Statement 2.Probabilistic economics is not just one of many models of specific economic systems, but a rather universal method of numerical description and research for any market economic systems, both local and global. After studying them using this method and identifying the main effects, processes and regularities in their functioning, it is possible to build various simple models of these systems. Nevertheless, in order to avoid misunderstandings, it should be noted that probabilistic economics is far from being a “theory of everything”. It is aimed at investigating, perhaps, the most important, but by no means all important burning questions of economic theory, namely, how the structure and behavior of the market as a whole follows from the individual actions of market agents, i.e. from their individual presentation of demands and supplies. Therefore, let us emphasize once again that everything described in this monograph and everything asserted therein covers only the direct problem of economics, unless it is specifically stipulated.

Statement 3.The proposed mathematical apparatus for describing the market dynamics is built on using orders or quotations of market agents; therefore, it automatically takes into account all the principles of theory, since market agents take into account all the information coming to the market at any given moment in time when choosing the quotations. In other words, they are under constant influence of all forces and influences acting on the market at a given moment: this includes the influence of other agents, assets and markets; as well as the effect of institutional and environmental factors, etc., which is reflected in regular changes in their quotations.

In the next two sections we will describe in detail the mathematical body of the probabilistic economy based on the actions of agents and illustrate its work on the example of a simple model market with one buyer, one seller, and one traded commodity. It will be shown that the most specific features and regularities in the behavior of markets are already evident in such a simple two-agent model. An extension of this theory to multi-agent markets with one traded commodity will be presented in subsequent chapters.

1.6. CLASSICAL THEORY OF THE TWO-AGENT MARKET

Note that since we neglect all probabilistic effects in classical theory, or classics, we do not consider the uncertainty and probability principle in classics, although it is clear that it plays an important role in probabilistic theory. It is hardly worth seriously discussing which of these two theories is better. As in the case of classical and quantum mechanics, it is preferable to talk about different applications of classical (in a certain sense deterministic) and probabilistic theories, as we will demonstrate more than once below. Let us remind you that the classical theory in this book refers simply to an initial approximation of the probabilistic theory in which the principle of uncertainty and probability are not explicitly taken into account.

Thus, we will thoroughly describe this approach to the study of the economy dynamics, or evolution, within the framework of the classical economy using the example of the simplest model, namely, a market with one buyer and one seller selling one commodity, such as grain. The economic space in this case is obviously two-dimensional.

