Due to the payment of the equity capital of 300,000 a surplus of cash of 300,000 occurs in the finance plan. (2)

The two steps – step (1) (payment of equity capital) and step (2) (surplus of money resulting from the finance plan) – that are presented in the finance plan lead to the following effects in the budgeted balance sheet of the enterprise:

Due to the cash deposit of the shareholders the equity of the enterprise is increased from 0 to 300,000. (1)

Also, the bank account of the enterprise rises from 0 to 300,000 due to the surplus of cash in the finance plan. (2)

The cash contribution of equity has absolutely no effect on the profit plan.

Assignment of tasks

The enterprise in the example given plans a capital increase of 300,000 in form of a capital contribution by the associates (shareholders) to the bank account of the enterprise.

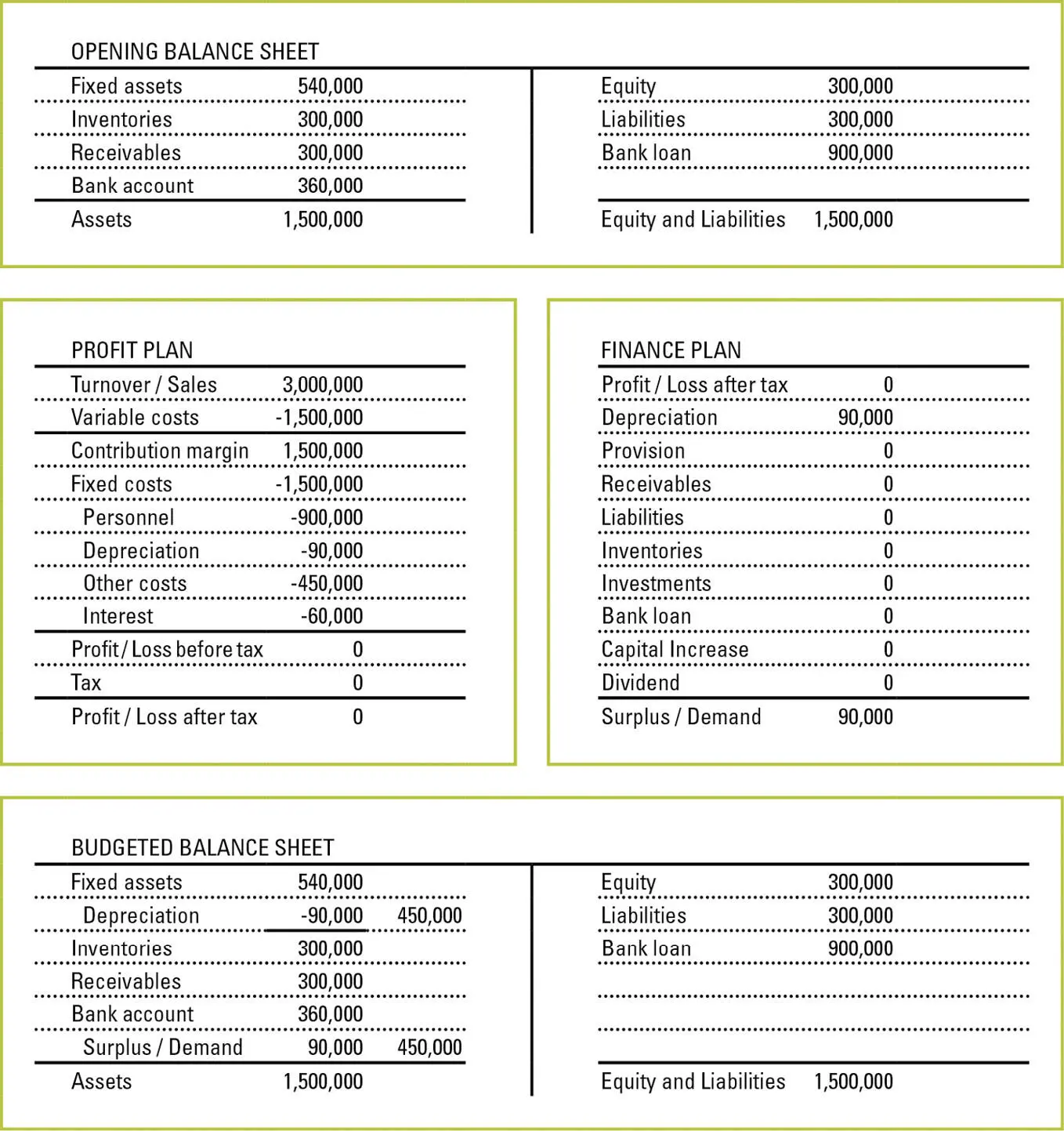

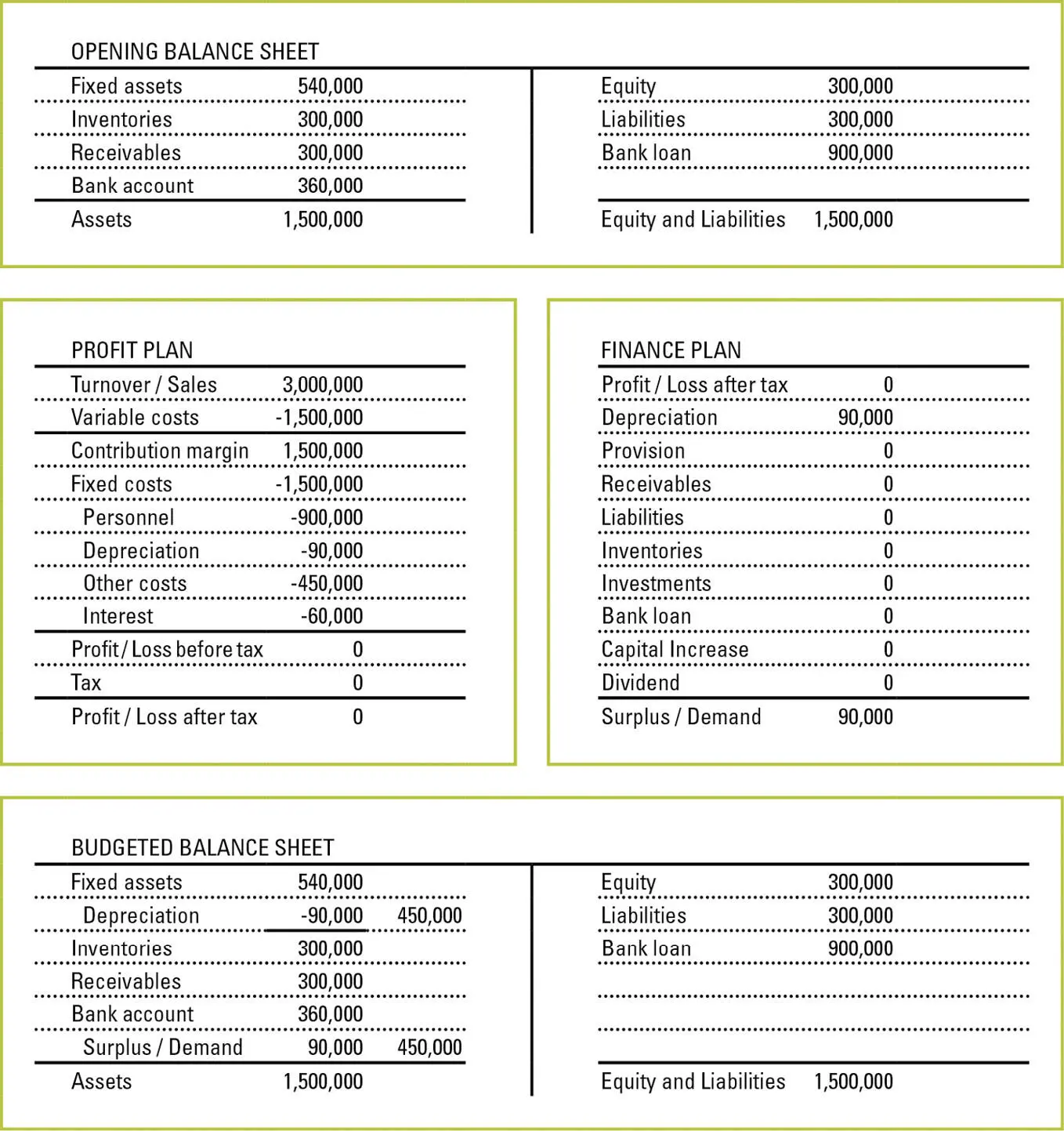

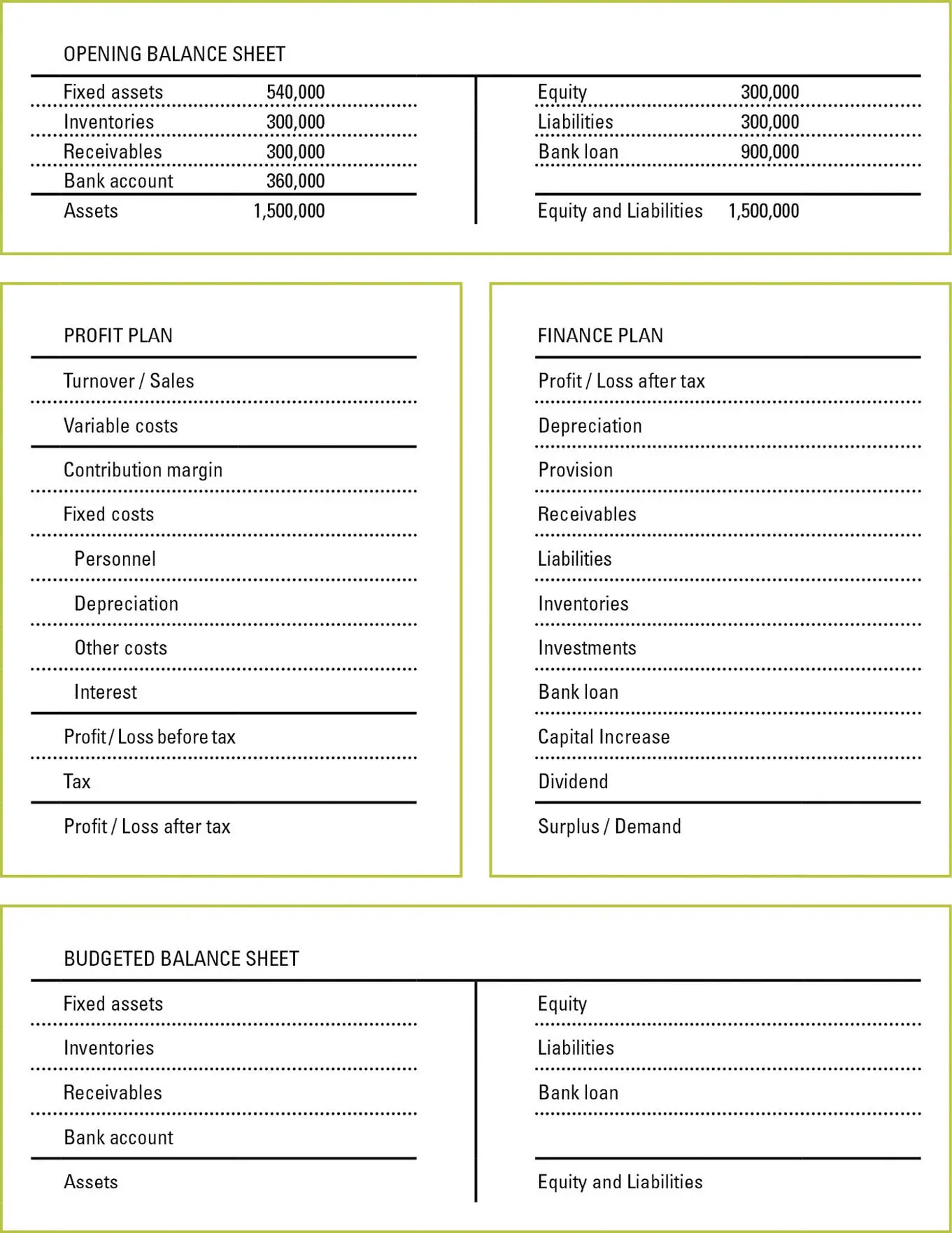

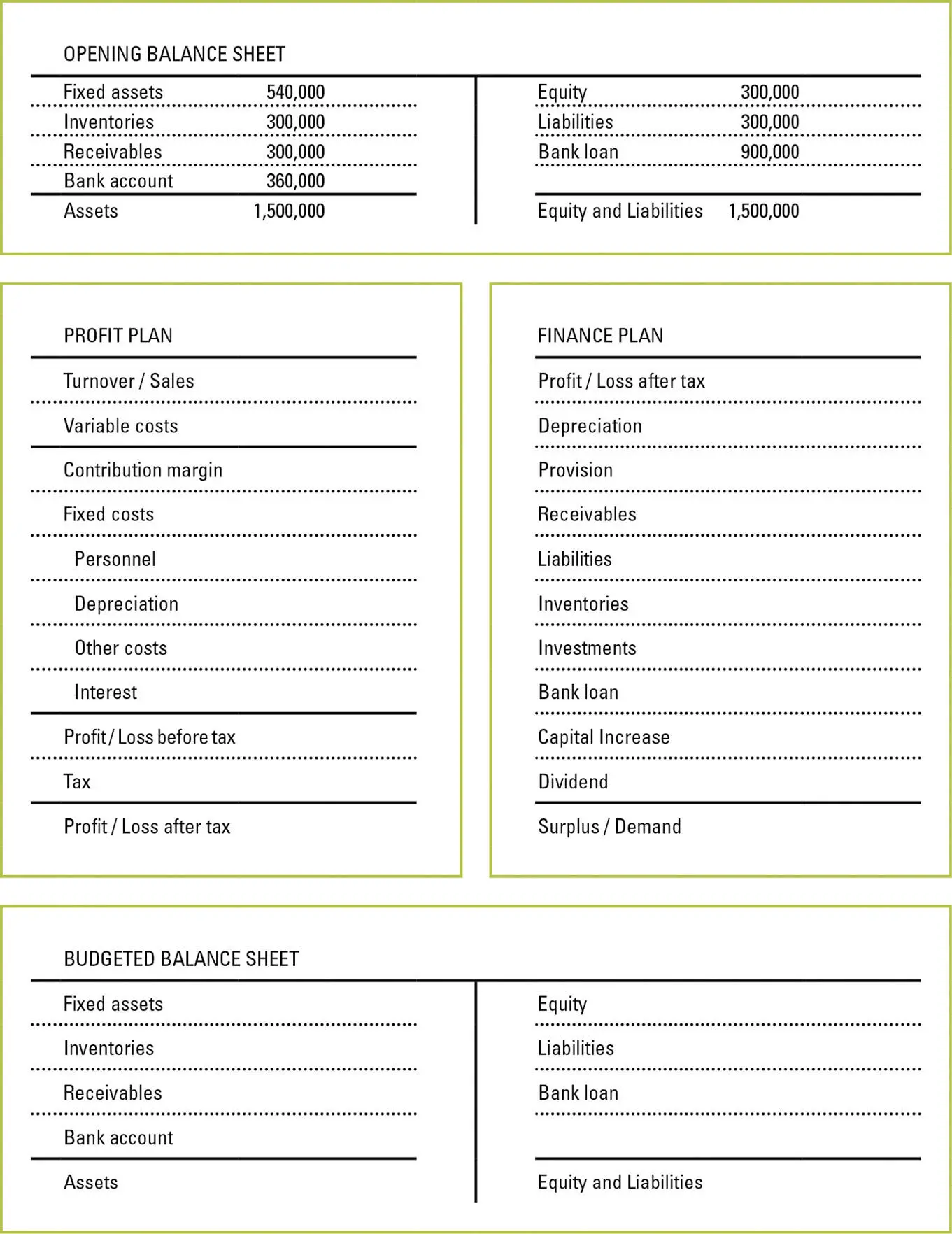

On the next page, opening balance sheet, as well as profit plan, finance plan and budgeted balance sheet of the enterprise are presented before taking the described business activity into account.

Please, present in what way the capital increase affects profit plan, finance plan and budgeted balance sheet.

