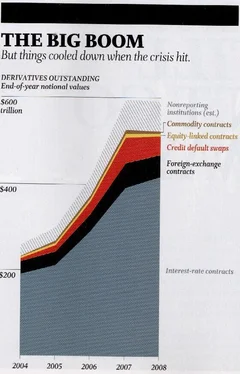

Array Fortune - Derivatives - The Risk That Still Won’t Go Away

Здесь есть возможность читать онлайн «Array Fortune - Derivatives - The Risk That Still Won’t Go Away» весь текст электронной книги совершенно бесплатно (целиком полную версию без сокращений). В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: economics, personal_finance, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Derivatives: The Risk That Still Won’t Go Away

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:5 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 100

- 1

- 2

- 3

- 4

- 5

Derivatives: The Risk That Still Won’t Go Away: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Derivatives: The Risk That Still Won’t Go Away»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Derivatives: The Risk That Still Won’t Go Away — читать онлайн бесплатно полную книгу (весь текст) целиком

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Derivatives: The Risk That Still Won’t Go Away», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Congress, which has never shown talent for putting genies back into bottles—think of earmarks—once again has derivatives on the agenda. The last time Washington considered regulating them, in the late 1990s, things didn’t go too well. The champion of change then was the chairman of the Commodity Futures Trading Commission, Brooksley Born, who was determined to bring these exotic, unregulated instruments under the purview of her agency, which already oversaw futures trading—of puts and calls, for example. Still living in the Washington area today, she recently told the Washington Post that dire premonitions about derivatives back then caused her to wake repeatedly in a “cold sweat.”

It couldn’t have helped that in daylight she faced three men who were implacably opposed to regulation: Fed chairman Alan Greenspan, Secretary of the Treasury Lawrence Summers, and Senator Phil Gramm (R-Texas). Not only did Born lose the battle, but Gramm pushed through legislation that specifically barred federal regulation of OTC derivatives.

Greenspan has since said he’s sorry he opposed regulation of derivatives; Summers, now economic adviser to the President, has signaled his recantation by joining Geithner in calling for strong regulation; Gramm, no longer in the Senate, would not comment to Fortune . The ranks of the converted, however, have been swelled by no less than former President Bill Clinton, who recently told New York Times writer Matt Bai that he was wrong in listening to Greenspan about derivatives and wishes he had demanded that they be regulated by the Securities and Exchange Commission.

Today, the chances for regulatory reform are improved because the administration has made it a top priority, and two powerful legislators, Congressman Barney Frank (D-Mass.) of the House financial services committee, and Chris Dodd (D-Conn.) of the Senate banking committee, have signed on. The administration’s plan calls for new regulation of “systemic risk” and envisions the Fed shouldering most of the job. In that role, the Fed would have czarlike authority to move in on trouble spots wherever they flared up, including derivatives sites—like an AIG—that aren’t part of the banking system.

While believing the Fed the best candidate for this role (best athlete, as headhunters say), Bob Steel, the former Treasury official, calls the regulation of systemic risk a “next to impossible job.” Essentially, it requires someone to be risk manager for the entire United States (and also be cleverly attuned to world risks, of course), when individual companies have shown repeatedly that they are incapable of managing the risk right under their noses. Suffice it to say that AIG believed for years, until the roof fell in, that those CDS it wrote were money-good.

A Treasury colleague of Steel’s, David Nason, now a managing director of Washington’s Promontory Financial Group, joins him in believing that the challenge awaiting a systemic regulator will be extraordinary. But Nason says there is no question where this regulatory eye in the sky will fasten its attention: on all the interconnections between institutions. And here, he says, derivatives—“highly complicated, specialized, using their own language”—are ground zero.

That means there must be new regulations for OTC derivatives. Naturally the dealer community will resist, since it believes that operating out of direct sight—in the Dark Market, as Born called it—is best for profits. But since the dealers judge some degree of regulation inevitable, their strategy is to hold it to a minimum.

That leaves them not raising Cain about today’s conventional wisdom, which is that “standardized” contracts—for example, five-year, $10 million CDS on a well-known company—must be moved into a clearinghouse. This organization would, first, set capital and margin requirements for its members. Second, it would become the creditworthy counterparty for both the buyer and the seller in every contract submitted for clearing.

But clearinghouses have their own drawbacks. Were there a financial megashock, for instance, some clearinghouse members could be weakened to the point of defaulting on their contracts with the clearinghouse, whose reverses would in turn threaten the stability of other members. Former regulator Corrigan is one expert respecting this risk: He says that if a clearinghouse is to be a financial Gibraltar, it needs sufficient resources to withstand a simultaneous default by two of its biggest members! That would equate to, say, J.P. Morgan Chase and Bank of America going bust. The mind reels at the thought.

The big derivatives dealers, in any case, do not expect to find much use for clearinghouses. They will be asserting in any debate that there are just about enough standardized contracts to fill a thimble and that the big sewing-box of derivatives mainly produces customized—or “bespoke”—contracts that couldn’t possibly be handled by a clearinghouse. In response, the administration is calling for all customized derivatives to be reported to a central repository and for the systemic regulator to have the authority to peer deeply into the derivatives book of any individual company.

We are probably a long way from having these rules, or reasonable facsimiles, on the books, and some people question whether they would make much difference anyway. “It doesn’t matter what they do in Washington,” said a New York derivatives trader recently, showing Wall Street’s all too common contempt for policymakers. “The smart guys who come out of business school don’t take regulatory jobs there. The smart guys go to places where there are chances to do well. And if there are new rules, the smart guys will just deal with them and move ahead.”

Unfortunately, he may be right. That’s the trouble with genies out of the bottle: They gain a life of their own. Many people, of course, argue that the U.S. lurches into financial crises every so often, and that it is specious to think of derivatives as adding some whole new dimension to the problem. But in fact they did. The financial world lost an anchor when derivatives installed the idea that risk could be shed as easily as it was assumed. We drifted then into an interconnected world of new dangers not easily comprehended or controlled. Fifteen years after Fortune first used the description, derivatives look even more like the risk that won’t go away.

Интервал:

Закладка:

Похожие книги на «Derivatives: The Risk That Still Won’t Go Away»

Представляем Вашему вниманию похожие книги на «Derivatives: The Risk That Still Won’t Go Away» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Derivatives: The Risk That Still Won’t Go Away» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.