Importantly, the rise of sovereign investors is reflected not only in the increase in the size of assets under their management but also in the proliferation of new funds established over the past decade and the anticipated establishment of new funds in countries with recent resource wealth (such as African countries), as well as in regions striving for government-driven economic transformation (e.g., the EU).

Their ample resources, preference for lower profile, passive investing, their long time horizon and adherence to sustainability, as well as their need to diversify globally and by sector, have helped to transform the investment world and, in particular, private markets for digital companies. They have helped create and sustain an environment that has fostered the rise of the likes of Uber, Alibaba, Spotify, and other transformative players in the digital economy, while providing their founders and business models the benefit of long-term capital.

Despite this increasingly important impact, sovereign investors remain mostly unknown, often maintaining a low profile in global markets. For the same reason, they're also among the most widely misunderstood investors, as many view investments made by sovereign investors as purely driven by political aims. The general perception is that most sovereign investors lack transparency and have questionable governance controls, causing an investee nation to fear exposure to risks of unfair competition, data security, corruption, and non-financially or non-economically motivated investments.

As this book goes to press, the pandemic raging around the globe has brought them again to the front pages. Sometimes it's their key role in fostering the rise of the tech unicorns of artificial intelligence (AI) and big data and their big bets on biotech startups searching for treatments and vaccines. More frequently, it's coverage of their role as economic superheroes called upon to rescue the global economy or as comic book villains scooping up Western champions the pandemic has made vulnerable. These simple caricatures do not reflect reality, of course. Revealing the complex reality behind these simplistic depictions is the task of this book.

