1 ...8 9 10 12 13 14 ...19 – the distributions used are often of a known statistical type. However, as shown, the available data have no statistical significance and must be studied using new approaches (e.g. Levy distribution);

– the magnitude and recombination phenomena related to feedback loops highlight the presence of deterministic chaos as well as large-scale fluctuations that lead to the emergence of order structures;

– depending on the origin of the fluctuations manipulated, different classes of models must be used; what is valid and observed at the living level, or at the material level, what must be taken into account in an industrial system. For example:- the notions of initial quantum fluctuations taken into account at the agent level (such as those found in particle physics) can lead, during a phase of inflation and by propagation to its close neighbors, to the formation of simple and diluted aggregates [MAT 96a]. By placing themselves within an industrial system that is itself an assembly of agents, fluctuations in product flow do not correspond to strong initial disruptions and result in “apparently” random groupings at the end of the line,- typological defects related to phase transitions are due to symmetry breaks between fundamental interactions. However, these phenomena exist in chaotic systems where fluctuations are amplified and/or inhibited by feedback loops in order to generate clusters. This, of course, has a significant effect on product propagation times (product exit horizon) and therefore on the distribution of cycle time or T.A.T. (“Turn Around Time”). Similarly, a local defect will have a direct effect on close neighbors and more widespread effects on a global level due to the more or less strong interactions that may occur at long distances.

Based on these remarks, the following strategies can be formulated.

1.4.2. Interactions in industrial workshops

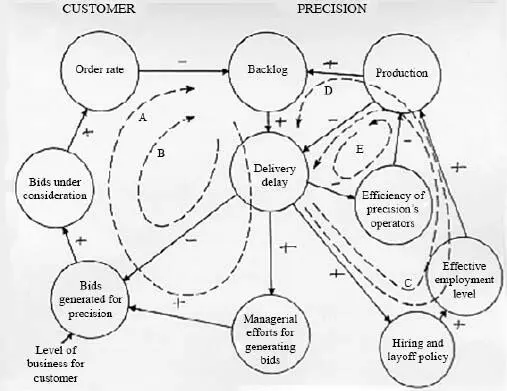

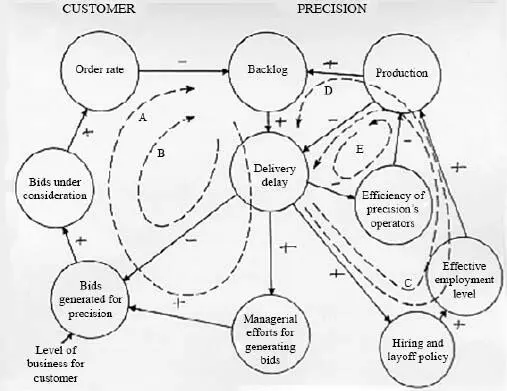

On the functional and logistical level, an industrial system has a network structure, as found in ecosystems or biology, with medium-sized non-hierarchical aggregations. At the information system level, this system contains positive and negative feedback loops: this is the case when several activity centers (workshops) are interconnected to form a complete plant. Such a system, with its interaction and feedback loops, is presented in Figure 1.1.

Figure 1.1 . An industrial MRP system with its feedback loops

More formally, it is a cybernetic system with strong interactions between distributed functions: a given function will influence the activity or “inhibition” of a neighboring function. The problem involves analyzing the overall behavior resulting from such a system; a systems dynamicsapproach is appropriate. We have applied it to study the dynamic influence of interactions between various manufacturing plants of the type: Semiconductor – Electronic boards – Computers.

