Stephen J. Mildenhall - Pricing Insurance Risk

Здесь есть возможность читать онлайн «Stephen J. Mildenhall - Pricing Insurance Risk» — ознакомительный отрывок электронной книги совершенно бесплатно, а после прочтения отрывка купить полную версию. В некоторых случаях можно слушать аудио, скачать через торрент в формате fb2 и присутствует краткое содержание. Жанр: unrecognised, на английском языке. Описание произведения, (предисловие) а так же отзывы посетителей доступны на портале библиотеки ЛибКат.

- Название:Pricing Insurance Risk

- Автор:

- Жанр:

- Год:неизвестен

- ISBN:нет данных

- Рейтинг книги:4 / 5. Голосов: 1

-

Избранное:Добавить в избранное

- Отзывы:

-

Ваша оценка:

- 80

- 1

- 2

- 3

- 4

- 5

Pricing Insurance Risk: краткое содержание, описание и аннотация

Предлагаем к чтению аннотацию, описание, краткое содержание или предисловие (зависит от того, что написал сам автор книги «Pricing Insurance Risk»). Если вы не нашли необходимую информацию о книге — напишите в комментариях, мы постараемся отыскать её.

A comprehensive framework for measuring, valuing, and managing risk Pricing Insurance Risk: Theory and Practice

Pricing Insurance Risk: Theory and Practice

Pricing Insurance Risk — читать онлайн ознакомительный отрывок

Ниже представлен текст книги, разбитый по страницам. Система сохранения места последней прочитанной страницы, позволяет с удобством читать онлайн бесплатно книгу «Pricing Insurance Risk», без необходимости каждый раз заново искать на чём Вы остановились. Поставьте закладку, и сможете в любой момент перейти на страницу, на которой закончили чтение.

Интервал:

Закладка:

Browse Classical Price Allocation Theory, Chapter 12, down through Loss Payments in Default, Chapter 12.3. This is material that should be more or less familiar to actuaries.

See how classical price allocation works out on our Case Studies in Chapter 13.

Read the first two sections in Chapter 14, Modern Price Allocation Theory. This covers the natural allocation of a coherent risk measure, properties and characterization of allocations, computational algorithms, and comments on selecting an allocation. This is the core theory about allocating SRMs. If you are looking for ways to visualize multidimensional risk, read Chapter 14.3, especially Chapter 14.3.7, as well.

Read Modern Price Allocation Practice, Chapter 15. This is essential “how-to” material.

If reserves feature prominently in your project, you may want to read Chapter 17in Part IV. This also covers the Solvency II risk margin in Chapter 17.3.

If reinsurance purchasing features prominently in your project, you may want to read Chapter 19.

If you are working with portfolio optimization, you may want to read Chapter 20.

2 The Insurance Market and Our Case Studies

In this chapter, we outline the operation of the insurance market as we model it and describe the hypothetical Ins Co. used in our examples. We then introduce a Simple Discrete Example and three more realistic Case Studies which are used throughout the book to illustrate the methods presented in the theory chapters.

2.1 The Insurance Market

Insurersare one period, limited liabilityentities with no existing liabilities. We consider multi-period insurers in Part IV only. The insurer is called Ins Co.It sells insurance policiesto insuredsor policyholders. Policyholder and insured are treated as synonyms, and both include claimants. Ins Co.’s portfoliois the collection of policies it writes. The length of the period is usually one year. Its length is relevant only because of the time value of money, since interest is a rate per year.

Policyholder liabilitiesare any amounts Ins Co. owes to policyholders. The two biggest are loss reserves and unearned premium reserves. We incorporate reserves in Part IV only. In property-casualty insurance, loss reserves cover claims that have been incurred but not paid, whether reported or not. In life insurance, liabilities include policy values for long duration contracts.

Assetsare the total financial resources owned by Ins Co. that it can use to meet its policyholder liabilities. A regulator usually stipulates required assets, a minimum amount of assets that Ins Co. must hold; see Section 1.2.

Ins Co., like all firms, finances its assets by issuing liabilities. It sells policies, creating policyholder liabilities, in exchange for premiums, and it raises capital from investorsby selling them its residual value (equity) or other promises (debt, reinsurance).

Investors can be shareholders when Ins Co. is a stock company or insureds when it is a mutual company or debt holders or reinsurers.

Insurers are intermediariesbetween insureds and investors. Intermediary always means an insurance company intermediary, and never an agent or broker.

Portfolio components are referred to as units. A unit can be a single policy or a group of policies or be defined by line, geography, branch, business unit, or other characteristics. Unit can also represent the segmentation between reinsurance ceded losses and retained losses.

Ins Co.’s aggregate lossis the sum of losses from its portfolio over one period.