Basic Data

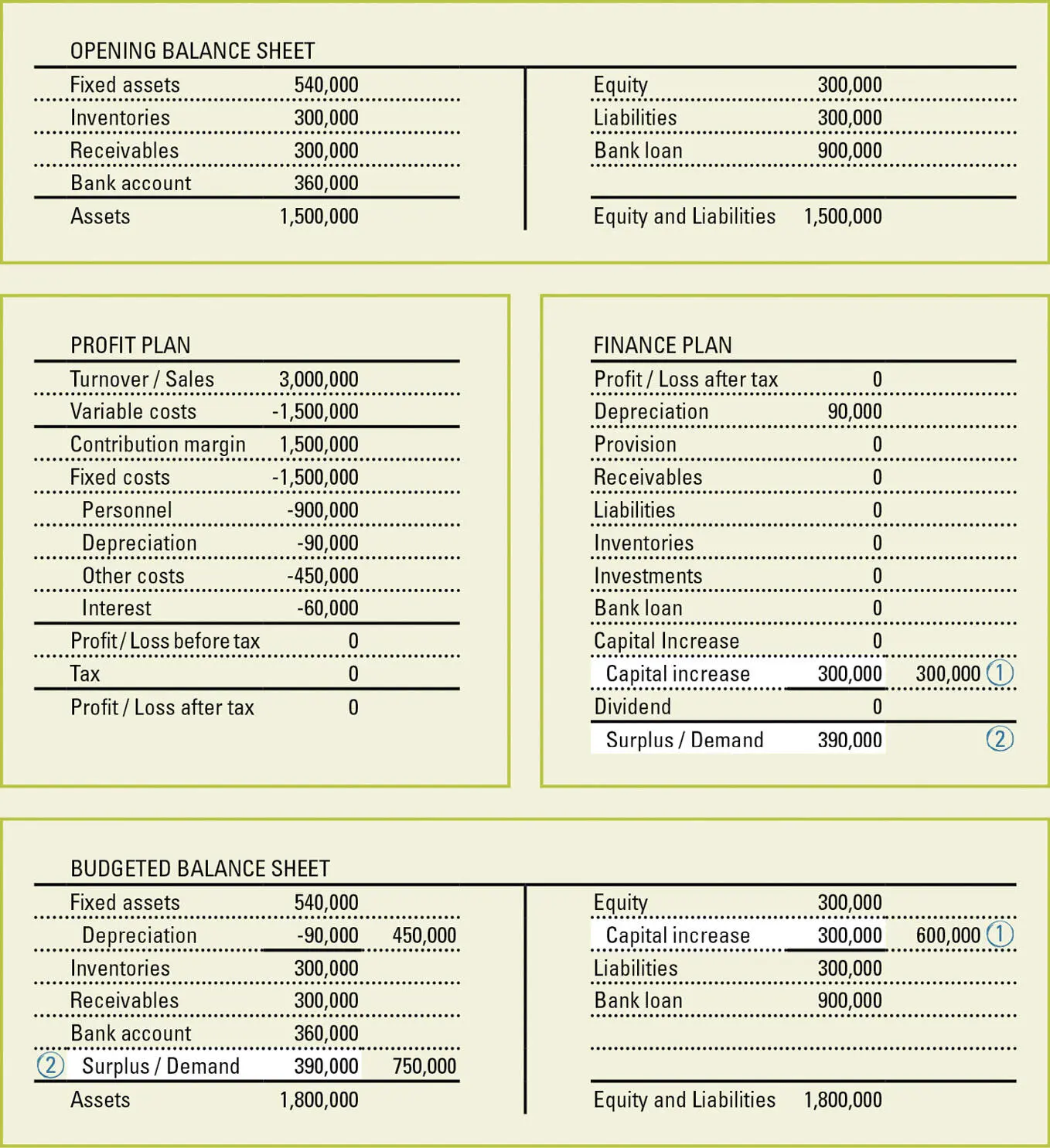

Figure 16: Capital Increase | Basic Data

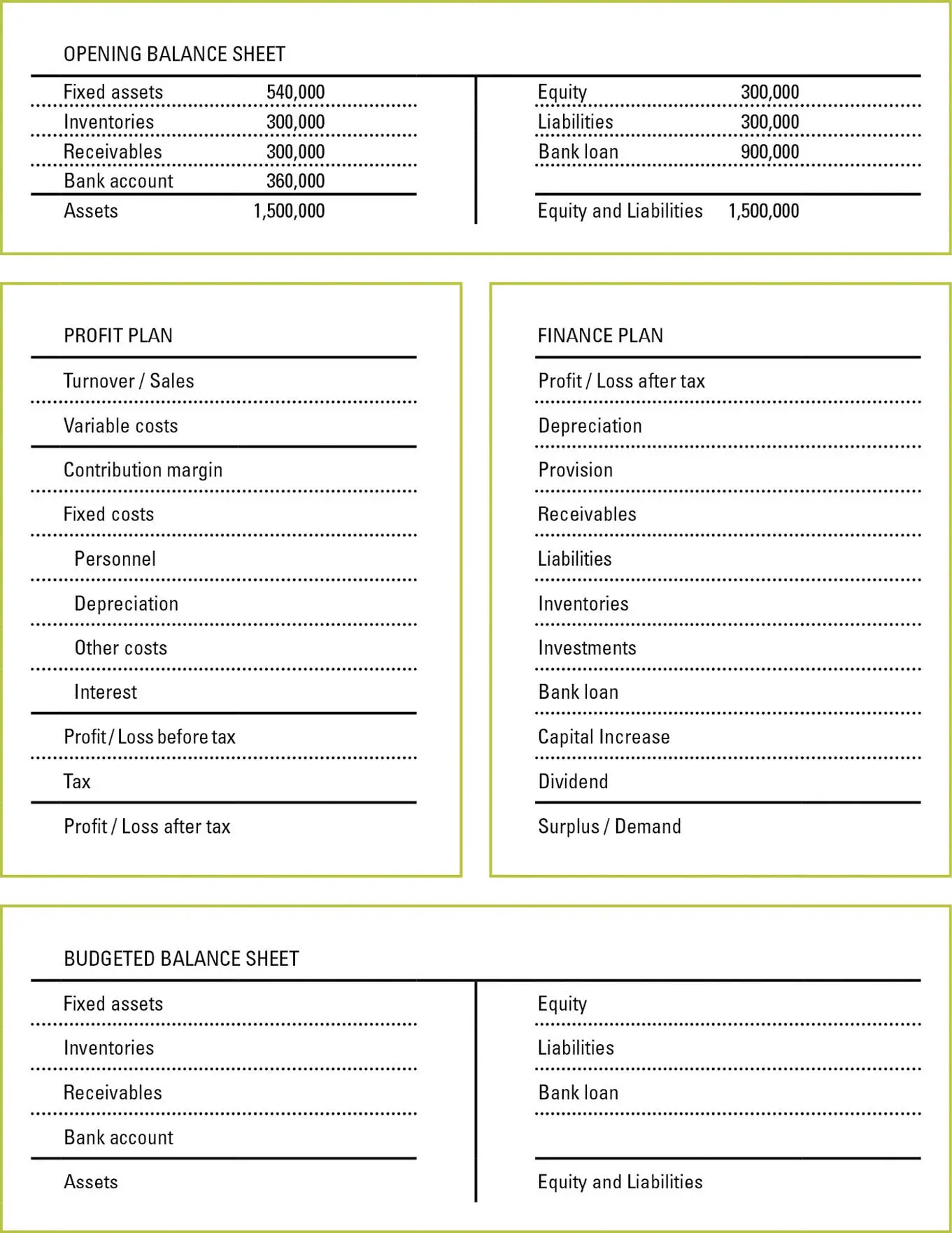

Answer Form

Figure 17: Capital Increase | Answer Form

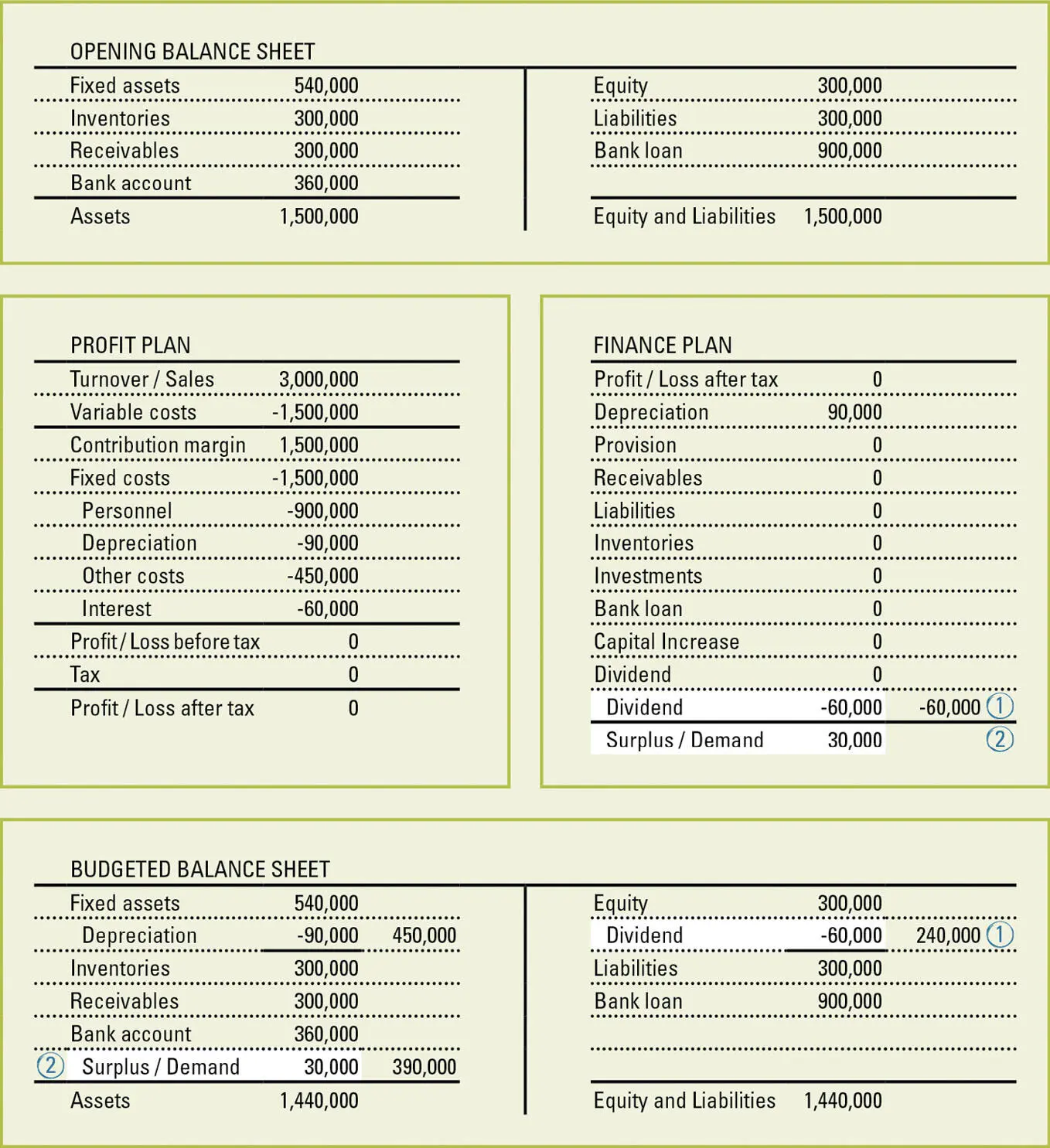

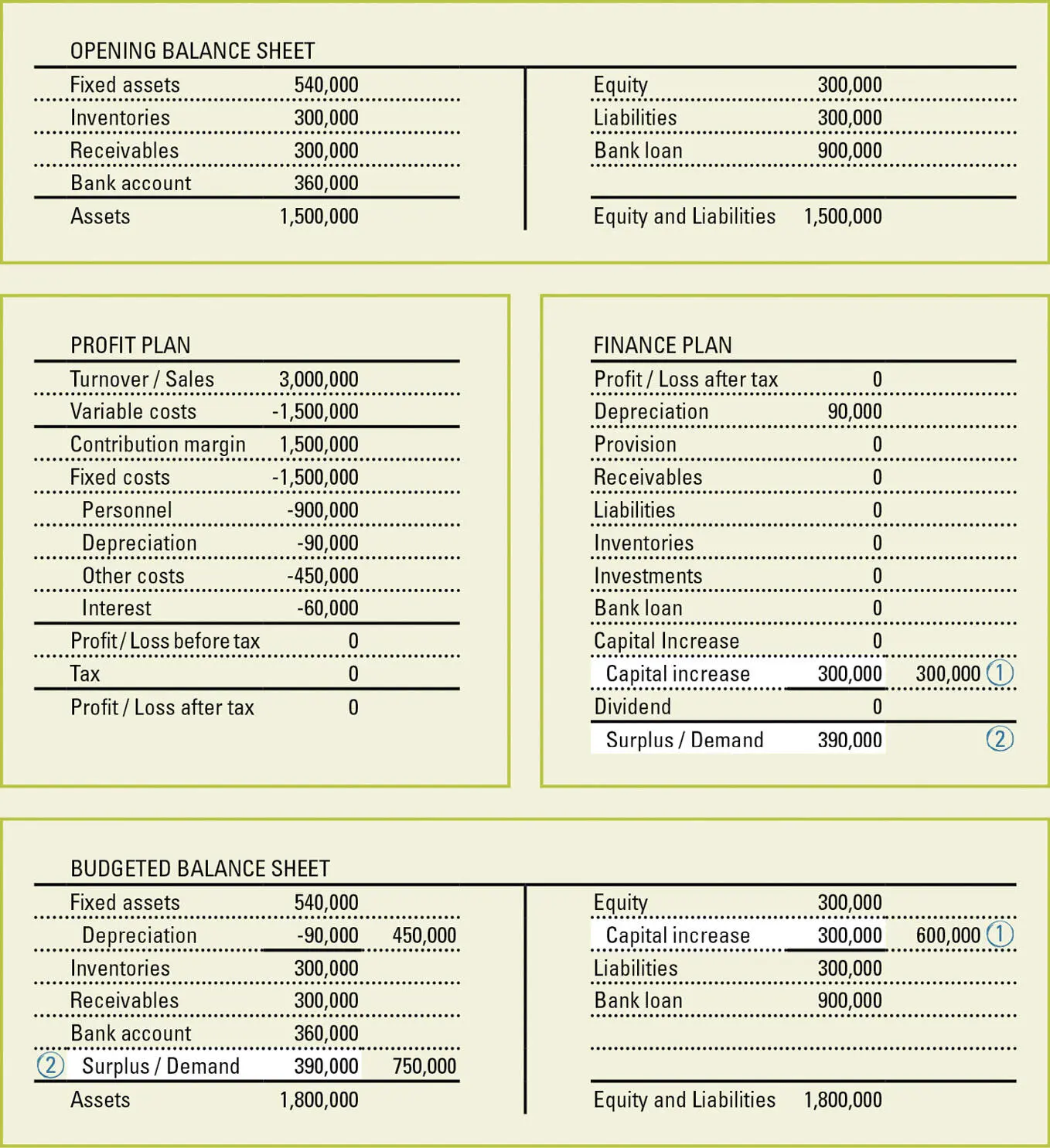

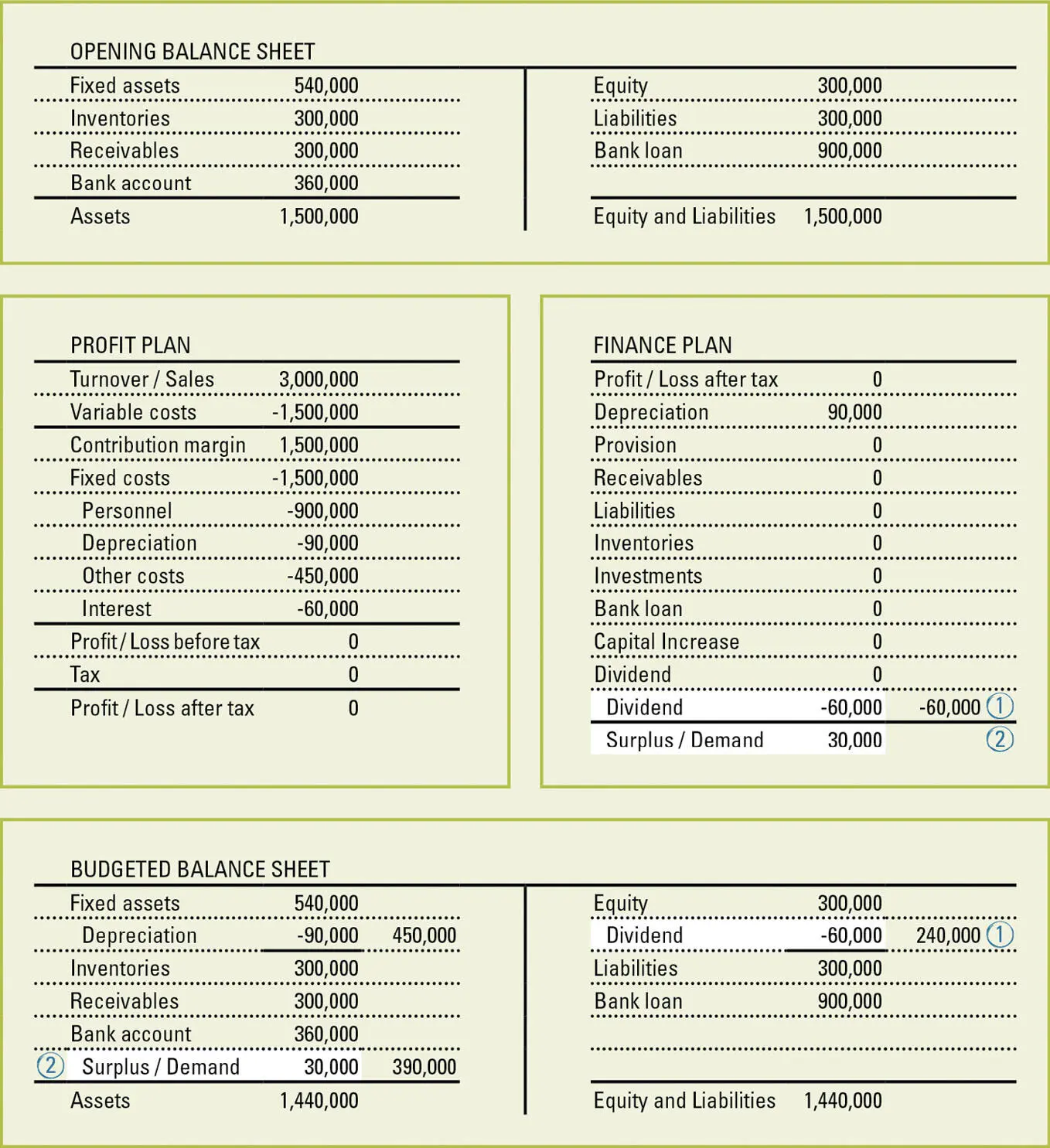

Complete Answer Key Step 1-2/2

Figure 18: Capital Increase | Complete Answer Key Step 1-2/2

The capital increase of the enterprise is carried out with a cash deposit by the shareholders. The shareholders invest equity capital amounting to 300,000 into the enterprise.

The contribution of the equity capital is carried out in the item Capital Increase in the finance plan. (1)

Due to the depreciation of 90,000 from the basic data and due to the contribution of the equity capital of 300,000 (1), a surplus of cash amounting to 390,000 arises as the result of the finance plan. (2)

All changing values from the finance plan are incorporated into the budgeted balance sheet:

The depreciation of 90,000 which has already been stated in the basic data continues to reduce the fixed assets in the budgeted balance sheet.

The capital increase of the shareholders increases the equity capital of the enterprise by 300,000. (1)

The surplus of cash of 390,000 as the result of the finance plan increases the bank account in the budgeted balance sheet. (2)

The contribution of equity capital has absolutely no effect in the profit plan.

