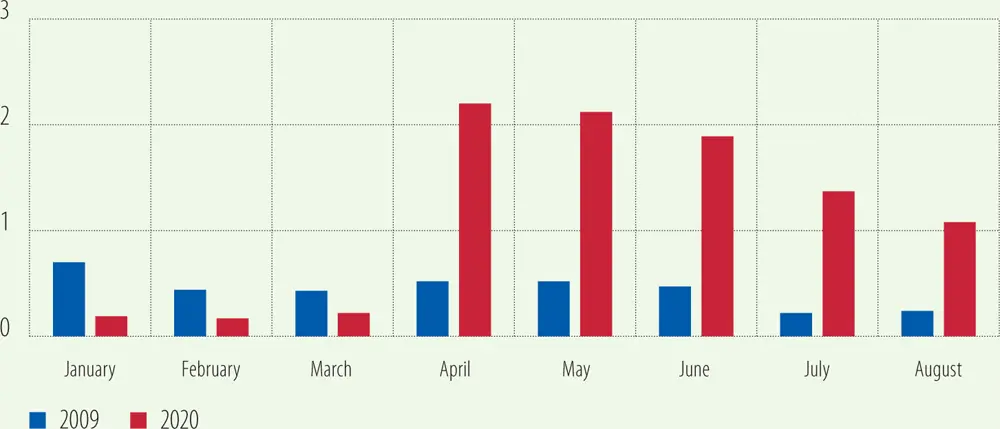

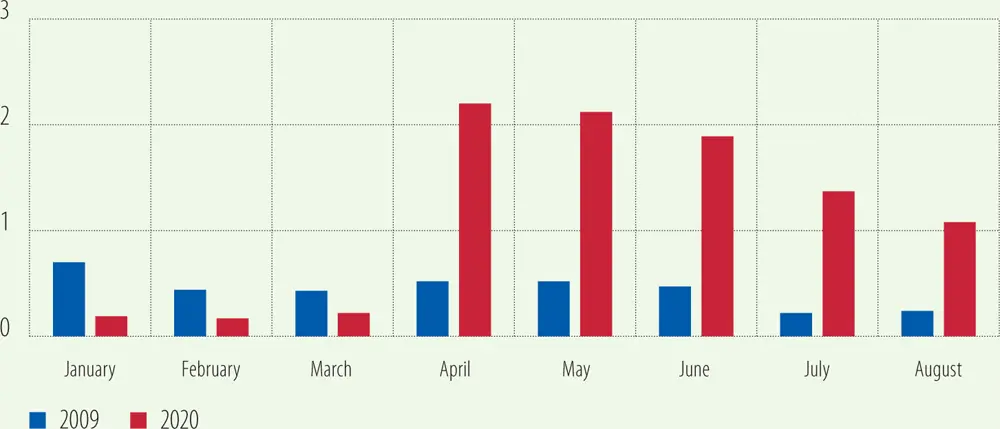

Figure D.3

Standard deviations of consensus forecasts of euro area GDP growth in 2009 and 2020

Source: Consensus Economic Forecasts.

Note: Forecasts were made in the month shown and were for the annual GDP growth in 2009 and 2020, respectively.

Over time, the unintended effects of STW schemes may become more apparent. As countries emerged from lockdowns over the summer, participation in STW schemes declined. With the health crisis continuing, however, a number of countries extended their schemes (including Germany, France and the Netherlands). This raises the risk that in some sectors, firms that continue to participate in STW schemes might become unviable because demand for their products has declined permanently. For example, demand for office space and public transport may not fully recover. In addition, the cost of discouraging workers from finding jobs that are more productive may soon increase.

