9.5.5 Design risks

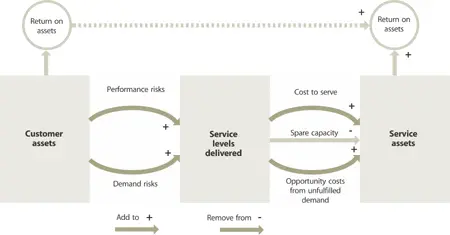

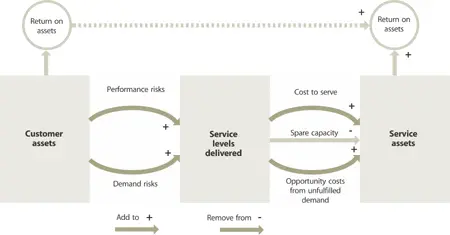

Customers expect services to have a particular impact on the performance of their assets, which is utility from their perspective. There is always a risk that services as designed fail to deliver the expected benefits utility. This is a performance risk (Figure 9.7). A major cause for poor performance is poor design. There is also a risk that the utility of a service diminishes with a significant change in the pattern of demand. For example, some services are designed in ways that prevent them from being scalable. In the short term, terms and conditions related to demand in service level agreement s might protect the service provider from penalties. It does not protect them from changes in customer perception about the suitability of the service.

The problem may be two-fold. There may be a lack of formal functions and processes in Service Design , which is different from the design of software application s and enterprise architecture . Service Design implements the principles of service management such as separation of concerns , modularity, loose coupling and feedback. Some Service Catalogue s list as services items that are actually service components, functions and processes. These typically are applications, infrastructure and supporting system s that have been offered as services by default and not by design. Customer s begin to use them only to face problems later as defects and failures emerge in actual use.

Figure 9.7 Risks from customer expectations

It is better to institutionalize a systematic approach to Service Design so that opportunities and resources are not wasted early in the lifecycle. Service Design processes and methods are a means to reduce the performance risks and demand risks of services. They take into account the type of customer assets to be supported, how those assets generate returns for customers, and the characteristics of demand they impose on the service to be designed. Service Design defines the best configuration of service assets that can provide the necessary performance potential and accept not only a specific pattern of demand but also tolerate variations within a specified range. Good designs also ensure that services are economical to operate and flexible enough to modify and improve. This ensures that performance risk s and demand risks do not result in high costs of utilized assets or opportunity cost s from unutilized or under-utilized assets.

9.5.6 Operational risks

Operational risks are faced by every organization. Contract s are risk-sharing arrangements in which customers transfer ownership of certain types of costs and risks to service providers (Figure 9.6). Two sets of risks are considered from a service management perspective: risks faced by business units and the risks faced by the service units. A more complex view of risk is considered by taking into account the risks across an entire value net that includes partners and supplier s. This shared view of risks may be much more difficult to manage but may provide better visibility and control since the risks interact with each other. However, customers expect to be isolated from the operation risks of service providers. Poor risk management on the part of service providers may expose customer assets to risks and consequential loss. Service management prevents that from happening.

The system s and processes of Service Transition are able to filter such risks between organizations connected through services. The capabilities in Service Operation convert operational risks into opportunities to create value for customers. Their effect of removing risks from the customer’s business is the core value proposition of many services.

Procedure s in Service Transition must be robust enough to ensure that this filtering capability is actualized: schedule pressures are likely to lead to demands for early delivery of new capability without the agreed level of warranty , leading to tensions when the service falls below the agreed quality .

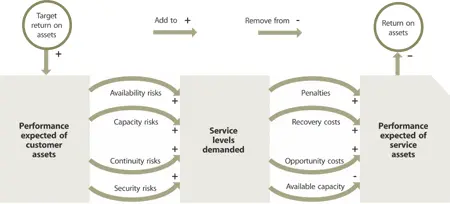

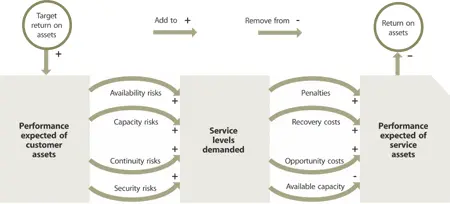

Value to customers is realized in the Service Operation phase of the lifecycle when actual demand for services arrives. Warranty commitments require every unit of demand to be met with a unit of capacity that is available, secure and continuous within a frame of reference. There are four types of warranty risks each covering an aspect of warranty (Figure 9.8).

Figure 9.8 Warranty commitments are a source of risk

The Contract Portfolio is the basis for analysing short-term and long-term trends in demand from various sources. Each contract is a source of one or more streams of demand, each with its own short-term variability. Address short-term shifts in demand reallocation of resources without significant investments in new capacity. This is to avoid the risk of under-utilized assets during periods of low demand. If the trend continues, plan ahead of investments in additional capacity. Address long-term shifts with not only new capacity but also review the Service Catalogue to identify opportunities for resource sharing and consolidation. This requires engagement of not just Service Transition but also Service Design .

When shifts in average demand are long-term or permanent shifts, the solution is often to increase source capacities (an expensive option). If the increase in demand is not long-term or not sufficiently large, then increasing capacity may result in under-utilization of assets in periods when demand is low. An option is to have ‘multi-skilled’ assets capable of serving more than one type of demand. Variability in capacity due to failure s, outages, absenteeism, or any other forms of disruption can also be handled this way.

When demand fluctuations are short and intermittent, adjusting the capacity of certain types of resources may be difficult or not possible due to various constraints. Analyse the characteristics of various types of capacity to understand the constraints:

Asset specificity. The more specialized capacity is for a service, the lower its usefulness may become for other services unless the two share a significantly high number of characteristics. A point-of-sale terminal has higher asset specificity than a PC workstation or storage device that can be repurposed. Asset specificity applies to People assets as well to a certain degree depending on the type of knowledge, experience and skills. Multi-skilled cross-trained staff with general management and administrative skills can be deployed on several tasks.

Scalability . It is possible to adjust or reallocate the capacity of certain resources such as storage and network bandwidth. Other types of capacity such as facilities, hardware and headcount have tighter constraints.

Set-up or training costs. It takes time, money and effort to set up and bring to productive state or redeploy an asset for a new task, purpose, or service. Set costs include adjustments, calibration and testing for the asset to perform better in the new role or context. People assets incur similar costs in terms of transition between assignments, new training and supervisory load.

Читать дальше