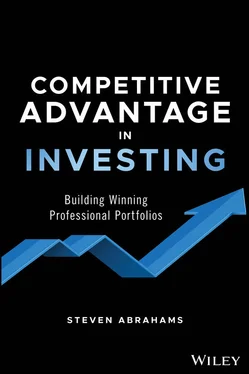

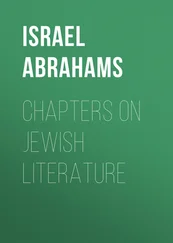

If an investor could go through all possible combinations of potential investments—all the items on our infinite list—the analysis leads to a set of portfolios that have both the highest return for a given level of risk and the lowest risk for a given level of return. These portfolios are the most efficient. Among all possible portfolios of investible assets, the efficient ones line up along a continuum or border from a point with the lowest risk and lowest return to a point with the highest risk and highest return. This becomes the efficient investment frontier ( figure 1.1).

It is easy to miss the genius in Markowitz's formulation of risk and return. By bringing risk into the picture, Markowitz puts the least tangible element of investing on par with the most. Return is tangible, easy to measure and compare. It gets reported every day, every month, every year. Return can actually buy things. Risk, however, only shapes returns over time, has to be imagined in advance, and often is clear only in hindsight. Risk rarely shows up in summaries of investment performance. We tell ourselves stories of likely investment return, and, in an effort to convince ourselves or convince others, we tend to narrow the range of likely risk. Markowitz makes risk and return equals.

Figure 1.1 Markowitz's approach leads to a limited combination of securities that have the highest return for a given a level of risk or the lowest risk for a given level of return.

The Surprising Power of Diversification

Markowitz would have taken an important step if he had only made risk and return equals, but he has another idea that revolutionizes investing: investors can improve risk and return in a portfolio by mixing investments. In other words, investors have something valuable to gain from diversification.

To get an intuition for diversification, think again about a company that flips a coin every year and pays $2 for heads and $0 for tails. Then imagine a second company that flips a second coin and also pays $2 for heads and $0 for tails. Each company would pay $1 a year on average with a variance of $1. 4 But because the two companies flip separate coins, they don't always pay on the same schedule. Some years, both will pay and investors will get $4. Other years, both will skip payments and investors will get $0. Most years, one or the other will pay, and investors will get $2. The companies still pay their separate cash flows, but the combination over time is smoother. In other words, the combination of the two companies doesn't reduce their expected return, but it does reduce their risk.

To Markowitz, mixed investment or diversification recognizes the unmeasured aspects of an investment that might make its returns move a little differently or very differently from all the investments around it. Diversification brought humility to investing. By diversifying, the investor would have to acknowledge that he or she would never know the likely timing, direction, or magnitude of returns of all the items on our infinite investment list. Diversification encourages adding a wide range of investments to a portfolio to capture the widest range of possible risks and returns.

