Copyright: © 2014 Nodira Abdunazarova; Uwe Christians

Printed and published by: epubli GmbH, Berlin, www.epubli.co.uk

ISBN 978-3-7375-0530-7

The aim of this study is to investigate ways on strengthening the role of banks in Uzbekistan's regional economic development. The proposals have been based on the experience of Germany – a country whose financial system is commonly referred to as one of the most regionally oriented. However, a major problem with this kind of application is a gap between these countries' levels of financial development. Uzbekistan does not have such a long and successful tradition of a market based financial system as Germany has. Uzbek banks still need to develop credit technologies, improve corporate governance, as well as strengthen a reputation among their clients. In implementing these overall system reforms it is important to take into account the specifics of bank activities in local areas. So far, however, there has been little discussion about the regional aspects of Uzbek banking system. In this regard, the well-studied Germany's case reveals some important lessons and prerequisites for creating a framework that would support the locally-oriented banks in Uzbekistan.

The German decentralized and not purely laissez-faire banking system is a unique example how various public as well as private regional banks can successfully contribute to economic development of less developed regions and be strong competitors with large joint-stock banks. On the other side of the spectrum there is a country, namely Uzbekistan, with a dominance of state-owned bank branches outside the capital city. These branches often do not have enough information about borrowers in peripheral regions and tend to provide credit to safe customers with sufficient collateral. This leads to an increase of regional disparities in the levels of lending and financial service development. As a result, it may nullify policy efforts to encourage banks to become an important source of investment and hence, economic growth. Currently, Uzbekistan needs a roadmap to involve banks in the regional economic processes and to enhance performance of regional banks.

This paper is organized as follows. Section 1 describes the main features of Uzbekistan's economy and banking system. In this section, regional aspects of the Uzbek banks' performance are also considered. Section 2 provides the main characteristics of the German three-pillar banking system, namely: large private banks, savings banks, and cooperative banks. We focus on the policies and business strategies that these banks carry out in the German regions. Sections 3 and 4 present the German guarantee banks and development banks which help to overcome credit rationing, lack of collateral, as well as the short-termism of commercial credit. Section 5 concludes the paper and offers some policy recommendations for the future reforms in Uzbekistan.

Ultimately, despite the differences in the two countries' development, this paper supports the recommendations based on the German experience for stimulating various local financial institutions, namely cooperative banks, a Development Fund and a Guarantee Fund which help to increase the level of competition, overcome asymmetric information with respect to borrowers, and stimulate regional economic growth in Uzbekistan.

1. Uzbekistan's economy and banking system

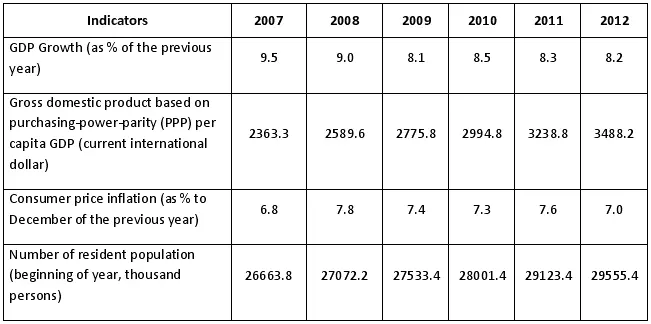

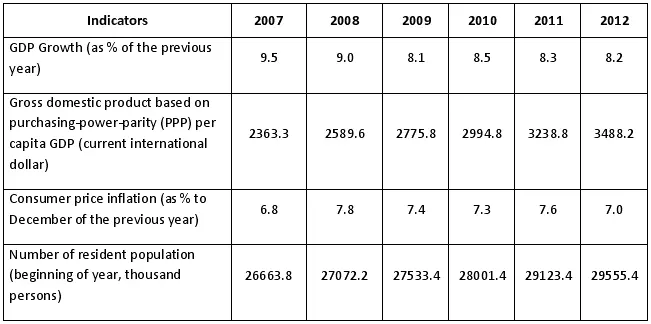

First, let us consider the basic facts about Uzbekistan's economy and banking system during the period of 2007-2012. Uzbekistan had GDP growth of over 8% since 2007 and the CPI inflation rate was around 7% (Table 1). Although about 50% of the population lives in rural communities, currently the percentage of agriculture in the country's GDP is less than 20%, the percentage of the industrial sector together with building, transportation and communication made up 40% of the GDP (the State Committee on Statistics of Uzbekistan, 2013). It is worth noting that in 2012 the share of small businesses in the country's GDP made up more than 54%.

Table 1

Main macroeconomic indicators of Uzbekistan

Source: the State Committee on Statistics and Central Bank of the Republic of Uzbekistan, IMF

In the post crisis period, Uzbekistan experienced growth due to reforms in the industrial sectors and the relatively high prices for resources - main export earners (gold, copper, gas, etc). Uzbekistan is the world's largest producer of cotton and holds the second position for its exports.

