1 Is there a determination or opinion letter for the latest amended version of the plan or the latest amendment to the plan?

2 Has the plan been formally amended to comply with the latest applicable laws and regulations?

3 Is the plan in compliance with applicable laws and regulations regarding age and service requirements for beginning participation, benefit accrual rates, vesting requirements, and nondiscrimination in plan provisions?

4 Is the plan operating in accordance with its formal plan provisions, including any authorized amendments, or Board resolutions?

5 Was the plan tested, as applicable, with respect to minimum number of participants, minimum plan coverage, nondiscrimination (ADP test and ACP test), nondiscrimination in contributions or benefits, disparity for Social Security integration, limit on maximum annual elective deferral, contributions, benefits, and compensation, and determination if the plan is top-heavy or compliance with minimum contribution or benefit and vesting requirements if it is top-heavy?

6 Is there evidence that plan activities or operations during the period did not comply with items listed in 5 previously, or with any other applicable tax laws and regulations, or would cause the plan to lose qualification?

7 Was the employer contribution to a defined benefit plan paid on time? If not, was PBGC Form 200 filed, a funding waiver received and plan participants notified if a waiver was not received?

8 Are hardship withdrawals permitted in a 401(k) plan? If yes, have plan terms been satisfied with respect to cessation of subsequent salary deferrals where applicable?

9 If there are loans to participants, is there evidence that the plan did not comply with requirements related to loans?

10 If the plan is a leveraged ESOP, have the terms of the plan and the applicable loan agreements been satisfied?

11 Was there an independent appraisal of any employer securities or other plan investments that are not readily tradable on an established securities market?

12 Have the distribution rules of the plan been satisfied, appropriate notices given, and consents received?

13 For ESOPs, is there evidence that plan investments are diversified at participants’ request in conformity with the IRS qualification standard?

14 Is there evidence of a prohibited transaction between the plan and a party in interest?

15 Is there evidence that the plan engaged in activities that would cause it to incur unrelated business income taxes? If so, was Form 990-T filed in a timely manner?

16 If the information about tax status or related uncertainties or contingencies is disclosed by the preceding items, or obtained during the audit, has consideration been given to the effect of such matters on financial statement accruals or disclosures, supplemental schedule disclosures, representation letter and the auditor’s report?

