Third, because there's no such thing as ‘get rich quick'.Most people can get themselves financially sorted in one year, then go on to become financially successful in six years. Yes, those are rubbery figures. A guesstimate. But after helping thousands of people over many years, I've found them to be pretty much bang on.

In Step 4 you'll meet Danielle, a single woman from Melbourne in her early 30s who was on the bones of her backside, working in admin, with credit card debts. Fast forward six years and she owns her own home and has emergency savings and a share portfolio. Even better, she did it all on her own: no boyfriend, no rich parents — just my plan and grit .

Here's another thought: stop for a second and work out where you were six years ago.

Go on … do it.

It seems like yesterday, right? It's likely the next six will too.

But if you don't make a commitment to starting today, nothing will change.

The good news is that you can do astonishing things in six years, but only if you schedule your Barefoot Date Nights right now.

Yep, this is where my apple tree analogy comes in …

Plant the bloody tree now!

Your future self will thank you for it.

Truth is, most people totally over estimate what they can achieve in one year, but totally under estimate what they can do in six years.

So to reiterate: you're going to schedule five weekly Barefoot Date Nights — after which it's monthly, forever.

I don't care if you're in your 20s or your 70s, whether you're gay, straight, married or single. Making a ritual of focusing on your money is the most powerful thing you can do. Period.

Schedule your first five Barefoot Date Nights

Please pull out your phone, or go to your diary (or Facebook, or kitchen calendar, or whatever you use to track your schedule) and book in your Barefoot Date Night each week for the next five weeks .

I promise it will be worth it …

In just five ‘date nights' you and I are going to radically change your financial life .

(With a drink in your hand.)

Barefoot Date Night confessions

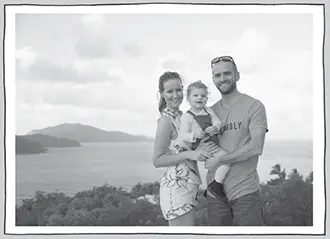

April Mac, NSW

I have never felt so financially secure as I am now … I feel excited about my future.

I was never under any great financial difficulty — I just never really had any money. I always had a job and earned enough to get by, but I spent everything I made each week.

My biggest problem was not thinking long term about my finances. I honestly just didn't think my husband and I could ever earn enough to be wealthy.

My sister got me onto Barefoot on the 1st of January 2014. I signed up in the middle of the night and read through everything I could. I was so excited to have a New Year's resolution that didn't involve dieting! I started by setting some simple goals to achieve by the 1st of January 2015.

Well, in 12 months I achieved everything I set out to achieve. And I did it all while earning half my regular salary, as I was on maternity leave.

Not only that — since joining Barefoot, I've managed to:

pay $30 000 off our mortgage

save another $30 000 for renovating our home

take the family to Fiji, Hamilton Island and Noosa

build a share portfolio worth $16 000

save up a nice little emergency money account (‘Mojo') …

… all while not having to sacrifice my lifestyle (I am ashamed to say I eat breakfast out more than I do at home).

Barefoot helped me visualise the bigger picture. I could see myself in the success stories of others, and it made me determined to be the one to provide financial security for my family (not Oz Lotto).

The only problem is, I never shut up about Barefoot and everyone is sick of me mentioning it. But I will continue to try and convince everyone because I've seen how far it has taken me in two short years. I know I am nothing special, so I think it can work for anyone.

I have never felt as financially secure as I am now, even when I was earning twice as much and didn't have a child to take care of. I feel excited about my future.

Given this is our first Barefoot Date Night, I want you to go out for dinner and really treat yourself.

I'm serious.

Get ready to buy the best thing on the menu and have a nice glass of wine (or two).

Why?

Because you're about to start saving money.

When I wrote this book, people were being charged $477 a year … or thousands of dollars over a decade. And in half an hour's work I showed them how to banish bank fees from their life forever.

Now it's your turn.

That's right, you'll never have to worry about sticking your card in a so-called foreign ATM and getting the banking equivalent of herpes (if you go to a non-bank ATM you could be hit with the dreaded $2 ‘FU fee').

What you're going to do is set up the accounts that will form the backbone of the Barefoot Steps, allowing you to automate your day-to-day finances to the point that you'll be able to manage your money in around 10 minutes a week.

Literally, while you're having your ‘wine time', you're going to set up your new zero-fee accounts via the wonder of the mobile phone.

Most people never get around to doing this. Instead, they flick through a finance book and put it back on the shelf — but not you. Never underestimate yourself with a drink in your hand.

Of course, this will mean making some changes to your current banking arrangements.

Here's you:Ugh! You want me to change my bank accounts? I really … can't be bothered.

Here's me:Your current bank account is a lot like your last boyfriend. You knew he was a bit of a dud, that he was draining you and that he was never going to change. Your current bank account is also draining you: the average Australian household gets whacked with $395 in bank fees each year (according to the Reserve Bank). Over 10 years that's $3950 — enough to take you to New York City and stay at a five-star hotel.

Here's you:Yeah, but I have all my direct debits set up. It would be such a pain …

Here's me:The real pain comes from dealing with a bank that slugs you with all sorts of annoying fees, and having to think about it.

Plus, switching isn't a big deal. If you call your bank they'll give you a list of all your direct debits over the past 13 months. And your new bank should bend over backwards (or at least limbo a little) to get your business. Often they'll have templates and other hacks that you can email to your existing billers.

Anyway, I think of it like this: having an awesome bank account is a self-confidence thing. It's the little wins — the habits you build — that strengthen your confidence.

Or think of it like surfing: sure, you have to paddle a bit at the start (with a freaking wine in your hand), but once you catch that wave, you can relax and let it carry you home.

How did you get your current bank account?

Maybe it was your parents' bank.

Maybe it was bundled with your home loan (they probably called it a ‘package’).

Maybe you were a Dollarmite (more on this in Step 3).

If you're dealing with one of the Big Four banks, there's every chance you're getting screwed. Earning zero per cent interest is like sooo noughties.

Читать дальше