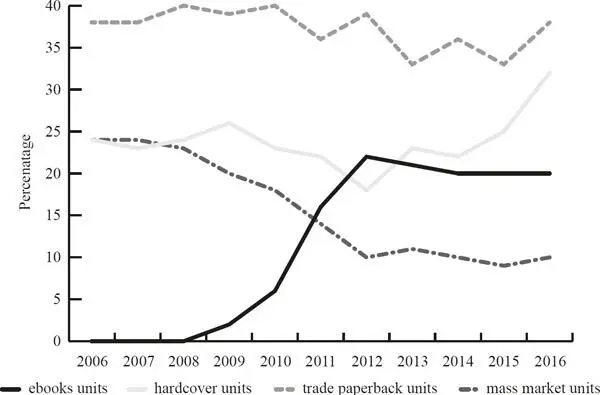

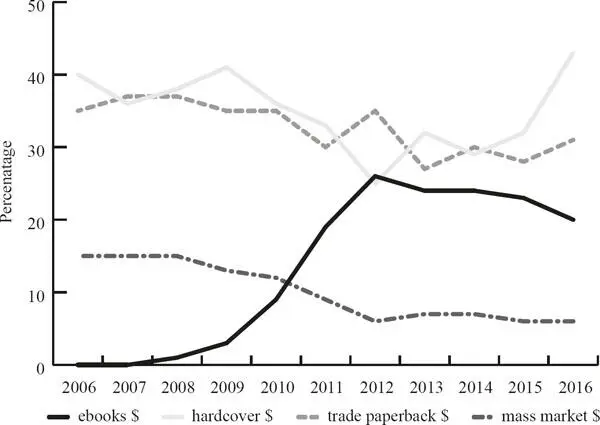

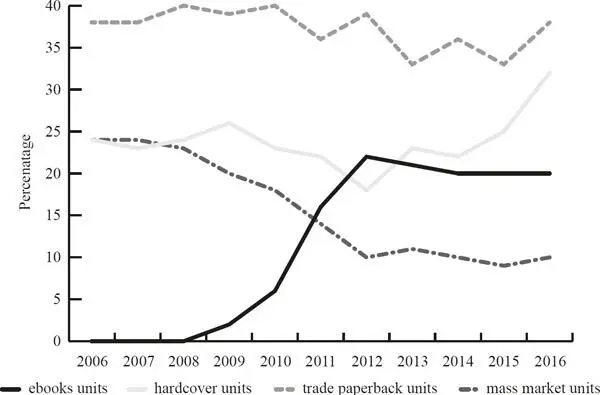

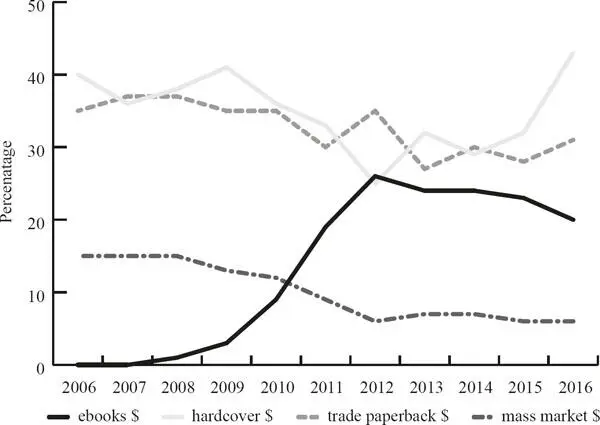

We find some support for the idea that ebooks are a new format (rather than a new form) if we look at the sales patterns of ebooks in relation to print formats at Olympic. Table 1.7and figures 1.11aand 1.11bshow sales by book format at Olympic in the period between 2006 and 2016, first by units and then by dollars, as a percentage of total sales. What these figures show is that the steep rise of ebooks in the period between 2008 and 2012 was accompanied by a substantial decline in the sales of mass-market paperbacks, both by units and by dollars: mass-market paperbacks declined from 24% of units and 15% of revenue in 2006 and 2007 to a mere 10% of units and 6% of revenue in 2016. By contrast, neither the hardback nor the trade paperback formats experienced such severe decline. Hardcover units remained fairly stable at around 25%; they dipped in 2012 to as low as 18% but then recovered, returning to 25% in 2015 and rising to 32% in 2016 – higher than it had been at any time in the previous decade. Hardcover revenue was accounting for 40% of overall revenue in 2006; this fell to 25% in 2012 but then rebounded to 32% in 2015 and 43% in 2016 – again, higher than it had been at any time in the previous decade. Trade paperback unit sales declined from 40% in 2008 to 33% in 2013 but then rebounded, climbing back up to 38% by 2016. Similarly, trade paperback dollar sales declined from 37% in 2008 to 27% in 2013, rising back to 31% in 2016.

