No survey of the sovereign investor playing field would be complete without a shout out to fugitive Malaysian financier Jho Low and 1Malaysia Development Berhad (1MDB), founded by former Malaysian Prime Minister Najib Razak. The fund was created to finance infrastructure and other development projects in Malaysia; instead the funds ended up “invested” in Hollywood films (“Dumb and Dumber,” “The Wolf of Wall Street”), a mega yacht, a private jet, a van Gogh, a Picasso, and luxury real estate.

Mr. Low, who remains at large and the subject of criminal charges for his alleged central role in defrauding up to $4.5 billion from 1MDB, recently agreed to forfeit over $700 million in assets to settle accusations of fraud involving the fund. That included a $125 million yacht, a $35 million jet, a $51 million New York City penthouse, the $139 million Park Lane Hotel in New York City, and, literally, a settlement from the producers of the “Wolf of Wall Street,” a movie that was partly financed with 1MDB-embezzled funds.

A former Malaysian prime minister has been sentenced to prison in the scandal. And the Malaysian government reached a $3.9 billion settlement with Goldman Sachs in the same affair, after a Goldman Sachs partner pled guilty in August 2018 to bribery and money laundering. Even a failed sovereign fund has a big impact on Wall Street.

It is far from clear what transpired with all the monies transferred to the fund by the Malaysian government and further funds borrowed by it from investors. What is clear is that controls and governance were sorely lacking and that in the sovereign investor leagues, the numbers are big – even in the worst case.

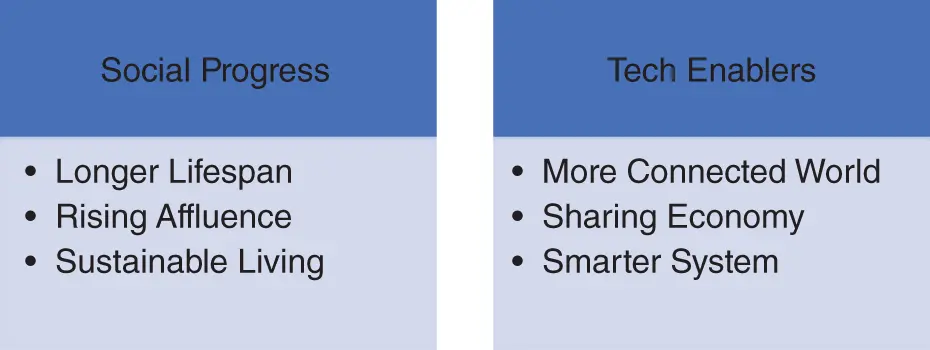

Given their typically global mandate and long-term investment horizon, sovereign investors increasingly build their portfolios based on major future trends, rather than on short-term market movements. Furthermore, they are not just passive actors affected by global megatrends, instead they actively influence the megatrends by their investments. For example, Temasek of Singapore has identified six structural trends, which collectively define the direction of its investment strategy: “Investing for a Better, Smarter, More Sustainable World” (see Figure 1.3 ):

Tech revolution essentially is the common denominator of all megatrends. Amid disruptions from new technologies, the sustainability of the world economy is critical for SIFs that seek long-term, sustainable returns from their investments. Consequently, most SIFs make global tech investments, either through external funds or directly; at the same time that they are integrating ESG factors into their investment process, leveraging tech capabilities for data analysis.

Take APG, the pension manager for ABPand a few other Dutch pension schemes, as an example. APG expresses its commitment to responsible investing by codifying such investing within one of its nine headline investment beliefs, and it has used digital tech for implementation. For instance, relating to the ESG/sustainable development goals (SDG) discussions in the previous section, whereas some asset owners say they are waiting for standardized data or more academic proof to implement ESG strategies, APG has used artificial intelligence (AI) to select companies that contribute sufficiently to the UN Sustainable Development Goals. ENTIS, the data analysis team of APG, uses smart algorithms to assess SDG-oriented investments, based on criteria that APG formulated itself.

Figure 1.3 Temasek Identified Six Structural Trends

Source: Temasek.