The financial system of Uzbekistan didn't have serious drawbacks from the global economic crisis, primarily due to its relative low exposure to the international financial markets.

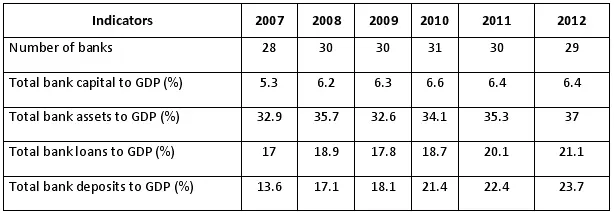

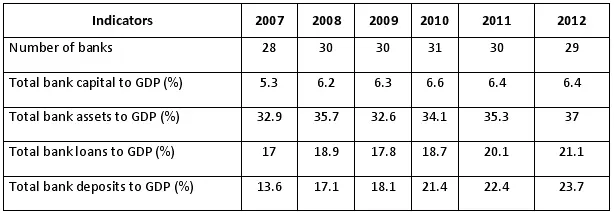

Table 2

Main indicators of Uzbekistan's banking system

Source: The Central Bank of the Republic of Uzbekistan.

The banking system relies more on internal resources, as reported by the Central bank of Uzbekistan, at the end of 2012 the share of loans from domestic sources in the banks' total loan portfolio made up to 85.8%. External borrowings were used mainly for the long-term lending for investment projects on modernization of strategic sectors and supporting small businesses.

By the beginning of the year 2013 there were 29 commercial banks, including 3 large state-owned banks, 9 private banks and 4 banks with foreign capital (Table 2). There were 4 small- and medium-sized regional private banks which operate outside the capital city. There were 829 local branches of commercial banks in total. These commercial banks are the main credit providers in the regions; there are also less than 30 small microfinance organizations in Uzbekistan.

All Uzbek commercial banks received a "stable" rating from the international rating agencies such as Moody's, Standard and Poor's, and Fitch. In 2012, the banking system's capital adequacy ratio of about 24.3% remained high by international standards and the level of non-performing loans was relatively low (IMF, 2013).

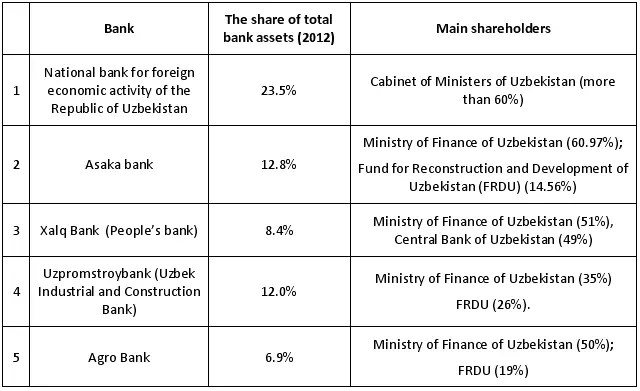

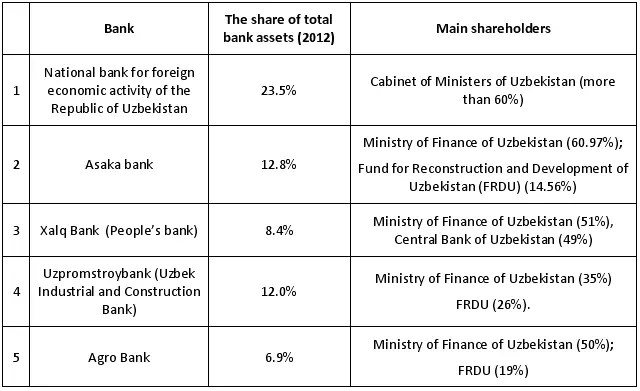

The Central bank declares about 3 of the biggest state-owned banks (National bank for foreign economic activity of the Republic of Uzbekistan, Xalq Bank (People's bank), and Asaka bank, but other banks also have the government's share in their equity (Table 3). Uzbek's large state-owned banks finance long-term strategic projects in communication, transportation, and the building industry, among others.

Table 3

General information about Uzbek large banks

Source: The Central Bank of the Republic of Uzbekistan. Information about the main shareholders was taken from the banks' official websites.

It is worth noting that the German regional savings banks promote their experience in similar financial institutions in developing and in transition countries. The Savings Banks Foundation for International Cooperation (SBFIC) had several financial projects in Uzbekistan, aiming to improve people's living conditions by enhancing their capacity to save money, countrywide lending to small and start-up businesses, introducing micro-insurance services, and training for bank assistants. The main partner of the German savings banks' group in Uzbekistan is Xalq Bank which has the largest branch network in the country. During the period 2003-2008 the SBFIC had supported the reformulation of Xalq Bank's business strategy towards retail banking. The project was composed of an introduction of risk (mainly credit) management, a development of new products, and an improvement of branch network performance (SBFIC, 2008).

Читать дальше