Eric Tyson - Investing All-in-One For Dummies

Здесь есть возможность читать онлайн «Eric Tyson - Investing All-in-One For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Investing All-in-One For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

Investing All-in-One For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Investing All-in-One For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Investing All-in-One For Dummies

.

Dummies

Investing All-in-One For Dummies

Investing All-in-One For Dummies

Investing All-in-One For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Investing All-in-One For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Pare down holdings in bloated markets

Perhaps you’ve heard the expression “buy low, sell high.” Although you can’t time the markets (that is, predict the most profitable time to buy and sell), spotting a greatly overpriced or underpriced market isn’t too difficult. There are some simple yet powerful methods you can use to measure whether a particular investment market is of fair value, of good value, or overpriced. You should avoid overpriced investments for two important reasons:

If and when these overpriced investments fall, they usually fall farther and faster than more fairly priced investments.

You should be able to find other investments that offer higher potential returns.

Ideally, you want to avoid having a lot of your money in markets that appear overpriced. Practically speaking, avoiding overpriced markets doesn’t mean that you should try to sell all your holdings in such markets with the vain hope of buying them back at a much lower price. However, you may benefit from the following strategies:

Ideally, you want to avoid having a lot of your money in markets that appear overpriced. Practically speaking, avoiding overpriced markets doesn’t mean that you should try to sell all your holdings in such markets with the vain hope of buying them back at a much lower price. However, you may benefit from the following strategies:

Invest new money elsewhere. Focus your investment of new money somewhere other than the overpriced market; put it into investments that offer you better values. As a result, without selling any of your seemingly expensive investments, you make them a smaller portion of your total holdings. If you hold investments outside of tax-sheltered retirement accounts, focusing your money elsewhere also allows you to avoid incurring taxes from selling appreciated investments.

If you have to sell, sell the expensive stuff. If you need to raise money to live on, such as for retirement or for a major purchase, sell the pricier holdings. As long as the taxes aren’t too troublesome, it’s better to sell high and lock in your profits.

Individual-investment risk

A downdraft can put an entire investment market on a roller-coaster ride, but healthy markets also have their share of individual losers. For example, from the early 1980s through the late 1990s, the U.S. stock market had one of the greatest appreciating markets in history. You’d never know it, though, if you held one of the great losers of that period.

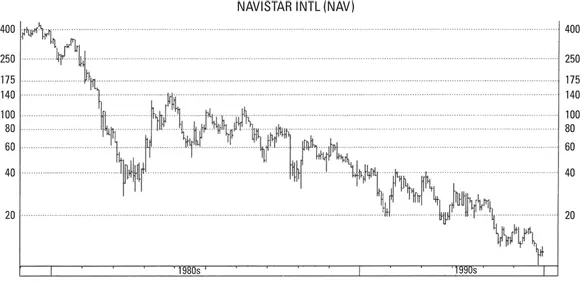

Consider a company now called Navistar, which has undergone enormous transformations in recent decades. This company used to be called International Harvester and manufactured farm equipment, trucks, and construction and other industrial equipment. Today, Navistar makes mostly trucks.

In 1979, this company’s stock traded at more than $400 per share. It then plunged more than 90 percent over the ensuing decade (as shown in Figure 2-3). Even with a rally in recent years, Navistar stock still trades at less than $35 per share (after dipping below $10 per share). If a worker retired from this company in the late 1970s with $200,000 invested in the company’s stock, the retiree’s investment would be worth about $14,000 today! On the other hand, if the retiree had simply swapped his stock at retirement for a diversified portfolio of stocks, his $200,000 nest egg would’ve instead grown to more than $5 million!

© John Wiley & Sons, Inc.

FIGURE 2-3:Even the bull market of the 1990s wasn’t kind to every company.