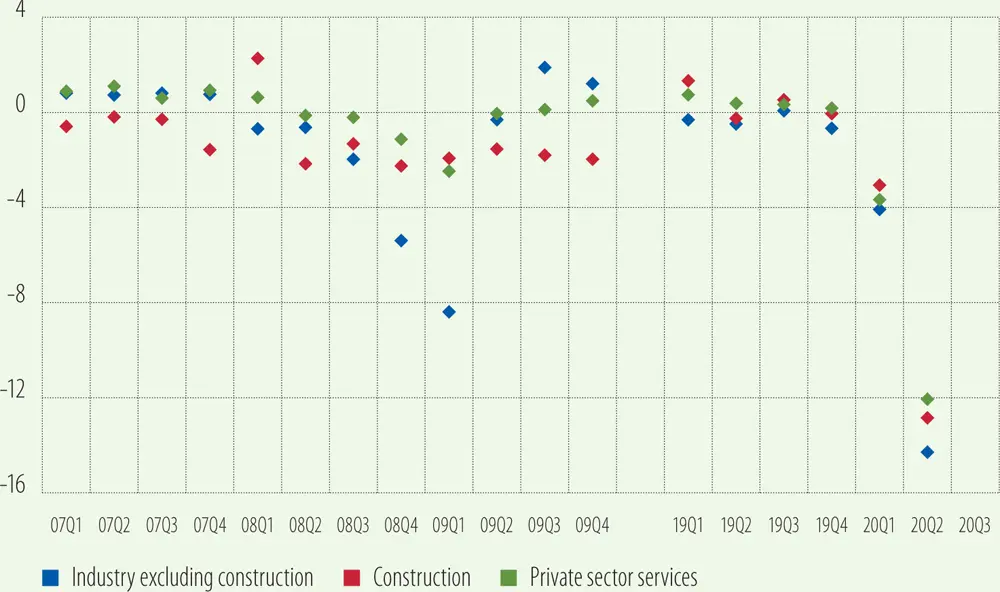

Figure D.4

Euro area GDP declined more sharply during the pandemic than in 2009

Source: ECB data warehouse.

Schemes may therefore need to be recalibrated to contain their unintended effects, and they must continue to reflect the institutional and market environment of the various countries, as well as the unfurling of the health crisis. In general, directing the STW schemes towards the sectors worst hit by government measures and promoting the mobility of workers from subsidised to unsubsidised jobs could help mitigate the schemes’ unintended effects.[4]

Financial developments and policies

Compared to the global financial crisis, the COVID-19 crisis took hold against the backdrop of already ultra-accommodative monetary policies and apparently smaller and very limited fiscal space.However, major steps had been taken to increase the resilience of Europe and its institutions: the creation of the European Systemic Risk Board and the three European Supervisory Authorities,[5] the setup of the Single Supervisory Mechanism and other building-blocks of the banking union, and the establishment of the European Stability Mechanism. Contrary to what might have been expected prior to the crisis, policy support unfolded massively and swiftly. As the eradication of the virus and the return to normal take longer than previously thought, this support may be recalibrated to ensure it can continue while minimising its side-effects.

The COVID-19 crisis is not a normal recession but a halting of activity triggered to prevent a public health disaster.The policy response has therefore had to be different. The purpose is to limit social distress and avert unnecessary bankruptcies that could hold back the recovery. Monetary and fiscal policies have cushioned the blow, mainly by providing financial assistance to companies and workers.

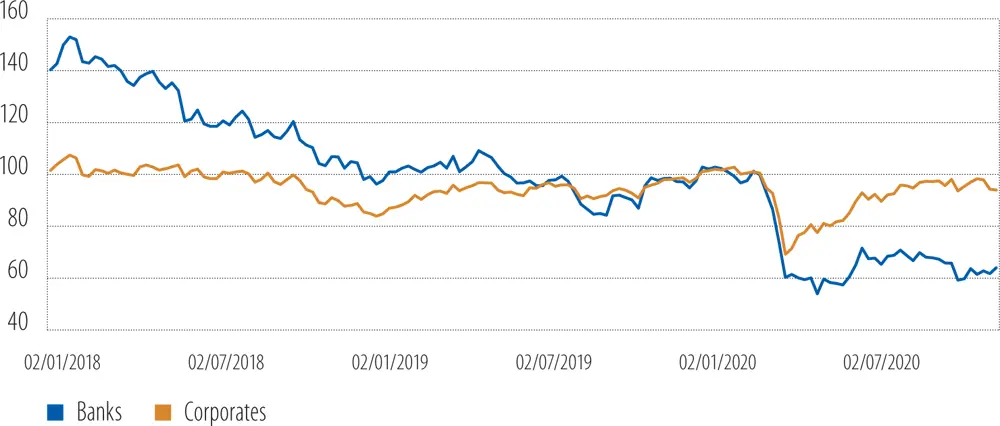

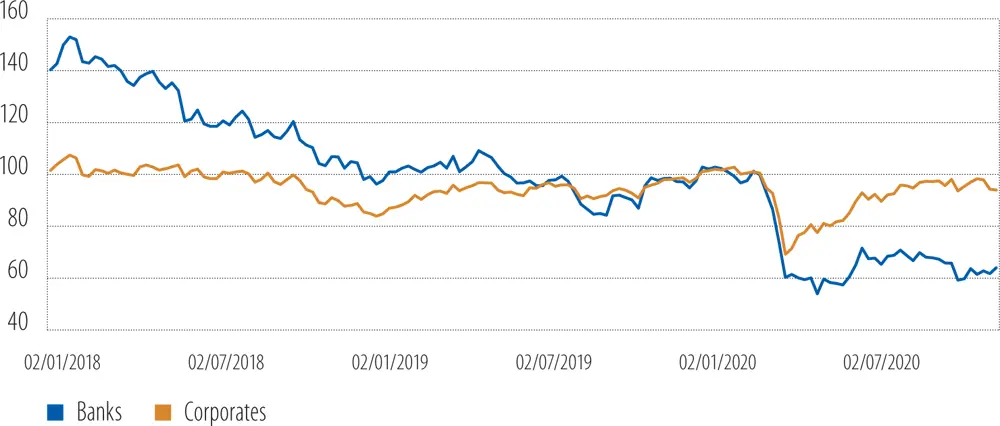

Figure 14

Corporate and bank stock prices(European Union, 100=Dec. 2019)

Source: Refinitiv and EIB calculations.

