In the bakery example, the discrepancy between the contractor’s account statement and the amount of money actually in the bank is Mrs McDoughnut’s bakery. Mr Greedy has put the bank’s money into the asset, trusting that one day it would be profitable. The bakery hasn’t baked a loaf of bread yet, but McDoughnut and Greedy anticipate that a year hence it will be selling thousands of loaves, rolls, cakes and cookies each day, at a handsome profit. Mrs McDoughnut will then be able to repay her loan, with interest. If at that point Mr Stone decides to withdraw his savings, Greedy will be able to come up with the cash. The entire enterprise is thus founded on trust in an imaginary future – the trust that the entrepreneur and the banker have in the bakery of their dreams, along with the contractor’s trust in the future solvency of the bank.

We’ve already seen that money is an astounding thing because it can represent myriad different objects and convert anything into almost anything else. However, before the modern era this ability was limited. In most cases, money could represent and convert only things that actually existed in the present. This imposed a severe limitation on growth, since it made it very hard to finance new enterprises.

Consider our bakery again. Could McDoughnut get it built if money could represent only tangible objects? No. In the present, she has a lot of dreams, but no tangible resources. The only way she could get her bakery built would be to find a contractor willing to work today and receive payment in a few years’ time, if and when the bakery starts making money. Alas, such contractors are rare breeds. So our entrepreneur is in a bind. Without a bakery, she can’t bake cakes. Without cakes, she can’t make money. Without money, she can’t hire a contractor. Without a contractor, she has no bakery.

Humankind was trapped in this predicament for thousands of years. As a result, economies remained frozen. The way out of the trap was discovered only in the modern era, with the appearance of a new system based on trust in the future. In it, people agreed to represent imaginary goods – goods that do not exist in the present – with a special kind of money they called ‘credit’. Credit enables us to build the present at the expense of the future. It’s founded on the assumption that our future resources are sure to be far more abundant than our present resources. A host of new and wonderful opportunities open up if we can build things in the present using future income.

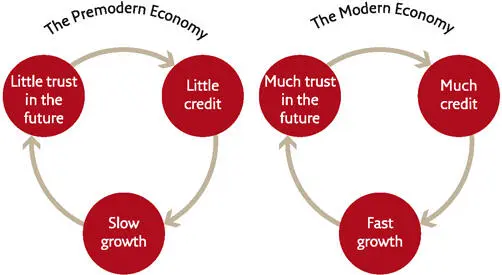

If credit is such a wonderful thing, why did nobody think of it earlier? Of course they did. Credit arrangements of one kind or another have existed in all known human cultures, going back at least to ancient Sumer. The problem in previous eras was not that no one had the idea or knew how to use it. It was that people seldom wanted to extend much credit because they didn’t trust that the future would be better than the present. They generally believed that times past had been better than their own times and that the future would be worse, or at best much the same. To put that in economic terms, they believed that the total amount of wealth was limited, if not dwindling. People therefore considered it a bad bet to assume that they personally, or their kingdom, or the entire world, would be producing more wealth ten years down the line. Business looked like a zero-sum game. Of course, the profits of one particular bakery might rise, but only at the expense of the bakery next door. Venice might flourish, but only by impoverishing Genoa. The king of England might enrich himself, but only by robbing the king of France. You could cut the pie in many different ways, but it never got any bigger.

That’s why many cultures concluded that making bundles of money was sinful. As Jesus said, ‘It is easier for a camel to pass through the eye of a needle than for a rich man to enter into the kingdom of God’ (Matthew 19:24). If the pie is static, and I have a big part of it, then I must have taken somebody else’s slice. The rich were obliged to do penance for their evil deeds by giving some of their surplus wealth to charity.

The Entrepreneur’s Dilemma

If the global pie stayed the same size, there was no margin for credit. Credit is the difference between today’s pie and tomorrows pie. If the pie stays the same, why extend credit? It would be an unacceptable risk unless you believed that the baker or king asking for your money might be able to steal a slice from a competitor. So it was hard to get a loan in the premodern world, and when you got one it was usually small , short-term , and subject to high interest rates . Upstart entrepreneurs thus found it difficult to open new bakeries and great kings who wanted to build palaces or wage wars had no choice but to raise the necessary funds through high taxes and tariffs.

The Magic Circle of the Modern Economy

That was fine for kings (as long as their subjects remained docile), but a scullery maid who had a great idea for a bakery and wanted to move up in the world generally could only dream of wealth while scrubbing down the royal kitchens floors.

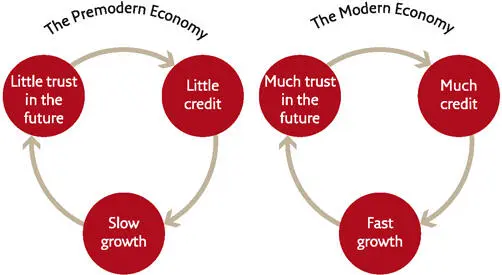

It was lose-lose. Because credit was limited, people had trouble financing new businesses. Because there were few new businesses, the economy did not grow. Because it did not grow, people assumed it never would, and those who had capital were wary of extending credit. The expectation of stagnation fulfilled itself.

A Growing Pie

Then came the Scientific Revolution and the idea of progress. The idea of progress is built on the notion that if we admit our ignorance and invest resources in research, things can improve. This idea was soon translated into economic terms. Whoever believes in progress believes that geographical discoveries, technological inventions and organisational developments can increase the sum total of human production, trade and wealth. New trade routes in the Atlantic could flourish without ruining old routes in the Indian Ocean. New goods could be produced without reducing the production of old ones. For instance, one could open a new bakery specialising in chocolate cakes and croissants without causing bakeries specialising in bread to go bust. Everybody would simply develop new tastes and eat more. I can be wealthy without your becoming poor; I can be obese without your dying of hunger. The entire global pie can grow.

Over the last 500 years the idea of progress convinced people to put more and more trust in the future. This trust created credit; credit brought real economic growth; and growth strengthened the trust in the future and opened the way for even more credit. It didn’t happen overnight – the economy behaved more like a roller coaster than a balloon. But over the long run, with the bumps evened out, the general direction was unmistakable. Today, there is so much credit in the world that governments, business corporations and private individuals easily obtain large , long-term and low-interest loans that far exceed current income.

The Economic History of the World in a Nutshell

The belief in the growing global pie eventually turned revolutionary. In 1776 the Scottish economist Adam Smith published The Wealth of Nations , probably the most important economics manifesto of all time. In the eighth chapter of its first volume, Smith made the following novel argument: when a landlord, a weaver, or a shoemaker has greater profits than he needs to maintain his own family, he uses the surplus to employ more assistants, in order to further increase his profits. The more profits he has, the more assistants he can employ. It follows that an increase in the profits of private entrepreneurs is the basis for the increase in collective wealth and prosperity.

Читать дальше

![Юваль Ной Харари - Sapiens. Краткая история человечества [litres]](/books/34310/yuval-noj-harari-sapiens-kratkaya-istoriya-cheloveche-thumb.webp)

![Юваль Ной Харари - 21 урок для XXI века [Версия с комментированными отличиями перевода]](/books/412481/yuval-noj-harari-21-urok-dlya-xxi-veka-versiya-s-ko-thumb.webp)