This set is subject to stepwise requests, at the final product “computers” level. The objective here is to analyze the impact of disruptions (demand level, yield variations, “over-reaction of production agents”) on the evolution of inventories and work in progress upstream, at the card and then semiconductor level. Modeling in the form of differential equations was carried out in a simple way on such systems, and it was possible to easily integrate the parameters and variables (size of buffer stocks, response times, etc.). In this case, it has been shown [MAS 95c] that the variation in component stocks, i.e. upstream, becomes chaotic when the system is subjected to simple control variations. As the capacity of the production system is limited, some products are penalized compared to others. This situation occurs more precisely when the flow of information is amplified and when we try to “recover” the drifts because the production agents tend to anticipate disruptions. On the contrary, in the case where the input variable is chaotic, it has not been possible to demonstrate with certainty that the system was chaotic: because of the buffer stocks (number, size, response time, etc.), the results can be smoothed, attenuated or even amplified. When the size of the buffer stocks is large and the yields are low, it has been found that the system can even diverge: in this case, the noise is amplified and directly influences the evolution of the system. However, this is also not possible due to the lack of sufficient reliable data.

Conventional management systems are essentially “planning”: they are intended to prepare a production system but not to manage it as well as possible. In some cases, they are even useless because they are too restrictive, sometimes unable to control a complete production system. In addition, they are subject to the normal reaction of a planning agent who reacts in the opposite direction to certain trends in an attempt to compensate for variations. In this case, the overly “planning” and “rigid” management system leads to dangerous, unexpected and unpredictable variations, such as changes and jolts that are amplifying disturbances. On another level, conventional production management systems are not designed to handle chaotic programs. In such production systems, reactive management tools can only degrade their overall performance. We therefore deduce that planning management systems, which are so reassuring and very useful in other respects, are costly in terms of procedures (many steering meetings, production readjustments, multiple planning steps, etc.) and are not the best suited to certain types of dynamic behavior.

According to the well-known principles of stability, it is sufficient to introduce compensation loops or decision-making centers whose action will change the direction of variation, positive or negative, of the product or information flow. It is also possible to control unstable systems by injecting “noise” and uncertainty into control parameters as well as stimuli and input variables. This allows the possibility of compensating or even eliminating knocks and counteracting the effects of pumping. For example, it is common for decision-makers to introduce noise: they can constantly modify product priorities in the workshop, depending on changes in the situation and conflicting demands. In fact, the stimuli generated are based on their perception of the problem and tend to create more disruptions and blows.

1.4.3. Product flow in a flexible production system

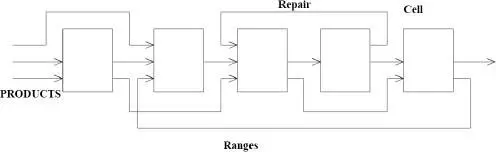

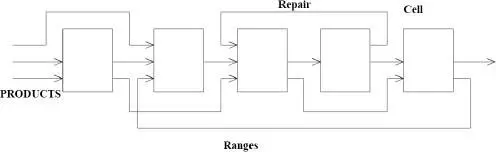

Consider a flexible multi-product and multi-process workshop with duplicated equipment, feedback loops and complicated ranges.

Figure 1.2. A flexible production system

Each node or cell has its own control system and behavioral procedures. We are in a “local” environment with a limited proximity; the production rules used here concern priority management, order sequencing, alarm management (in economy and finance: alert management) in case of problems, etc.

Such a production system has been studied [BAR 96] in terms of the organization to be put in place to compensate for the disruptive effects of chaos (in the sense that they are unpredictable). Here, the chaos is essentially due to interactions between cells: oscillations created by calls, supply orders that propagate from cell to cell, going up the “line” of manufacture. They are also production or launch orders from the production management system, which will spread from one cell to another and vice versa. This will generally be done from downstream to upstream, if we operate in a pull flow. When these orders respond to nonlinear functions or influences and the phenomena are amplified, making the system sensitive to initial conditions (SIC), this induces many possible states for the production system, which can be the result of deterministic chaos. This is observed, for example, in the dynamic variation of stocks (WIP or Work In Process) throughout the “line”. The cause is due to the sequencing and amplification effects specific to the physical and logical structure of the production system. We will call this the caterpillareffect. Under these conditions, we cannot predict the behavior of such a system. Moreover, the model corresponding to a real workshop is relatively complex and cannot integrate all the parameters and assumptions: it cannot be used for steering purposes. Simulation can therefore be used to “gauge” a complex system, to evaluate trends and define the least bad strategies.

Читать дальше