The business activities are presented in form of case studies or numerical examples respectively, in which the concrete numerical effects in and on balance sheet and profit/loss account are presented and annotated step by step and in detail.

To do so, numerical examples which have been presented basically in the textbook “Management Accounting.” are now presented in more detail and in individual steps in the “Workbook 1 – Balance Sheet | Profit/Loss Account”; as well as additional numerical examples that present further business activities or business cases respectively.

BALANCE SHEET | PROFIT/LOSS ACCOUNT

Every business activity of an enterprise always affects the profit/loss account and/or the balance sheet of an enterprise. Certain business activities affect only the balance sheet of an enterprise, other business activities however, affect both: balance sheet and profit/loss account.

In the context of balance sheet and profit/loss account it is decisive that both can only be determined together, meaningful and correct, under consideration of all business effects. Neither can a balance sheet present all business activities of an enterprise, nor can a profit/loss account do so.

In a first step, in the “Workbook 1 – Balance Sheet | Profit/Loss Account” the basic contents of balance sheet and profit/loss account are annotated in an overview. After that, the central connection between balance sheet and profit/loss account on the profit or loss respectively, is presented. Subsequently, the procedure in the framework of compiling balance sheet and profit/loss account is described in principle, as well as the procedure in the course of creating the numerical examples or case studies respectively.

All the connections presented here can be understood as generally valid basic principles and connections and can be applied universally, independent of specific national or international regulations on trade or tax laws.

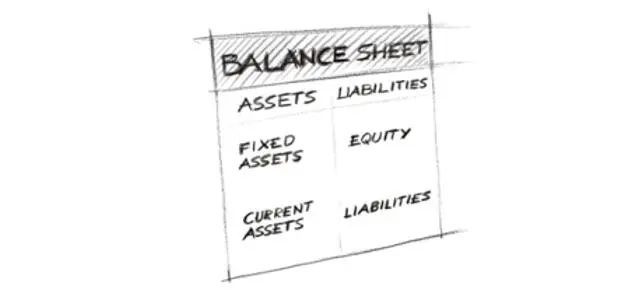

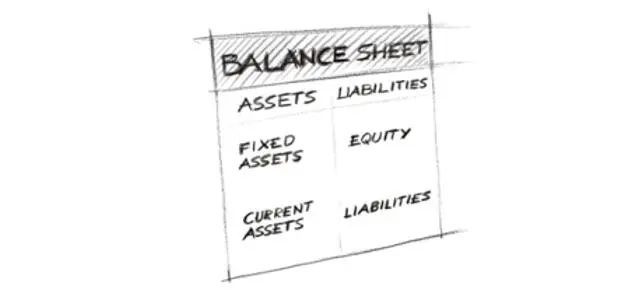

BALANCE SHEET

Figure 1: Balance Sheet

A balance sheet is always a look at the enterprise at a certain point in time. It contains permanently stock values.

The balance sheet presents – referring to a certain point in time – the goods or assets an enterprise has available at exactly this moment and in what way the enterprise is financed at this moment (with equity or debt capital / liabilities)

On the left side of the balance sheet, the assets side, the assets of an enterprise are presented, structured into fixed assets (non-current assets) and current assets. On the right side of the balance sheet, the liabilities side, the source of the financial means of the enterprise is presented, differentiating between equity and debt capital.

A balance sheet has the following basic structure:

Figure 2: Balance Sheet

In a more detailed presentation the following, more expanded structure of a balance sheet is created:

Figure 3: Balance Sheet, Presentation in Detail

The item Fixed Assets as well as the item Equity remain unchanged (of which only the Reserves are presented in an own, special item, in addition to the existing balance sheet items).

The items Current Assets and Debt Capital are presented in more detail; the items Deferred Charges and Deferred Income are presented as extra items in addition to the existing items of the balance sheet.

In Continental-European accounting, the order of the presentation or the structure of the balance sheet items on both sides, usually happens from long-term to short-term, which means from the items that have been fixed for a long-term period in the enterprise to the short-term items that can be changed immediately.

So, on the assets side of the balance sheet the order starts with the fixed assets (long-term or permanently existing assets in the enterprise) and goes on to the current assets (short-term changeable items or constantly changing assets such as bank account or cash).

