We may be inclined to explain the expansion of the debt by citing the party politics of the leader in charge. However, ideology offers a poor account of these trends. The major accumulations of US debt in the postwar period both began under Republican administrations: Ronald Reagan (1981–1989) and George W. Bush (2001–2009). This debt grew at a staggering pace during the 2007–2010 recession as the United States underwrote troubled banks and embarked on Keynesian policies of fiscal stimulus. By the third quarter of 2010, debt was $9.13 trillion or 62 percent of GDP. British debt follows a similar pattern. In 2002 debt stood at 29 percent of GDP, but by 2007 it was 37 percent and this has exploded in the wake of the 2008 financial crisis to 71 percent of GDP.

From a Keynesian perspective, many governments are taking the perverse steps of trying to cut spending during a recession instead of stimulating demand. This does not reflect a desire by politicians to borrow less. Rather debt crises in Iceland, Greece, and Ireland have led many investors to doubt the ability of nations to repay. This has pushed up the cost of borrowing and made it much harder to secure new loans. It is supply, not demand, that has shrunk.

Markets limit how much a nation can borrow. If individuals borrow too much and either cannot or will not repay it, then banks and other creditors can seize assets to recover the debt. With sovereign lending to countries, however, creditors cannot repossess property. On a few occasions creditors have tried. For instance, France invaded Mexico in 1862 in an attempt to get Mexico to repay loans. France also invaded the Ruhr, an industrial area of Germany, in 1923 to collect reparation payments due from World War I that Germany had not paid. Both attempts failed. In practice, the only leverage lenders have over nations is to cut them off from future credit. Nevertheless, this has a profound effect, as the ability to engage in borrowing in financial markets is valuable. For this reason nations generally pay their debt.

However, once the value of access to credit is worth less than the cost of servicing the debt then leaders should default. If they don’t then surely a challenger will come along who will offer to do so. This was one of the appeals of Adolf Hitler to the German people in the 1930s. Germany faced a huge debt, in part to pay reparations from World War I. Hitler defaulted on this debt. It was a popular policy with the German people since the cost of servicing the debt was so high.

As debt approaches the balance point where the value of access to credit equals the cost of debt service, lenders refuse to increase the overall size of debt. At this point, if leaders want to borrow more, then they need to increase revenues such that they could service this additional debt. As in the Nigerian case, the discovery of exploitable natural resources provides one means to increase debt service and hence more borrowing. However, without such discoveries, the only way to increase borrowing is to increase tax revenue. For autocratic leaders this means liberalizing their policies to encourage people to work harder because they already tax at a high (implicit) rate. Only when facing financial problems are leaders willing to even consider undertaking such politically risky liberalization. They don’t do it frequently or happily. They liberalize, opening the door to a more democratic, representative and accountable government only when they have no other path to save themselves from being deposed today.

Debt Forgiveness

Debt forgiveness is a popular policy, but one that is generally misguided. Those in favor of forgiving the debt of highly indebted poor countries argue that the debt burden falls on the poor people of the nation who did not benefit in a consequential way from the borrowed funds. This is certainly true. As we have explained, the benefits go to the leader and the coalition while the debt obligation falls on everyone. But people who argue for debt forgiveness construct their arguments in terms of how they think the world should operate, rather than how it actually works.

In the late 1980s, as many poor nations struggled to repay debts, creditors coordinated to reschedule and forgive debt. The French Ministry of the Economy, Finance, and Industry became an important center for negotiations, helping ensure that creditors shared similar losses. These meetings became known as the Paris Club. In 1996 the International Monetary Fund (IMF) and World Bank launched the Heavily Indebted Poor Country (HIPC) initiative. Instead of the previous case-by-case approach, this program provided systematic help to poor nations with writing down their debts. However, nations could only receive debt relief when they passed or made substantial progress towards meeting explicit criteria concerned with poverty alleviation and budget reform. The program received a huge boost under the Millennium Goals program. From 2006 onwards many HIPCs saw very large reductions in their debt. We will have to wait to see the consequences of these programs. However, it is useful to look back at some of the largest debt-relief efforts prior to 2000. It is particularly illustrative to observe how important the nature of governance is. Even though creditors carefully chose those nations that they thought would behave sensibly, in the wake of debt relief many nations started increasing debt again.

As a percentage of debt, the largest debt reliefs prior to 2000 were given to Ethiopia in 1999 (42 percent of debt), Yemen in 1997 (34 percent), Belarus in 1996 (33 percent), Angola in 1996 (33 percent), Nicaragua in 1996 (30 percent) and Mozambique in 1990 (27 percent). 17 With the exceptions of Angola and Nicaragua, each of these nations promptly started reaccumulating debt. For instance, after a series of small debt reductions, in 1999, with the forgiveness of $4.4 billion, Ethiopia had its debt reduced to $5.7 billion. But by 2003 this debt had risen to $6.9 billion. Despite the forgiveness of $589 million of debt in 1996, Belarus’s debt has steadily risen from $1.8 billion in 1995 to over $4.1 billion in 2005. Even though debt-reduction programs vet candidates, these examples suggest that in many cases forgiveness without institutional reform simply allows leaders to start borrowing again.

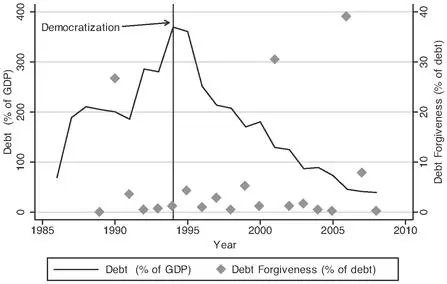

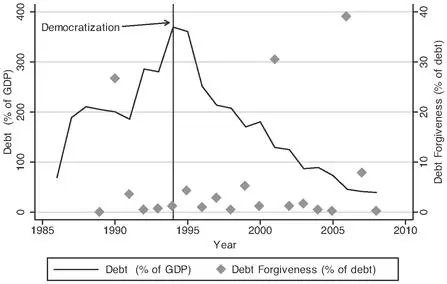

FIGURE 4.3 Mozambique’s Debt and Forgiveness

Democrats also like to borrow but they are not as profligate as autocrats. They prefer lower levels of indebtedness than autocrats. Democratization promotes successful debt reduction, as the history of Mozambique and Nicaragua illustrate. In 1990, 27 percent of Mozambique’s debt was forgiven. The result was the further accumulation of debt. By the time Mozambique democratized in 1994, debt was over $8 billion. However, this debt has gradually been reduced, as seen in Figure 4.3, aided in part by further forgiveness.

The HIPC program has received much criticism for its slow pace in reducing the debt of poor nations. Our criticism of HIPC is the opposite. These programs are actually too eager to forgive debt. Debt forgiveness simply allows autocratic leaders to start borrowing more money. As we’ll see a little later, financial crises are one of the important reasons leaders are compelled to democratize. Debt reduction, however, relieves financial pressure and enables autocrats to stay in office without reform, continuing to make the lives of their subjects miserable.

It is no wonder that autocrats love debt relief. But how does debt relief look to those who would like to improve governance and who want to start, as we do, from understanding how leaders behave rather than engaging in wishful thinking? We depart for the moment from looking at governance through a leader’s eyes and instead turn our attention to how to change an autocrat’s vision. That is, we turn for the moment to thinking about how we can use the logic of dictatorial rule to give autocrats the right incentives to change their government for the better. We wonder, can we create a desire by at least some autocrats to govern for the people as the best way to ensure their own political survival?

Читать дальше