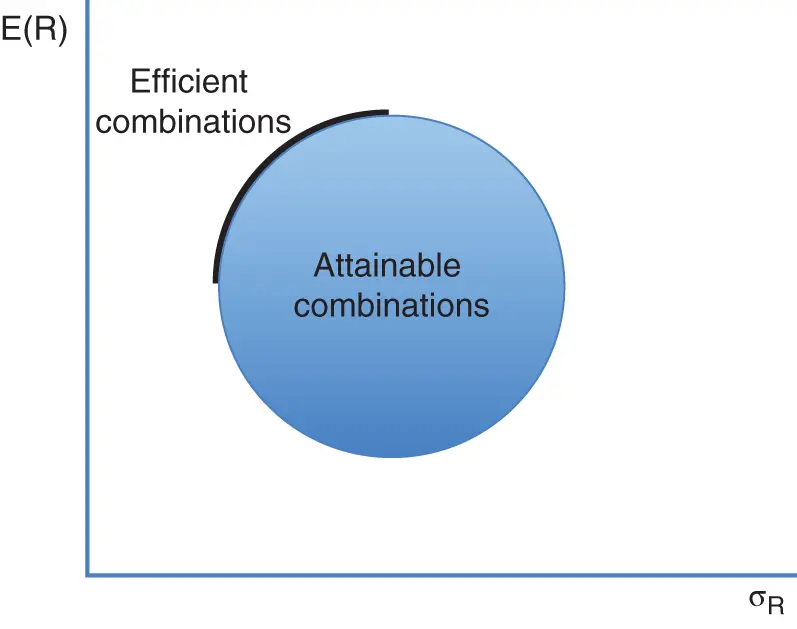

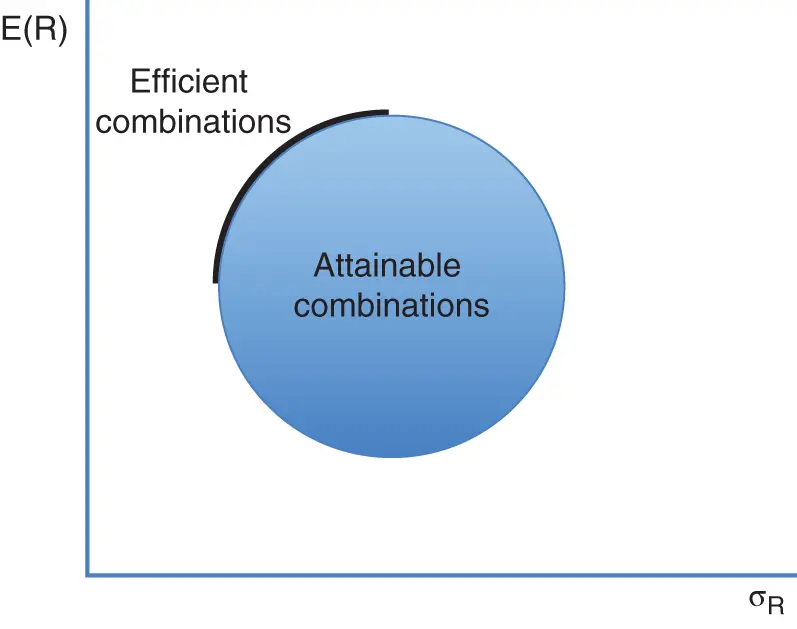

Diversification might have sounded like just another nice idea if Markowitz had not provided a powerful example of its benefits. Markowitz measured diversification by the correlation between investment returns, or how much returns on different investments move together. Investments with returns that move proportionately up and down by the same amount at the same time would have a correlation of 1 ( figure 1.2). Returns that moved proportionately in opposite directions at different times would have a correlation of −1. Investments with returns that have no relationship would have a correlation of 0, such as the two companies that flipped coins. Two investments with the same risk and same return but with a correlation of less than 1, for example, could combine into an investment with the same return but less risk. 5 An investor who put the two coin-flipping companies into a portfolio would end up with an investment that returned $1 a year on average but had less than two-thirds of the risk of holding either company alone. The cash flow from the portfolio would be smoother than from either company alone. This is Markowitz's powerful insight on the benefit of diversification.

Figure 1.2 The periodic returns on different assets can vary together, with the correlation ranging from perfectly positive (1) to perfectly negative (−1) to anywhere in between.