On the capital side | liabilities side of the balance sheet the structure begins with equity capital (long-term capital provided by the owners), goes on to debt capital and also within the debt capital from long-term to short-term, which means from a long-term bank loan to a short-term daily changing bank account | bank loan.

In contrast to the structure of the balance sheet described which is normally used in Continental-European Accounting, the balance sheet items Fixed Assets and Current Assets as well as Equity Capital and Debt Capital are presented in the reverse order in Anglo-American or International Accounting – according to the decreasing liquidity which means beginning with the assets bound for the shortest time (cash, short-term bank account) and capital items (short-term liabilities) to the long-term items which have been existing for a long time in the enterprise (fixed assets and equity capital).

These diverse structures have no effect on the contents in principal or on the basic information respectively of balance sheets or the items of the balance sheet. The numerical examples presented subsequently also affect the respective items of the balance sheet in the same way, independent of the form of their presentation.

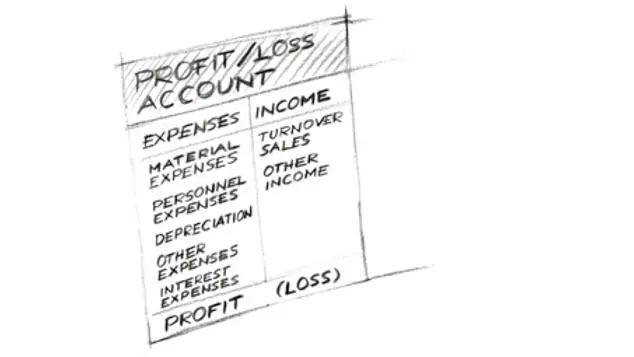