Table 1.7Sales in percentages by format, units and dollars at Olympic, 2006–2016

|

Ebooksunits |

Ebooks$ |

Hardcoverunits |

Hardcover$ |

Trade paperbackunits |

Trade paperback$ |

Mass marketunits |

Mass market$ |

| 2006 |

0 |

0 |

24 |

40 |

38 |

35 |

24 |

15 |

| 2007 |

0 |

0 |

23 |

36 |

38 |

37 |

24 |

15 |

| 2008 |

0 |

1 |

24 |

38 |

40 |

37 |

23 |

15 |

| 2009 |

2 |

3 |

26 |

41 |

39 |

35 |

20 |

13 |

| 2010 |

6 |

9 |

23 |

36 |

40 |

35 |

18 |

12 |

| 2011 |

16 |

19 |

22 |

33 |

36 |

30 |

14 |

9 |

| 2012 |

22 |

26 |

18 |

25 |

39 |

35 |

10 |

6 |

| 2013 |

21 |

24 |

23 |

32 |

33 |

27 |

11 |

7 |

| 2014 |

20 |

24 |

22 |

29 |

36 |

30 |

10 |

7 |

| 2015 |

20 |

23 |

25 |

32 |

33 |

28 |

9 |

6 |

| 2016 |

20 |

20 |

32 |

43 |

38 |

31 |

10 |

6 |

Figure 1.11aSales in percentages by format and units at Olympic, 2006–2016

Figure 1.11bSales in percentages by format and dollars at Olympic, 2006–2016

The data from Olympic show pretty clearly that the rise of ebooks has eroded the markets for paperbacks, both trade and mass market, but that it has hit mass-market paperbacks particularly hard: in the decade when ebooks rose from virtually nothing to 20% of Olympic’s revenue, the share of Olympic’s revenue accounted for by mass-market paperback’s fell from 15% to 6%. The decline of the mass-market paperback is not a new phenomenon: mass-market paperback sales have been falling since the 1980s, their market undermined by various factors, including the heavy discounting of hardcover editions by the book superstore chains and the mass merchandisers. Why wait a year for the mass-market paperback of a new novel by James Patterson or Nora Roberts if you could buy the hardcover as soon as it’s published for less than $20? But the rise of ebooks has driven a few more nails into the coffin of the mass-market paperback.

To understand why ebooks have had a differential impact on print formats and have hit mass-market paperbacks particularly hard, we have to return to the point about windowing. In the world of print, the different formats of trade publishing are typically windowed: books are first published as hardcover at relatively high price points, and then brought out a year or so later as a paperback, either trade or mass market, at significantly lower price points. Windowing segments consumers into those who are willing to pay a higher price to get a new book quickly, on the one hand, and those who are willing to wait a year or more to get the book at a significantly lower price. But ebooks are typically not windowed: they are usually published at the same time as the first print edition, though typically at a lower price than the print edition. Some attempts were made by publishers to window ebooks in the early stages of the ebook take-off, in 2009 and 2010, partly as a way of trying to minimize the cannibalization of hardcover sales, but these attempts didn’t last long – publishers came under enormous pressure from ebook retailers, including Amazon and Apple, to abandon ebook windowing, and all of the major publishers soon did. But the fact that ebooks were now available at the same time as the first print edition was published, and generally priced below the print edition, meant that the windowing rationale for the remaining print editions was now significantly weakened. Why wait a year or more for a cheaper paperback edition if a cheaper edition was available at the same time as the hardcover edition, albeit in a digital format? In format terms, it was the cheaper paperback editions, released at later dates and lower price points, that were hardest hit by the non-windowed ebook upstart.

So ebooks may turn out to be no different from the trade or mass-market paperback: a new format, hugely significant as such, but not a new form. And if that is how it turns out, then it is likely to be far less disruptive for the publishing industry than many commentators thought and many insiders feared. Despite initial anxieties that ebooks might be the harbinger of a much more radical disruption in the publishing industry, many in the industry have now come to the view that ebooks are just another format in the sense that I’ve described here, albeit one that comes with an array of special features. This is how the CEO of one large trade house put it in 2017:

Fifty years after Allen Lane’s invention of the paperback we received the gift of a new format and, with it, we received the gift that people could, all of a sudden, read everywhere without having the book at hand because they had their reading device. And the gift was also that someone had developed an ecosystem that was so compelling that people were willing to actually pay for that experience – it was not something that started free like music and the Napster experience. So we had a paid ecosystem that was extremely compelling and convinced people that it made sense given the convenience not to steal books but actually to pay for them in a digital format.

This publisher has always been of the view that ebooks were more of a gain for the industry than a threat: publishers were lucky because others went to the expense of creating an ecosystem in which it was attractive for readers to purchase books in a digital format, thereby opening up a new revenue stream for publishers while obviating the need for consumers to acquire digital content illegally.

Читать дальше