Eric Tyson - Investing All-in-One For Dummies

Здесь есть возможность читать онлайн «Eric Tyson - Investing All-in-One For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Investing All-in-One For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

Investing All-in-One For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Investing All-in-One For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Investing All-in-One For Dummies

.

Dummies

Investing All-in-One For Dummies

Investing All-in-One For Dummies

Investing All-in-One For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Investing All-in-One For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Career risk

Your ability to earn money is most likely your single biggest asset or at least one of your biggest assets. Most people achieve what they do in the working world through education and hard work. By education, we’re not simply talking about what one learns in formal schooling. Education is a lifelong process. You may learn far more about business from your own front-line experiences and those of others than you learn in educational settings.

Your ability to earn money is most likely your single biggest asset or at least one of your biggest assets. Most people achieve what they do in the working world through education and hard work. By education, we’re not simply talking about what one learns in formal schooling. Education is a lifelong process. You may learn far more about business from your own front-line experiences and those of others than you learn in educational settings.

If you don’t continually invest in your education, you risk losing your competitive edge. Your skills and perspectives can become dated and obsolete. Although that doesn’t mean you should work 80 hours a week and never do anything fun, it does mean that part of your “work” time should involve upgrading your skills.

The best organizations are those that recognize the need for continual knowledge and invest in their workforce through training and career development. Just remember to consider your own career objectives, which may not be the same as your company’s.

Analyzing Returns

When you choose investments, you have the potential to make money in a variety of ways. Each type of investment has its own mix of associated risks that you take when you part with your investment dollar and, likewise, offers a different potential rate of return. The following sections cover the returns you can expect with each of the common investing avenues. But first, you go through the components of calculating the total return on an investment.

The components of total return

To figure out exactly how much money you’ve made (or lost) on your investment, you need to calculate the total return. To come up with this figure, you need to determine how much money you originally invested and then factor in the other components, such as interest, dividends, and appreciation (or depreciation).

If you’ve ever had money in a bank account that pays interest, you know that the bank pays you a small amount of interest when you allow it to keep your money. The bank then turns around and lends your money to some other person or organization at a much higher interest rate. The rate of interest is also known as the yield. So if a bank tells you that its savings account pays 2 percent interest, the bank may also say that the account yields 2 percent. Banks usually quote interest rates or yields on an annual basis. The interest that you receive is one component of the return you receive on your investment.

If a bank pays monthly interest, the bank also likely quotes a compounded effective annual yield. After the first month’s interest is credited to your account, that interest starts earning interest as well. So the bank may say that the account pays 2 percent, which compounds to an effective annual yield of 2.04 percent.

When you lend your money directly to a company — which is what you do when you invest in a bond that a corporation issues — you also receive interest. Bonds, as well as stocks (which are shares of ownership in a company), fluctuate in value after they’re issued.

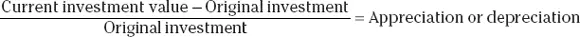

When you invest in a company’s stock, you hope that the stock increases (appreciates) in value. Of course, a stock can also decline, or depreciate, in value. This change in market value is part of your return from a stock or bond investment:

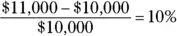

For example, if one year ago you invested $10,000 in a stock (you bought 1,000 shares at $10 per share) and the investment is now worth $11,000 (each share is worth $11), your investment’s appreciation looks like this:

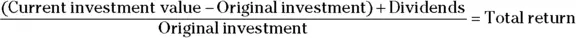

Stocks can also pay dividends, which are the company’s sharing of some of its profits with you as a stockholder. Some companies, particularly those that are small or growing rapidly, choose to reinvest all their profits back into the company. (Of course, some companies don’t turn a profit, so they don’t have anything to pay out!) You need to factor any dividends into your return as well.

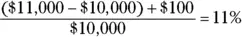

Suppose that in the previous example, in addition to your stock appreciating from $10,000 to $11,000, it paid you a dividend of $100 ($1 per share). Here’s how you calculate your total return:

You can apply this formula to the example like so:

After-tax returns

Although you may be happy that your stock has given you an 11 percent return on your invested dollars, note that unless you held your investment in a tax-sheltered retirement account, you owe income taxes on your return. Specifically, the dividends and investment appreciation that you realize upon selling are taxed, although often at relatively low rates. The tax rates on so-called long-term capital gains (for investments held more than one year) and stock dividends are lower than the tax rates on other income.

If you’ve invested in savings accounts, money market accounts, or bonds, you owe federal income taxes on the interest plus whatever state income taxes your state levies.

Often, people make investing decisions without considering the tax consequences of their moves. This is a big mistake. What good is making money if the federal and state governments take away a substantial portion of it?

If you’re in a moderate tax bracket, taxes on your investment probably run in the neighborhood of 30 percent (federal and state). So if your investment returned 6 percent before taxes, you’re left with a return of about 4.2 percent after taxes.

Psychological returns

Profits and tax avoidance can powerfully motivate your investment selections. However, as with other life decisions, you need to consider more than the bottom line. Some people want to have fun with their investments. Of course, they don’t want to lose money or sacrifice a lot of potential returns. Fortunately, less expensive ways to have fun do exist!

Psychological rewards compel some investors to choose particular investment vehicles such as individual stocks, real estate, or a small business. Why? Because compared with other investments, such as managed mutual and exchange-traded funds, they see these investments as more tangible and, well, more fun.

Be honest with yourself about why you choose the investments that you do. Allowing your ego to get in the way can be dangerous. Do you want to invest in individual stocks because you really believe that you can do better than the best full-time professional money managers? Chances are high that you won’t. Such questions are worth considering as you contemplate which investments you want to make.

Be honest with yourself about why you choose the investments that you do. Allowing your ego to get in the way can be dangerous. Do you want to invest in individual stocks because you really believe that you can do better than the best full-time professional money managers? Chances are high that you won’t. Such questions are worth considering as you contemplate which investments you want to make.

Savings and money market account returns

You need to keep your extra cash that awaits investment (or an emergency) in a safe place, preferably one that doesn’t get hammered by the sea of changes in the financial markets. By default and for convenience, many people keep their extra cash in a bank savings account. Although the bank offers the U.S. government’s backing via the Federal Deposit Insurance Corporation (FDIC), it comes at a price. Most banks pay a relatively low interest rate on their savings accounts. ( Chapter 4in Book 2 discusses banking options.)

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Investing All-in-One For Dummies»

Представляем Вашему вниманию похожие книги на «Investing All-in-One For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Investing All-in-One For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.