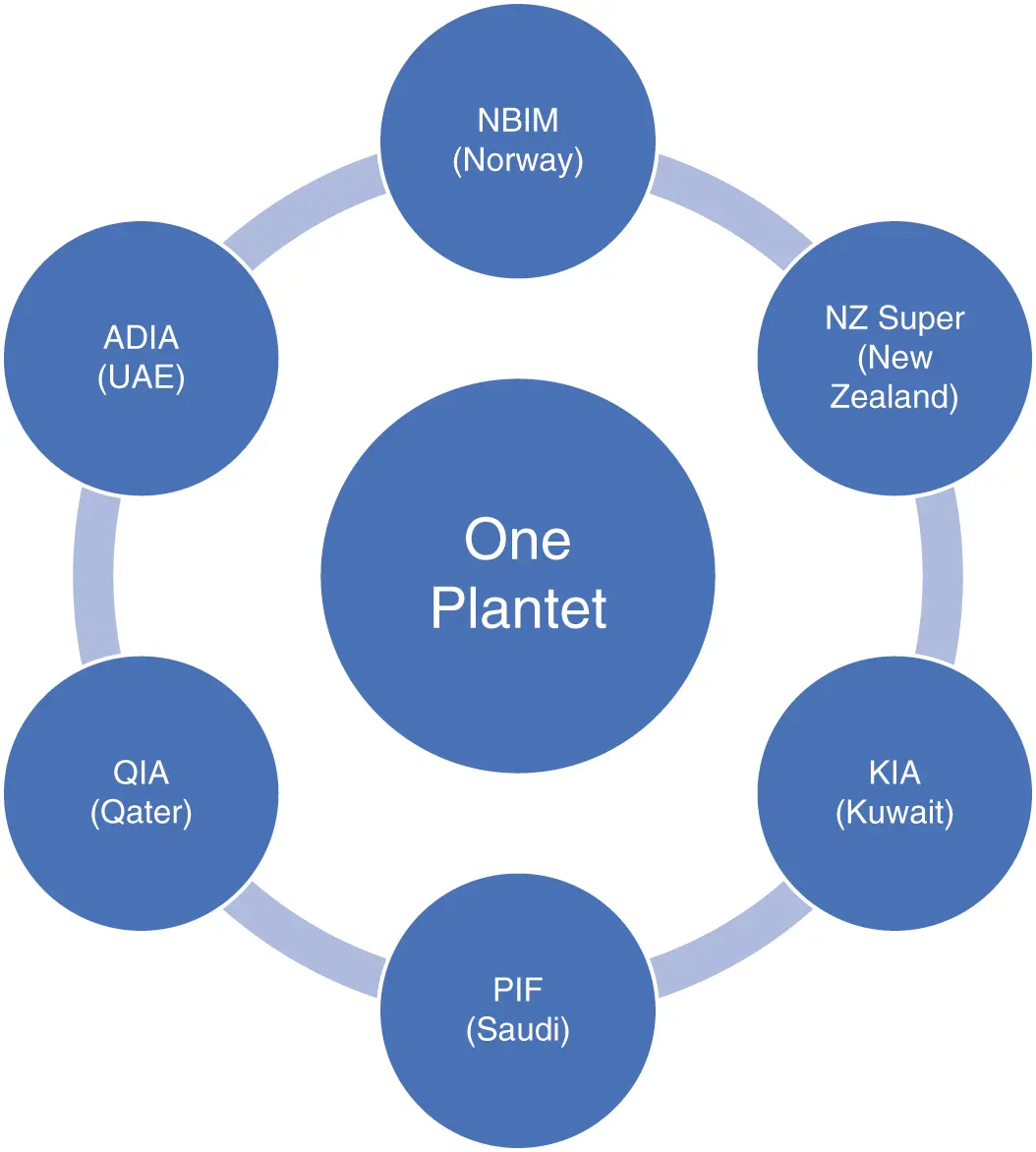

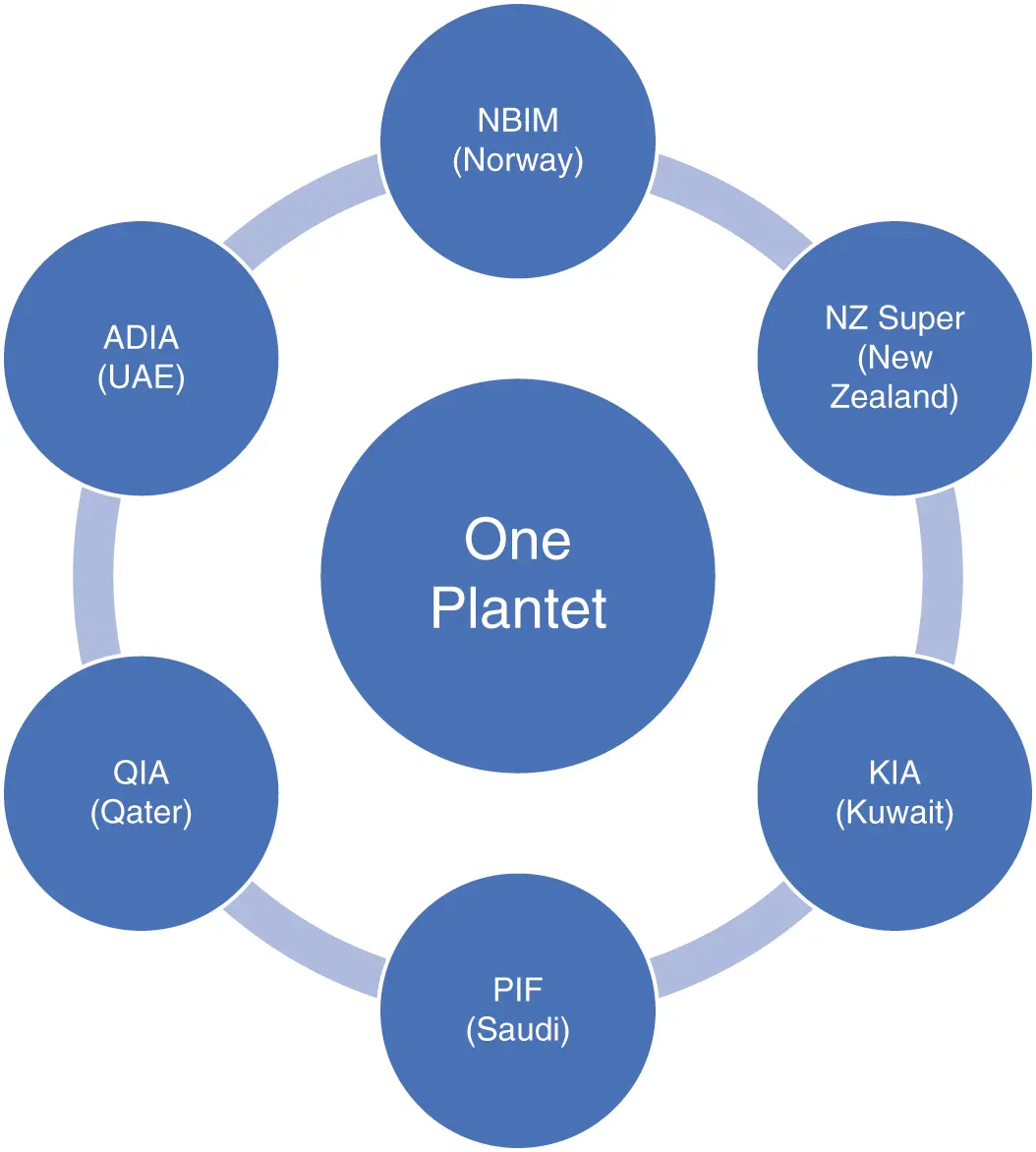

On climate change, the most significant movement is the One PlanetSWF Working Group formed by five hydrocarbon wealth powers (Norway and four Middle East funds) and the NZ Super (see Figure 1.4 ). Representing several trillions of assets under management, the six funds held the One Planet Summit on December 12, 2017, which was followed by the Climate Finance Day (building upon the success of the 2015 Paris Agreement to collectively mitigate the effects of climate change), and the working group was established at the event.

Figure 1.4 One Planet SWF Working Group

For sovereign investors, climate change is both a financial risk for long-term portfolios, and an opportunity, as the development of technology and changes in government policy create new avenues for investments. During the transition to a lower-carbon economy, SIFs have embraced opportunities ranging from solar and wind energy infrastructure in both developed and emerging markets, to early stage venture investments in the battery and mobility sectors. In July 2018, One Planet published an Investment Framework designed to accelerate efforts to integrate financial risks and opportunities related to climate change in the management of large, long-term asset pools like those of SIFs, including the following aims:

foster a shared understanding of the key principles, methodologies, and indicators related to climate change;

identify climate-related risks and opportunities in their investments; and

enhance their investment decision-making frameworks to better inform their priorities as investors and participants in financial markets.

One Planet hopes that more SIFs and then the general institutional investors industry will adopt the Investment Framework. Its success, interestingly, is dependent on data and technology. That's because across the industry, high-quality company-level environmental data – for example, those relating to carbon emissions and