Array Fortune - Derivatives - The Risk That Still Won’t Go Away

Здесь есть возможность читать онлайн «Array Fortune - Derivatives - The Risk That Still Won’t Go Away» весь текст электронной книги совершенно бесплатно (целиком полную версию без сокращений). В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: economics, personal_finance, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Derivatives: The Risk That Still Won’t Go Away

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:5 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 100

- 1

- 2

- 3

- 4

- 5

Derivatives: The Risk That Still Won’t Go Away: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Derivatives: The Risk That Still Won’t Go Away»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Derivatives: The Risk That Still Won’t Go Away — читать онлайн бесплатно полную книгу (весь текст) целиком

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Derivatives: The Risk That Still Won’t Go Away», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Derivatives: The Risk That Still Won’t Go Away

By Carol J. Loomis

Washington wants to step up regulation of these complex instruments, hut new rules may not be enough to tame them.

Since it is chillingly clear that U.S. financial institutions have for a good while been regulated no more stringently than, say, demolition derby drivers, Washington has belatedly locked the garage door and begun to debate strict new rules. The blueprint at hand is President Obama’s sweeping proposal in mid-June to revamp the responsibilities of government agencies and impose new regulations on the financial establishment. Nothing about this plan will fall easily into place: Too many government agencies will dig in their heels. Too many financial companies will battle every aspect of reform that threatens their bottom lines.

Inevitably the center of controversy is going to be the complex instruments called over-the-counter derivatives. These are contractual arrangements between two parties—at least one of which is likely to be a giant financial institution that transfer risk. They typically have notional values (par values, essentially) in the millions of dollars, are often long in duration, and go by such names as swaps, forwards, and options. And they are, not incidentally, a source of lush profits for banks.

Perhaps for that reason, it is the amazing contention of some in the financial world that derivatives sailed quite smoothly through the financial crisis. One banker said recently that the derivatives problem at AIG was mainly that management wasn’t paying attention.

This article will present a different view. We’ll start with reminders of how derivatives contributed to the collapse of Bear Stearns and AIG, in the process delivering a large, and detested, bill to the U.S. taxpayer. We’ll also go behind the scenes of the bankrupt Lehman Brothers, whose 900,000 derivatives contracts are proving once again that the sheer complexity of these instruments is itself an enormous problem. So is regulating them, which does not mean we shouldn’t be trying.

A basic reason for favoring regulation is that derivatives create a kind of mirage. They don’t extinguish risk, they simply transfer it to a different party—a counterparty, as the term goes. The ultimate outcome is millions of contracts and an endless, virtually unmapped, web of connections among financial institutions. That maze exists today, and so does the systemic threat it raises: that some major counterparty will go bust and drag down other institutions to which it is linked.

We came perilously close to such a chain reaction in the past 18 months, as both the economy and the financial system buckled in distress. Derivatives cannot be called the central villain in this drama. That dishonor belongs to some combination of bad management and a real estate world gone crazy. But derivatives elevated the stakes, as they seem constantly to do. Today, as the financial system goes about digging itself out of the muck of trouble, no one imagines that the risks of derivatives have diminished. That’s what the regulatory clamor is all about.

We did not get to this juncture without red flags flying. In a 1994 cover story by this writer, Fortune called derivatives, then relatively new on the scene, “The Risk That Won’t Go Away” (see fortune.com). Roughly a year later, there was a rash of derivatives problems that punished companies like Procter & Gamble and American Greetings and supported the notion that most nonfinancial CEOs didn’t have a clue about the intricacies of these instruments. That conviction endures today, as one story after another emerges of derivatives bets gone wrong: Harvard (at the behest of its then-president, Lawrence Summers) entrapping itself in an interest-rate swap that drained its cash; Alabama’s Jefferson County entering into swaps that have helped push it toward bankruptcy (see “Birmingham on the Brink” on fortune.com). In 1998 derivatives even helped usher the managing savants and Nobel Prize principals of Long-Term Capital into disaster.

