1 Cover

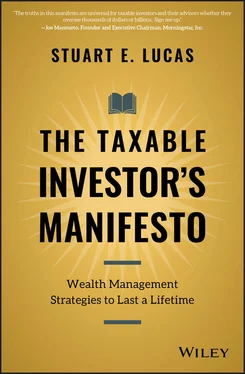

2 About the Author About the Author Stuart E. Lucas is founder, Co-Managing Partner, and Chief Investment Officer of Wealth Strategist Partners, advisor to large complex families across financial, business, and cultural dimensions of their enterprises. Stuart designed and is Co-Director of the University of Chicago Booth School of Business's Private Wealth Management continuing education program, which has served over 1,000 wealthy individuals and families in the 12 years since the course's inception. He is a speaker on topics of wealth management around the world. His first book, Wealth: Grow It and Protect It (FT Press), has been published on three continents. He is the author of numerous articles on investing and wealth management, most recently “The 50% Rule” and “Pick Your Battles” ( Journal of Wealth Management ), co-authored with Alejandro Sanz. Stuart is chairman of the Investment Committee of National Public Radio in Washington, D.C., and is involved in various other philanthropic endeavors in education and media. Previously, Stuart was the senior managing director of the Ultra-High Net Worth Group within Private Client Services at Bank One (now JP Morgan Chase); director of a multifamily investment office in Paris, France; general manager of European operations of Wellington Management Company in London, England; and assistant portfolio manager of a Forbes Honor Roll mutual fund. He has a BA with honors from Dartmouth College, an MBA from Harvard Business School, and is a Chartered Financial Analyst. He has been married for more than 30 years to his wife, Susan, and they have three grown children.

3 Acknowledgments

4 Introduction

5 CHAPTER ONE: Taxable Investors Need to Think Differently KEY CHAPTER TAKEAWAYS

6 CHAPTER TWO: Diversify at the Right Time and in the Right Way KEY CHAPTER TAKEAWAYS

7 CHAPTER THREE: Generate Value from That Magical Liability: Deferred Tax ALTERNATIVES TO SELLING KEY CHAPTER TAKEAWAYS

8 CHAPTER FOUR: If You Want Wealth to Grow, Own Stocks OVER TIME, STOCKS OUTPERFORM BONDS GEOGRAPHIC DIVERSIFICATION MANAGING SHORT-TERM VOLATILITY ASSET LOCATION: TAXABLE, TAX-DEFERRED, OR TAX-EXEMPT? KEY CHAPTER TAKEAWAYS

9 CHAPTER FIVE: Lengthen Time Horizon to Lower Risk and Enhance Returns KEY CHAPTER TAKEAWAYS

10 CHAPTER SIX: Control Cash Flow to Perpetuate Purchasing Power KEY CHAPTER TAKEAWAYS

11 CHAPTER SEVEN: Don't Be Misled by Performance KEY CHAPTER TAKEAWAYS

12 CHAPTER EIGHT: Get Value from Active Management TACTICS FOR IMPROVING SUCCESS WITH ACTIVE MANAGERS KEY CHAPTER TAKEAWAYS

13 CHAPTER NINE: Approach Alternative Investments with Skill and Skepticism, or Not at All HEDGE FUNDS ARE RARELY GOOD FOR TAXABLE INVESTORS PRIVATE EQUITY AND VENTURE MAY BE BETTER SCALE, STRUCTURE, AND TAX ARE IMPORTANT CONSIDERATIONS ARE YOU PREPARED TO INVEST? KEY CHAPTER TAKEAWAYS

14 CHAPTER TEN: Plan Your Estate: It Adds More Value Than Investing KEY CHAPTER TAKEAWAYS

15 CHAPTER ELEVEN: Shift from Success to Significance KEY CHAPTER TAKEAWAYS

16 CHAPTER TWELVE: Reinforce Positive Family Culture through Financial Design KEY CHAPTER TAKEAWAYS

17 CHAPTER THIRTEEN: Evaluate the Risks to This Approach KEY CHAPTER TAKEAWAYS

18 CHAPTER FOURTEEN: Select an Advisor with Strong Investment Skills, an Interdisciplinary Approach, and a Fiduciary Mindset KEY CHAPTER TAKEAWAYS

19 APPENDIX Additional Books about Taxable Investing

20 Index

21 End User License Agreement

1 Chapter 1 FIGURE 1.1 A FRAMEWORK FOR TAXABLE INVESTING.

2 Chapter 3FIGURE 3.2 TO SELL OR TO HOLD?

3 Chapter 4FIGURE 4.2 LONG-TERM ROLLING REAL RETURNS FOR STOCKS AND BONDS.

4 Chapter 5FIGURE 5.1 THE EFFECT OF TIME HORIZON ON STANDARD DEVIATION OF REAL RETURN.

5 Chapter 7FIGURE 7.1 GROWTH OF $100, JANUARY 1, 1999, TO December 31, 2018.

6 Chapter 8FIGURE 8.1 CONCEPTUAL FRAMEWORK OF THE RELATIONSHIP BETWEEN TRACKING ERROR A...FIGURE 8.2 SCREENING MATRIX FOR TAXABLE EQUITY MANAGERS.

7 Chapter 10FIGURE 10.1 CREATE VALUE AT THE INTERSECTIONS.

1 Cover

2 Table of Contents

3 Begin Reading

1 ii

2 iii

3 iv

4 v

5 vii

6 viii

7 xi

8 xiii

9 xiv

10 xv

11 xvii

12 xviii

13 xix

14 xx

15 xxi

16 xxii

17 xxiii

18 xxiv

19 1

20 2

21 3

22 4

23 5

24 6

25 7

26 9

27 10

28 11

29 12

30 13

31 14

32 15

33 17

34 18

35 19

36 20

37 21

38 22

39 23

40 24

41 25

42 26

43 27

44 28

45 29

46 30

47 31

48 32

49 33

50 34

51 35

52 36

53 37

54 39

55 40

56 41

57 42

58 43

59 44

60 45

61 46

62 47

63 49

64 50

65 51

66 52

67 53

68 54

69 55

70 56

71 57

72 58

73 59

74 60

75 61

76 62

77 63

78 65

79 66

80 67

81 68

82 69

83 70

84 71

85 72

86 73

87 74

88 75

89 76

90 77

91 79

92 80

93 81

94 82

95 83

96 84

97 85

98 86

99 87

100 89

101 90

102 91

103 92

104 93

105 94

106 95

107 96

108 97

109 99

110 100

111 101

112 102

113 103

114 104

115 105

116 106

117 107

118 108

119 109

120 111

121 112

122 113

123 114

124 115

125 116

126 117

127 118

128 119

129 120

130 121

131 122

132 123

133 124

134 125

135 126

136 127

137 128

138 129

139 130

140 131

141 132

142 133

143 134

144 135

145 136

146 137

147 138

148 139

149 140

150 141

151 142

152 143

153 144

154 145

Also by Stuart Lucas

Wealth: Grow It, Protect It, Spend It and Share It

Wealth: Grow It and Protect It

The Taxable Investor's Manifesto

Wealth Management Strategies to Last a Lifetime

Stuart E. Lucas

Copyright © 2020 by Stuart E. Lucas. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

Читать дальше