3.1.3 Framing the value of services

There is scepticism about the value realized from services when there is uncertainty in the service output. It is not good for the customer that there is certainty in costs and uncertainty in utility from one unit of output to another. When the utility of a service is not backed up by warranty, customers worry about possible losses due to poor service quality more than the possible gains from receiving the promised utility. To allay such concerns and influence customer perceptions of possible gains and losses, it is important that the value of a service is fully described in terms of utility and warranty.

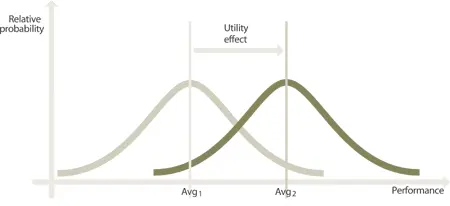

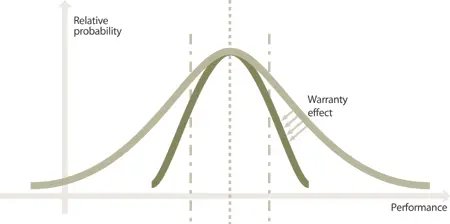

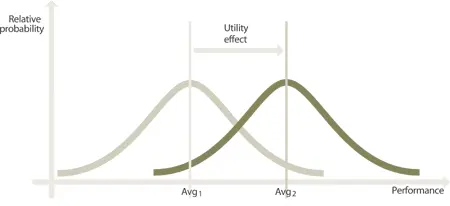

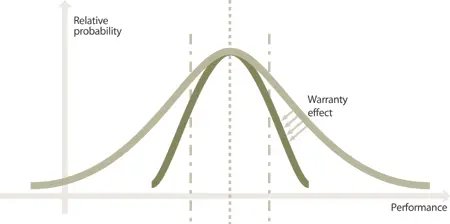

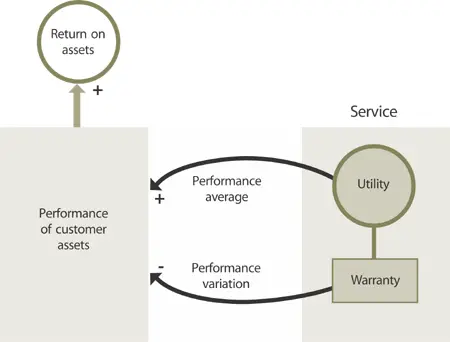

The utility effect of a service is explained as the increase in possible gains from the performance of customer asset s, leading to an increase in the probability of achieving outcomes (Figure 3.3). Warranty of services is explained as the decrease in possible losses for the customer from variation in performance (Figure 3.4). Customer s feel more certain that every unit of demand for service will be fulfilled with the same level of utility with little variation.

Figure 3.3 Utility increases the performance average

Figure 3.4 Warranty reduces the performance variation

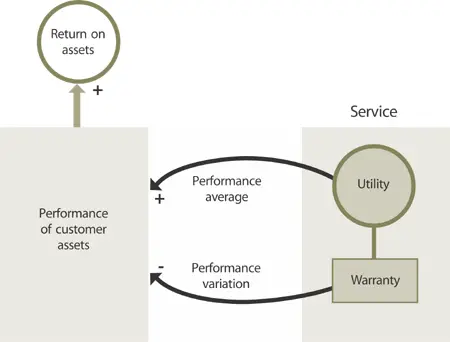

This approach can change customer perceptions of uncertainty in the promised benefits of a service. Customers expect to see a strong link between the utilization of a service and the positive effect on the performance of their own asset s, leading to higher return on assets (Figure 3.5).

Figure 3.5 Value of a service in terms of return on assets for the customer

A mere graphic is, however, not sufficient to convince customers. They must be assured of the actual mental mapping made by groups engaged in different parts of the Service Lifecycle . Customer s may also expect evidence that policies, procedure s, and guideline s are in place to uncover all costs and risk s associated with service delivery and support. In the absence of such institutionalized practice , the promise of a service can just as easily turn to peril during the course of carrying out the terms of the contract or service agreement .

