Popular culture: In 1931, Edward Angly exposed forecasts made by President Hoover in a book titled Oh Yeah? Another hilarious book is Cerf and Navasky (1998), where, incidentally, I got the pre-1973 oil-estimation story.

Effects of information: The major paper is Bruner and Potter (1964). I thank Danny Kahneman for discussions and pointing out this paper to me. See also Montier (2007), Oskamp (1965), and Benartzi (2001). These biases become ambiguous information (Griffin and Tversky [1992]). For how they fail to disappear with expertise and training, see Kahneman and Tversky (1982) and Tversky and Kahneman (1982). See Kunda (1990) for how preference-consistent information is taken at face value, while preference-inconsistent information is processed critically.

Planning fallacy: Kahneman and Tversky (1979) and Buehler, Griffin, and Ross (2002). The planning fallacy shows a consistent bias in people’s planning ability, even with matters of a repeatable nature—though it is more exaggerated with nonrepeatable events.

Wars: Trivers (2002).

Are there incentives to delay?: Flyvbjerg et al. (2002).

Oskamp: Oskamp (1965) and Montier (2007).

Task characteristics and effect on decision making: Shanteau (1992).

Epistēmē vs. Technē : This distinction harks back to Aristotle, but it recurs then dies? down—it most recently recurs in accounts such as tacit knowledge in “know how.” See Ryle (1949), Polanyi (1958/1974), and Mokyr (2002).

Catherine the Great: The number of lovers comes from Rounding (2006).

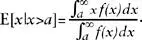

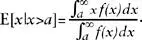

Life expectancy: www.annuityadvantage.com/lifeexpectancy.htm. For projects, I have used a probability of exceeding with a power-law exponent of 3/2: f= Kx 3/2. Thus the conditional expectation of x , knowing that x exceeds a

CHAPTERS 11–13

Serendipity: See Koestler (1959) and Rees (2004). Rees also has powerful ideas on fore-castability. See also Popper’s comments in Popper (2002), and Waller (2002a), Cannon (1940), Mach (1896) (cited in Simonton [1999]), and Merton and Barber (2004). See Simonton (2004) for a synthesis. For serendipity in medicine and anesthesiology, see Vale et al. (2005).

“Renaissance man”: See www.bell-labs.com/project/feature/archives/cosmology/.

Laser: As usual, there are controversies as to who “invented” the technology. After a successful discovery, precursors are rapidly found, owing to the retrospective distortion. Charles Townsend won the Nobel prize, but was sued by his student Gordon Gould, who held that he did the actual work (see The Economist , June 9, 2005).

Darwin/Wallace: Quammen (2006).

Popper’s attack on historicism: See Popper (2002). Note that I am reinterpreting Popper’s idea in a modern manner here, using my own experiences and knowledge, not commenting on comments about Popper’s work—with the consequent lack of fidelity to his message. In other words, these are not directly Popper’s arguments, but largely mine phrased in a Popperian framework. The conditional expectation of an unconditional expectation is an unconditional expectation.

Forecast for the future a hundred years earlier: Bellamy (1891) illustrates our mental projections of the future. However, some stories might be exaggerated: “A Patently False Patent Myth still! Did a patent official really once resign because he thought nothing was left to invent? Once such myths start they take on a life of their own.” Skeptical Inquirer , May–June, 2003.

Observation by Peirce: Olsson (2006), Peirce (1955).

Predicting and explaining: See Thom (1993).

Poincaré: The three body problem can be found in Barrow-Green (1996), Rollet (2005), and Galison (2003). On Einstein, Pais (1982). More recent revelations in Hladik (2004).

Billiard balls: Berry (1978) and Pisarenko and Sornette (2004).

Very general discussion on “complexity”: Benkirane (2002), Scheps (1996), and Ruelle (1991). For limits, Barrow (1998).

Hayek: See www.nobel.se. See Hayek (1945, 1994). Is it that mechanisms do not correct themselves from railing by influential people, but either by mortality of the operators, or something even more severe, by being put out of business? Alas, because of contagion, there seems to be little logic to how matters improve; luck plays a part in how soft sciences evolve. See Ormerod (2006) for network effects in “intellectuals and socialism” and the power-law distribution in influence owing to the scale-free aspect of the connections—and the consequential arbitrariness. Hayek seems to have been a prisoner of Weber’s old differentiation between Natur-Wissenschaften and Geistes Wissenschaften —but thankfully not Popper.

Insularity of economists: Pieters and Baumgartner (2002). One good aspect of the insularity of economists is that they can insult me all they want without any consequence: it appears that only economists read other economists (so they can write papers for other economists to read). For a more general case, see Wallerstein (1999). Note that Braudel fought “economic history.” It was history.

Economics as religion: Nelson (2001) and Keen (2001). For methodology, see Blaug (1992). For high priests and lowly philosophers, see Boettke, Coyne, and Leeson (2006). Note that the works of Gary Becker and the Platonists of the Chicago School are all marred by the confirmation bias: Becker is quick to show you situations in which people are moved by economic incentives, but does not show you cases (vastly more numerous) in which people don’t care about such materialistic incentives.

The smartest book I’ve seen in economics is Gave et al. (2005) since it transcends the constructed categories in academic economic discourse (one of the authors is the journalist Anatole Kaletsky).

General theory: This fact has not deterred “general theorists.” One hotshot of the Platonifying variety explained to me during a long plane ride from Geneva to New York that the ideas of Kahneman and his colleagues must be rejected because they do not allow us to develop a general equilibrium theory, producing “time-inconsistent preferences.” For a minute I thought he was joking: he blamed the psychologists’ ideas and human incoherence for interfering with his ability to build his Platonic model.

Samuelson: For his optimization, see Samuelson (1983). Also Stiglitz (1994).

Plato’s dogma on body symmetry: “Athenian Stranger to Cleinias: In that the right and left hand are supposed to be by nature differently suited for our various uses of them; whereas no difference is found in the use of the feet and the lower limbs; but in the use of the hands we are, as it were, maimed by the folly of nurses and mothers; for although our several limbs are by nature balanced, we create a difference in them by bad habit,” in Plato’s Laws . See McManus (2002).

Drug companies: Other such firms, I was told, are run by commercial persons who tell researchers where they find a “market need” and ask them to “invent” drugs and cures accordingly—which accords with the methods of the dangerously misleading Wall Street security analysts. They formulate projections as if they know what they are going to find.

Читать дальше