European Union’s economy sustainable by turning climate and environmental challenges into opportunities, and by making the transition just and inclusive for all. It consists of sector strategies and other elements such as the Just Transition Mechanismfor regions that depend on carbon-intensive industries, the Biodiversity Strategy for 2030and the Circular Economy Action Plan. It also includes a Farm to Fork Strategyfor agriculture and food security, a strategy on adaptation to climate change, as well as initiatives targeting the financial sector such as the EU Taxonomyfor sustainable green investments and new regulations on non-financial disclosures.

Читать дальше