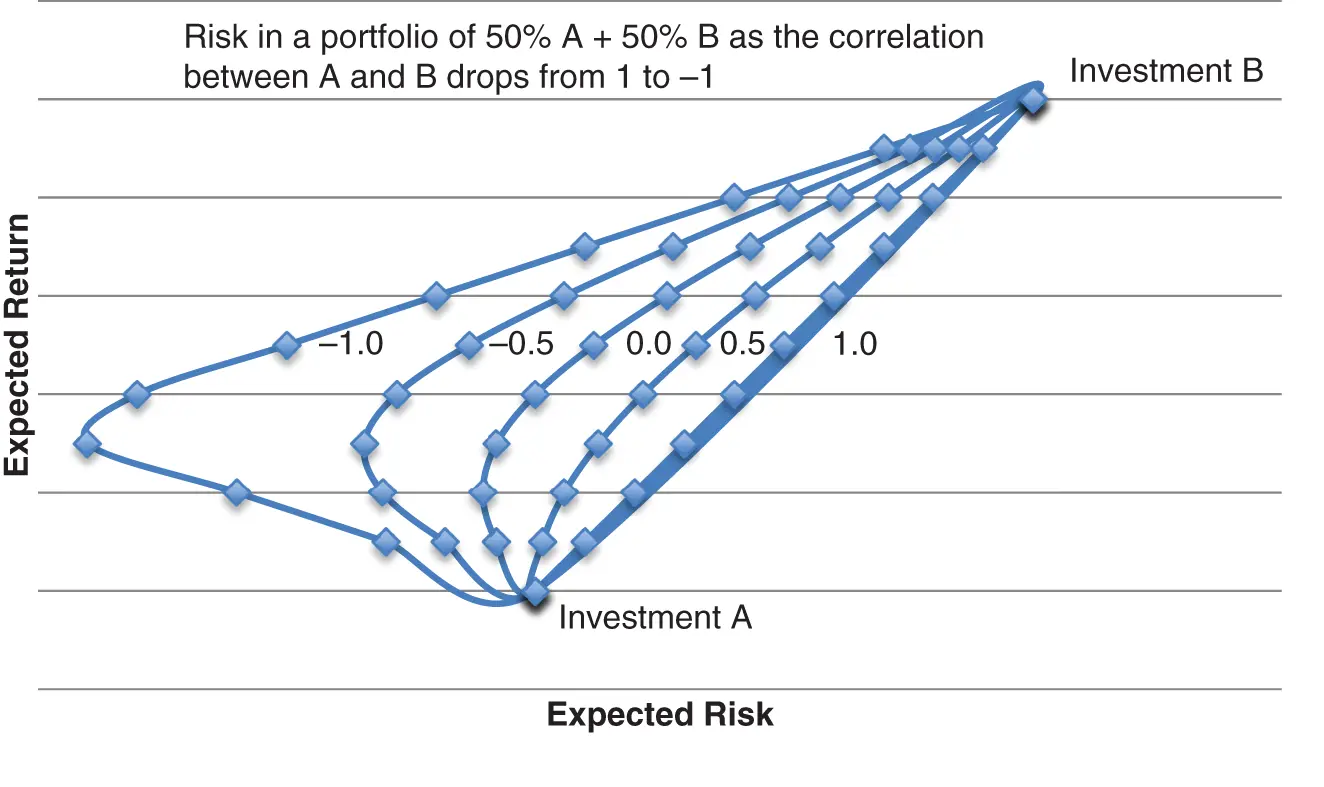

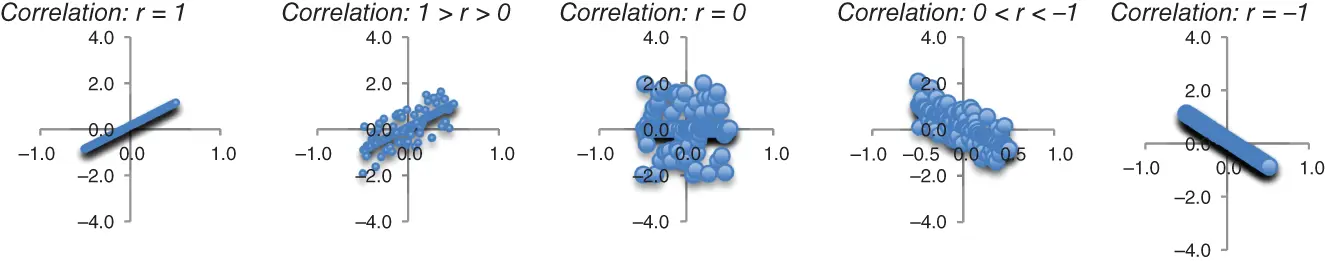

Figure 1.3 Markowitz also showed that risk in a portfolio falls as the correlation between investments drops below 1.

Markowitz's insight leads to a finer appreciation for the ways investors could shape the risk and return of a portfolio by mixing different assets. The expected return from mixing assets would simply add up to the expected return from each investment, weighted, of course, by the share of the portfolio invested in each one. But the expected risk depended on the correlation between assets. Assets with a high positive correlation would simply be a weighted sum of the risk in each investment. But as the correlation fell, risk would fall, too ( figure 1.3). And if an investor could add items that tended to spin off positive returns when others were spinning off negative—items with negative correlation—then risk could fall dramatically.

By showing that investors could use diversification to reduce risk without necessarily reducing return or add return without necessarily adding risk, Markowitz moved the investment discussion beyond present value and discounting rates and into modern portfolio theory. Building portfolios becomes an exercise in assembling cash flows that have the right mix of expected return, risk, and diversification.

For an investor staring at an infinite menu of choices, the challenge becomes picking the best set of choices, not just simply the single best choice. Any investment with acceptable risk and return could become part of an efficient portfolio as long as it adds diversification. Investing changed from the evaluation and pursuit of single assets into the construction of portfolios that maximized return for the portfolio of risks taken.

The Sources of Risk and Correlation

For all the insight of Markowitz's approach, he left largely unexamined the building blocks of risk and correlation. We know a good investor needs compensation for risk, and we know that correlation provides the glue that joins the elements of an efficient portfolio, but we do not know how risk and correlation arise. They simply seem to exist, and Markowitz arrived on the scene to tell us how to use them.

To better understand risk and correlation, the idea of companies in different coin-flipping businesses is a good way to start. The coin that each company flips stands for the risk that each company takes to earn a return. One company can flip the same coin as another or a different coin. Another company can earn returns by flipping multiple coins, and those coins may overlap partially or completely with the coins flipped by yet another company. And the payoff or sensitivity to the outcomes from those coins may differ across companies as well.

Читать дальше