Their overseas expansion has accelerated since China started the “Digital Silk Road” ( DSR) initiative in 2017. The DSR is the new digital dimension of the “Belt and Road Initiative” ( BRI), which was launched by the Chinese government in 2013 to promote cross-continent trade through major infrastructure investments. Whereas BRI has been commonly associated with physical infrastructure projects, such as roads, railways, energy pipelines, and ports, the DSR will bring advanced IT infrastructure to the BRI country, such as broadband networks, e-commerce hubs, and smart cities.

In DSR, China sees its burgeoning digital economy as a success story that can be shared with emerging markets, and it has also become a partner for other countries' digital revolution (see the detailed DSR discussion in Chapter 10), including examples such as:

Localized solutions. Baidu has opened a language processing lab in Singapore to improve its search applications for speakers of Southeast Asian languages, and it has launched a localized version of its search engine in Brazil.

Smart infrastructure. Alibaba Cloud has set up data centers in Indonesia, offering a reliable and cost-effective cloud product and services to Indonesian businesses, particularly small to medium-sized enterprises (SMEs) and startups;

Education. Alibaba set up worker training programs in Malaysia to teach small and medium-sized enterprises to sell their products on Alibaba platforms;

Investing into new startups. Tencent and Didi Chuxing, among others, have invested in the ASEAN car sharing apps, including Grab and Go-Jek, which surpassed the global ride-hailing service Uber in Southeast Asia. (Notably, Chinese capital has also actively invested in Silicon Valley, but in recent years, such investments have plummeted due to tightened US CFUIS investment regulations.)

Global M&A transactions. In early 2018, a Chinese investment consortium acquired a majority stake in London-based data center operator Global Switch, in a series of transactions worth more than US$3 billion. Just like investing into new startups, these M&A deals aim to find synergies between overseas companies and the Chinese market.

Not surprisingly, the latest addition to the DSR is, again, the blockchain. In April 2020, China launched the Blockchain Services Network ( BSN), which is a critical part of China's national blockchain strategy that was announced by President Xi in late November 2019. The BSN is an ambitious effort to include as many blockchain frameworks as possible and make them accessible under one uniform standard on the BSN platform. As such, it's the largest blockchain ecosystem in China, and in the DSR context, it is rapidly expanding its network overseas.

According to its official announcement, the BSN promotes low-cost development, deployment, and maintenance of consortium blockchain applications. Just like building a simple website on the internet, developers can deploy and operate blockchain applications conveniently and at extremely low cost. So far, no blockchain project has yet found widespread commercial usage globally. By significantly reducing entry barriers for blockchain application developers, the BSN can potentially drive significant innovation in traditional businesses across countries, which would have profound implications for cross-border applications from finance and payments to commerce.

As China's digital economy gains increasing global influence, the global economy sees China in Asia and the United States in the West forming two leading innovation centers of the world. Chinese and US companies represented 90% of the total market value of the top 70 digital business platforms, according to the United Nation's 2019 digital economy report. The two innovation centers have different strengths, but are also highly connected—the United States is the incubator of original technologies, and China is the best market for commercialization. Thanks to its largest user population, China excels at incremental innovation, but still lags the United States in transformational, science-based innovation.