environmental impact – is still not readily available. To make informed investment decisions, institutional investors demand timely, relevant, accurate, and complete climate-related data. As such, the Investment Framework encourages SIFs to adopt agreed standards that promote the disclosure of material climate-related data. With the help of big data technology, the SIFs collectively would improve the volume, quality, and consistency of financial data to promote ESG investments effectively.

Besides being the only non-oil SWF fund in the One Planet, NZ Super also signed onto a broader grouping launched at the same time which is more favored by pension funds. Characterized by Bloomberg Business Week as “the biggest, richest, and possibly the most benevolent bully the corporate world has ever seen,” Climate Action 100+has been signed by more than 450 investors from across dozens of countries, who collectively control more than $40 trillion in assets, including aforementioned prominent pension funds such as ABP, BCI, CDPQ, CalPERS, GPIF, ISIF, and OTPP. They have pledged to work with their investee companies to ensure that they are minimizing (and disclosing) the risks and maximizing the opportunities presented by climate change.

Now the tech revolution is presenting the same mix of opportunities and risks for sovereign investors. On the one hand, investing into the high-growth tech sector can diversify their portfolios and generate superior financial returns. Given both their capital power and long-term investment horizons, they are best positioned for digital infrastructure (such as smart cities) that's critical for a sustainable global economy. On the other hand, major technological and disruptive innovations are disrupting traditional industries, putting SIFs' existing portfolio companies at risk. SIFs must act to “future-proof” their portfolios, as well as their own operating models. As will be seen in the next section, SIFs are all rushing into the digital economy revolution.

Читать дальше