Assignment of tasks

The enterprise in the example given plans to pay out dividends amounting to 60,000 to the shareholders of the enterprise.

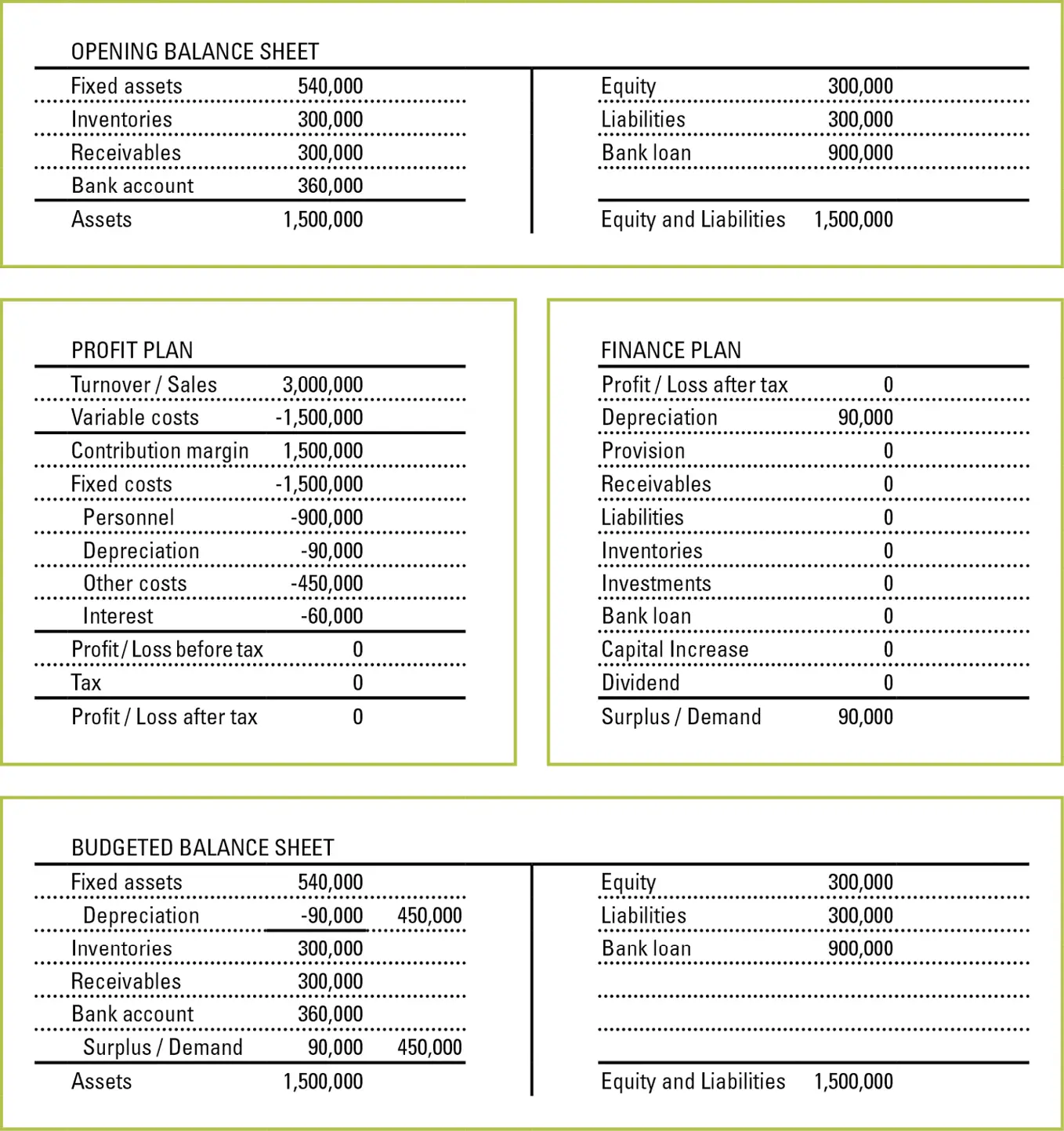

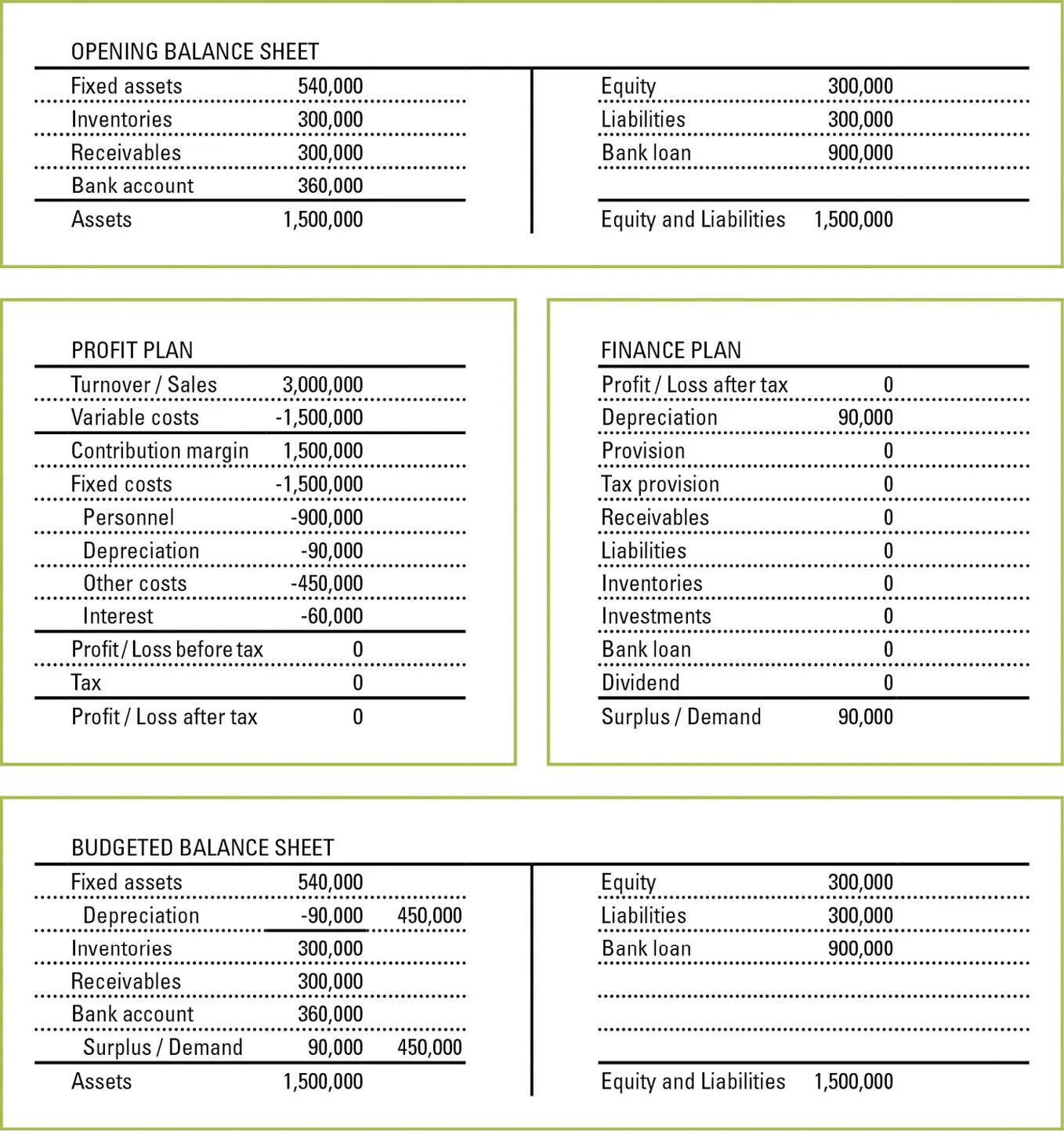

On the next page, opening balance sheet, as well as profit plan, finance plan and budgeted balance sheet of the enterprise are presented before taking the described business activity into account.

