The Gaussian is not self-similar, and that is why my coffee cup does not jump on my desk.

Now, consider a trip up a mountain. No matter how high you go on the surface of the earth, it will remain jagged. This is even true at a height of 30,000 feet. When you are flying above the Alps, you will still see jagged mountains in place of small stones. So some surfaces are not from Mediocristan, and changing the resolution does not make them much smoother. (Note that this effect only disappears when you go up to more extreme heights. Our planet looks smooth to an observer from space, but this is because it is too small. If it were a bigger planet, then it would have mountains that would dwarf the Himalayas, and it would require observation from a greater distance for it to look smooth. Likewise, if the planet had a larger population, even maintaining the same average wealth, we would be likely to find someone whose net worth would vastly surpass that of Bill Gates.)

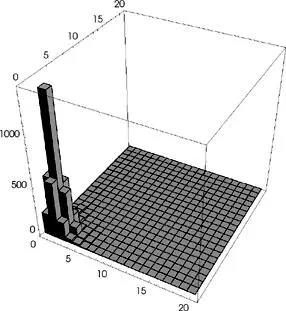

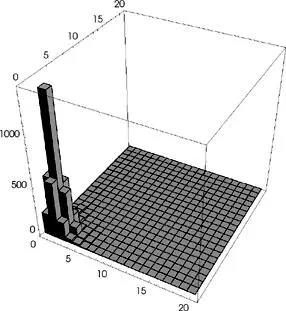

Figures 11 and 12 illustrate the above point: an observer looking at the first picture might think that a lens cap has fallen on the ground.

Recall our brief discussion of the coast of Britain. If you look at it from an airplane, its contours are not so different from the contours you see on the shore. The change in scaling does not alter the shapes or their degree of smoothness.

Pearls to Swine

What does fractal geometry have to do with the distribution of wealth, the size of cities, returns in the financial markets, the number of casualties in war, or the size of planets? Let us connect the dots.

The key here is that the fractal has numerical or statistical measures that are (somewhat) preserved across scales —the ratio is the same, unlike the Gaussian. Another view of such self-similarity is presented in Figure 13. As we saw in Chapter 15, the superrich are similar to the rich, only richer—wealth is scale independent, or, more precisely, of unknown scale dependence.

In the 1960s Mandelbrot presented his ideas on the prices of commodities and financial securities to the economics establishment, and the financial economists got all excited. In 1963 the then dean of the University of Chicago Graduate School of Business, George Shultz, offered him a professorship. This is the same George Shultz who later became Ronald Reagan’s secretary of state.

FIGURE 11:Apparently, a lens cap has been dropped on the ground. Now turn the page.

Shultz called him one evening to rescind the offer.

At the time of writing, forty-four years later, nothing has happened in economics and social science statistics—except for some cosmetic fiddling that treats the world as if we were subject only to mild randomness—and yet Nobel medals were being distributed. Some papers were written offering “evidence” that Mandelbrot was wrong by people who do not get the central argument of this book—you can always produce data “corroborating” that the underlying process is Gaussian by finding periods that do not have rare events, just like you can find an afternoon during which no one killed anyone and use it as “evidence” of honest behavior. I will repeat that, because of the asymmetry with induction, just as it is easier to reject innocence than accept it, it is easier to reject a bell curve than accept it; conversely, it is more difficult to reject a fractal than to accept it. Why? Because a single event can destroy the argument that we face a Gaussian bell curve.

In sum, four decades ago, Mandelbrot gave pearls to economists and résumé-building philistines, which they rejected because the ideas were too good for them. It was, as the saying goes, margaritas ante porcos , pearls before swine.

FIGURE 12:The object is not in fact a lens cap. These two photos illustrate scale invariance: the terrain is fractal. Compare it to man-made objects such as a car or a house. Source: Professor Stephen W. Wheatcraft, University of Nevada, Reno .

In the rest of this chapter I will explain how I can endorse Mandelbrotian fractals as a representation of much of randomness without necessarily accepting their precise use. Fractals should be the default, the approximation, the framework. They do not solve the Black Swan problem and do not turn all Black Swans into predictable events, but they significantly mitigate the Black Swan problem by making such large events conceivable. (It makes them gray. Why gray? Because only the Gaussian give you certainties. More on that, later.)

THE LOGIC OF FRACTAL RANDOMNESS (WITH A WARNING) *

I have shown in the wealth lists in Chapter 15 the logic of a fractal distribution: if wealth doubles from 1 million to 2 million, the incidence of people with at least that much money is cut in four, which is an exponent of two. If the exponent were one, then the incidence of that wealth or more would be cut in two. The exponent is called the “power” (which is why some people use the term power law) . Let us call the number of occurrences higher than a certain level an “exceedance”—an exceedance of two million is the number of persons with wealth more than two million. One main property of these fractals (or another way to express their main property, scalability) is that the ratio of two exceedances *is going to be the ratio of the two numbers to the negative power of the power exponent. Let us illustrate this. Say that you “think” that only 96 books a year will sell more than 250,000 copies (which is what happened last year), and that you “think” that the exponent is around 1.5. You can extrapolate to estimate that around 34 books will sell more than 500,000 copies—simply 96 times (500,000/250,000) −1.5. We can continue, and note that around 12 books should sell more than a million copies, here 96 times (1,000,000/250,000) −1.5.

FIGURE 13: THE PURE FRACTAL STATISTICAL MOUNTAIN

The degree of inequality will be the same in all sixteen subsections of the graph. In the Gaussian world, disparities in wealth (or any other quantity) decrease when you look at the upper end—so billionaires should be more equal in relation to one another than millionaires are, and millionaires more equal in relation to one another than the middle class. This lack of equality at all wealth levels, in a nutshell, is statistical self-similarity.

TABLE 2: ASSUMED EXPONENTS FOR VARIOUS PHENOMENA *

Phenomenon Assumed Exponent (vague approximation) Frequency of use of words 1.2 Number of hits on websites 1.4 Number of books sold in the U.S. 1.5 Telephone calls received 1.22 Magnitude of earthquakes 2.8 Diameter of moon craters 2.14 Intensity of solar flares 0.8 Intensity of wars 0.8 Net worth of Americans 1.1 Number of persons per family name 1 Population of U.S. cities 1.3 Market moves 3 (or lower) Company size 1.5 People killed in terrorist attacks 2 (but possibly a much lower exponent)

Phenomenon Assumed Exponent (vague approximation) Frequency of use of words 1.2 Number of hits on websites 1.4 Number of books sold in the U.S. 1.5 Telephone calls received 1.22 Magnitude of earthquakes 2.8 Diameter of moon craters 2.14 Intensity of solar flares 0.8 Intensity of wars 0.8 Net worth of Americans 1.1 Number of persons per family name 1 Population of U.S. cities 1.3 Market moves 3 (or lower) Company size 1.5 People killed in terrorist attacks 2 (but possibly a much lower exponent)

* Source: M.E.J. Newman (2005) and the author’s own calculations .

Читать дальше