Dependencies. The capacity of certain assets is unusable without free capacity of other assets. For example, a high-speed printer is not usable unless it is provisioned on a network accessible to the user domain. Similarly, it is not possible to add additional staff to a service function or process unless adequate resources such as workstations, software licences, office space and financial budget s are allocated.

Overloaded assets. Certain capacity is blocked simply because it is already overloaded beyond a factor of safety. Because of commitments made in service agreement s and contract s, no further demand can be allocated to such capacity. For example, if a service contract supports a mission-critical function of a customer’s business , no other service may access the capacity of resource s dedicated to the contract.

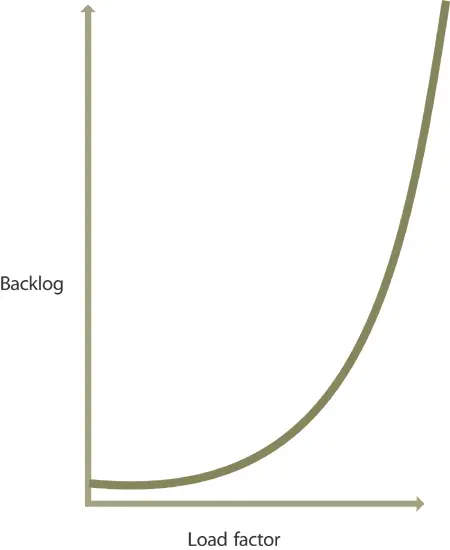

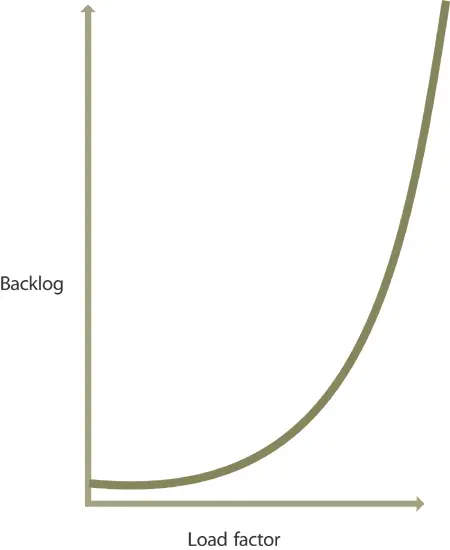

A certain amount of idle capacity is required to maintain a given level of contingency. A capacity buffer or headroom is required to respond to unexpected peaks in demand. Trade-off exists between efficiency in utilization of resources and the service level s they can support (Figure 9.9). This constraint is particularly strong in shared services environment s.

Figure 9.9 Higher load factors can create backlogs under certain conditions

Variability exists not only in demand but also capacity. The effective available capacity of a resource may vary as normal or because of failure s or outages. Both types of variability affect the performance of services because of imbalance leading to backlog. Manufacturing system s overcome such problem with production planning and control techniques just as the kanban system for line balancing and redesign of process flow or assembly. Similar methods are applicable in the case of services. Six Sigma methods have been effective in service industries.

Strategic plans and initiatives that depend on the quick adjustments of productive capacity should take into consideration the inertia or resistance from capacity constraints to rapid adjustments. The processes for developing service design s, transition plans and operational plans should also include an activity or step that considers these constraints. The agility or responsiveness of a service unit depends on the mix of service asset s. If service assets with high inertia dominate a service model , changes should be considered in terms of improvements or replacement of those assets.

9.5.7 Market risks

A common source of risk for all type of service provider s is the choice that their customers have on sourcing decisions. In recent years, Type I providers have faced the risk of outsourcing when customers sign contract s with external providers in pursuit of strategic objective s. Customer s are willing to make that switch when benefits outweigh the costs and risks of switching from one type to another. Reducing the total cost of utilization (TCU) gives customers incentives not to switch to other options. While outsourcing and shared services are the dominant trend, insourcing (or perhaps the affirmation of status quo) continues to be a valuable strategic option for customers. This is the risk faced primarily by Type III providers and to a limited extent by Type II providers. Effective service management helps reduce the levels of competitive risks faced by service providers by increasing the scale and scope of demand for a Service Catalogue . Conversely, another approach is to modify the contents of the Service Catalogue appropriately so that customers perceive the depth and width in the Catalogue with respect to their needs.

