3 Profit from referrals to other customers. Less needs to be spent on advertising and promotion due to word-of-mouth recommendations from satisfied customers.

4 Profit from price premium. Customer acquisition can benefit from introductory promotional discounts, while long-term customers are more likely to pay regular prices. (But many companies have learned that if they advertise widely about a lower-price offer, they'd better be prepared to give it to current customers who want it too—or better yet, offer it without being asked.)

No matter what the industry, the longer an enterprise keeps a customer, the more value that customer can generate for shareholders. 17 Reichheld and Sasser found in a classic study that for one auto service company, the expected profit from a fourth-year customer is more than triple the profit that same customer generates in the first year. Other industries studied showed similar positive results (see Exhibit 2.1).

No matter what the industry, the longer an enterprise keeps a customer, the more value that customer can generate for shareholders.

EXHIBIT 2.1 Profit One Customer Generates over Time

| Industry |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

| Credit Card |

$30 |

$42 |

$44 |

$49 |

$55 |

| Industrial Laundry |

$144 |

$166 |

$192 |

$222 |

$256 |

| Industrial Distribution |

$45 |

$99 |

$123 |

$144 |

$168 |

| Auto Servicing |

$25 |

$35 |

$70 |

$88 |

$88 |

Source: Frederick F. Reichheld and W. Earl Sasser Jr., “Zero Defections: Quality Comes to Services,” Harvard Business Review 68:5 (September–October 1990): 106.

Enterprises that build stronger individual customer relationships enhance customer loyalty, as they are providing each customer with what they need. 18 Loyalty building requires the enterprise to emphasize the value of its products or services and to show that it is interested in building a relationship with the customer. The enterprise realizes that it must build a stable customer base rather than concentrate on single sales. 19

A customer-strategy firm will want to reduce customer defections because they result in the loss of investments the firm has made in creating and developing customer relationships. Customers are the lifeblood of any business. They are, literally, the only source of its revenue. 20 Loyal customers are more profitable because they likely buy more over time if they are satisfied. It costs less for the enterprise to serve retained customers over time because transactions with repeat customers become more routine. Loyal customers tend to refer other new customers to the enterprise, thereby creating new sources of revenue. 21 It stands to reason that if the central goal of a customer-strategy company is to increase the overall value of its customer base, then continuing its relationships with its most profitable customers will be high on its list of priorities.

On average, U.S. corporations have tended to lose half their customers in five years, half their employees in four, and half their investors in less than one. 22 In his classic study on the subject, Fred Reichheld described a possible future in which the only business relationships will be onetime, opportunistic transactions between virtual strangers. 23 However, he found that disloyalty could stunt corporate performance by 25% to 50%, sometimes more. In contrast, enterprises that concentrate on finding and keeping good customers, productive employees, and supportive investors continue to generate superior results. For this reason, the primary responsibility for customer retention or defection lies in the chief executive's office.

Customer loyalty is closely associated with customer relationships and may, in certain cases, be directly related to the level of each customer's satisfaction over time. 24 According to James Barnes, satisfaction is tied to what the customer gets from dealing with a company as compared with what they have to commit to those dealings or interactions. 25 For now, it's enough to know that the customer satisfaction issue is controversial—maybe even problematic. There are issues of relativity (are laptop users just harder to satisfy than desktop users, or are they really less satisfied?) and skew (is the satisfaction score the result of a bunch of people who are more or less satisfied, or a bimodal group whose members either love or hate the product?). Barnes believes that by increasing the value that the customer perceives in each interaction with the company, enterprises are more likely to increase customer satisfaction levels, leading to higher customer retention rates. When customers are retained because they enjoy the service they are receiving, they are more likely to become loyal customers. This loyalty leads to repeat buying and increased share of customer. (We will discuss more about the differences between emotional loyalty and behavioral loyalty, as well as ways to measure loyalty and retention, later in the chapter.)