Note: Last record, 4 November 2020.

The initial contraction could have easily turned into a financial collapse.At the onset of the crisis, the stock market plunged, with corporate stock prices indices plummeting by 35% and bank stocks by 40% as investors fled to safer assets ( Figure 14). However, a massive and unprecedented response by central banks and governments prevented a financial collapse from compounding the freefall in output. Share prices recovered strongly for corporate stocks, whose performance was uncoupled from bank stocks. Nine months after the start of the crisis, in late November 2020, bank stocks are still 30% below pre-crisis levels. In the longer term, banks´ profitability is likely to remain subdued, given the persistent low interest rate environment that is squeezing net interest income and the returns from maturity transformation.

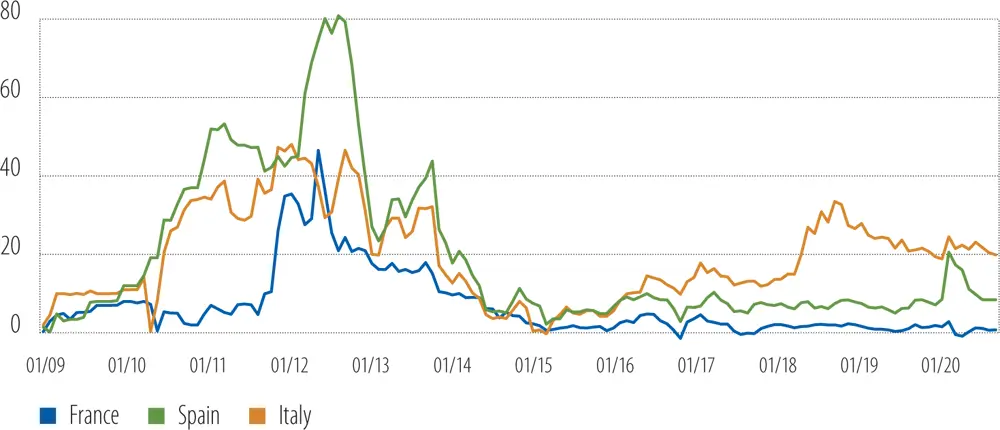

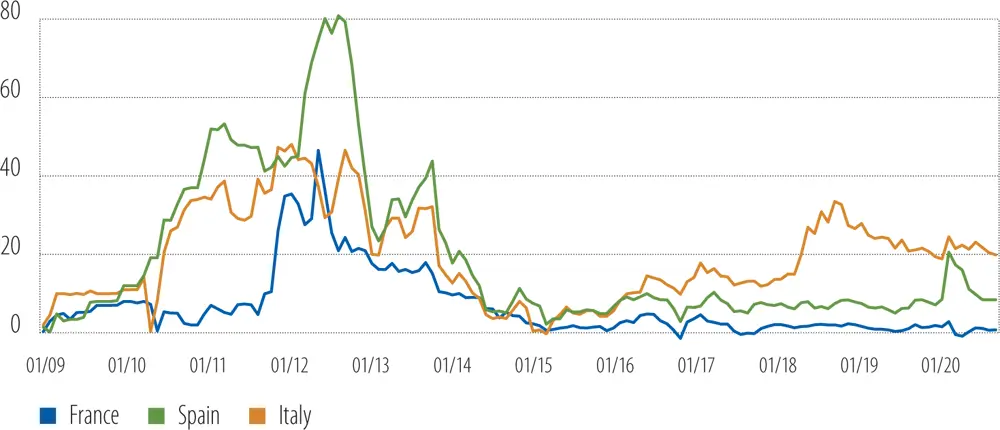

The ECB swiftly dispelled initial fears about the integrity of the euro area.In Figure 15, we plot quanto CDS spreads, or the difference between credit default swap quotes in US dollars and euros. The resulting measure is an indication of the risk associated with the break-up of the euro area as perceived by investors.[6] In contrast to what happened during the sovereign debt crisis, the quanto CDS spreads did not escalate for the three major sovereigns – France, Italy and Spain – compared to Germany, and stayed almost unchanged compared to the period prior to the COVID-19 crisis. This suggests that the ECB’s response was perceived as bold enough to support the integrity of the euro area.

