Array Fortune - Derivatives - The Risk That Still Won’t Go Away

Здесь есть возможность читать онлайн «Array Fortune - Derivatives - The Risk That Still Won’t Go Away» весь текст электронной книги совершенно бесплатно (целиком полную версию без сокращений). В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: economics, personal_finance, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Derivatives: The Risk That Still Won’t Go Away

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:5 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 100

- 1

- 2

- 3

- 4

- 5

Derivatives: The Risk That Still Won’t Go Away: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Derivatives: The Risk That Still Won’t Go Away»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Derivatives: The Risk That Still Won’t Go Away — читать онлайн бесплатно полную книгу (весь текст) целиком

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Derivatives: The Risk That Still Won’t Go Away», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

That dread epithet could be applied in spades to AIG. On Sept. 16, precisely six months after Bear’s rescue, AIG’s board called in lawyers and prepared to file for bankruptcy. But, as the whole world knows, the government stepped in to save the company, eventually committing $180 billion to keeping it solvent.

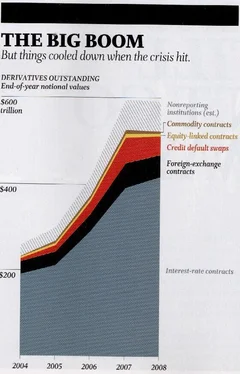

AIG’s particular burden was $80 billion of credit default swaps it had sold that exposed it to subprime mortgages (see “AIG: The Company That Came to Dinner” on fortune.com). When real estate caved, AIG’s financial products operation (FP) received calls for collateral from its CDS counterparties and at first complied. But the next round of calls exhausted AIG’s resources, and bankruptcy loomed. The feds essentially decided at this point that it was better to save AIG than to risk a domino effect among its counterparties, which were about two dozen prominent financial institutions in North America and Europe. The government’s decision quickly got the prize for most-hated-by-the-aver-age-citizen. Moreover, FP is still stuck with about $1.5 trillion in derivatives contracts (more than half of what it originally had) and is looking at large costs of exit. At a Senate hearing in May, Treasury Secretary Geithner described a pressing need for AIG to avoid defaults that might even at this date bring it down: “I do not believe,” Geithner said intensely, “that the system today can withstand the effects of a failure of this institution to meet its obligations.”

Derivatives certainly did not cause the earthshaking failure of Lehman on Sept. 15 last year. The blame can be laid first on out-of-control leverage and bad investments in commercial real estate, and second on the U.S. government’s decision not to save the company. But the Lehman saga illustrates another toxic aspect of derivatives: They are often a mess to value. That can lead, intentionally or not, to misreported profits and assets. It turns out that the files of this biggest-ever bankruptcy prove the accounting complexity in quite bizarre ways.

Basic facts first: Lehman had a derivatives book of only $730 billion as it neared bankruptcy. Even so, when Lehman’s U.S. entities filed for Chapter 11 in September, this not so-big figure translated into about 900,000 derivatives contracts. The great bulk of them have been “terminated” by derivatives counterparties which under industry protocols had the right to immediately “net” their accounts with Lehman in the event it declared bankruptcy. A handful the last reported number was 18,000—are still open.

Each of these contracts has a “fair value”—an amount that one-side owes the other. Lehman, in fact, has a lot of open contracts that have been going its way. In a droll sign of how derivatives have come to be viewed as indispensable, Lehman has received permission from the court to buy them to hedge some of its open contracts, so that it can lock in the profits it has made since filing for bankruptcy.

Move now to the accounting problem. While sometimes the fair value of a derivative can be precisely determined, at other times it must be derived from murky markets and models that leave considerable room for interpretation. That gives the holders of derivatives a lot of bookkeeping discretion, which is troubling because changes in fair value flow through earnings—every day, every quarter, every year—and alter the carrying amounts of receivables and payables on the balance sheet.