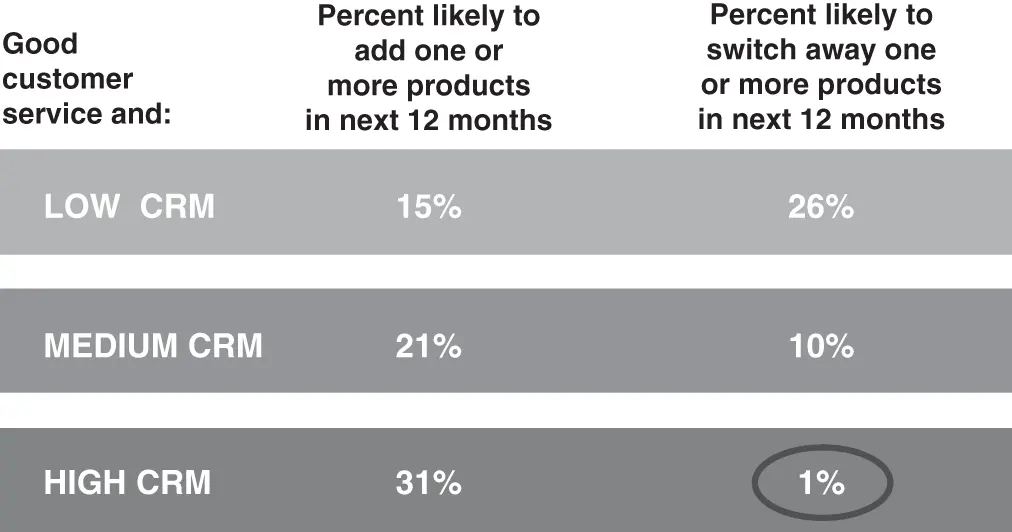

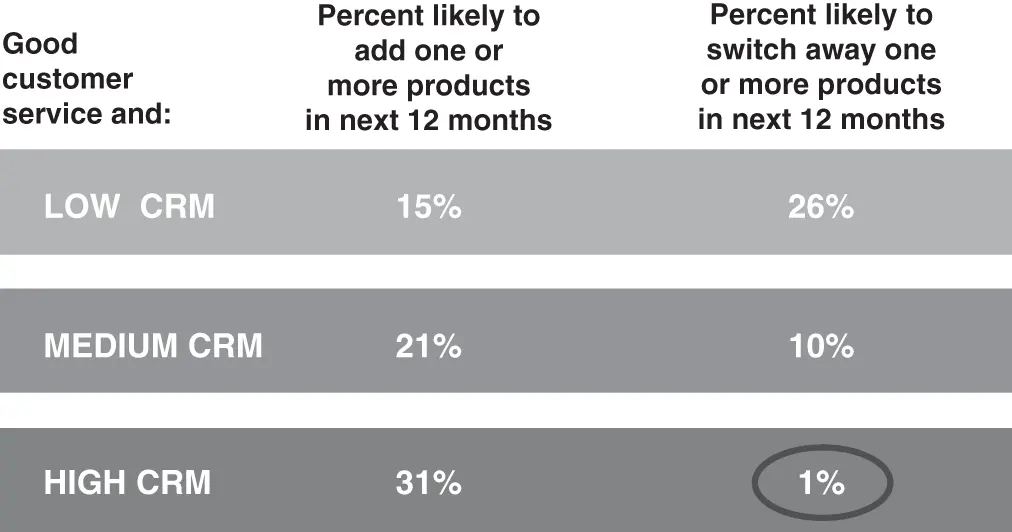

The Financial Payoff of Building Customer Relationships in Financial Services

Managing individual customer relationships has a profound effect on enhancing long-term customer loyalty, thereby increasing the enterprise's long-term profitability. Relationship strategies, for example, have a substantial effect on customer retention in the financial services sector. A study conducted by Peppers & Rogers Group (with Roper Starch Worldwide) found that—looking at a group of “satisfied customers”—only 1% of consumers who rate their financial services provider high on relationship management say they are likely to switch away products to competitors. One-fourth of consumers (26%) who rate their primary financial services provider as low on relationship management attributessay they are likely to switch away one or more products during the next 12 months. The financial implications of these findings are staggering (see Exhibit 2.2). Using a conservative average annual profitability per household for U.S. retail banks of $100, a reduction in attrition of 9% represents over $700 million in incremental profits for all U.S. households with accounts. If an individual financial institution with 20,000 customers can reduce attrition by 9 percentage points by providing excellent customer relationship management(e.g., recognizingreturning customers, anticipating their needs, etc.), that institution can increase profits by $180,000. For a similar-size financial institution with an average household profitability of $500, the increase in profitability climbs to $900,000.

EXHIBIT 2.2 Benefits of CRM in Financial Services

Source: Peppers & Rogers Group, Roper Starch Worldwide survey.

Retaining customers is more beneficial to the enterprise for another reason: Acquiring new customers is costly. Consider the customer acquisition cost (CAC)for the banking industry. Averaging across channels, banks can spend at least $303 to replace each customer who defects. 26 So if a bank has a clientele of 50,000 customers and loses 5% of those customers each year, it would need to spend $757,500 or more each year simply to maintain its customer base. 27 Many Internet startup companies, without any brand-name recognition, faced an early demise during the 2000–2001 dot-com bubble bust, largely because they could not recoup the costs associated with acquiring new customers. The typical Internet pure-play spent an average of $82 to acquire one customer in 1999, a 95% increase over the $42 spent on average in 1998. 28 Much of that increase can be attributed to the dot-com companies' struggle to build brand awareness during 1999, which caused web-based firms to increase offline advertising spending by an astounding 518%. Based on marketing costs related to their online business, in 1999, offline-based companies spent an average of $12 to acquire a new customer, down from $22 the previous year. Online firms spent an unsustainable 119% of their revenues on marketing in 1999. Even with the advantages of established brands, offline companies spent a still-high 36%.

Читать дальше