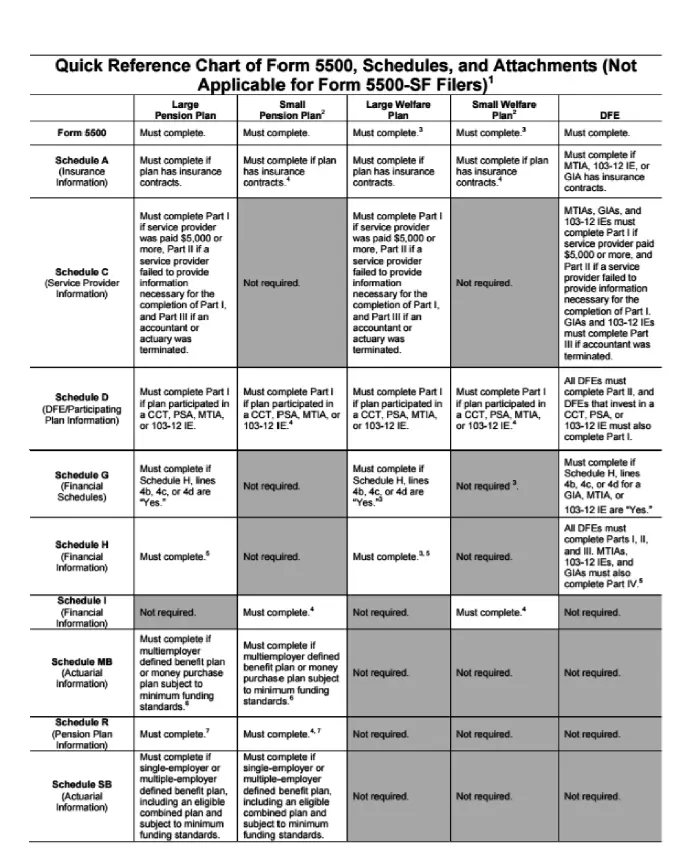

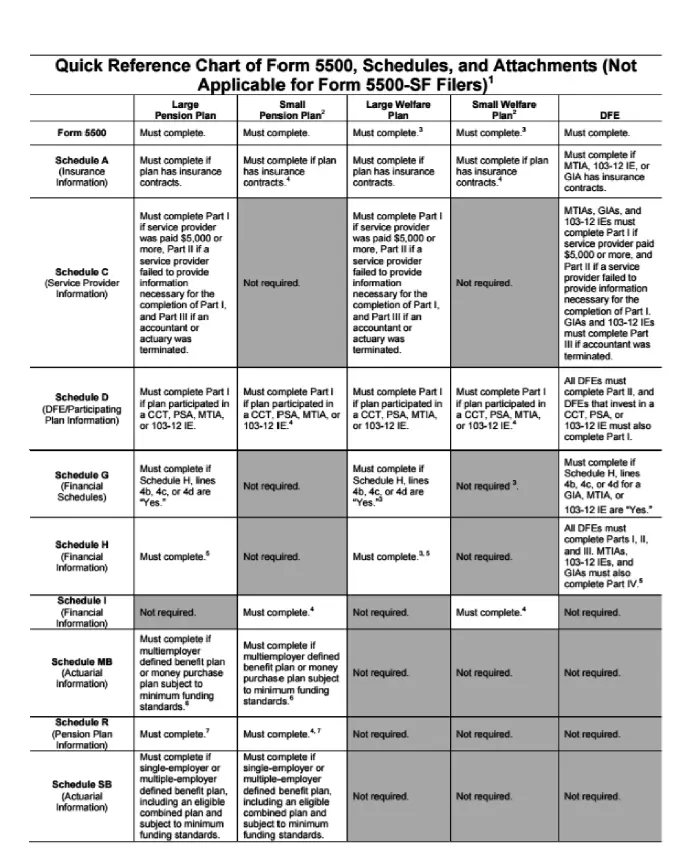

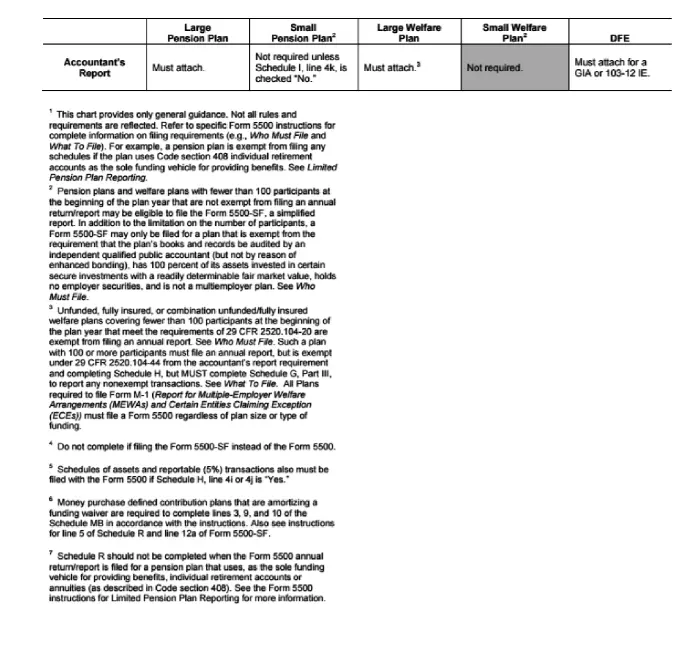

Exhibit 1-4

Exhibit 1-4

1 What is the annual employee deferral limit for 2018 for participants less than 50 years of age?$17,000.$17,500.$18,000.$18,500.

1 1Donovan v. Dillingham, [3 EBC 2122, 3 EBC 1073, 5 EBC 2092, 688 F2d 1367 (1983)].

2 2 Certain severance pay plans are exempt from classification as pension plans, but they are still classified as welfare benefit plans.

3 3 See DOL Advisory Opinion 83-06A.

4 4 IRC Section 409(l).

5 5IRC Regulations 54.4975-7 and -11.

6 6Revenue Ruling 79-122.

7 7IRS Notice 2011-19.

8 8 DOL Technical Releases 88-01 ( https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/technical-releases/88-01).

9 9 DOL Field Assistance Bulletin 2004-1( https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/field-assistance-bulletins/2004-01); DOL Field Assistance Bulletin 2006-2 ( https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/field-assistance-bulletins/2006-02).

10 10 IRS Notice 2011-1 provides that these rules will not be enforced until after regulations are issued. Regulations were issued on July 18, 2016, with the effective date generally deferred to plan years beginning on or after January 1, 2017.

11 11 IRC Section 436.

12 12 DOL Advisory Opinion 2012-04A.

13 13 See www.irs.gov/pub/irs-tege/rollover_chart.pdffor guidance for restrictions on certain rollovers.

Chapter 2 Accounting and Reporting Standards

Learning objectives

After completing this chapter, you should be able to do the following:

Identify applicable authoritative guidance surrounding employee benefit plans.

Recognize unique accounting, reporting, and other requirements for employee benefit plan financial statements.

Recognize accounting and reporting for merging and terminating plans.

Identify recent developments affecting accounting and reporting for employee benefit plans.

This chapter will address applicable guidance as well as recent developments in the industry.

Employee benefit plans are governed by standards of accounting and reporting provided by FASB through the codification. The Department of Labor (DOL) and IRS also have authority to issue regulations for reporting and disclosure requirements of benefit plans under the Employee Retirement Income Security Act of 1974 (ERISA).

This course will not address accounting or reporting for governmental employee benefit plans, which are governed by statements issued by GASB.

In addition, this chapter will not address additional accounting or reporting requirements for plans of issuers subject to the provisions of the Sarbanes-Oxley Act, the regulations of the SEC, and the rules and standards of PCAOB.

1 Which authoritative standards are used for the accounting and reporting for nonissuer employee benefit plans?FASB through the codification.SEC and PCAOB.DOL.IRS.

Generally accepted auditing standards and accounting principles apply to employee benefit plans. In addition, the AICPA Audit and Accounting Guide Employee Benefit Plans , provides guidance to practitioners on certain accounting, auditing, and reporting matters unique to employee benefit plans.

Defined benefit, defined contribution, and health and welfare are types of employee benefit plans. The objectives of financial reporting for all types of employee benefit plans are to report the resources available to fund participant benefits and the claims on those benefits. Regardless of plan type, employee benefit plan financial statements should include a statement of net assets available for benefits as of the end of the year and a statement of changes in net assets available for benefits. Defined benefit plans have additional statements in connection with disclosing the actuarial present value of accumulated benefits. Common elements in the financial statements of an employee benefit plan include investments, contributions receivable and received, investment income receivable and received, net appreciation (depreciation) in the fair value of investments, benefits paid and expenses paid. Refer to appendixes A– Cand B-1–C-1 in this course and appendixes C– Fin the Audit and Accounting Guide Employee Benefit Plans for illustrative financial statements and disclosures by plan type.

Читать дальше

Exhibit 1-4

Exhibit 1-4