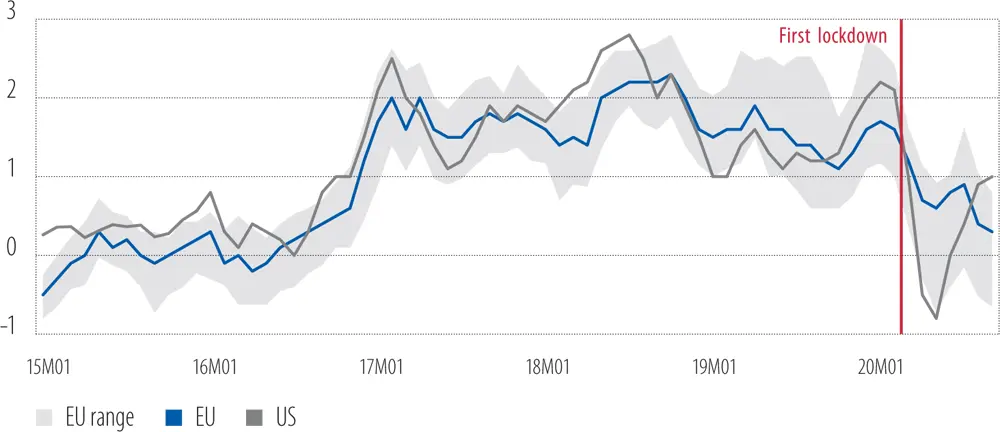

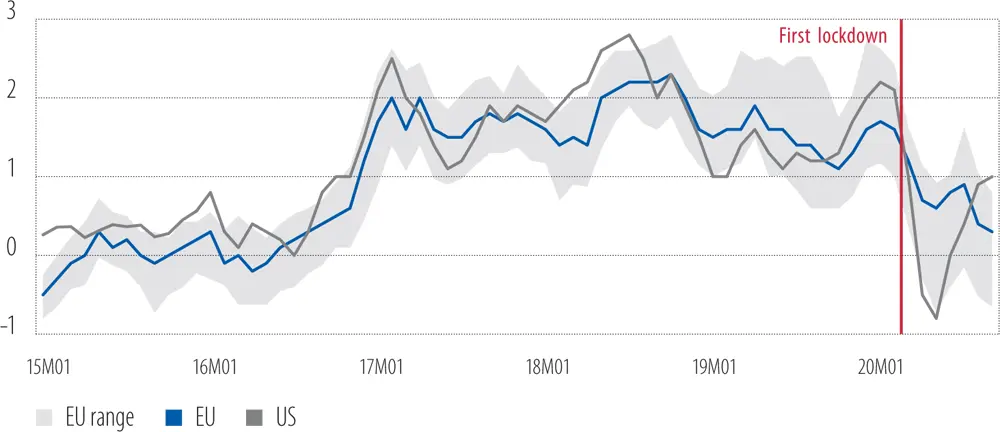

Lower inflation for longer.At its onset, some analysts argued that the crisis could have a negative or positive impact on inflation (Shapiro, 2020). Since the lockdown has resulted in both an adverse supply shock and an adverse demand shock, inflation could theoretically have responded either way. In the first few months, however, inflation slowed down sharply across Europe, and the decline was due to other factors than the most volatile components, such as energy ( Figure 16). In the long term however, the risk of inflation rising beyond its target is substantial given the amount of liquidity injected in the system. Moreover, as public debt accumulates, monetary policy may well give way to fiscal constraints (come under fiscal dominance), if rate hikes are seen as doing too much damage to public finances.[7]

Figure 15

Quanto CDS spreads(basis points)

Source: Refinitiv and EIB calculations.

Note: Last record, October 2020.

Figure 16

EU Harmonised Index of consumer prices and dispersion(annual rate, %, and interquartile quartile range, in percentage points)

Source: Eurostat and EIB calculations.

Note: Last record September 2020.

Major central banks entered the crisis with little leeway for lowering short-term policy rates. Figure 17plots the interbank money market rates for the three major advanced economies. While the US Federal Reserve had embarked on tightening its monetary policy, the ECB and Bank of Japan were already deploying negative short-term rates close to the effective zero lower bound. Consequently, only the United States had some latitude to use standard monetary policy to support the economy. From February 2020 until October 2020, the effective federal funds rate decreased by 150 basis points in the United States.

Long-term rates also were already low prior to the crisis.Several structural drivers were already fuelling the downward trend in long-term interest rates ( Figure 18). While monetary policy can be a contributor, demographic changes are a major cause. As the populations in advanced economies age, the balance between the various age groups in these populations shifts, affecting the overall supply of savings. Middle-aged individuals tend to save and provide funds to the rest of the economy, while the young and the old tend to spend more than their disposable income and demand funds. As a result, the real interest rate that balances the overall supply of savings with the demand for investment is affected by the relative size of these age groups (del Negro et al., 2018).

Читать дальше