• Light bulbs. Always a valuable commodity. I bought a whole shopping cart full, mostly to go into trade goods.

• Freezer wrap paper. I bought two extra rolls as well as five extra rolls of tape.

• Sugar. We are pretty well stocked ahead, but it’s currently very inexpensive, so an extra 25 pounds went in the trade goods.

• Frozen pizza. Probably would be valuable trade goods, but after thinking a bit, I decided I didn’t want to fool with it. Nothing extra purchased.

• Box of wire—one for me and one for storage.

• Ballpoint pens. Always a use for these. One dozen to the office, one dozen to the shelf.

• Tomato and cream of mushroom soup. I bought a case of each to rotate the older cases out of storage and into the pantry for current use. Some of these have been on the shelf for almost 6 years now.

• Gallon can of olive oil. We didn’t have this in storage. One gallon for use and one for the shelf.

• Canned capers—we enjoy these a lot but in an emergency we can do without. Nothing more purchased.

• Fifty pounds of 16-penny nails. Disaster averted, as I just used the last of my previous supply. Now we are back up to 50 pounds again plus 50 on the storage shelf that are only touched in an emergency This reminded me to check other nails and screws. I also bought a gross box of 2-inch #8 wood screws and 50 pounds of 6-penny nails.

• Toilet paper. I don’t know how much of this we have in storage, surely quite a lot. This is always an item that will be in demand. I bought three additional 24-roll packages.

There were several other items that I considered, but they have already been forgotten. Not even the brightest man in the world could list everything without leaving holes. But, no doubt, readers get the idea.

Paying for all these goods is always a limiting factor. That’s why purchasing a little at a time each week has so much charm. Perhaps looking at all this as an investment that will eventually pay great dividends will help. Also, expenses cycle a bit. After being in the program for a time, weeks will go by when nothing extra is purchased.

Other months there will be expensive batteries, fuel, gloves, jackets, flashlights, buckets of soap, tarps, rope, and a million other items.

It all depends on your level of commitment and dedication, and your personal will to survive.

Chapter 10

Trading

Trading is a significant component of city survival. The past 100 years’ experience demonstrates that those who understand and prepare for the process do well. Others don’t.

Our understanding of how we might use trading to survive in the city has changed dramatically. Survivors must be extremely practical people. They absolutely must engage in activities that work, even if it means breaking moral or religious codes. A Moslem who wants to survive, for example, would have to ignore his religion’s taboos about pork if that were the only food around. How do we know what actually works? Again, by looking around us at actual city survival situations.

Some of the devices to follow will upset some city survivors. This is because these devices do not fit into their preconceived notion of how they fervently wish events would unfold. Let the record note that I wish that our government would collapse and that we could start anew with one based on freedom rather than legal plunder. But looking out over the various countries in the world, there is little cause for hope. We just don’t see this happening.

Electing to vigorously pursue some trading strategies will be tough because we really don’t want them to work. The use of U.S. dollars as a medium of exchange is an excellent example.

Paper currency marked from one million to 20 million German marks, flanked by a U.S. $100 bill, which is currently the world standard. Worthless Cuban and Zairean currency notes are seen on the right.

Only a government can take perfectly good paper, cover it with perfectly good ink, and create perfectly worthless money. There’s no argument that our money has been mercilessly debased and devalued over the past few decades.

It has already been established that those with their financial houses in good order will have the best chance of surviving. Great numbers of examples out of history prove this point. Cubans with money for boats and fuel were able to make it to Mexico, the United States, and Spain early on. Chinese with money are currently emigrating to Canada. Rhodesians with cash are now sprinkled all around the world. They didn’t all make it, but only Jews with lots of cash had a chance of getting out of Nazi Europe. Later they had the only real chance of getting to Palestine, before it became Israel. I have even encountered an extremely wealthy, former high ranking Nazi living in the United States who used his considerable money to buy connections that eventually got him and much of his loot out of post-World War II Europe.

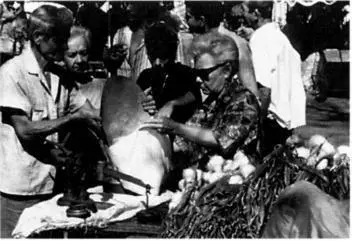

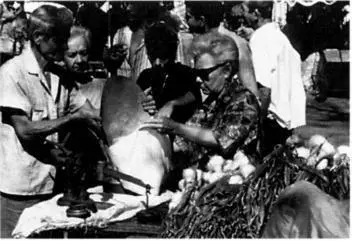

At this outdoor market in Cuba prices are publicly posted in Cuban pesos, but privately everything is transformed into dollars.

As much as I hate to admit it, the medium of exchange for the foreseeable future appears to be U.S. dollars. This, I realize, is something of a reversal of my past position. But if the late 20th century has taught us anything, it is that politicians hold on and on. Mexicans, Russians, Poles, South Africans, Kenyans, and just about everybody collects dollars. Not euros, not Swiss francs, not German marks, not Hong Kong dollars, and certainly not Chinese renminbi or Japanese yen. The yen was once considered one of the strongest currencies, but 8 years of grinding recession finally wore it down.

I will gladly change my position on U.S. dollars when I see something coming that will also grind them down. Then I can trade my dollars for hard goods and consumables that always have value.

In times past, U.S. dollars, British pounds, German marks, and Swiss francs were equally prized by traders throughout the world. No longer. Everything is U.S. dollars—even in agricultural villages in remote Mexico, prices are quoted in dollars.

It’s kind of like being the chief leper in a leper colony. Because national finances are run so very poorly in most other countries, our own post-freedom economy stands out as being strongest.

New Zealand may be the only exception! Although New Zealand is headed in the correct direction economically and politically with increased emphasis on freedom it currently is experiencing a severe recession. This isn’t of their own doing. Traditionally New Zealand exported raw materials to Asia while importing many manufactured goods. The collapse of Asian markets and 2 years of El Nino-induced agricultural failure has taken its toll.

At any rate, New Zealand’s economy is and always will be too small to be much of a player in world markets. This also may be what happened to little Switzerland—it is a good economy but it’s too small to be influential.

America’s economy is so very large that it will dominate for the foreseeable future. Here is another example. While living in rural Africa, I frequently came across original Maria Theresa thalers being used in trade. This was 70 years after the collapse of the Austrio-Hungarian Empire. Certainly things move much faster these days, but even if the United States does somehow manage to collapse, it may still take years before people realize that its dollars are worthless.

Читать дальше