1.6.1. DISCRETE STRATEGY OF MARKET AGENTS

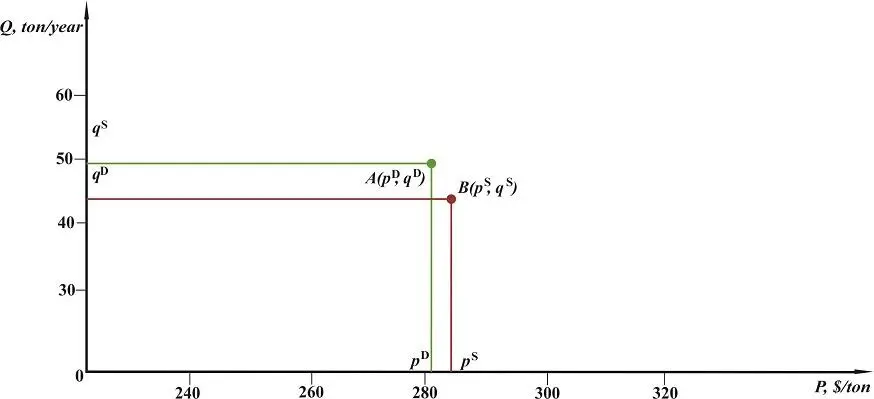

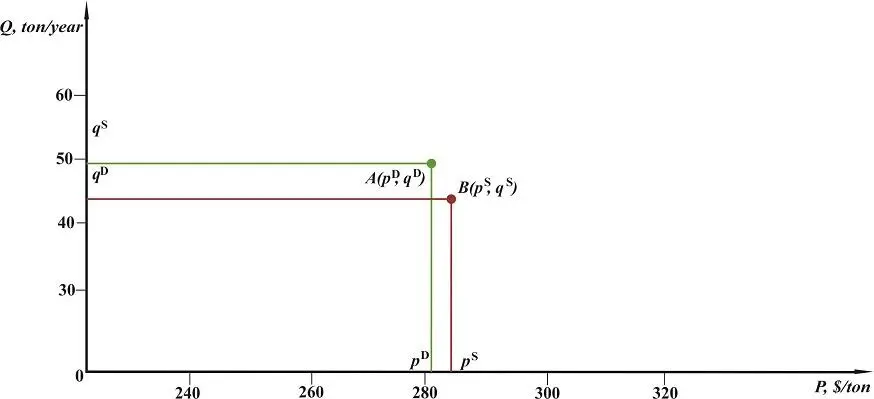

Let’s consider a typical situation in a market, which has a real potential buyer and seller of a certain good, say, grain. The buyer wants to buy goods in quantity q D at price p D , and the seller wants to sell goods in quantity q S at price p S. These four parameters fully characterize the state of the market in the classical economy at each point in time. It is commonplace in the market that both prices and quantities of buyer and seller do not coincide. Therefore, if they both insist on their bid and ask, respectively, there will obviously be no deal. The oldest, well-established mechanism for resolving such trade disputes over the years since the emergence of markets is that the buyer and seller enter into trade negotiations with the aim of getting them to agree to a sale and purchase deal on terms that suit both parties. Let us describe this negotiation process in mathematical language as follows. Let the functions p D ( t ) and q D ( t ) denote the price and quantity of goods desired and offered by the buyer for buying during negotiations with the seller at a certain time t . Similarly, let the functions p S (t) and q S (t) denote the price and quantity of the good desired and offered by the seller for sell during negotiations with the buyer in the market. In their meaning, the values of prices and quantities introduced above are the main content of agent proposals to buy or sell the goods. Below, for brevity, we will denote these desired and offered values as buyer’s and seller’s quotations. And such a line of agents' behavior in the market will be called a discrete or point strategy, since at each time t these quotes are represented by one point in two-dimensional space, for example, point A with coordinates p D (t) and q D (t) for the buyer and point B with coordinates p S(t) and q S(t) for the seller, as presented in Fig. 1.2.

These quotations are made, of course, taking into account all the circumstances affecting the market operation: institutions, etc. In our view, quotations made by market agents are the essence of the main market phenomenon of classical economic theory in the view of the Austrian economic school, namely the market process [Mises, 2005], consisting of specific acts of choice and actions of market agents, which ultimately lead buyers and sellers to the conclusion of purchase and sale transactions. Graphically, we can depict these quotations as trajectories of agents' movement in economic space (Fig. 1.3). In real market life, these quotations are discrete time functions, but, for the sake of simplicity, we will depict them graphically (just like the S&D functions) as continuous straight lines. Such an approximation does not lead in this case to a loss of generality, because these functions are intended only to illustrate the most general details of the market mechanism and the way they are described (see Fig. 1.3). In their economic sense, such diagrams characterize the temporal dynamics of the market.

Fig. 1.2. Graphical representation of the discrete strategy of buyer’s and seller’s market behavior represented by the two points, A ( p D, q D ) and B ( p S, q S ), in the two-dimensional price-quantity space at some particular moment in time for the model grain market. p D= 280,0 $/ ton, q D= 50,0 ton/year, p S= 285,0 $/ ton, q S= 52,0 ton/year.

We will speak (for the sake of brevity) of this aggregate agents’ movement as market behavior, and sometimes as the economy evolution over time. All these terms are essentially synonymous in this context of discussion. Thus, by putting up desired prices and quantities as their quotations, buyers and sellers take part in the market process, proceeding here in the format of negotiations between bargaining people ( homo negotians ) seeking to bargain for the best terms for themselves in concluding a deal and achieving market goals. Let us note that in reality the actions of market agents include the procedures of concluding final deals along with quotations, but these procedures are automatically accounted by means of changing quotations by market agents after the conclusion of deals. Therefore, there is no need to Explicitly include the procedure of concluding transactions in the structure of agents' actions, it is enough to take into account only the quotation process in the course of trading.

Читать дальше