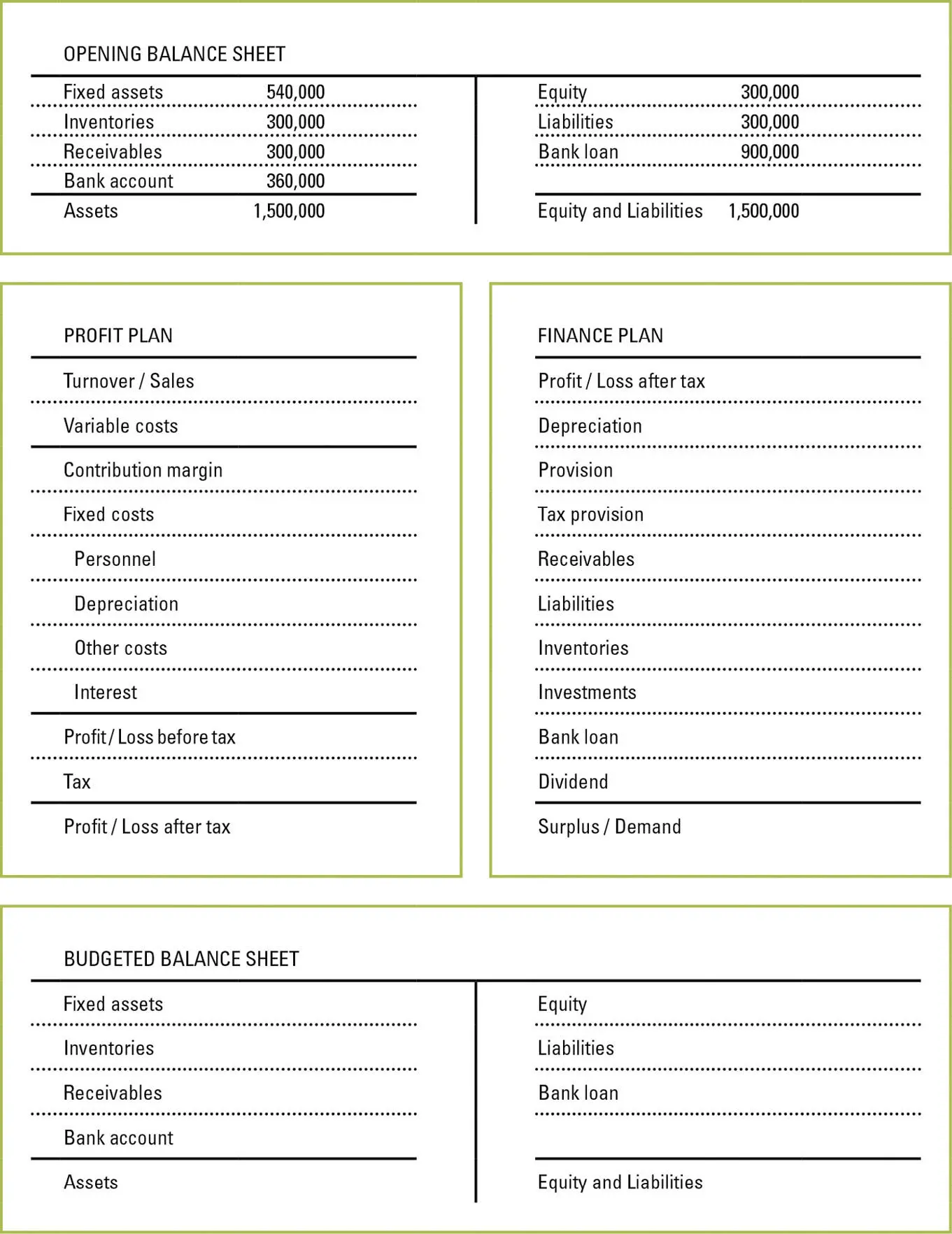

Please, present in what way the planned payment of the dividends affects profit plan, finance plan and budgeted balance sheet of the enterprise.

