This separation allows us to decompose the portfolio's monthly return variation into its two component parts. We do so by calculating the fractional contribution to total variance (FCTV), as follows:

(3.1)

In Equation 3.1, Σ is the covariance matrix of return components, 1 is a column vector of ones, and ʹ denotes the matrix transpose. The sum of FCTV across components always equals one (as can be seen from Equation 3.1, where the numerator will equal the denominator after pre-multiplying by 1ʹ).

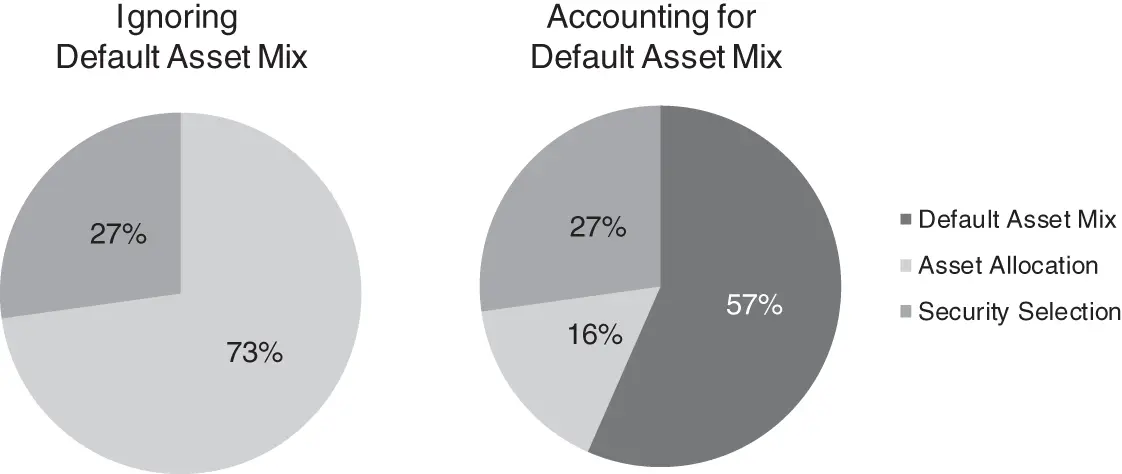

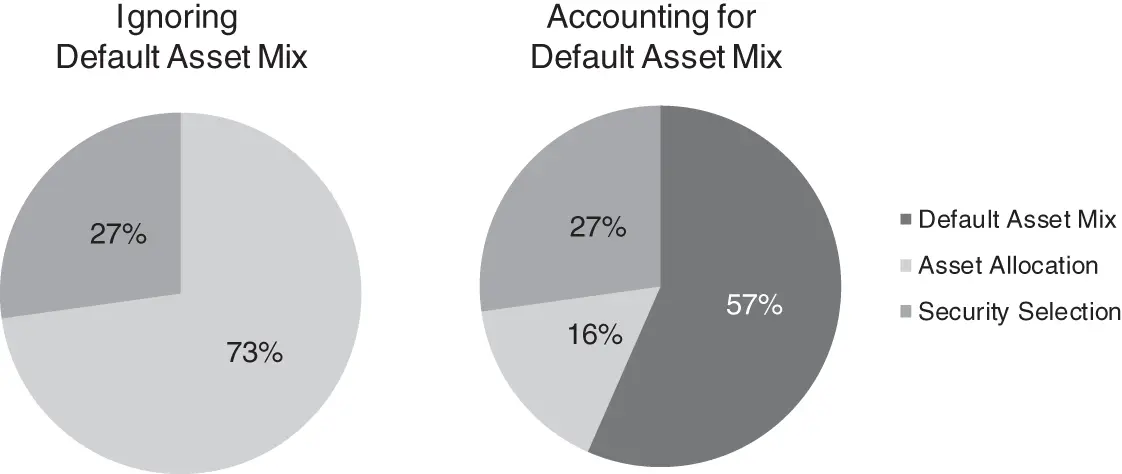

In this example, the asset allocation component appears to explain 73% of the total return variation, dwarfing the 27% explained by security selection. This conclusion mirrors the logic of Brinson, Hood, and Beebower. Intuitively, it seems surprising that such a dramatic security selection tilt carries so little relative importance. In fact, this approach incorrectly implies that asset allocation is more important than security selection because it considers all market volatility to be the result of an asset allocation decision.

Now, let us propose a different perspective. In the absence of any skill, effort, or careful consideration, investors can still default to a broadly diversified portfolio such as 60/40 stocks and bonds. The default might represent, for example, the average allocation across a pool of similar investors. The returns of this default asset mix reflect the decision to invest. They do not reflect an asset allocation decision for the simple reason that it was chosen without any care or consideration at all.