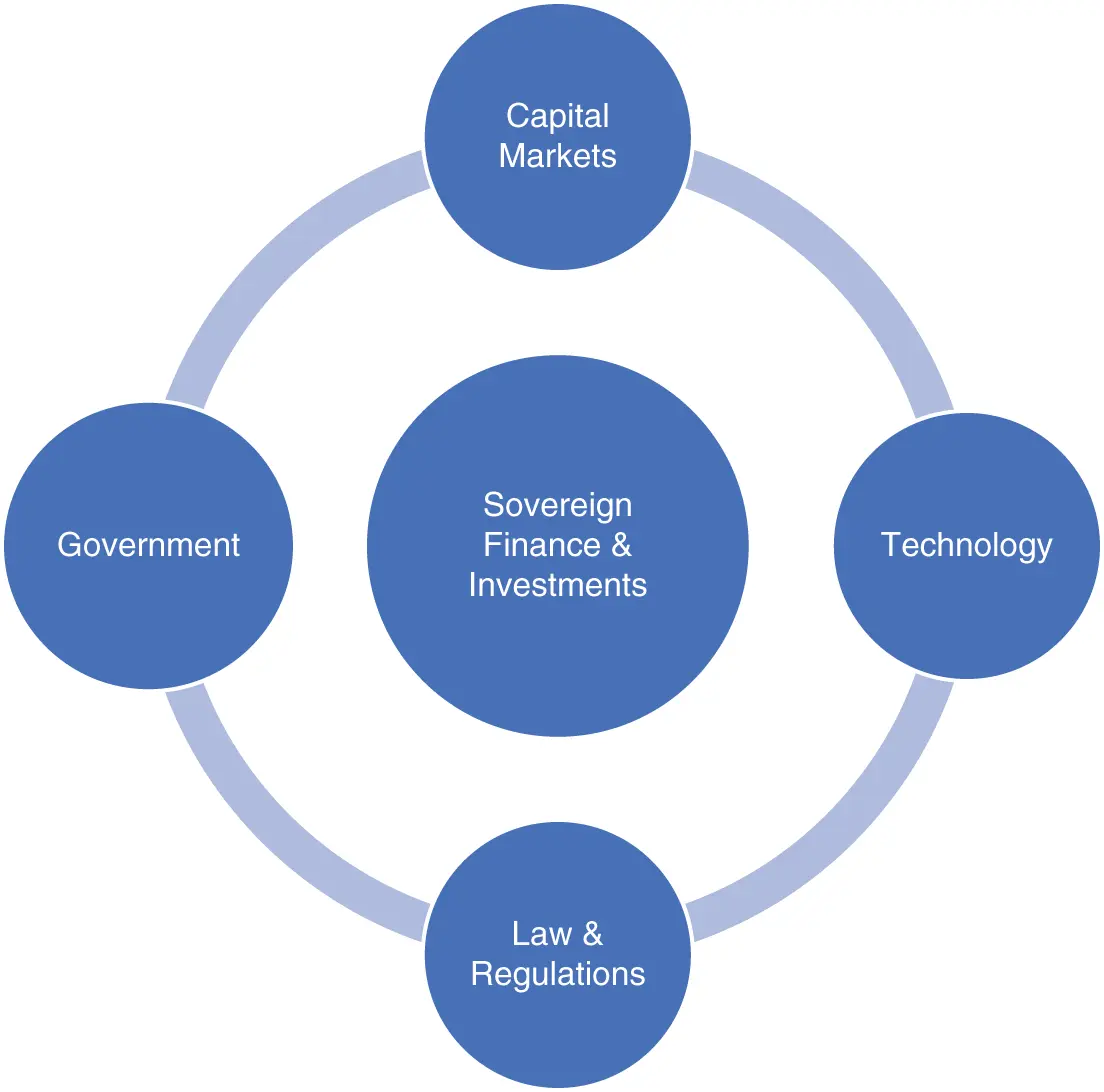

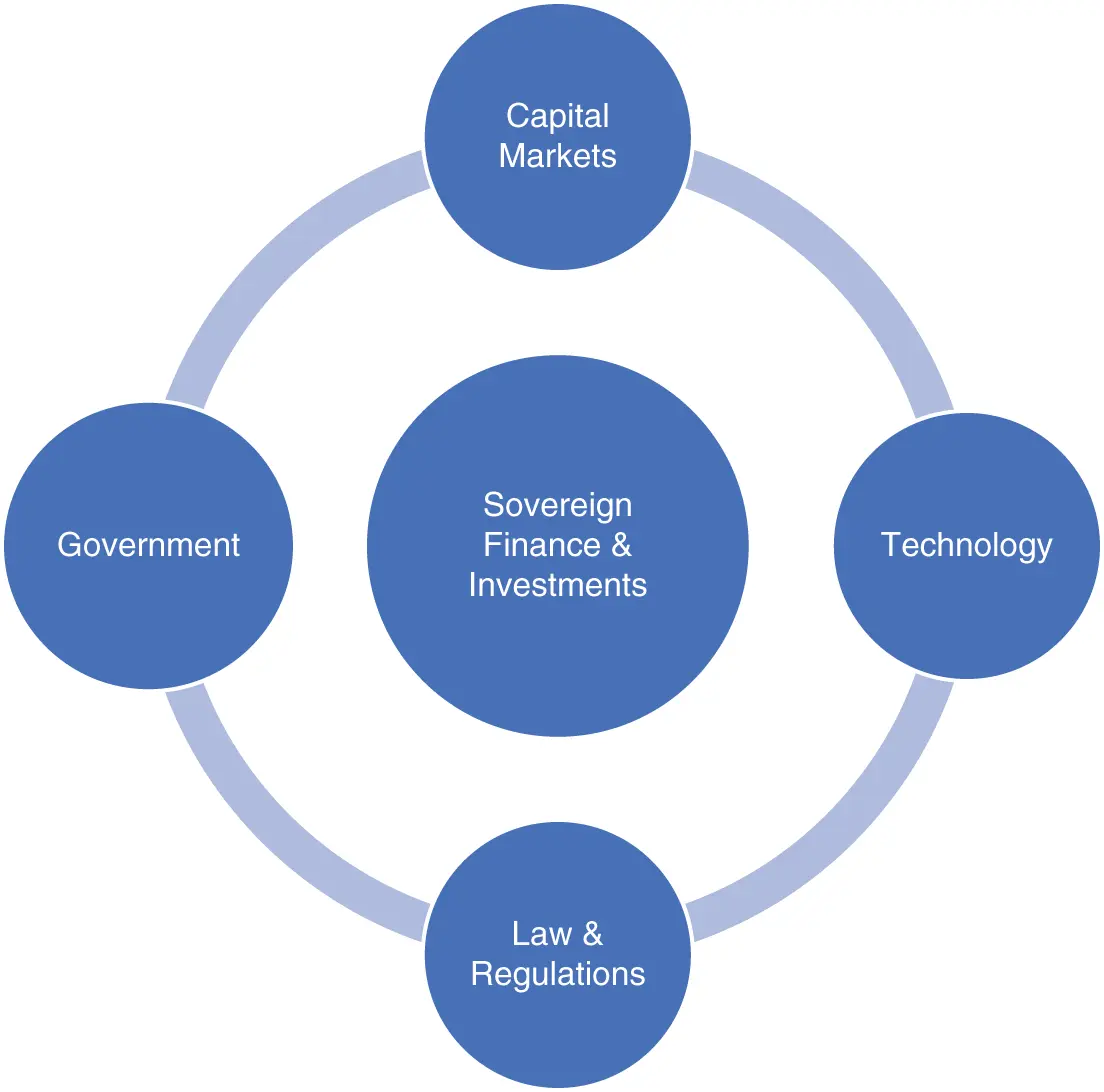

The current global tensions around the AI race and tech competition – and now the corona virus pandemic – have exacerbated such misperceptions, spawning controversies around sovereign investors and capital markets, governments, new technologies, cross-border investments, and related laws and regulations ( see the chart below):