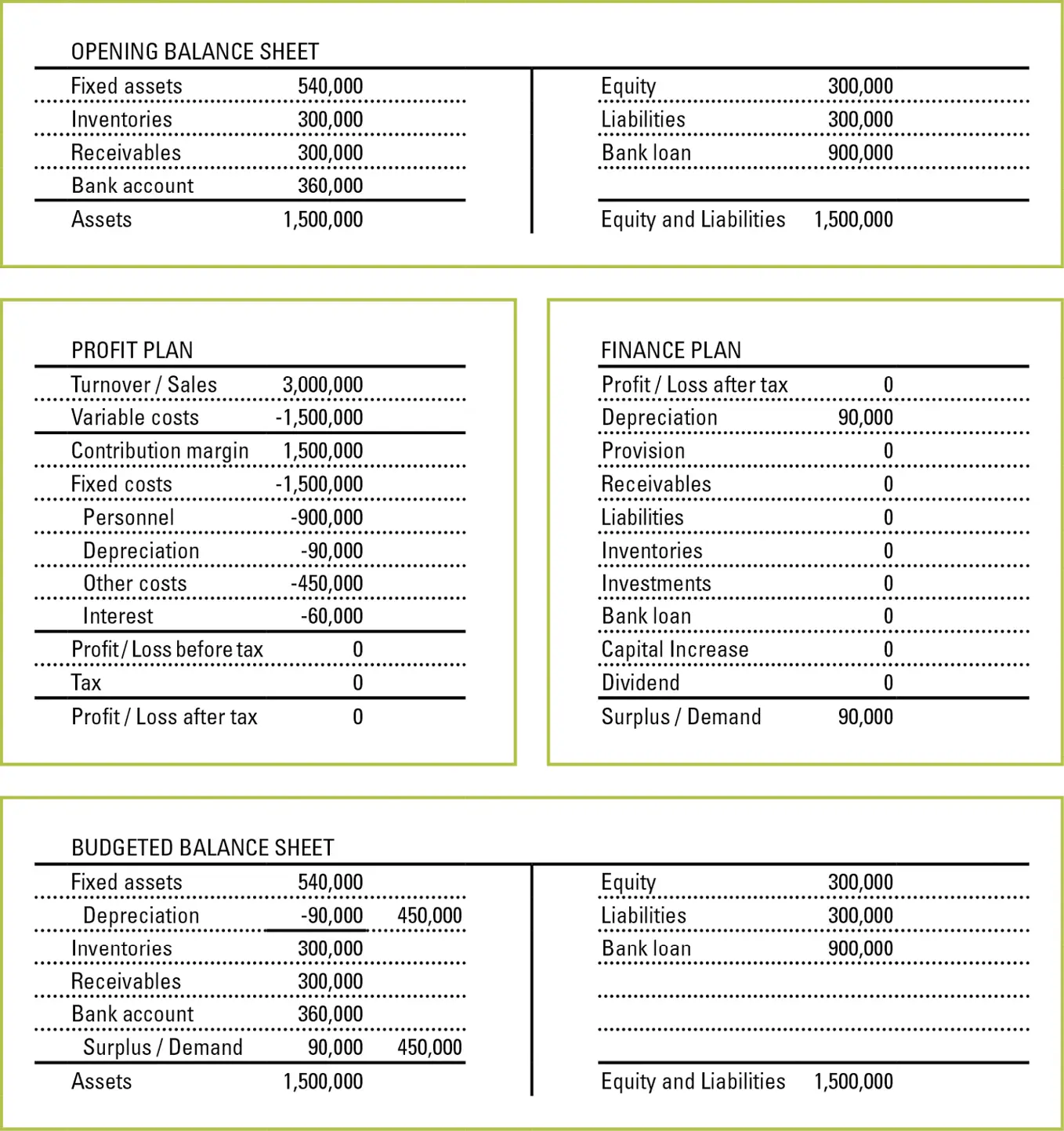

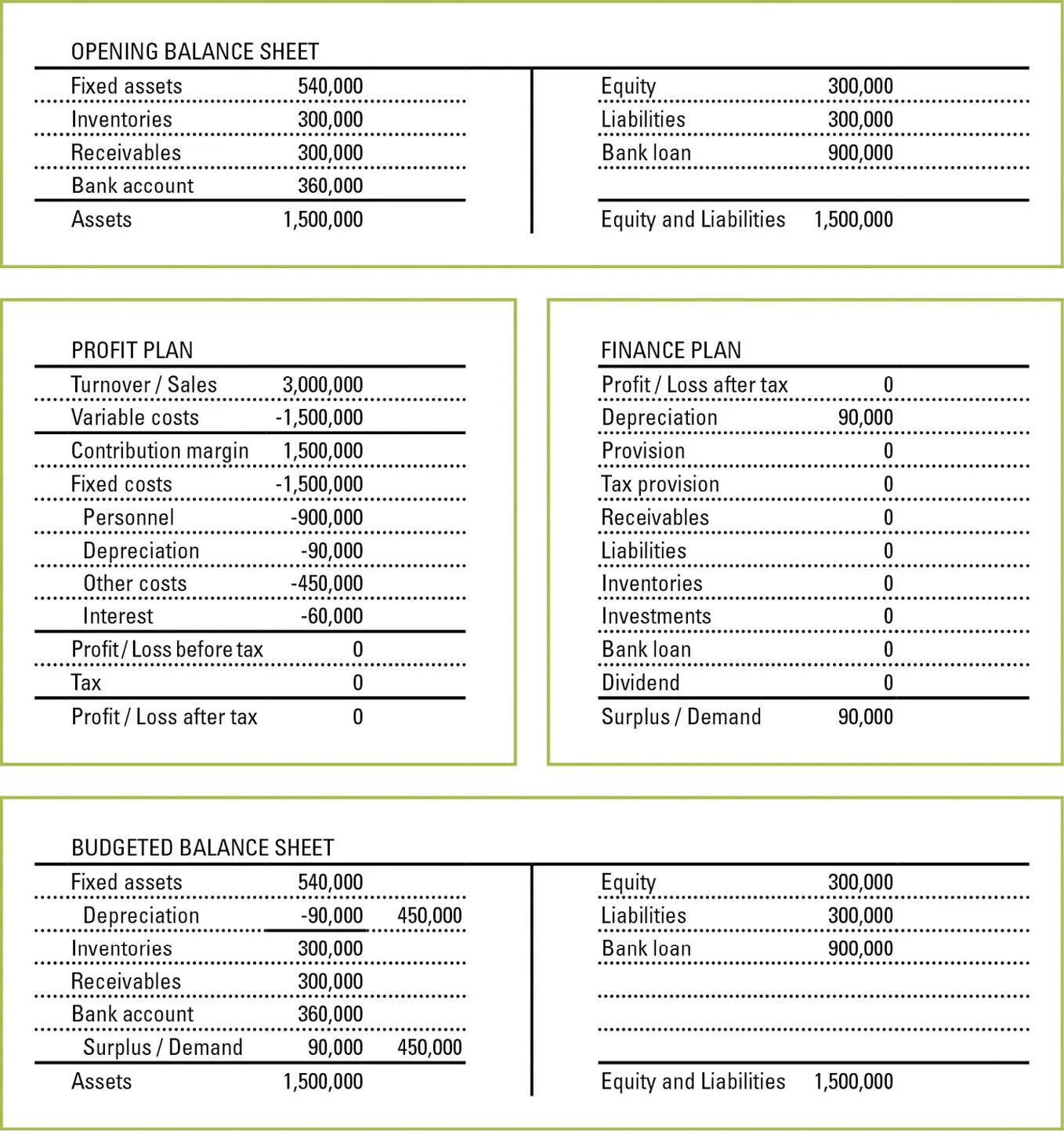

Basic Data

Figure 19: Dividend | Basic Data

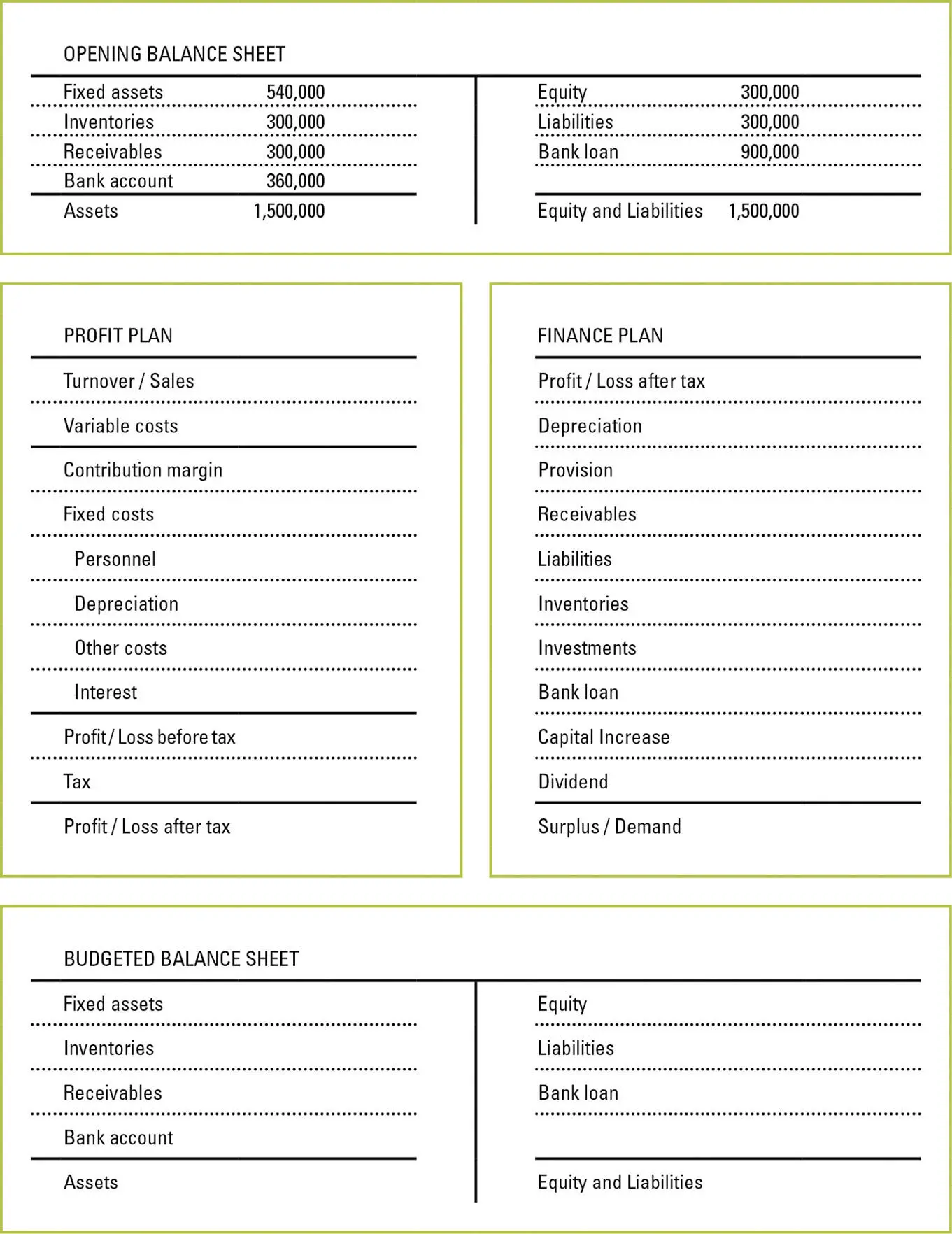

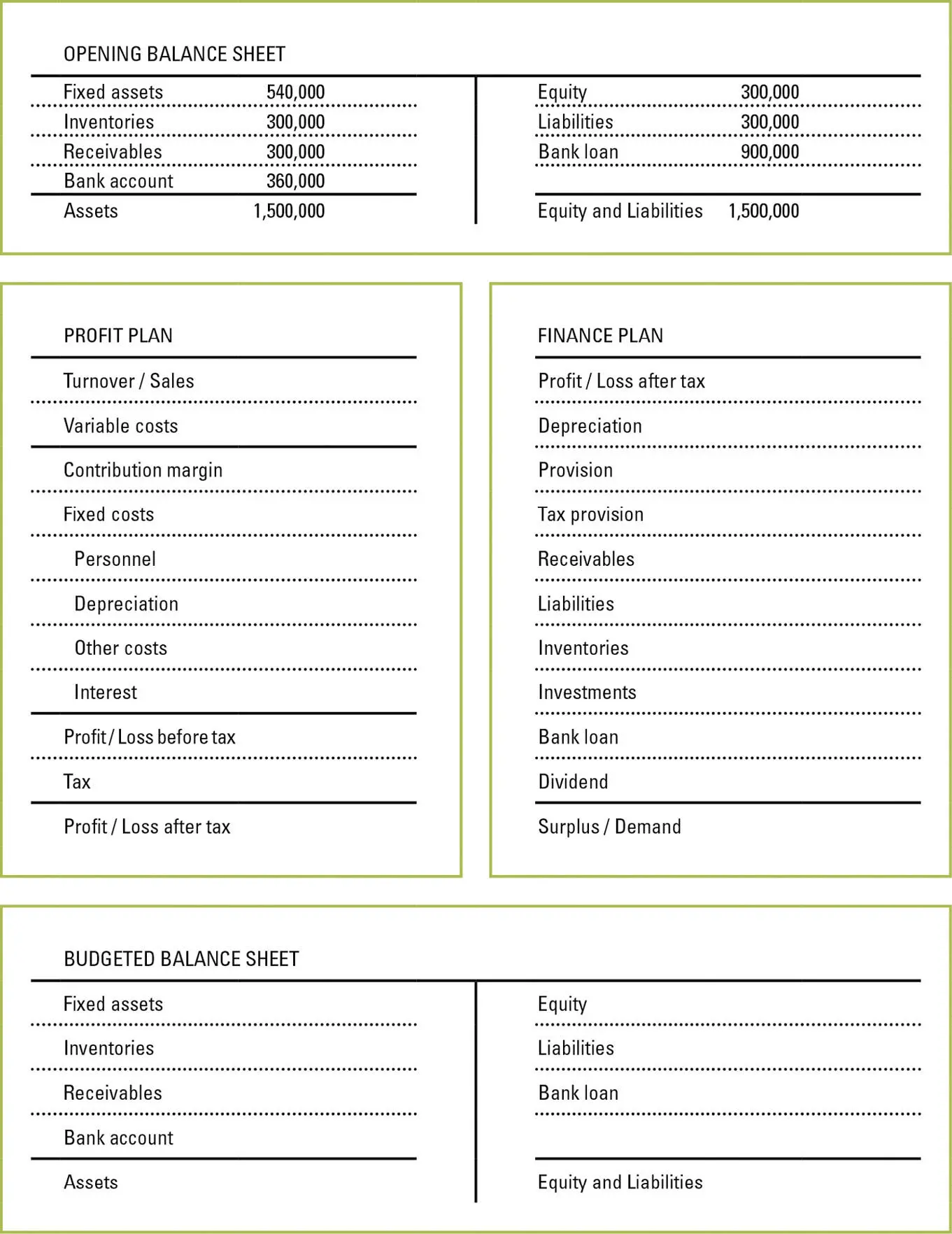

Answer Form

Figure 20: Dividend | Answer Form

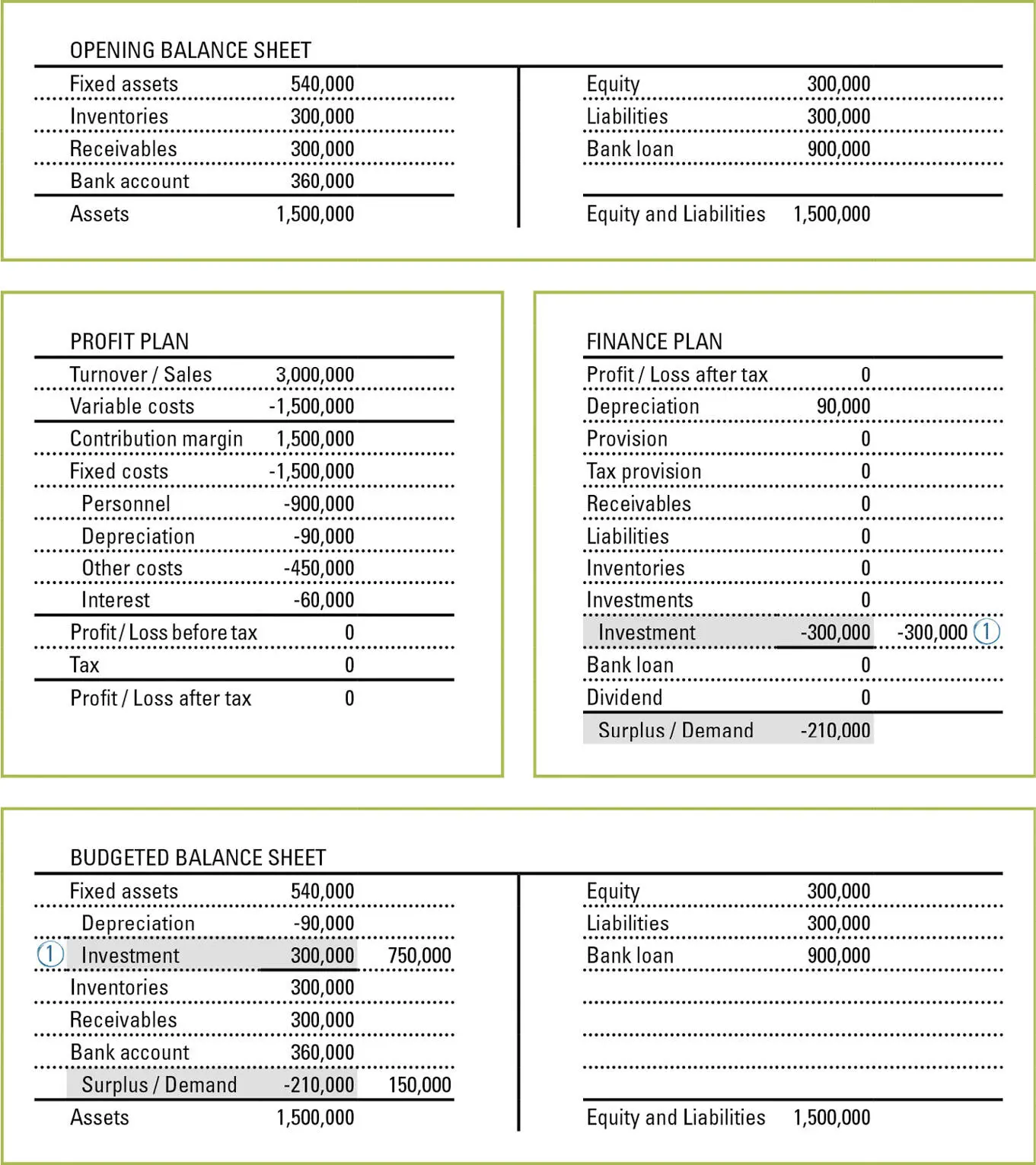

Complete Answer Key Step 1-2/2

Figure 21: Dividend | Complete Answer Key Step 1-2/2

The planned payment of the dividend is carried out through the item Dividend in the finance plan. (1)

Together with the depreciation of 90,000 which is incorporated into the finance plan with a positive mathematical sign, the planned payout of the dividend of 60,000 (1), based on a planned profit or loss of 0 from the profit plan which forms the basis for the finance plan, now leads to a surplus of cash of 30,000 as the result of the finance plan. (2)

All changing values from the finance plan are incorporated into the budgeted balance sheet:

The depreciation of 90,000 which has already been stated in the basic data continues to reduce the fixed assets in the budgeted balance sheet.

The payout of the dividend reduces the equity capital by 60,000 in the budgeted balance sheet of the enterprise. (1)