Just as individual stock prices can plummet, so can individual real estate property prices. In California during the 1990s, for example, earthquakes rocked the prices of properties built on landfills. These quakes highlighted the dangers of building on poor soil. In the decade prior, real estate values in the communities of Times Beach, Missouri, and Love Canal, New York, plunged because of carcinogenic toxic waste contamination. (Ultimately, many property owners in these areas received compensation for their losses from the federal government as well as from some real estate agencies that didn’t disclose these known contaminants.)

Here are some simple steps you can take to lower the risk of individual investments that can upset your goals:

Here are some simple steps you can take to lower the risk of individual investments that can upset your goals:

Do your homework. When you purchase real estate, a whole host of inspections can save you from buying a money pit. With stocks, you can examine some measures of value and the company’s financial condition and business strategy to reduce your chances of buying into an overpriced company or one on the verge of major problems. Book 3give you information on researching your stock investments.

Diversify. Investors who seek growth invest in securities such as stocks. Placing significant amounts of your capital in one or a handful of securities is risky, particularly if the stocks are in the same industry or closely related industries. To reduce this risk, purchase stocks in a variety of industries and companies within each industry.

Hire someone to invest for you. The best funds offer low-cost, professional management and oversight as well as diversification. Stock funds typically own 25 or more securities in a variety of companies in different industries.

Purchasing-power risk (also known as inflation risk)

Increases in the cost of living (that is, inflation) can erode the value of your retirement resources and what you can buy with that money — also known as its purchasing power. When Teri retired at the age of 60, she was pleased with her retirement income. She was receiving a $1,600-per-month pension and $2,400 per month from the money that she had invested in long-term bonds. Her monthly expenditures amounted to about $3,000, so she was able to save a little money for an occasional trip.

Fast-forward 15 years. Teri still receives $1,600 per month from her pension, but now she gets only $1,800 per month of investment income, which comes from some certificates of deposit. Teri bailed out of bonds after she lost sleep over the sometimes roller-coaster-like price movements in the bond market. Her monthly expenditures now amount to approximately $4,000, and she uses some of her investment principal (original investment). She’s terrified of outliving her money.

Teri has reason to worry. She has 100 percent of her money invested without protection against increases in the cost of living. (Her Social Security does have inflation adjustments.) Although her income felt comfortable at the beginning of her retirement, it doesn’t work at age 75, and Teri may easily live another 15 or more years.

The erosion of the purchasing power of your investment dollar can, over longer time periods, be as bad as or worse than the effect of a major market crash. Table 2-2shows the effective loss in purchasing power of your money at various rates of inflation and over differing time periods.

Skittish investors often try to keep their money in bonds and money market accounts, thinking they are “playing it safe.” The risk in this strategy is that your money won’t grow enough over the years for you to accomplish your financial goals. In other words, the lower the return you earn, the more you need to save to reach a particular financial goal.

Skittish investors often try to keep their money in bonds and money market accounts, thinking they are “playing it safe.” The risk in this strategy is that your money won’t grow enough over the years for you to accomplish your financial goals. In other words, the lower the return you earn, the more you need to save to reach a particular financial goal.

TABLE 2-2Inflation’s Corrosive Effect on Your Money’s Purchasing Power

| Inflation Rate | 10 Years | 15 Years | 25 Years | 40 Years |

|---|---|---|---|---|

| 2% | –18% | –26% | –39% | –55% |

| 4% | –32% | –44% | –62% | –81% |

| 6% | –44% | –58% | –77% | –90% |

| 8% | –54% | –68% | –85% | –95% |

| 10% | –61% | –76% | –91% | –98% |

A 30-year-old wanting to accumulate $500,000 by age 65 would need to save $440 per month if she earns a 5 percent average annual return, but she needs to save only $170 per month if she earns a 9 percent average return per year. Younger investors need to pay the most attention to the risk of generating low returns, but so should younger senior citizens. At the age of 65, seniors need to recognize that a portion of their assets may not be used for a decade or more from the present.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Investing All-in-One For Dummies»

Представляем Вашему вниманию похожие книги на «Investing All-in-One For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Investing All-in-One For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.