1 ...6 7 8 10 11 12 ...17 Chapter 6reveals that little could have prepared these investors for the world of earlier stage venture capital where their hunt now took them. It recounts the ways in which sovereign investors have needed to fundamentally reinvent themselves as early stage venture investors and their spectacular successes and humbling failures in this new realm.

Shifting their investment process to support digital startups requires different key performance indicators, revenue standards, business models, growth potential, government relations, and more. To evolve in the changing landscape, they must strive to master early stage investing techniques, a field historically occupied exclusively by VC funds, to capture growth from emerging tech startups.

Chapter 7: The Hunt for the Hunting Party

This chapter reviews the operational challenges that sovereign investors encounter as they seek to participate in the digital economy by recruiting larger, tech-savvy, local teams and moving close to the innovation source. The chapter contrasts successful strategies with those that have not worked as well, highlighting the unique advantages – and disadvantages – of sovereign investors as team builders. It concludes with a look at alternative routes to engage in the digital ecosystem, most notably the $100 billion Vision Fund, but also the seeding of new managers and fostering startup interaction among portfolio companies.

Part III: Global Expansion, Regulatory Responses, and International Policies

These chapters address the regulatory response to the pursuit of the digital revolution by sovereign investors. All these tensions, currently highlighted by the China–US tech war, are playing out across the globe, from UK to Australia, from Germany to Canada, from Israel to Japan.

Chapter 8: Overseas Expansion and National Security Collide

This chapter examines the national security implications in home and host states as a result of sovereign investors' activities – both overseas investments (global portfolio) and overseas presence (global offices). We explore how national security legislation has adjusted to the rise of sovereign investors with their ties to foreign governments. The Committee on Foreign Investment in the United States (CFIUS) mechanism and the related US–China tensions serve as one case study, as well as similar regulations in Australia, Canada, EU member states, and Israel. Finally, the chapter traces the evolution of the concept of “national security” from weaponry to critical infrastructure to data, where it inevitably collides with the ambitions of sovereign investors in the digital economy.

Chapter 9: Tech Transactions Snared by Geotech Tensions

This chapter focuses on sovereign investors' direct investments into the AI and digital technology sectors. These activities have contributed to geopolitical tensions and tightened cross-border regulations. Deal blockings are on the rise under the US CFIUS and similar regimes of the EU, Israel, and Australia. Meanwhile, also on the rise, this time for US institutions, are restrictions on investments into foreign jurisdictions like China.

Such developments will profoundly impact venture capital and the startup ecosystem in the US, China, and elsewhere, because sovereign capital, whether foreign SIF funds or US pension funds, has been a major source of funds for the latest tech boom. The chapter concludes with an exploration of tactics available to sovereign investors investing overseas into digital technology in this ring-fenced environment.

