Kenneth W. Boyd - Cost Accounting For Dummies

Здесь есть возможность читать онлайн «Kenneth W. Boyd - Cost Accounting For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Cost Accounting For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 80

- 1

- 2

- 3

- 4

- 5

Cost Accounting For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Cost Accounting For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Cost Accounting For Dummies

Cost Accounting For Dummies

Cost Accounting For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Cost Accounting For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

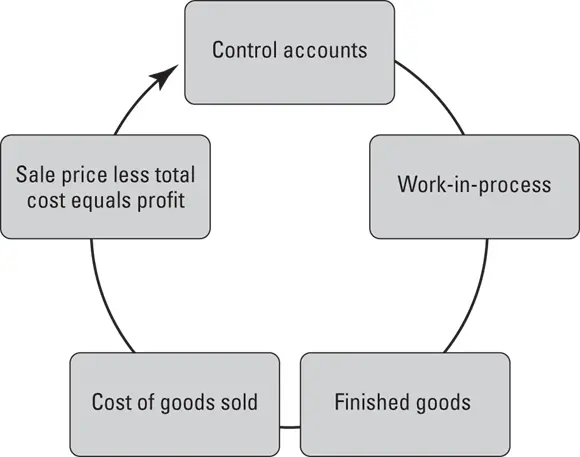

Costs flow through a manufacturing system, from buying materials for a product all the way to the customer sale. When you envision the flow of costs, you find it easier to collect all the product costs you need to price a product. When you know all the steps, you remember all the costs related to those steps!

Control starts with control accounts

Control accounts are temporary holding places for costs. Managing costs has to start somewhere, and in accounting, that process most often starts out with control accounts.

Labor, materials, and indirect costs start off in control accounts. It may sound strange, but these accounts and their balances don’t appear in the financial statements. That’s because the balances are eventually moved to other accounts. All the checks you write for manufacturing costs are posted first to control accounts.

For many manufacturers and retailers, inventory is the biggest investment; more cash is spent on inventory than any other asset. Because of that, a big part of operating a profitable business is to control the costs of inventory.

Inventory is an asset you eventually sell to someone. (That’s a little different, of course, from buildings and equipment.) For manufacturers, inventory has three components: raw materials, work-in-process, and finished goods, whereas retailers just have finished goods. Raw materials inventory is, broadly, products not yet started; work-in-progress inventory is partially completed products; and finished goods inventory is completed products.

The three kinds of inventory are assets, because you eventually sell the goods to a customer. When you do, the inventory asset becomes an expense — cost of goods sold. Managing inventory starts in a control account.

Table 4-3lists control account titles for each component of inventory.

TABLE 4-3Control Accounts for Inventory

| Type of Costs | Control Account |

|---|---|

| Materials | Materials control |

| Labor | Wages payable control |

| Indirect costs | Overhead control |

Here are what those types of costs in Table 4-3refer to:

Materials: You buy materials (such as wood for making kitchen cabinets) in advance of making your products. Materials control is the term for the control account for material costs.

Labor: Consider labor costs. Employees report the hours they work on time cards each week. Those cards list hours worked on various projects. For custom cabinets, the time cards list customer jobs that employees completed, and the hours worked. Wages payable control is the term for the control account for labor.

Indirect costs: A business (such as the kitchen cabinet business) has indirect costs (for example, machine repair and maintenance). Your firm has some method to allocate those costs to clients (see “ Budgeting for indirect costs”). However, you may not get to the allocation until after you write checks for the cost. Overhead control is the term for the control account for indirect costs.

Control accounts (materials, labor and overhead), work-in-process, and finished goods are inventory accounts, which are assets. Cost of goods sold (COGS) is an expense account. When you make a sale to a customer, you “use up” the asset. The asset becomes an expense. Figure 4-1 shows the flow of manufacturing costs:

Explaining the debit and credit process

You increase and decrease account balances using debits and credits. Business owners need to know these terms because they can’t understand your accounting process without them.

©John Wiley & Sons, Inc.

FIGURE 4-1:The flow of manufacturing costs.

Don’t be frustrated if you need to read this section a few times. I’ve taught the concept for years, and it requires some review before you fully understand it. Here are rules that never change:

Debits: Always posted on the left side of an account

Credits: Always posted on the right side of an account

All accounts are formatted like this:

| Material Control | |

| Debit | Credit |

In accounting, debit and credit don’t mean the same things they do in common talk. Debit can refer to an increase or a decrease. It depends on what type of account you’re working with. The same is true of a credit. Here are the rules for the purposes of this book:

Asset accounts:

Debits: Always increase the account balance. A big debit in the Cash account (an asset) is a good thing

Credits: Always decrease the account balance

Control accounts, work-in-process, and finished goods are all inventory accounts, making them asset accounts. Cost of goods sold is an expense account. Debiting increases all these accounts. The balance for any of these accounts is equal to debit balance less credit balance.

Liability accounts:

Debits: Always decrease the account balance

Credits: Always increase the account balance

Income accounts:

Debits: Always decrease the account balance

Credits: Always increase the account balance

Expense accounts:

Debits: Always increase the account balance.

Credits: Always decrease the account balance

There’s an accounting mantra: “What’s the impact of this transaction on the general ledger?” Always ask. There are several answers, depending on what you’re doing, but in time you will know them all. And it’s not as though if something goes up something else goes down. For example, when you sell something, cash (an asset) gets a debit and goes up. On the other side of the transaction, income gets a credit and goes up.

There’s an accounting mantra: “What’s the impact of this transaction on the general ledger?” Always ask. There are several answers, depending on what you’re doing, but in time you will know them all. And it’s not as though if something goes up something else goes down. For example, when you sell something, cash (an asset) gets a debit and goes up. On the other side of the transaction, income gets a credit and goes up.

Walking through a manufacturing cost example

Say you’re the manager of Karl’s Kustom Kitchen Kabinets. You order $20,000 in lumber. You then take $5,000 of the lumber and start making cabinets for a customer.

When you bought the lumber, cash (an asset) went down, but the material control account (as asset) went up. The material control account was increased (debited) when you bought the lumber.

The material control account balance decreases (credit) when you take $5,000 in lumber to start using the material for a customer. Now how would your material control account look?

Material control account

| Debit | Credit | |

|---|---|---|

| $20,000 | ||

| $5,000 |

If the month ends with no other activity, the ending material control balance is $15,000 (20,000 – $5,000).

But the $5,000 didn’t just vanish. When you put materials into production, you reduce (credit) the material control account and increase (debit) the work-in-process control account.

Work-in-process control account

| Debit | Credit |

|---|---|

| $5,000 |

You reduce one asset (material control account) and increase another asset (work-in-process control account).

Now assume that the people on the shop floor finish some cabinets and move $2,000 of the $5,000 work-in-process to finished goods.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Cost Accounting For Dummies»

Представляем Вашему вниманию похожие книги на «Cost Accounting For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Cost Accounting For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.