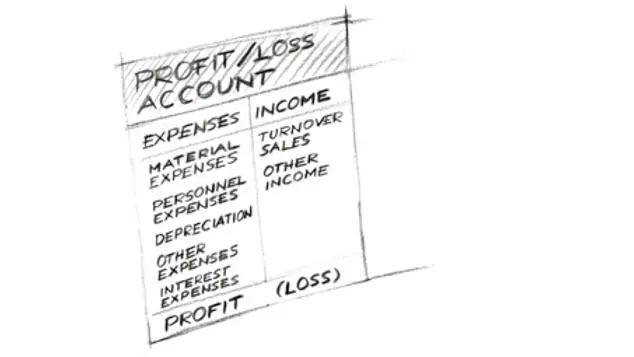

Profit/Loss Account

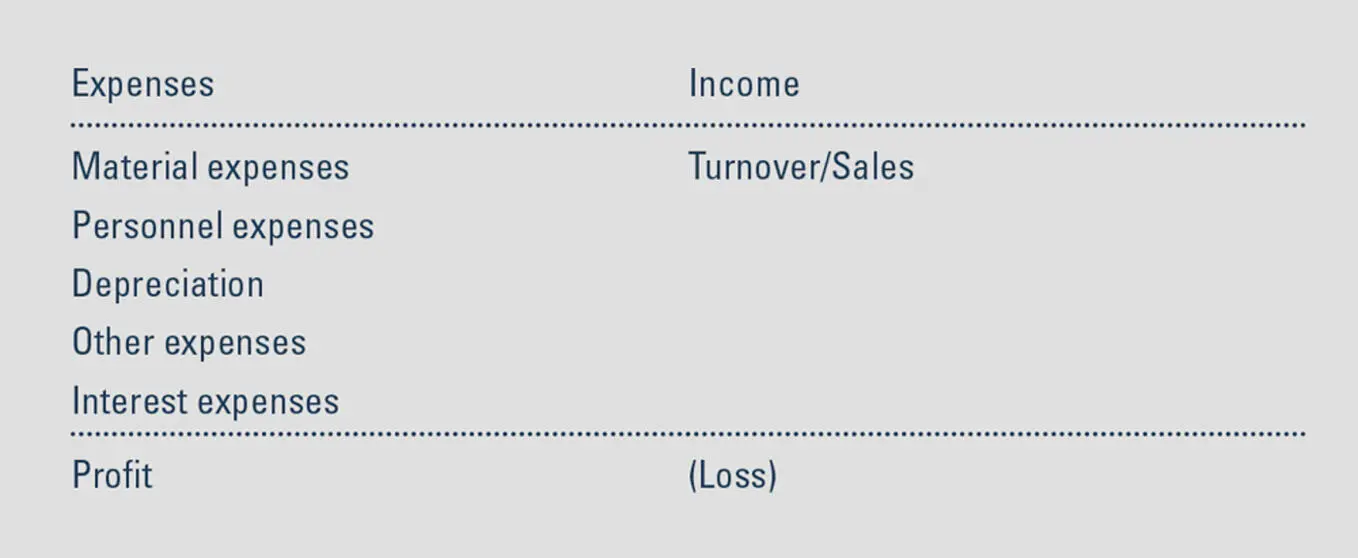

Figure 4: Profit/Loss Account

The profit/loss account, in contrast to the balance sheet, is a period of time-oriented reflection of an enterprise, a consideration of the economic development of an enterprise in the course of time. The profit/loss account contains permanently flow values.

In the profit/loss account the result of the business activity (the profit or loss of the enterprise respectively) is presented – in form of the difference between expense and income. The income or turnover/sales which are achieved by selling products, goods or services are compared to the arising expense in the enterprise and the result of the comparison leads to the profit or loss of the enterprise.

The profit/loss account contains a list of all expense and income items which arise during a settlement period of an enterprise.

The difference between expense and income results in the profit or loss of the settlement period.

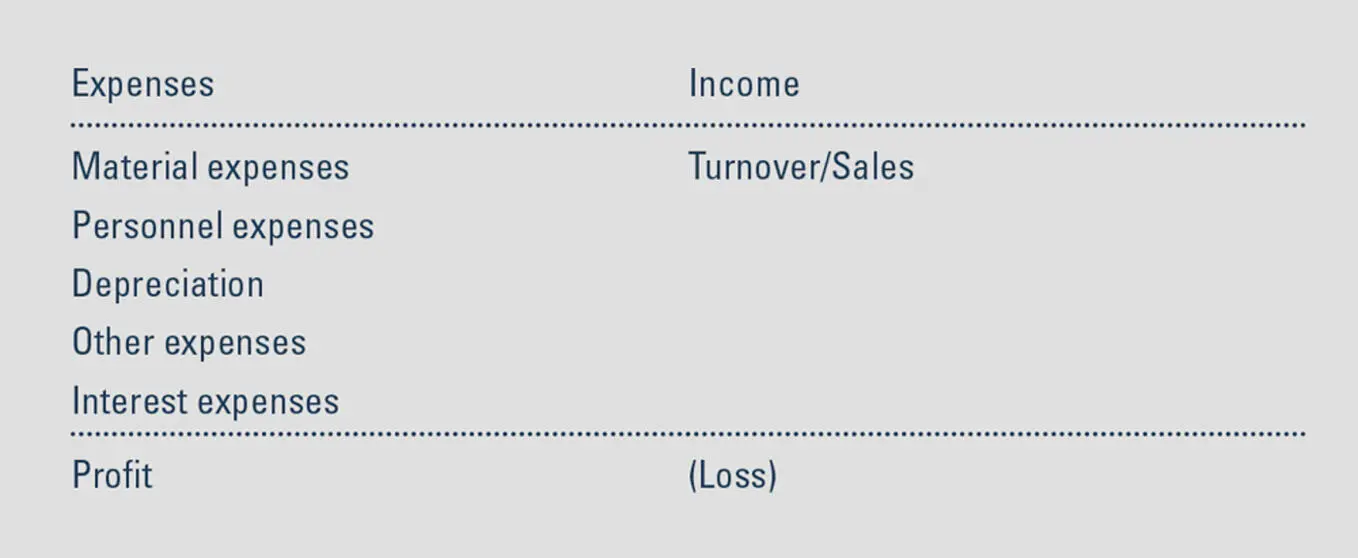

In its simplest form, the profit/loss account in the so called account form has the following structure and leads to the following result:

Figure 5: Profit/Loss Account, Account Form

Читать дальше