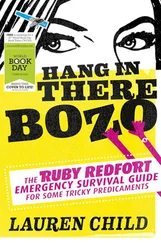

1 Cover

2 Title Page Survival Kit for an Equity Analyst The Essentials You Must Know Shin Horie

3 Copyright

4 Dedication

5 Preface: Why I Wanted to Write This Book

6 Introduction: How to Approach Company Analysis Structure of this Book

7 List of Acronyms

8 Part I: Lessons from the Past: My Story as an Analyst

9 Part II: Laying the Groundwork Chapter 1: Understand the ‘Character’ of the Industry Six Basic Steps for Forecasting Industry Growth TAM Growth Rate Ten Additional Angles for Testing Forecasts Chapter 2: Assess the Earnings Drivers in Different Industries Hyper Growth – Internet, Fintech, Biotechnology Secular Growth – Software, Medical Technology Cyclical – Capital Goods, Transport, Energy, Commodities, Chemicals, Autos Cyclical Growth – Semiconductor, Electronic Components, Technology Hardware, Clean Energy Stable – Consumer Staples, Retail, Consumer Discretionary, Pharmaceutical, Media, Business Services Interest Rate Sensitive – REITs, Property Developers, Banks, Insurance Regulated – Utilities, Telecoms Chapter 3: Identify the ‘Personality’ of the Company Product and Service Origin and History Management Profile Ownership Structure Value Chain Competitive Moat Track Record of Strategic Decisions Corporate Culture by Country Earnings Guidance Track Record Controversy Record Management Quality – A Framework

10 Part III: Analyse and Apply the Findings Chapter 4: Put Findings into the Earnings Model Segmental Revenue Forecast Income Statement Forecast Balance Sheet Forecast Cash Flow Forecast How to Put Cyclicality into Long‐term Earnings Forecasts Quarterly Forecasts can be Helpful A Birdseye View is Helpful Financial and Property Sectors are Unique Chapter 5: Summarize All Thoughts A Suggested Method for Creating a Practical Scorecard Chapter 6: Find the Appropriate Valuation Framework Hyper Growth – Internet, Biotechnology Secular Growth – Software, Medical Technology Cyclical – Capital Goods, Transport, Energy, Commodities, Chemicals, Autos Cyclical Growth – Semiconductor, Technology Hardware, Clean Energy Stable – Consumer Staples, Retail, Consumer Discretionary, Pharmaceutical, Media, Business Services Interest Rate Sensitive – Banks, Emerging Market Banks, Insurance, Property, REITs Regulated – Utilities, Telecoms Conglomerates Additional Considerations on Valuation Chapter 7: Differentiation versus Street Is the View Actually Different? Where is the Difference? What is Driving the Difference? Value of an Undifferentiated Conclusion

11 Part IV: What to Research and How to Power the Analysis Chapter 8: How to Generate Exciting Ideas 1: Burning Questions 2: Products to Solve Problems 3: Forgotten New Technologies 4: ‘Little Stories’ 5: New Language 6: B2B and Orphan Stocks 7: The Second or Third Derivatives of Structural Changes 8: Local Trends 9: Inputs from the Real World Chapter 9: How to Deal with Disruptors, Emerging Markets, ESG, and Downturns How to Forecast and Value ‘Disruptors’ How Should Emerging Markets be Looked at? How to Think about ESG Issues How to Cope with Economic Downturns Chapter 10: Using Soft Skills to Power the AnalysisHow to Build a Relationship with Companies How to Leverage the Team How to Communicate Ideas Effectively What Types of Training Should New Analysts Ask for? Time Management

12 Part V: Recap and Closing Thoughts

13 About the Author

14 Acknowledgements

15 Index

16 End User License Agreement

1 Chapter 2Table 2.1 Earnings drivers in different industries

1 Chapter 1Figure 1.1 Steps to forecast industry growthSOURCE: Goldman Sachs Global Inv...

2 Chapter 3Figure 3.1 Sample management scorecard

3 Chapter 4Figure 4.1 Framework for building company earnings modelsSOURCE: Goldman Sac...

4 Chapter 5Figure 5.1 Sample company scorecard: industry characteristics.Figure 5.2 Sample company scorecard: peer comparison.Note: ***

5 Chapter 6Figure 6.1 Key factors that can influence company valuationSOURCE: Goldman S...Figure 6.2 Company earnings multiples are influenced by multi-layered factor...Figure 6.3 Sample valuation framework by sector

1 Cover

2 Table of Contents

3 Begin Reading

1 iii

2 iv

3 v

4 xi

5 xii

6 xiii

7 xv

8 xvi

9 xvii

10 xviii

11 xix

12 xx

13 xxi

14 xxii

15 1

16 2

17 3

18 4

19 5

20 6

21 7

22 8

23 9

24 10

25 11

26 12

27 13

28 14

29 15

30 16

31 17

32 18

33 19

34 21

35 22

36 23

37 24

38 25

39 26

40 27

41 28

42 29

43 30

44 31

45 32

46 33

47 34

48 35

49 37

50 38

51 39

52 40

53 41

54 42

55 43

56 44

57 45

58 46

59 47

60 48

61 49

62 50

63 51

64 52

65 53

66 54

67 55

68 56

69 57

70 58

71 59

72 60

73 61

74 62

75 63

76 64

77 65

78 66

79 67

80 68

81 69

82 71

83 72

84 73

85 74

86 75

87 76

88 77

89 78

90 79

91 80

92 81

93 82

94 83

95 85

96 86

97 87

98 88

99 89

100 90

101 91

102 92

103 93

104 94

105 95

106 96

107 97

108 98

109 99

110 100

111 101

112 102

113 103

114 105

115 106

116 107

117 108

118 109

119 110

120 111

121 112

122 113

123 114

124 115

125 116

126 117

127 118

128 119

129 120

130 121

131 122

132 123

133 124

134 125

135 126

136 127

137 128

138 129

139 131

140 132

141 133

142 134

143 135

144 137

145 138

146 139

147 140

148 141

149 142

150 143

151 145

152 146

153 147

154 148

155 149

156 150

157 151

158 152

159 153

160 154

161 155

162 156

163 157

164 158

165 159

166 160

167 161

168 162

169 163

170 164

171 165

172 166

173 167

174 169

175 170

176 171

177 173

178 175

179 177

180 178

181 179

182 180

183 181

184 182

185 183

186 184

187 185

188 186

189 187

Survival Kit for an Equity Analyst

The Essentials You Must Know

Shin Horie

This edition first published 2021 Copyright © 2022 by John Wiley & Sons, Ltd.

Registered office John Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Читать дальше