But there are some ways you can help draw us out while we recover and figure out how to get back up on our feet:

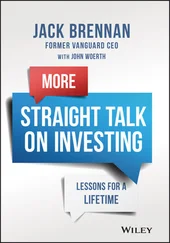

1. ORGANIZE YOUR MONEY AND GIVE HIM SOME CONTROL

A financial planner gave me this critical advice years ago: to really organize your money and help everyone in the house feel like they’re contributing and benefiting from their paychecks, every couple should have at least four bank accounts. One is the household checking account-the one where each of you deposits your paycheck. This makes one large family money pool from which a portion, for most of us the majority of, pays all of your bills and the necessities that help you live from day to day-the car note, the electricity and credit card bills, the tuition, the mortgage. The second account should be a savings account that requires two signatures to move any of the money. This is both the emergency fund-the cash you set aside for a rainy day and the fund in which you can save for life’s big expenses: housing, automobiles, tuition. It doesn’t matter if you transfer from your joint checking account 10 percent, 20 percent, or just $10 dollars a month; the point is that the two of you are using it to save, with the intention of using those savings for emergencies. The last two accounts should be individual accounts-one for him, and one for you. Those accounts comprise the spending allowances the two of you agree to keep solely for yourselves.

Having these four accounts allows you to pool your resources together and work as a couple to get your finances in order, while helping you maintain your individuality. In some families, the car note may be her responsibility and the rent and tuition his. Now it’s all shared, even the child support. Now the two of you are linked together in a united financial front. In good times, that means the two of you are contributing as a couple toward the upkeep of your lives. In bad times, it’s the perfect way to help your man feel like he’s still got a handle on the finances, even if he’s not bringing in as much. If he’s writing the bills and the checks have his last name on them and he’s making decisions about which payment takes priority (or at least he thinks he is) and the lady down at the cable company is addressing him with respect-“Thank you, Mr. Johnson, for your payment”-then he doesn’t feel like someone is kicking him in the teeth every time a bill collector calls or another late notice shows up in the mailbox.

The pep talk that keeps him focused is the one where you tell him no matter who is putting what into the account, you need him to handle the money and keep the bills as current as possible-and that you trust him to do it. This goes a long way in helping him maintain at least some financial dignity while he works to get back on his feet. For the women who feel like this is handing over too much control, know that you still share the responsibility; the two of you still need to talk about the finances, no one can dip into the savings without checking in with the other, and the two of you still have your separate accounts that give you the autonomy you need for yourselves without any questions from your mate. If he wants to buy a box of cigars, he can dip into his individual account to buy them, no questions asked; if you want to get your nails done or buy a cute pair of shoes and you have the money in your individual account, he can’t say anything about it. See? Everybody has some control.

Now, if your man spends frivolously, isn’t taking care of business, and doesn’t seem like he’s remotely interested in climbing out of his jobless state, you’ve got a problem-and I don’t have the book to help you with that guy. Rest assured, a man who isn’t taking care of business is going against what I think are his natural instincts, and if you happen to be hitched to him in any way, you have the absolute right and power to walk away. Or you can hang in there-and good luck to you.

But the bottom line is that when you make the move to be with someone, from the get-go you have to play the game like you practice the game. If you have the hard conversations about finances and how the two of you handle bills and saving before you get in deep, and put into place this practice of handling money together in both good financial times and bad, then the sharing is going to work, even when something goes wrong, especially when things go wrong.

2. REMIND HIM WHY YOU FELL IN LOVE

We’ve already discussed that telling your partner you love him when the chips are down is something that, while appreciated, may ring hollow with a man who’s down on his financial luck. But showing him you love him is something wholly different. My parents didn’t have a lot of money, but they made it. And I’ve got news for you: you can make it too. All that history together, all the time you’ve loved each other, is worth preserving. Show him that by reminding him what made him love you in the first place-by focusing on the little unexpected things. Make his favorite meal, hold his hand, send him love notes. Do things as a family that don’t cost money: rent a DVD, make popcorn, and have movie night; spread a blanket on the living room floor and have an indoor picnic; after dinner, take a family walk around the neighborhood; go swing on the swings at the playground; park your car by the airport and watch the planes take off and land; drive to the suburbs and look at the Christmas lights; learn how to play one of his video games, then challenge him to a duel. While you’re out on those impromptu “dates,” take care to enjoy each other’s company. Don’t bother talking about the negative things or the problems. Just take the time to really connect; even if the connection is short-lived, make it count. Encourage him to find solace in you, even on the days when he’d rather find a corner and get really quiet. Building a loving relationship takes work, but keeping that love and romance alive in times of adversity takes hard work. But your relationship is worth it.

3. DON’T JUDGE HIM

You have to remember that if money is tight, anything you say to him about money is going to amplify the situation in a negative way. A scenario: You come home from a tough day on the job to a mailbox full of bills, and before you can get into the house, the phone rings. It’s the cable company, informing you once again that if you don’t pay the bill, they’re going to shut down service. Now, your man knows the bill is late but you hang up the phone and huff, “The cable bill is due.”

In his mind, you might as well have said: “They’re about to shut off the cable and if that happens, I won’t be able to watch my shows after a hard day’s work and I’ll be doggone if I’m going to be the one going out here and getting the money and you’re sitting here doing nothing while they take away the one thing I do to relax. You got us into this mess; what are you going to do to get us out of it?”

Unfortunately, it doesn’t matter that this isn’t what you intended; it’s about the perceived attitude and tone, which can come across even when you don’t realize you’re doing it. He’s already disappointed in himself, and he’s just biding his time until you show that you’re disappointed in him, too, until you let it be known that he’s failing as a husband, father, and man because he’s not providing for and protecting his family.

You know the bills are due and so does he; there’s no need to bring it up unless you’ve got something concrete to offer in terms of how to dig yourselves out of the mess in which you’ve found yourselves. Otherwise, your words-whether they were said with attitude or meant as a simple observation-might just have him taking a trip down to the pawn shop, or dialing up a loan shark, or going down to the corner to do some things he has no business doing. All I’m saying is tread lightly.

Читать дальше