Closing Chapter: Super Asset Owners

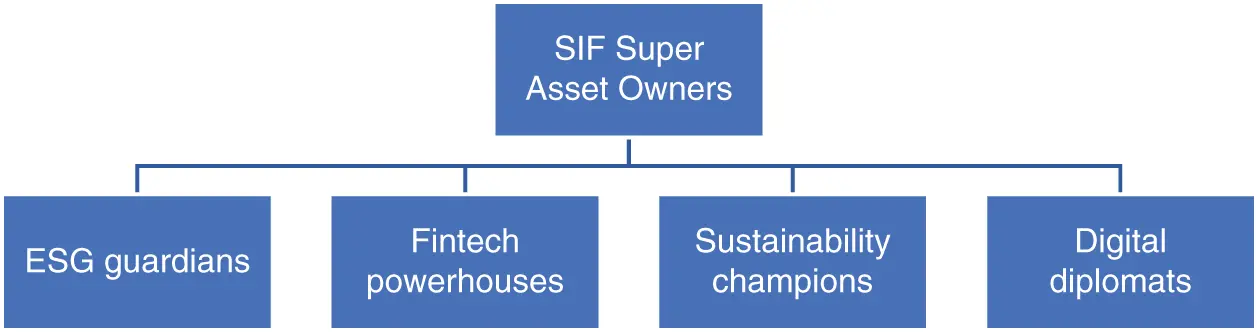

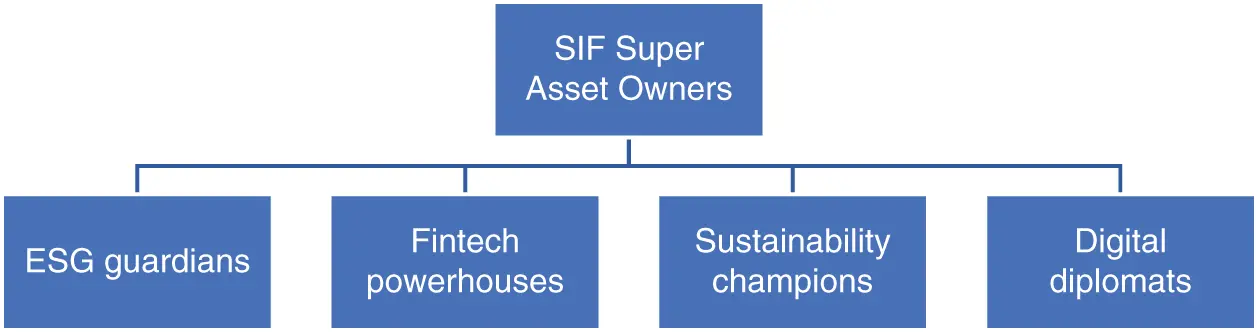

Chapter 10provides a portrait of sovereign investors as super asset owners and their growing impact and influence in four key roles ( see chart below).

First, ESG guardians.They lead in ESG and SDG in the digital economy, uniting to counter live-streamed shootings, relying on AI to monitor the conduct of portfolio companies, chiding the management of others, and rebalancing their portfolios to de-risk them for climate change and technological disruption.

Second, fintech powerhouses.They have, by necessity, evolved into fintech hotbeds, creating internal teams focused on the risks, opportunities, and operational implications of the digitalization of everything. AI and blockchain are deployed internally and seeded in startups, as they are poised to be the leaders, instead of the clients, of the asset management industry.

Third, Sustainability champions.Sovereign investors are putting long-term capital to cutting-edge technologies, fostering innovation hubs out of traditional centers like the US and Germany. Consequently, emerging economies are becoming smarter and more competitive. Even those who view the digital future as a zero-sum game have come to recognize the utility of these super asset owners.

Finally, digital diplomats.Sovereign investors are confronting an increasingly fractured tech world. The collaboration among the SIFs, however, provides a path whereby the US, China, EU, Japan, and many other parts of the world could reach a new equilibrium and collectively drive innovation. Viewed for what they truly are, these super asset owners of the future can become opportunities for mutual prosperity.

CHAPTER 1 Sovereign Investors Rising in Crisis

Passing through the understory of lounge chairs and low tables, you approach the bar with a view of televisions carrying the major international news channels. The suited barista serves up the coffee of your choice and you relax briefly as you scan your emails on the free wifi, glance at a few of the international papers and periodicals, and recover from the constant bustle just outside the lounge – business professionals from a multitude of lands clearing security and taking elevators from the towering atrium .

No, you are not in the first-class lounge at an international hub airport ( although it might well be one from all appearances). You have arrived, instead, at the visitor lounge in the hometown high-rise offices of Abu Dhabi Investment Authority, one of the world's largest and lowest profile sovereign wealth funds. ADIA manages its vast $700 billion plus global portfolio from this edifice where it employs investment professionals from around the world in a gleaming glass tower that would not look out of place in any world city. And ADIA is but one of the growing number of large sovereign wealth funds that remain below the radar but have an increasing impact on global markets .

Their low profile is in contrast to the better known dealmakers in the centers of finance. But their checkbooks and influence on the world at large outweigh the erstwhile titans of finance.

And as the number and size of such operations continue to surge, their influence does as well. Large as they are, in crises they have an even larger role to play. As this book went to press, the world was facing a pandemic, an inflection point where two themes of this book converged in sharp relief: the power of these massive funds in times of crisis and the world's now urgent march to the digital economy.

The global economy has witnessed the emergence of a new set of key actors over the last two decades – the Sovereign Investors. In this group we include Sovereign Wealth Funds (SWFs) and the very large Public Pension Funds (PPFs), which are active in the global marketplace and have many of the characteristics of SWFs. The concept of SWFs also includes sovereign development funds (SDFs), government established investment vehicles with development objectives.

Читать дальше