Eric Tyson - Investing All-in-One For Dummies

Здесь есть возможность читать онлайн «Eric Tyson - Investing All-in-One For Dummies» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Investing All-in-One For Dummies

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:3 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 60

- 1

- 2

- 3

- 4

- 5

Investing All-in-One For Dummies: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Investing All-in-One For Dummies»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

Investing All-in-One For Dummies

.

Dummies

Investing All-in-One For Dummies

Investing All-in-One For Dummies

Investing All-in-One For Dummies — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Investing All-in-One For Dummies», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Check the FDIC’s website database of FDIC-insured institutions to see whether the bank you’re considering doing business with is covered. Search by going to the FDIC’s Bank Find page (

Check the FDIC’s website database of FDIC-insured institutions to see whether the bank you’re considering doing business with is covered. Search by going to the FDIC’s Bank Find page ( banks.data.fdic.gov/bankfind-suite/bankfind ). You can search by the name, city, state, or zip code of the bank. For insured banks, you can see the date when it became insured, its insurance certificate number, the main office location for the bank (and branches), its primary government regulator, and other links to detailed information about the bank. In the event that your bank doesn’t appear on the FDIC list, yet the bank claims FDIC coverage, contact the FDIC at (877) 275-3342.

In addition to ensuring that a bank is covered by the FDIC, investigate the following:

What is the bank’s reputation for its services? This may not be easy to discern, but at a minimum, you should conduct an internet search of the bank’s name along with the word “complaints” or “problems” and examine the results.

How accessible are customer-service people at the bank? Is a phone number provided on the bank’s website? How hard is it to reach a live person, the local branch, and its personnel (including the manager)? Are the customer-service representatives you reach knowledgeable and service-oriented?

What are the process and options for getting your money out? This issue is a good one to discuss with the bank’s customer-service people.

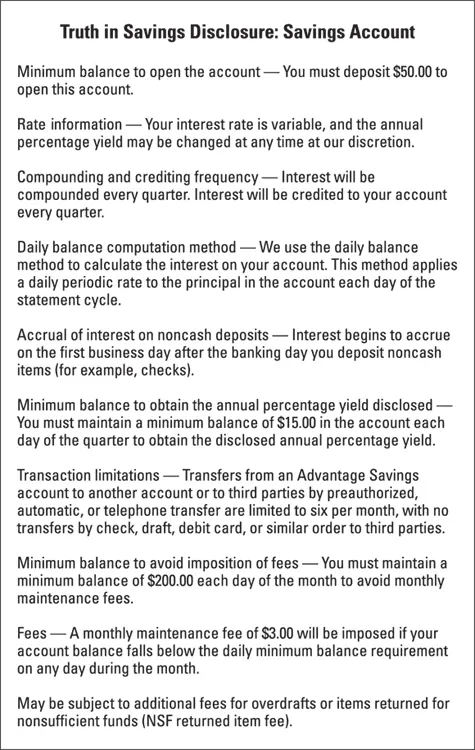

What fees are charged for particular services? This information should be posted on the bank’s website in a section called something like Account Terms or Disclosures. Also, request and inspect the bank’s Truth in Savings Disclosure, which answers relevant account questions in a standardized format. Figure 4-1 is an example of an online bank’s disclosure for savings accounts.

Protecting yourself when banking online

The attractions of banking online are pretty obvious. For starters, it can be enormously convenient, as you bank when you want on your computer or smartphone. You don’t have to find a local bank branch during their limited open hours. And thanks to their lower overhead, the best online banks are able to offer competitive interest rates and account terms to their customers.

You probably know from experience that conducting any type of transaction online is safe as long as you use some common sense and know who you’re doing business with before you go forward. That said, others who’ve gone before you have gotten ripped off, and you do need to protect yourself.

© John Wiley & Sons, Inc.

FIGURE 4-1:A sample Truth in Savings Disclosure statement from an online bank.

Take the following steps to protect yourself and your identity when conducting business online:

Take the following steps to protect yourself and your identity when conducting business online:

Never access your bank accounts from a shared computer or on a shared network, such as the free access networks offered in hotel rooms and in other public or business facilities.

Use two-factor authentication to minimize the chances that anyone other than you can access your account(s).

Be aware of missed statements, which could indicate that your account has been taken over.

Report unauthorized transactions to your bank or credit card company as soon as possible; otherwise, your bank may not stand behind the loss of funds.

Use a complicated and unique password (including letters and numbers) for your online bank account.

Log out immediately after completing your transactions on financial websites.

Exploring Alternatives to Bank Accounts

If you’ve been reading since the beginning of this chapter, you know that the best banks that are focused online should have a cost advantage over their peers that have branch locations. Well, there are other financial companies that have similar, and in some cases even better, cost advantages (which translates into better deals for you): credit unions, discount and online brokerage firms, and mutual fund companies.

Credit union accounts and benefits

Credit unions are unique creatures (well, a unique species) within the financial-services-firm universe. Credit unions are similar to banks in the products and services that they offer (although private banks tend to offer a deeper array).

However, unlike banks, which are run as private businesses seeking profits, credit unions operate as nonprofit entities and are technically owned by their members (customers). If they’re efficiently operated, the best credit unions offer their customers better terms on deposits, including checking and savings accounts (higher interest rates and lower fees) and some loans (lower rates and fees).

Don’t assume that credit unions necessarily or always offer better products and services than traditional banks, because they don’t. The profit motive of private businesses isn’t evil; quite to the contrary, the profit motive spurs businesses to keep getting better at and improving on what they do.

Don’t assume that credit unions necessarily or always offer better products and services than traditional banks, because they don’t. The profit motive of private businesses isn’t evil; quite to the contrary, the profit motive spurs businesses to keep getting better at and improving on what they do.

Credit unions have insurance coverage up to $250,000 per customer through the National Credit Union Administration (NCUA), similar to the FDIC protection that banks offer their customers. As when checking out a bank, be sure that any credit union you may deposit money into has NCUA insurance coverage.

The trick to getting access to a credit union is that by law, each individual credit union may offer its services only to a defined membership. Examples of the types of credit union memberships available include

Alumni

College and university

Community

Employer

Place of worship

There can be some overlap between these groups. To access a credit union, you also may be able to use your family ties.

To find credit unions in your local area, visit the Credit Union National Association consumer’s website at

To find credit unions in your local area, visit the Credit Union National Association consumer’s website at www.asmarterchoice.org/ .

Brokerage cash management accounts

A type of account worth checking out at brokerage firms is generally known as an asset management account. When these types of accounts first came into existence decades ago, they really were only for affluent investors. That is no longer the case, although the best deals on such accounts at some firms are available to higher-balance investors.

Brokerage firms enable you to buy and sell stocks, bonds, and other securities. Among the larger brokerage firms or investment companies with substantial brokerage operations you may have read or heard about are Charles Schwab, ETrade, Fidelity, and T.D. Ameritrade. Vanguard has a solid brokerage offering but discontinued their cash management account and is exploring whether to offer another again.

Now, some of these firms have fairly extensive branch office networks, and others don’t. But those that have a reasonable number of branch offices have been able to keep a competitive position because of their extensive customer and asset base and because they aren’t burdened by banking regulations (they aren’t banks) and the costs associated with operating as a bank.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Investing All-in-One For Dummies»

Представляем Вашему вниманию похожие книги на «Investing All-in-One For Dummies» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Investing All-in-One For Dummies» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.