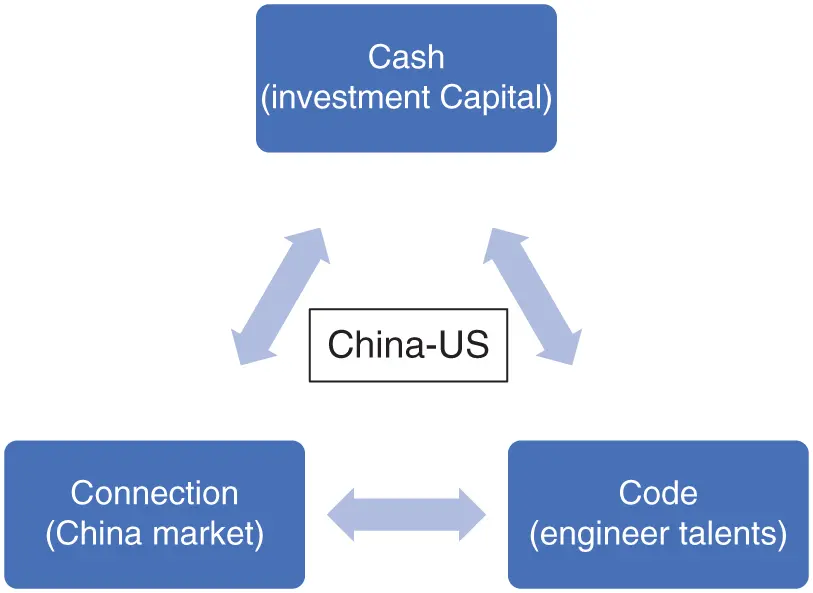

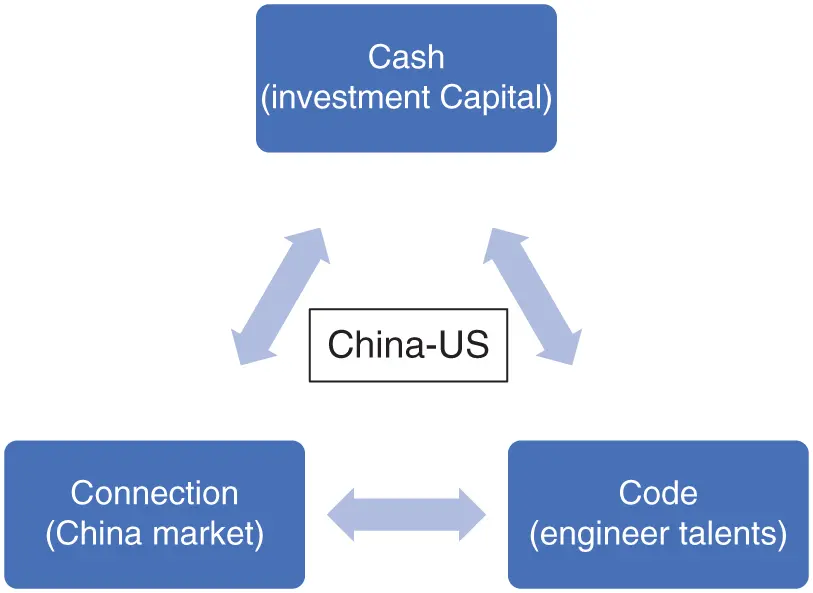

Until recently, the two markets enjoyed a cross-border flow of ideas, capital, and talents. Silicon Valley operated on three key ingredients: code, connections, and cash, and the Chinese link brought in abundant supply (before the recent US–China tech and trade tensions). Chinese engineers churned out plenty of the first, and Chinese venture capital brought an infusion of the second and third (see Figure 1.11). (As a cross-border investor, the author used to focus on US investments that had a strong potential synergy with the Chinese market from a commercial perspective as well as Chinese portfolio companies that sought to globalize in overseas markets.) The two-way bridge created synergies and speeded up startup launches, innovation, and scale on both sides of the Pacific Ocean.

Figure 1.11 The 3C transpacific synergy (of yesterday)

However, investment from China into US tech companies quickly slowed in August 2018 after the Trump administration stepped up vetting of deals over national security issues in American critical technologies. One key driver is that, with focused policy and substantial investment by its government, and the unrivalled user data pool, original 5G iABCD innovation is advancing in China, which, in more and more fields, is in head-on competition with the United States. Another important factor is, for each country, the data used to train AI models are locally managed and carefully guarded, as tech innovation is now of national security and geopolitical significance.

Even after the US–China phase I trade agreement (“a truce”) was reached in early 2020, the tech war has shown no sign of easing. For example, stoked by the COVID-19 pandemic, the short video app TikTok was second in downloads to the Zoom video-conference app in the first half of 2020, according to market-research firm Sensor Tower. Since 2019, US lawmakers have been calling for an investigation of TikTok's relationship with its Beijing-based parent company (ByteDance) and the Chinese government. In July 2020, Secretary of State Mike Pompeo suggested that the United States is considering banning TikTok because it views the popular social media app as a security threat – despite the fact that TikTok had spent much of the previous 12 months trying to distance itself from its Chinese roots.

And the blow came more quickly—and broader—than everyone anticipated. Weeks later, on August 6, US President Trump issued sweeping bans against TikTok and fellow Chinese tech app WeChat (the “superapp” owned by Tencent), citing concerns that TikTok and WeChat collect “vast swaths of information from its users”; i.e., from US users. On top of that, Trump issued another executive order within a week, ordering ByteDance to divest the US operations of TikTok within 90 days.

In response, ByteDance and TikTok filed a lawsuit against the US government, challenging the president's executive order that bans US companies from doing business with them on national security grounds. According to a ByteDance statement, that executive order was issued “without any due process”. Noteworthy, TikTok's lawsuit did not challenge the order to divest its US assets, and Microsoft and Oracle and other private investors immediately started a bid for TikTok's businesses in the US, Canada, Australia, and New Zealand, in the hope that the TikTok platform could bring significant synergies to their existing consumer-facing businesses.

Regarding the popular messaging app WeChat, the order would bar “any transaction that is related to WeChat”. In response, a group of WeChat users formed the US WeChat Alliance Group, a nonprofit group (not affiliated with the app's owner Tencent), which then filed a lawsuit against the Trump administration's executive order, calling the prohibition unconstitutional. Interestingly, because the WeChat app is ubiquitous in China, more than a dozen major US multinational companies raised concerns in a call with White House officials that such a ban could undermine US companies' competitiveness in China, according to Wall Street Journal reports.

Читать дальше