9.5.7.1 Reducing market risk through differentiation

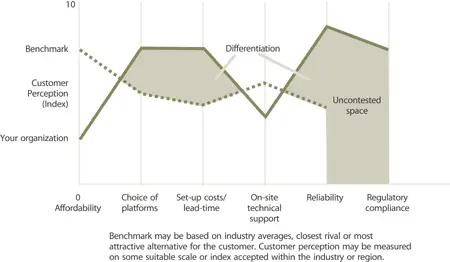

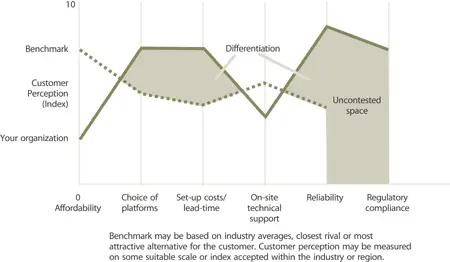

How do you ensure good returns from investments made in service asset s? How do you find new opportunities for those assets to be deployed in service of new customers? From a customer’s perspective services bring to bear assets that are both scarce (i.e. customers do not have enough) and complementary (i.e. there is value in combining the customer and service assets). In a controlled and coordinated manner, service providers are allowing their assets to be used by their customers for gain. From a corresponding perspective, all service providers must maintain the assets most valued by their customers but not adequately provided by others. Unserved and underserved market space s represent the most attractive opportunities (Figure 9.10).

Figure 9.10 Uncontested market space based on underserved needs25

For example, business process outsourcing (BPO) corresponds to the need of customers to have access to world-class business processes in function s such as finance, human resources and logistics. Customers do not want to invest their financial capital into the research and development of such processes. Customers pay a fee for using the business process, or simply for enjoying its outputs (e.g. invoices, claims or applications processes). They are free from the risk of operating or maintaining the process and keeping it efficient and compliant. They simply pay for the delivery of a given service level . Service provider s have a larger basis for recovering costs in the form of service contract s, so they continue to innovate, improve and control the performance of the business processes and its enabling infrastructure. Network effects and positive feedback set in when customers receive the expected value from the BPO provider and influence the decisions of their peers.

A service provider may see this as an opportunity. It may assume the risks of investing in the design , engineering and development of a set of business processes that it would offer as services. It would also invest in the automation and staffing of the processes, and in ongoing efforts to increase their effectiveness and efficiencies. By offering these business processes as services, the provider can spread the investment across several customers and reduce the risks of not recovering its investments.

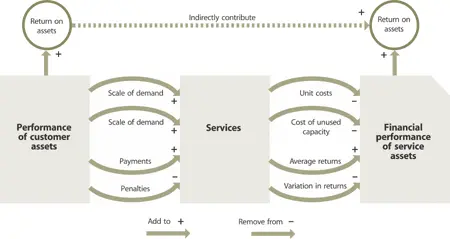

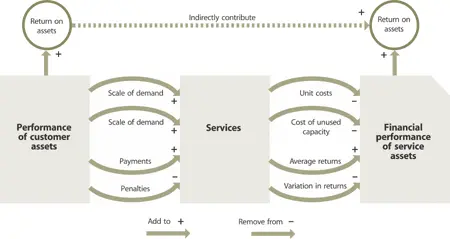

9.5.7.2 Reducing market risk through consolidation

Consolidation of demand reduces the financial risks for service providers and in turn reduces operation risks for customers. With an increase in the scale and scope of demand there is a reduction in the costs to serve the next unit of demand (Figure 9.11). The cost of unused capacity is also reduced through careful grouping of demand. Similar demand from multiple customer organizations can be hosted by the same set of service asset s or service units. Fragmented pieces of demand are matched with the capacity to fulfil the demand. This leads to economy of scope for those particular service assets. On the whole there is an increase in the average return of assets realized by the service unit, and a reduction in the variation in returns.

Figure 9.11 Consolidation of fragmented demand reduces financial risks

Читать дальше