Dr. Pass - Economics

Здесь есть возможность читать онлайн «Dr. Pass - Economics» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Economics

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 80

- 1

- 2

- 3

- 4

- 5

Economics: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Economics»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Economics — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Economics», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

asset specificitythe extent to which a TRANSACTION or CONTRACT needs to be supported by transaction-specific assets. Where a contract involves the need to create transaction-specific assets, this creates a fundamental transformation in the nature of the relationship between the parties to the transaction. Before investing in specific assets, the investing partner is likely to have many alternative trading partners, which allows for bidding competition. However, after the investment creates transaction-specific assets these become SUNK COSTS with no alternative use and the parties to the transaction then have no alternative trading partners. The terms of the transaction are then determined by bilateral bargaining between the parties to the transaction.

Bargaining between the parties can lead to opportunistic behaviour where one party in a contractual relationship seeks to exploit the other’s vulnerability. For example, a seller might attempt to exploit a buyer who is dependent on the seller by claiming that the production costs have risen and pressing for an upward adjustment of the negotiated price. Such opportunistic behaviour seeks to exploit or ‘hold up’ one party to the transaction to benefit the other party

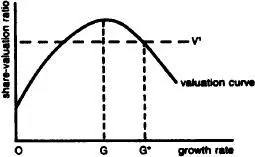

Fig. 9 Asset-growth maximization.The variation of share valuation ratio against the company growth rate.

For transactions with high asset specificity, the costs of MARKET transactions are high and such transactions are likely to be ‘internalized’ and conducted within organizations, for example a VERTICALLY INTEGRATED firm. See INTERNALIZATION.

asset-strippera predator firm that takes control of another firm (see TAKEOVER) with a view to selling off that firm’s ASSETS, wholly or in part, for financial gain rather than continuing the firm as an ongoing business.

The classical recipe for asset-stripping arises when the realizable market value of the firm’s assets are much greater than what it would cost the predator to buy the firm; i.e. where there is a marked discrepancy between the asset-backing per share of the target firm and the price per share required to take the firm over. This discrepancy usually results from a combination of two factors:

(a) gross under-valuation of the firm’s assets in the BALANCE SHEET;

(b) mismanagement or bad luck, resulting in low profits or losses, both of which serve to depress the firm’s share price.

asset-value theory (of exchange rate determination)an explanation of the volatility of EXCHANGE-RATE movements under a FLOATING EXCHANGE-RATE SYSTEM. Whereas the PURCHASING-POWER PARITY THEORY suggests that SPECULATION is consistent with the achievement of BALANCE-OF-PAYMENTS EQUILIBRIUM, the asset-value theory emphasizes that, in all probability, it will not be. In this theory, the exchange rate is an asset price, the relative price at which the stock of money, bills and bonds and other financial assets of a country will be willingly held by foreign and domestic asset holders. An actual alteration in the exchange rate or a change in expectations about future rates can cause asset holders to alter their portfolios. The resultant change in demand for holdings of foreign currency relative to domestic currency assets can at times produce sharp fluctuations in exchange rates. In particular, uncertainty about future market rates and the unwillingness of banks and other large financial participants in the foreign-exchange markets to take substantial positions in certain currencies, especially SOFT CURRENCIES, may diminish funds for stabilizing speculation that would in turn diminish or avoid erratic exchange-rate movements.

If this should prove the case, then financial asset-switching is likely to reinforce and magnify exchange-rate movements initiated by current account transactions (i.e. changes in imports and exports), and in consequence may produce exchange rates that are inconsistent with effective overall balance-of-payments equilibrium in the longer run.

assisted areaan area of a country designated as qualifying for financial and other assistance under a country’s REGIONAL POLICY in order to promote industrial regeneration. Assisted areas typically suffer from severe unemployment problems resulting from the decline of local firms and industries and are characterized by INCOME PER HEAD (GDP per capita) levels that are substantially below the national average.

In the UK, the main assisted areas are ‘Tier 1’ areas (formerly DEVELOPMENT AREAS) and ‘Tier 2’ areas (formerly INTERMEDIATE AREAS). These arrangements came into force in 2000 as part of a European Union (EU) programme aimed at establishing a comparable regional aid system across all the then 15 EU member states. Under EU policy, the main criteria for designating an assisted area is a GDP per capita that is below 75% of the EU average.

In the case of the UK, the areas proposed by the government, based on electoral voting ‘wards’, are still under review by the European Commission. Proposed Tier 1 areas are Cornwall and the Scilly Isles, Merseyside, South Yorkshire, West Wales and the Valleys, together with the whole of Northern Ireland. Proposed Tier 2 areas, totalling some 1550 smaller localities , are 79 from the east of England region; 133 from the East Midland region; 44 from the London region; 228 from the Northeast region; 144 from the Northwest region; 440 from Scotland; 129 from the Southeast region; 20 from the Southwest region; 51 from Wales; 197 from the West Midlands region and 91 from the Yorkshire and Humber region. Regarding Tier 2 submissions, the European Commission’s preferred policy is to support ‘clusters’ of adjacent localities, providing sufficient ‘critical mass’ for industrial development rather than isolated localities.

In addition, a ‘Tier 3’ of assisted areas has been designated that covers areas of ‘special need’ (for example, coalfields and rural development areas).

The application of the new Tier structures is subject to an overall population ceiling requirement; specifically, for any country the number of persons residing in the assisted areas should not exceed more than 28.7% of the total population of the country. See REGIONAL DEVELOPMENT AGENCY.

associated companya JOINT-STOCK COMPANY in which another company or group has a significant, but not controlling, shareholding (specifically 20% or more of the voting shares but not more than 50%). In such a situation the investing company can exert influence on the commercial and financial policy decisions of the associated company, though in principle the associated company remains independent under its own management, producing its own annual accounts, and is not a subsidiary of the HOLDING COMPANY.

Association of British Insurerssee INSURANCE COMPANY.

Association of Futures Brokers and Dealers (AFBD)see SELF-REGULATORY ORGANIZATION.

Association of Investment Trust Companiessee INVESTMENT TRUST COMPANY.

Association of Southeast Asian Nations (ASEAN)a regional alliance formed in 1967 with the general objective of creating a FREE TRADE AREA. The current member countries of ASEAN are Brunei, Indonesia, Malaysia, Philippines, Singapore and Thailand. However, only limited progress has been made to date towards the reduction of internal tariffs and quotas. See ASIAN PACIFIC ECONOMIC COOPERATION, TRADE INTEGRATION.

assumptionssee ECONOMIC MODEL.

assurancesee INSURANCE.

asymmetry of informationa situation where the parties to a CONTRACT or TRANSACTION have information available but this information is unevenly distributed between the parties. This information could include the identity of alternative suppliers or customers or product quality or performance.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Economics»

Представляем Вашему вниманию похожие книги на «Economics» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Economics» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.