The subjectivity involved in derivatives accounting also means that the counterparties in a contract may come up with very different values for it. Indeed, you will be forgiven if you immediately suspect that each party to a derivatives contract could simultaneously claim a gain on it which should be a mathematical impossibility. In fact, we have a weird tale, gleaned from court documents, supporting that suspicion. It involves Lehman, Bank of America, and J.P. Morgan, and suggests how far some of those “terminated” contracts are from being truly settled.

When Lehman failed, one of its subsidiaries was holding (sort of, which is a point we’ll get back to) $357 million of BofA collateral—an amount that was roughly related to the fair value of Lehman’s derivatives contracts with the banking giant. Presumably BofA had delivered the collateral because it thought Lehman had a legitimate claim to it.

But within two weeks of the bankruptcy filing, BofA sued Lehman to recover the $357 million, saying that Lehman in fact owed derivatives payments to BofA. Ultimately BofA placed the amount it was owed at $1.95 billion! In other words, by BofA’s thinking, Lehman didn’t have a plus of $357 million, but rather a minus of $1.95 billion. Trying to capture some of that money, BofA had by that time seized $500 million belonging to Lehman—described by Lehman as an overdraft account—held in a BofA Cayman Islands branch. Leave aside the point that anything about banking in the Caymans raises eyebrows, and behold that rich overdraft account, whose size suggests that Lehman may have been the Imelda Marcos of investment banks.

As of now, there has been no court finding as to the accuracy of BofA’s $1.95 billion or whether the seizure of the $500 million was lawful. Meanwhile, BofA is still trying to recover its $357 million of collateral. But it turns out that before the bankruptcy filing, Lehman had deposited this collateral with its clearing bank, J. P. Morgan, which upon the bankruptcy seized it to cover derivatives debts that Lehman supposedly owes Morgan. So, to sum up, Morgan has captured $357 million of either BofA’s or Lehman’s assets—we don’t know which—to offset what Lehman supposedly owes Morgan on derivatives, though Morgan has never told the court what that amount is.

We may put down some of these absurdities to lawyers pushing their claims. But to avoid the kind of morass this tale describes, a working group co-headed by Jerry Corrigan has recommended that the counterparties in a trade periodically discuss and agree on its value. One intermediary helping that happen is a Swedish company called TriOptima, which offers a service called TriResolve. Raf Pritchard, head of TriOptima’s U.S. operations, says his reconciliation service is booming, embraced by derivatives folk who, for example, truly wish to know what amounts of collateral should be changing hands. It sounds as if some of the Lehman litigants could benefit from the service.

Considering the unending complications of derivatives, wouldn’t we be better off without them? Robert Pickel, CEO of the International Swaps and Derivatives Association, acknowledges that the opposition includes “a camp that would ban them all—like Charlie Munger would” (referring to the vice chairman of Berkshire Hathaway). But the very suggestion of a ban causes most of those with even remote connections to the derivatives business to stiffen; turn from friendly to antagonistic; question the sanity of the fool who asked; and recite the creed of financial derivatives, which is that they beneficially spread risk. Never mind that we have spent several pages casting doubt on the idea that, the wholesale spreading of risk is a virtue. In the mind of all who have dealt with derivatives, and typically made their living off them, it is.

Pickel does not include Munger’s colleague, Warren Buffett, among those who would ban derivatives, because it is a celebrated fact in the financial world that the man who sparked 1,370,000 Google citations for “financial weapons of mass destruction” has bought a good many of them for Berkshire Hathaway. Explaining, Buffett points out that as far back as 1998 he had told shareholders about derivatives Berkshire owned, and that he never said he wouldn’t again exploit a mispricing when he saw one in a derivative. (It is the opinion of this writer, a friend of both Buffett’s and Munger’s, that Buffett is incapable of ignoring mispricings, wherever in the financial markets they may exist.)

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Derivatives: The Risk That Still Won’t Go Away»

Представляем Вашему вниманию похожие книги на «Derivatives: The Risk That Still Won’t Go Away» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Derivatives: The Risk That Still Won’t Go Away» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.