3.1.4 Communicating utility

3.1.4.1 In terms of outcomes supported

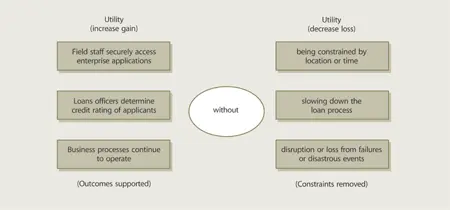

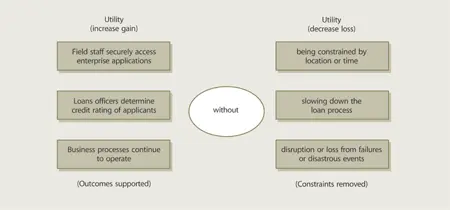

Take the example of a bank that earns profit from lending money to credit-worthy customers who pay fees and interest on loans. The bank would like to disburse as many good loans as possible within a time period (desired outcome ). The bank has a lending process that includes the activity of determining the credit rating of loan applicants. The bank uses a commercial credit reporting service, which is available over the phone and internet. The service provider undertakes to supply accurate, comprehensive, and current information on loan applicants in under a minute. The lending process is the consumer of the credit report, the loan officer being the user . The utility of a credit reporting service is from the high quality of information it provides to the lending process ( customer asset) to determine the credit-worthiness of borrowers, so that loan applications may be approved in a timely manner after calculating all the risks for the applicant (Figure 3.6). By reducing the time it takes to obtain good quality of information, the bank is able to have a high-performance asset in the lending process.

Figure 3.6 Utility framed in terms of outcomes supported and constraints removed

3.1.4.2 In terms of ownership costs and risks avoided

Value of the credit-reporting service also comes from the lending division being able to avoid certain costs and risks it would incur from operating a credit inquiry system on its own instead of using the reporting service. For example, the costs of maintaining capabilities and resource s required to operate a credit reporting system would be borne entirely by the lending division. The cost per credit report would become prohibitive within the scope of the loan approval process, and would have to be passed on to the cost of the loan or be absorbed elsewhere within the banking system. Under prevailing conditions, buying the service turns out to be a good decision for the bank. It increases gains and reduces losses.

An alternative strategy is for the lending division to convince other divisions within the same bank, financial services group, or industry to use its credit reporting system. This may be a viable option in which the lending division would now offer a credit reporting service to lenders along with its core service to borrowers. This is a strategic choice that has to be made by the senior managers of the lending division and their leadership at the bank. The risks of such a choice include the lending division straying from its core capabilities, inability to convince others of its competence, and attracting too little demand to make the credit reporting service economically viable.

By using a credit reporting service rather than operating a credit reporting system , the lending division is deliberately avoiding specific risks and costs. In effect, the lending division frees itself from certain business constraints. Sets of constraints are often traded for others provided the overall performance of the business is not lessened. Such trade-offs are made by the senior leadership of customers who are in the best position to decide. The senior leadership of service provider s become business partners when they are able to support their counterparts in managing constraints on business strategies.

From the business perspective in the example above, service providers support the business strategies of their customers by removing or relaxing certain types of constraints on business model s and strategies. The constraints are of the type that imposes specific costs and risk s that customers wish to avoid, as follows:

Maintaining non-core and under-utilized asset s: customers would like to avoid ownership and control of assets which drain financial resource s from core assets, and those used rarely or sporadically. In such cases the return on assets is typically low or uncertain, making the investments risky.

Opportunity cost s due to limited capacity and overloaded assets: assets that are overloaded are unable to serve additional units of demand or accommodate unexpected surges in demand. Insufficient capacity also means that new opportunities cannot be pursued with high probability of success.

3.1.5 Communicating warranty

Warranty ensures the utility of the service is available as needed with sufficient capacity, continuity and security. Customer s cannot realize the promised value of a service that is fit for purpose when it is not fit for use.

Читать дальше