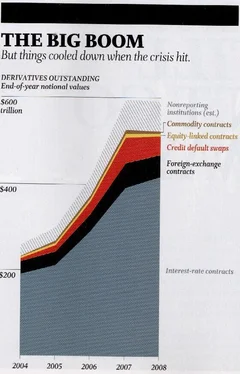

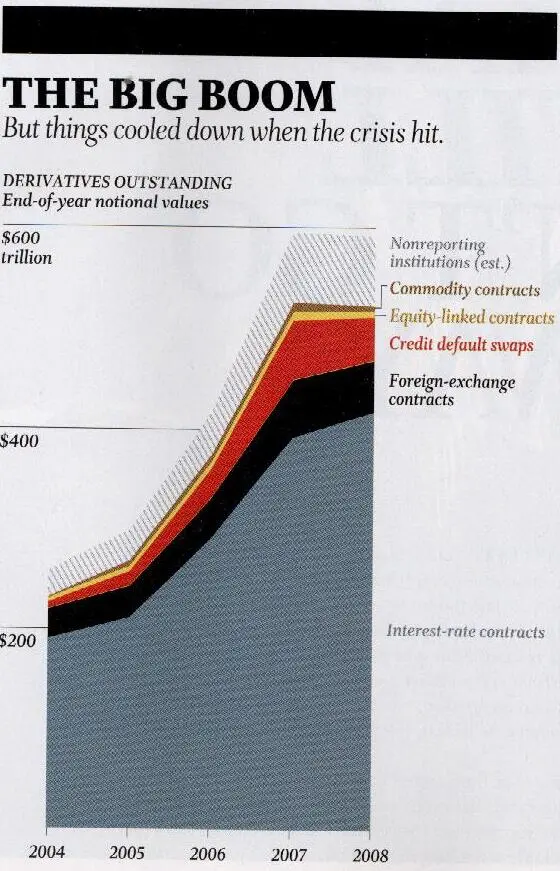

Not too long after that, Warren Buffett tagged derivatives with the name that follows them everywhere, “financial weapons of mass destruction.” But if this description was to enter the lexicon of finance, it was not to stop derivatives’ spread. Between 2000 and mid-2008 (the peak so far), the worldwide notional value of derivatives went from $95 trillion to $684 trillion, an annual growth rate of 30%. A new form of derivatives, credit default swaps, a sort of rich chocolate to the plain vanilla of interest-rate swaps, became the rage during this period. Initially these CDS allowed institutions to insure the creditworthiness of bonds they held, and next permitted speculators—controversially, to say the least—to pressure the prices of bonds and other fixed-income securities.

The CDS growth was marked by a back-office breakdown: Unsigned confirmations proliferated and general confusion reigned over who owed what or even how many CDS had been written. Timothy Geithner, then president of the New York Federal Reserve, and one of his predecessors, Gerald Corrigan, attacked this disorder in 2005, leading a drive that has greatly improved the infrastructure of CDS the plumbing, so to speak, that connects one derivatives party with another. Corrigan, a top Goldman Sachs executive since he left the Fed, is proud of the progress that, has been made, advances that have been compared by others to taming the Wild West. Without these process improvements, Corrigan recently told Fortune , what happened over the past couple of years could have been “much worse.”

That’s a head-snapper for sure, considering that despite this progress we suffered a disaster so cosmic that it crushed the economy and brought down an appalling collection of famed U.S. financial companies. Consider the main wreckage of 2008: Bear Stearns, bought by J.P. Morgan Chase; Fannie Mae and Freddie Mac, taken over by the U.S., the parent that didn’t want them; Merrill Lynch, bought by Bank of America; Lehman, gone bankrupt; AIG, rescued by the U.S.; Wachovia, bought by Wells Fargo.

It was the earliest casualty of these, Bear, that brought a new concept—“too interconnected to fail”—to the forefront. Going in, the government really did not want to save the company. Robert Steel, a ranking member of Henry “Hank” Paulson’s U.S. Treasury team, remembers the case against a rescue: “Gee whiz, this isn’t a depository institution. It should just go out of business.” Nor was it that Bear was a colossus in derivatives: Its book at the end of the company’s 2007 fiscal year (its last) had a notional value of “only” $13.4 trillion, compared to $85 trillion for the giant among U.S. derivatives dealers, J.P. Morgan. Bill Winters, co-head of investment banking at J.P. Morgan, says that in Bear’s last week—as the firm teetered between bankruptcy and being bought by his company—he even worried less about derivatives than he did about the many billions that the firm borrowed every day on its assets in the overnight loan market. If Bear went bankrupt, Winters could imagine all those assets being calamitously dumped on the market.

Bankruptcy, of course, didn’t happen. On Sunday, March 16, 2008, J.P. Morgan agreed to buy Bear in a government-brokered deal to which the feds contributed guarantees of $30 billion (later reduced by $1 billion). And two weeks later Geithner appeared at a Senate hearing to explain this huge intervention (well, it seemed huge at the time). He didn’t talk about the overnight loan market. He stressed instead that bankruptcy for Bear could have led to the “sudden discovery” by its derivatives counterparties that hedges they had put in place to protect themselves were wiped out. The prospect, he said, would then be a “rush” by Bear’s counterparties to liquidate collateral and replicate their hedges in already fragile markets. Derivatives, in other words, had changed Bear from a broker-dealer that could have been simply the latest name on a Wall Street tombstone to an entity that the government needed to save because it was too interconnected to fail.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Derivatives: The Risk That Still Won’t Go Away»

Представляем Вашему вниманию похожие книги на «Derivatives: The Risk That Still Won’t Go Away» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Derivatives: The Risk That Still Won’t Go Away» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.