The relevant question for investors is: how much impact can I have on return outcomes by deviating from the default asset allocation, as opposed to deviating from the default security selection? The answer to this question helps to allocate scarce time and attention across competing investment activities. Figure 3.1shows that when we account for the return variation explained by the default asset mix, our conclusion is reversed. Only 16% of the return variation is due to asset allocation, which means it is less important than security selection in this example. More than half of the portfolio's variation in returns comes from the mere decision to invest.

FIGURE 3.1Fractional contribution to total variance.

To stress our point even further, it is possible to construct a simple yet extreme example of the Brinson, Hood, and Beebower methodology that leads to an obvious contradiction. Kritzman (2006) describes an imaginary world with two stocks and two bonds. 2 The first stock always produces the same return as the first bond, and the second stock always produces the same return as the second bond. Thus, stocks and bonds as asset classes always have identical returns, which means that the weights assigned to stocks versus bonds have no impact. In other words, asset allocation is completely irrelevant to returns. Security selection does matter, though. Suppose that the second stock and second bond have returns that are always twice as large as those of the first stock and first bond. The punch line is that an investor who allocates entirely to the second stock and second bond will earn twice the return of an investor who allocates to the first stock and first bond, but both of their returns will be 100% correlated to their asset allocation benchmarks (equivalent to an R-squared of 100% in a regression of returns). The methodology proposed by Brinson, Hood, and Beebower would conclude that asset allocation explains 100% of performance variation across the two investors, but we know the opposite to be true: asset allocation is irrelevant in this example.

THE BEHAVIORAL BIAS OF POSITIVE ECONOMICS

The Brinson, Hood, and Beebower methodology has another feature that limits its ability to separate the relative importance of various investment activities, which is also common to other methodologies that address this question. Most studies analyze the actual performance of funds. 3 In this sense, they are positive, as opposed to normative; they rely on actual returns that reflect some combination of the relative importance of alternative investment choices as well as the behavior of investors; that is, the extent to which investors choose to engage in various investment activities.

For example, some investors choose to invest in actively managed funds with high tracking error relative to the norm, but choose an asset mix that is close to the norm, such as the average asset mix of a relevant universe. Other investors choose actively managed funds with low tracking error relative to the norm, but choose an asset mix that is substantially different from the normal asset mix. In the former case, security selection will be seen to be more important than it is normally thought to be, whereas asset allocation will be seen to be less important than it is typically construed to be. In the latter case, the opposite will be true. But these conclusions could be misleading, because they may reflect as much or more about the investors' choices to emphasize asset allocation over security selection than the potential impact asset allocation and security selection have on portfolio performance.

To separate the intrinsic importance of an investment choice from an investor's decision to emphasize that choice, we need to measure the potential for an investment choice to cause dispersion in wealth. Dispersion is important to investors who believe they are skillful because it enables them to increase wealth beyond what they could expect to achieve by passive investment or from average performance. Dispersion is also important to investors who are unlucky because it exposes them to losses that might arise as a consequence of bad luck. 4 As beneficial as it is for skillful investors to focus on activities that cause dispersion, it is equally important for unlucky investors to avoid activities that cause dispersion.

Determining Relative Importance Analytically

It is simple to measure the relative importance of asset allocation and security selection analytically if we limit our investment universe to two asset classes, each of which contains two securities. We simply measure the potential for dispersion as the tracking error between two investments that differ either by asset class composition or by security composition. We should expect security selection to cause greater dispersion than asset allocation because individual securities are more volatile than the asset classes that comprise them unless the securities move in perfect unison. Therefore, if we argue that asset allocation causes greater dispersion, we necessarily believe that high correlations among individual securities offset their relatively high individual volatilities.

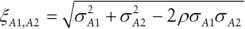

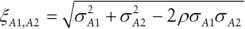

Consider two asset classes that contain two securities each. Asset class A includes securities A1 and A2, while asset class B includes B1 and B2. We measure the relative volatility and hence the importance of security selection within asset class A as shown:

(3.2)

In Equation 3.2,  equals the relative volatility between A1 and A2,

equals the relative volatility between A1 and A2,  equals the standard deviation of A1,

equals the standard deviation of A1,  equals the standard deviation of A2, and

equals the standard deviation of A2, and  is the correlation between A1 and A2. The same equation is used to calculate the relative volatility between securities B1 and B2.

is the correlation between A1 and A2. The same equation is used to calculate the relative volatility between securities B1 and B2.

Читать дальше

equals the relative volatility between A1 and A2,

equals the relative volatility between A1 and A2,  equals the standard deviation of A1,

equals the standard deviation of A1,  equals the standard deviation of A2, and

equals the standard deviation of A2, and  is the correlation between A1 and A2. The same equation is used to calculate the relative volatility between securities B1 and B2.

is the correlation between A1 and A2. The same equation is used to calculate the relative volatility between securities B1 and B2.