As such, sovereign capital and the global digital economy are undergoing an unprecedented, contentious moment. This book maps the global footprints of these super asset owners; in particular, the three intersecting aspects of their pursuit of digital revolution: their strategy and institutional setup, their investments and impact, and regulatory policy responses.

This book is organized as follows.

Part I: The Trillion-Dollar Club

The two chapters in Part I lay the foundation for the rest of book by identifying key characteristics of the sovereign investors, such as capital size, investment policies, and governance structures. Many of the sovereign investment funds are transforming themselves to better invest into the new digital economy.

Chapter 1: Sovereign Investors Rising in Crisis

This chapter surveys the universe of sovereign investors and analyzes the origin of different Sovereign Investment Funds (SIFs) from a comparative political economy perspective. It reveals how sovereign investors perform a wide-ranging set of functions, which are not mutually exclusive – in fact most funds, today, perform more than one of the functions outlined in this chapter. It also introduces their little-known enormous capital power for global investments, highlighting that role in times of pandemic, financial crisis, and conflict as well as their global leadership in environmental, social, and governance (ESG) and sustainable development goals (SDG). Finally, it will focus on the factors behind the current rise in states' participation in high-tech markets – domestic as well as overseas.

Chapter 2: From Passive Allocators to Active Investors

Chapter 2recounts the funds' transition to active investment from their traditional function of simply allocating capital to external fund managers (which left them passive and little-known in the capital markets). The chapter goes on to highlight how they are increasingly active and direct in digital economy investments, collaborating among themselves as they become mature investors. Also in view is their cause/effect impact on the markets, their role in the rise of the unicorns, and the shrinkage of the public equities markets.

Part II: In Pursuit of the Digital Revolution

These chapters cover in detail sovereign investors' pursuit of digital revolution.

Chapter 3: The Global Hunt for Unicorns (Decacorns)

Chapter 3turns its attention to the hunt for unicorns. Increasingly, sovereign investors are going direct into transactions in the tech industry and digital economy sectors, on par with private equity (PE) and venture capital (VC) funds. They are active globally, due to both overseas investments (global portfolio) and overseas presence (global offices).

The chapter chronicles high-profile investments in disruptive technology giants, such as e-commerce giants like Alibaba and JD.com, as well as sharing economy leading players like Airbnb, Uber, and WeWork, and AI/mobility pioneers GM Cruise, Tesla, and Waymo; their growing appetite to develop their own internal investment capabilities; and the close relationship between sovereign investors and national governments.

Chapter 4: Long-term Capital into the Digital Infrastructure

Chapter 4highlights how, for the sovereign investors, the digital economy infrastructure – and the much broader digital ecosystem – has become another frontier asset class as a proxy to invest in technology. Digital infrastructure investment also provides an avenue to foster development goals and green initiatives, consistent with global government initiatives such as China's Belt & Road and Blue Dot of the US.

This combination has attracted large pools of sovereign capital into data centers, global digital logistics systems, digital satellite networks, and smart cities. The next big thing is the Internet of Things, and fintech, paytech, and digital health all form part of the future digital infrastructure that the sovereign investors are keen to invest in.

Chapter 5: Spurring Domestic Digital Transformation

Chapter 5focuses on how, with such powerful positions, SIFs are being seen by their stakeholders not simply as vehicles for financial returns from digital infrastructure. They also enjoy significant leverage to serve multiple purposes for long-term investment strategies, solving countless needs from political pressures to domestic technology-infrastructure shortages.

New sovereign funds are being created to this end and existing funds are repurposed. Africa provides innovative examples of resource-based funds that foster the domestic digital ecosystem. This chapter describes the increase in collaboration among sovereign investors seeking to accelerate development of the domestic digital ecosystem from Italy to the UAE, from China to Russia, from Saudi Arabia to Egypt.

Chapter 6: Go Early, Go Nimble

Читать дальше