The surplus of cash of 30,000 as the result of the finance plan increases the bank account in the budgeted balance sheet. (2)

The payout of the dividend has absolutely no effect on the profit plan.

Assignment of tasks

In the enterprise in the example given an investment is planned for the beginning of the business year. The sum to be invested amounts to 300,000. The investment object is to be paid totally from the existing bank account. The depreciation period of the object is 10 years.

On the next page, opening balance sheet, as well as profit plan, finance plan and budgeted balance sheet of the enterprise are presented before considering the above mentioned business activities.

Please, present in what way the investment and the further activities quoted in connection with the investment affect profit plan, finance plan and budgeted balance sheet of the enterprise.

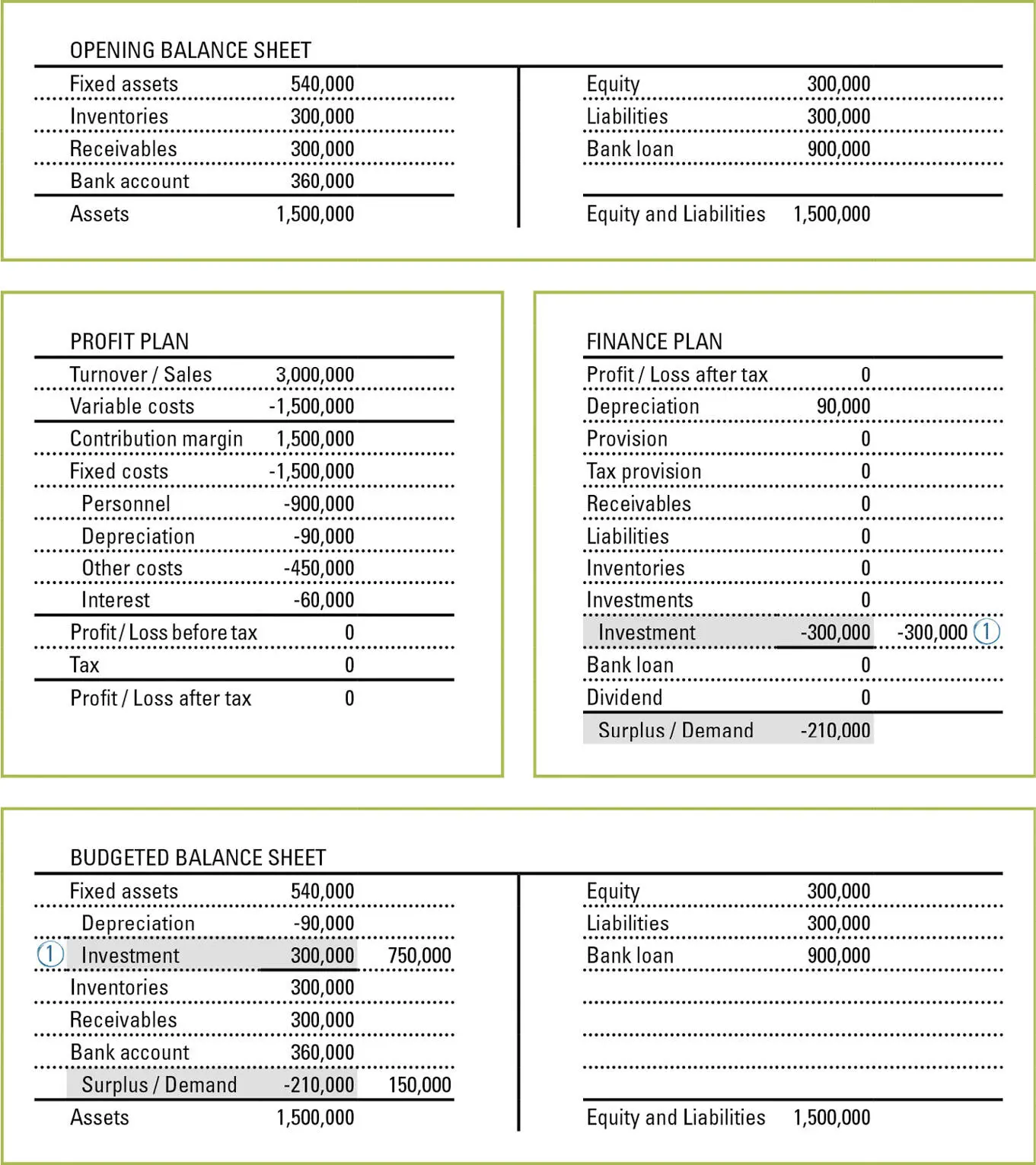

Basic Data

Figure 22: Investment | Basic Data

Answer Form

Figure 23: Investment | Answer Form

Answer Key Step 1/4

Figure 24: Investment | Answer Key Step 1/4

Читать дальше