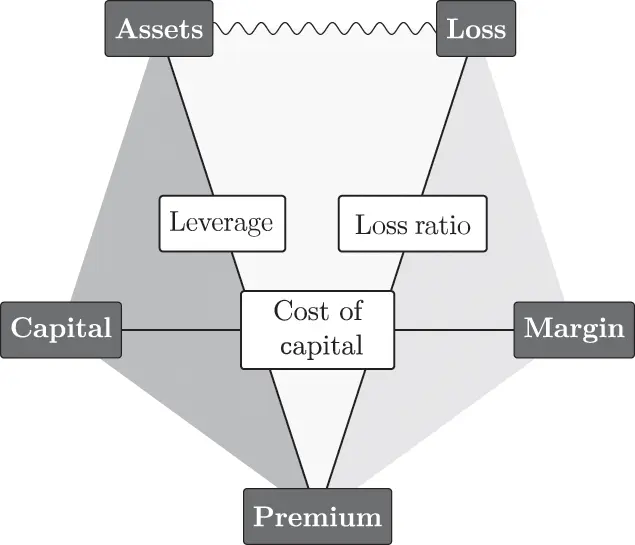

Ins Co.’s operations are controlled by eight variables: (expected) loss, premium, assets, margin, capital, loss ratio, cost of capital, and leverage. The first five are monetary quantities, and the last three are unitless ratios. They obey five relationships:

1 premium equals loss plus margin,

2 assets equal premium plus capital, which we call the asset funding constraint,

3 loss ratio equals loss divided by premium,

4 cost of capital equals margin divided by capital, and

5 asset leverage equals assets divided by premium.

Figure 2.1 lays out these variables and relationships. Monetary quantities are the vertices, the bold diagonal lines correspond to the ratios, and the two shaded triangles signify the asset and premium sum conditions.

Figure 2.1 The eight variables that control insurance operations and five relationships between them.

Premiumis the amount charged for providing insurance. Premium is net of (i.e., excludes) underwriting expenses but includes an allowance for risk called the margin. Profit, profit load, profit margin, risk margin, and risk load are all synonyms for margin.

Premium is the critical variable; it is the foundation of the schematic. It is the bridge between investor cash flows on the left and insurance cash flows on the right. At the expected outcome, premium is shared, with margin flowing to investors and expected loss to the insured.

Policyholders are liable for their expected loss—as Adam Smith pointed out in 1789; by “common loss” he means expected loss. Financing the remaining assets is the shared liabilityof policyholders and investors. The shared liability equals assets minus expected loss, or equivalently capital plus expected margin. Pricing apportions the shared liability to policyholders and investors.

The loss ratiois the ratio of loss to premium. Because premiums exclude expenses, a 90% loss ratio includes a healthy margin. The premium markupis the inverse expected loss ratio, the ratio of premium to expected loss. Catastrophe bond pricing often quotes markups rather than loss ratios. Premium leveragerefers to the ratio of premium to capital.

The margin is distinct from the contingency provision, which the Actuarial Standards Board (2011) defines as a correction for persistent biases in ratemaking. It says the “contingency provision is not intended to measure the variability of results and, as such, is not expected to be earned as profit.”

A catastropheor catastrophe eventrefers to an single event causing loss to multiple units, such as a hurricane, typhoon, earthquake, winter storm, terrorist attack, or pandemic. A catastrophe lossis the total loss across all units from a catastrophe event. A catastrophe unitmeans a unit prone to catastrophe losses. A catastrophe riskis a peril likely to result in catastrophe losses. Catastrophe risks tend to attract large margins, making them particularly interesting.

At various points we mention catastrophe models. These are computer simulation tools used to estimate potential catastrophe losses from an insurance portfolio. Mitchell-Wallace et al . (2017) provides helpful background about the operation and use of catastrophe models.

Losses in a thick-tailedunit have a high coefficient of variation, are right-skewed and leptokurtic (high kurtosis), and have a significant probability of assuming a very substantial value. Catastrophe losses are usually thick-tailed.

Читать дальшеИнтервал:

Закладка:

Похожие книги на «Pricing Insurance Risk»

Представляем Вашему вниманию похожие книги на «Pricing Insurance Risk» списком для выбора. Мы отобрали схожую по названию и смыслу литературу в надежде предоставить читателям больше вариантов отыскать новые, интересные, ещё непрочитанные произведения.

Обсуждение, отзывы о книге «Pricing Insurance Risk» и просто собственные мнения читателей. Оставьте ваши комментарии, напишите, что Вы думаете о произведении, его смысле или главных героях. Укажите что конкретно понравилось, а что нет, и почему Вы так считаете.